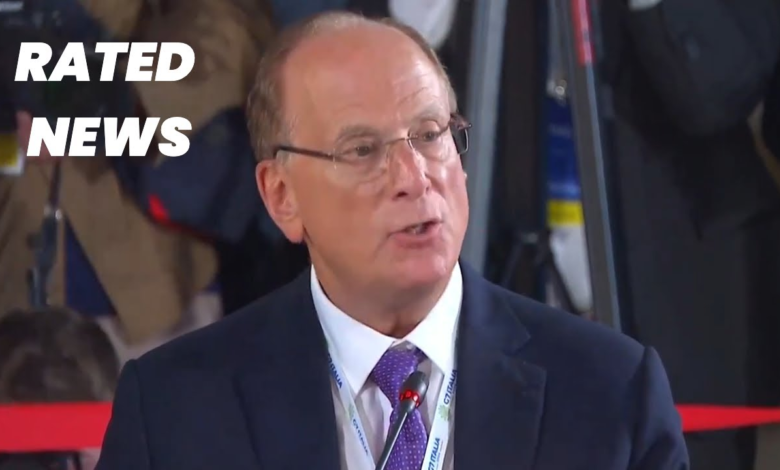

Larry Fink Protectionism Concerns Impact on Global Trade

Larry Fink, the BlackRock CEO, has voiced significant concerns regarding protectionism, warning that the rise of such policies could severely impact global trade and economic stability. In his annual letter to investors, he elaborated on the risks posed by growing protectionist sentiments, asserting that these trends are likely to deepen economic divides. Fink emphasized that countries now face contrasting economic realities which pose unique challenges for market growth. As protectionist measures proliferate, the potential for a trade war looms, adding to the uncertainty swirling around global markets and individual economies. Such developments could not only hinder private market growth but also intensify existing economic concerns among investors and policymakers alike.

The rising tide of protectionist measures has sparked alarm among industry leaders, particularly within the realm of international trade. BlackRock’s chief executive has raised alarms about how these policies could disrupt the intricacies of global commerce, leading to a potential crisis in economic relations. With trade dynamics shifting under the weight of tariffs and restrictive measures, there are real fears about a slowdown in economic growth. The divide between affluent and struggling markets is widening, and Fink’s insights reflect a broader sentiment in the business community regarding the future trajectory of investment and economic collaboration. As the landscape of trade continues to evolve, stakeholders are acutely aware of the implications that stringent policies could have on global financial markets.

Larry Fink’s Warnings on Protectionism

Larry Fink, the CEO of BlackRock, has recently voiced alarm over the rise of protectionist policies across the globe. In his annual letter to investors, he elaborated on how these measures threaten to disrupt global trade, which has historically been a catalyst for economic growth and prosperity. He explained that protectionism could seriously hinder progress, giving rise to two distinct economic realities: one of increasing wealth for some and escalating hardship for others. This dynamic not only impacts individual industries but also fundamentally alters the economic landscape and the political climate in which businesses operate.

Fink’s concerns resonate particularly now, as his message comes in the wake of significant tariff announcements from the U.S. government. These protective tariffs, designed to shield domestic markets from perceived unfair foreign competition, may lead to unintended consequences such as trade wars, rising costs for consumers, and jeopardized relationships between trading partners. As emphasized by Fink, the continuation of such policies could ultimately stifle innovation and diminish the competitiveness of global markets, creating long-lasting economic ramifications.

Global Trade Impact Amid Rising Protectionist Policies

The global economy has traditionally thrived on free trade, enabling countries to specialize and benefit from comparative advantages. However, the resurgence of protectionist policies threatens to reverse this trend, leading to considerable implications for global trade. Analysts warn that such policies could trigger retaliatory measures from other nations, culminating in an escalating trade war that dampens global economic growth. The implications extend beyond immediate financial markets; they hint at a destabilized trading environment that could impede future international collaborations and economic agreements.

With rising tariffs and protectionism becoming prevalent, companies may face increased uncertainty in planning and investment strategies. Fink’s insights suggest that economic growth might decelerate as the world grapples with increased costs of goods and services driven by tariffs. Businesses that depend on international supply chains and global market dynamics may find themselves recalibrating their operational strategies, which could ultimately affect employment rates and consumer prices across various sectors.

Economic Concerns in the Era of Protectionism

As Larry Fink pointed out, economic anxiety is palpable among clients and leaders alike. The fear that the protectionist shift in trade practices could lead to slower growth or even a recession has left many questioning the sustainability of investment returns. Economic concerns, such as increased tariffs resulting in higher production costs, have a cascading effect that impacts consumer spending and business investment. This climate of uncertainty inhibits confidence, leading to cautious financial behaviors which could stifle economic momentum.

Moreover, the potential for a trade war looms large, as countries retaliate against one another, impacting various industries. Economic analysis suggests that if protectionist policies persist, we might see a significant reduction in trade volumes, hindering economic recovery efforts and potentially leading to a global economic downturn. Thus, the current economic climate calls for a reevaluation of strategic plans, driving businesses to seek avenues for resilience amidst the challenges posed by these policies.

Private Market Growth: An Answer to Economic Challenges

In response to the shifting economic landscape, Larry Fink has identified emerging opportunities within private markets, particularly in sectors like infrastructure and private credit. His assertion hinges on the belief that as public sector financing becomes increasingly constrained, private investments will fill the gap. This shift indicates a transformative moment where traditional sources of capital may dwindle, prompting businesses to explore alternative funding avenues, thus fostering a burgeoning space for private equity.

Investment strategies in private markets present a compelling alternative in a protectionist environment, especially when government budgets are stretched thin. Fink’s emphasis on infrastructure indicates a recognition of the urgent need for robust solutions in public works, presenting opportunities for growth in private investments. Furthermore, as market conditions fluctuate, the agility of private equity and credit markets could provide the necessary buffer against the economic disruptions caused by protectionist measures, potentially driving innovation and efficiency in undercapitalized sectors.

Adapting to a Shifting Economic Landscape

Navigating the complexities of today’s economic environment requires businesses to be agile and forward-thinking, particularly amid the rise of protectionist policies. In light of Larry Fink’s observations, companies must reassess their operational models to adapt to new realities. This may involve diversifying supply chains or re-evaluating customer markets to mitigate the risks associated with increased tariffs and trade barriers. Companies not only need to protect their interests but must also seek innovative strategies that enhance resilience.

The capability to pivot in response to external pressures will be crucial for sustaining business growth. Organizations should proactively engage in scenario planning, weighing the potential impacts of protectionism on their operations and exploring opportunities within domestic and private markets. By fostering an adaptable corporate culture, businesses can better withstand the fluctuating tides of global trade conditions, capitalizing on shifts towards local sourcing and private investment options.

The Dual Economy Phenomenon

Larry Fink’s commentary on the divide between wealth and hardship reveals the emergence of a dual economy where affluence grows for the few while many face increasing struggles. This duality affects not only socioeconomic dynamics but also influences investment priorities and corporate responsibilities. As diverse sectors experience vastly different growth trajectories, the implications for global trade and capital markets are significant, indicating the need for tailored investment strategies that address these disparities.

The dual economy phenomenon may prompt investors to focus on sectors that cater to both ends of the spectrum. Companies providing essential goods and services might see growth even amid economic stagnation, while luxury sectors may thrive in isolated environments of wealth accumulation. Understanding the intricacies of these economic divides can help investors and companies make informed decisions aimed at bridging the gap, fostering a more inclusive economic framework that benefits a broader population.

Infrastructure Investment as a Strategy for Resilience

Infrastructure spending has become increasingly vital in the context of rising protectionist sentiments. With governments less capable of financing large-scale projects purely through deficit spending, the attention shifts toward attracting private investors to fill the void. Larry Fink’s emphasis on infrastructure highlights its pivotal role as a driver of economic growth, capable of providing both social benefits and investment opportunities amid uncertainty in global trade.

As such, industries focusing on infrastructure development may experience accelerated growth, attracting substantial investment flows. Fink’s insights suggest that both public and private sectors must collaborate to create strategic partnerships that leverage available capital for transformative projects. Emphasizing infrastructure ensures a dual benefit: bolstering resilience against economic downturns while simultnously laying the groundwork for sustainable growth in a protectionist climate.

Navigating Client Anxieties in a Protectionist Era

Larry Fink’s candid assessment of client anxieties underscores the significance of communication and strategic support during times of economic uncertainty. Clients increasingly express concerns about the long-term implications of protectionist policies on market stability and growth. To address these anxieties, asset managers and advisors must prioritize transparency, keeping clients informed about global developments while offering strategies to mitigate the risks associated with protectionism.

Understanding client sentiments can shape service offerings, tailoring investment solutions to align with their risk tolerance and growth aspirations. As the protectionist trend intensifies, firms need to reposition themselves as not just financial stewards but also trusted advisors helping clients navigate challenges. Regular dialogue fosters a collaborative environment, empowering clients to make informed decisions in the face of evolving economic landscapes.

The Future of Global Trade: A Hopeful Outlook

Despite the challenges posed by rising protectionism, there remains a glimmer of hope for future global trade dynamics. Larry Fink’s optimism about navigating these turbulent waters suggests resilience is possible. As markets adapt, opportunities can emerge from the very disruptions that protectionist policies create. By harnessing innovation and fostering collaboration, industries can find pathways towards robust economic activity and revitalization in underserved sectors.

The direction of global trade may shift considerably, with businesses and governments alike reevaluating priorities and working towards fairer, more sustainable trade practices. This could fuel a renewed commitment to international cooperation, culminating in trade agreements that embrace inclusivity. By remaining vigilant and responsive, companies can position themselves advantageously, contributing to an economic environment that prioritizes both growth and equitable opportunity amid the backdrop of protectionism.

Frequently Asked Questions

What are Larry Fink’s concerns regarding the spread of protectionism?

Larry Fink, the CEO of BlackRock, has expressed significant concerns about the growing presence of protectionist policies around the world. He argues that these policies pose a serious threat to global trade by creating barriers that hamper economic growth. In his annual letter to investors, Fink highlighted how protectionism can exacerbate inequality, stating that countries now show a stark divide between wealth accumulation and economic hardship.

How do protectionist policies impact global trade according to Larry Fink?

According to Larry Fink, protectionist policies can severely hinder global trade by fostering an environment where tariffs and trade barriers increase. This can lead to a downturn in economic growth, as countries that engage in protectionism might find themselves isolated from the benefits of trade, ultimately weakening their economies. Fink notes that the return of protectionism could result in significant ramifications for international markets.

What is Larry Fink’s perspective on the economic outlook amidst rising protectionism?

Larry Fink acknowledges the rising anxiety regarding economic conditions due to protectionist policies. He has indicated that clients and market leaders are increasingly concerned about economic stability and potential slowdowns. However, he believes that history shows resilience in the face of such challenges and that solutions will emerge in the long run.

What are the private market growth opportunities mentioned by Larry Fink?

In light of increasing protectionist policies, Larry Fink sees substantial growth opportunities in private markets, particularly in sectors like infrastructure and private credit. He asserts that as governments seek private investors to support infrastructure financing due to budget constraints, these sectors are likely to thrive, presenting robust investment opportunities for firms like BlackRock.

How has BlackRock adapted to the challenges posed by protectionist policies?

BlackRock has adapted to the challenges posed by protectionist policies by strategically expanding its footprint in private markets. Larry Fink highlighted recent acquisitions, including HPS Investment Partners and Global Infrastructure Partners, aimed at enhancing their presence in private credit and infrastructure investments. This strategic move is intended to cater to the evolving financial landscape where reliance on traditional bank lending is diminishing.

What does Larry Fink suggest about government financing in a protectionist environment?

Larry Fink suggests that in a climate marked by protectionist policies, governments cannot rely solely on deficits to finance their infrastructure needs. He believes that there is a limit to how much deficits can increase, prompting governments to actively seek private investors for funding. This shift emphasizes the growing importance of private capital in supporting infrastructure development amidst challenging economic policies.

| Key Point | Description |

|---|---|

| Protectionism Concerns | Larry Fink warns that rising protectionist policies will negatively impact global trade and economies. |

| Wealth Divide | Fink highlights the growing contrast between affluent and struggling economies, affecting politics and policies. |

| Recent Policy Changes | The discussion comes amid President Trump’s tariffs on various imports, which Fink believes could lead to a trade war. |

| Client Sentiment | Fink notes widespread client anxiety about the economy and acknowledges the potential for recession. |

| Investment Shifts | Fink sees growth in private markets like infrastructure and credit as solutions in the current economic climate. |

| BlackRock’s Strategy | BlackRock is expanding its presence in private investments through significant acquisitions, enhancing its market position. |

| Infrastructure Funding | Fink argues that governments must seek private financing for infrastructure due to limits on deficits. |

Summary

Larry Fink protectionism concerns highlight the serious implications of rising protectionist policies on global trade and economies. His warnings reflect a significant divide in wealth, affecting not only financial markets but also public sentiment and political landscapes. As Fink navigates these complexities, he suggests that a shift towards private investments in infrastructure and credit could alleviate the challenges posed by such economic policies. Ultimately, finding adaptive solutions will be crucial for sustaining growth amid growing anxieties in the market.