Individual Investors Confidence in Trump’s Tariff Policy

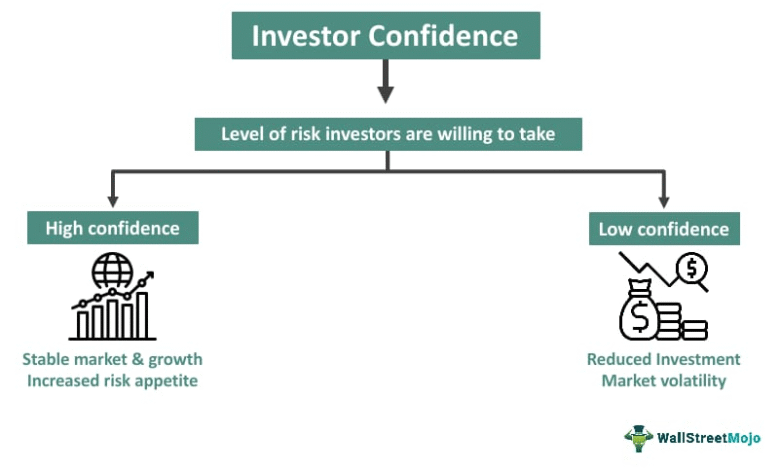

Individual investors’ confidence has become a focal point in discussions about market behavior amid ongoing volatility, particularly in the wake of President Trump’s tariff policy. Despite economic uncertainties and a potential economic slowdown, retail investors have chosen to hold onto their investments, demonstrating a remarkable resilience compared to their institutional counterparts. Treasury Secretary Scott Bessent highlights that 97% of Americans have refrained from making any trades in the last few months, indicating a steadfast trust in the current administration’s economic direction. The contrasting responses between individual and professional investors underline a complex landscape where market volatility continues to influence decisions. Understanding the motivations behind individual investor confidence is crucial, as it provides insight into broader economic trends and the potential resilience of the market.

The resilience of retail investors reflects a broader trend where non-professional traders exhibit a different approach toward market fluctuations when compared to institutional investors. This unwavering trust in governmental policies, particularly in the face of market volatility and external economic pressures, paints a vivid picture of current investor sentiment. Amid fears of a looming recession and fluctuating trade policies, it is essential to analyze how individual investors’ trust affects market dynamics. As we delve deeper into this topic, terms such as individual investor attitudes, retail trading confidence, and public trust in economic strategies become essential in understanding these behaviors. In an era characterized by trade-related uncertainties, the actions and sentiments of small-scale investors could play a pivotal role in shaping market outcomes.

Individual Investors Confidence Amid Market Volatility

The stock market has always seen its fair share of ups and downs, but the recent wave of volatility fueled by President Trump’s tariff policies has posed unique challenges. Individual investors, however, have demonstrated remarkable confidence amidst this turmoil. Treasury Secretary Scott Bessent revealed that despite significant market fluctuations, approximately 97% of retail investors have chosen to hold their positions instead of making hasty trades. This steadfastness not only reflects their belief in the long-term stability of the market but also underscores their trust in Trump’s approach to economic policy.

This scenario highlights a defining characteristic of individual investors: a tendency to maintain composure during market stress. Unlike institutional investors, who have reacted more dramatically to market signals by betting against trends, retail investors have capitalized on lower stock prices to buy into the market. The current climate shows how personal conviction can lead to strategic behavior, ultimately isolating retail traders from the knee-jerk reactions often exhibited by professional counterparts.

Frequently Asked Questions

How does individual investors’ confidence affect responses to Trump tariff policies?

Individual investors’ confidence significantly influences their responses to Trump’s tariff policies. Despite market volatility, many retail investors have chosen to hold their positions, demonstrating trust in the administration’s approach. This resilient behavior indicates a divergence from institutional investors, who are more prone to react to economic conditions.

What role does market volatility play in individual investors’ confidence?

Market volatility can shake the confidence of many investors, but for individual investors, it has often led to strategic buying opportunities. During times of high volatility, as seen with recent responses to Trump’s tariff policy, retail investors have shown persistence, often remaining firm in their investment strategies while institutional investors may retreat.

Why are retail investors maintaining their positions amid economic slowdown?

Retail investors are maintaining their positions amid economic slowdown largely due to their confidence in market recovery inspired by political leadership, notably President Trump. Despite concerns over potential recession stemming from tariff impacts, these individual investors tend to adopt a long-term perspective, focusing on future market potential.

How do individual investors’ confidence levels compare to those of institutional investors?

Individual investors’ confidence levels often contrast sharply with those of institutional investors. While retail investors have shown resilience and a willingness to hold during fluctuations, such as those triggered by Trump’s tariff policies, institutional investors have reacted with caution, indicative of differing risk appetites and investment strategies.

What factors influence the confidence of individual investors in today’s market?

Factors influencing the confidence of individual investors include political events such as Trump’s tariff policies, overall market conditions, economic indicators signaling potential slowdowns, and media narratives surrounding investor behavior. The ability to avoid panic during market downturns illustrates a key aspect of individual investor confidence.

What can individual investors learn from recent market reactions to Trump’s tariff policies?

Individual investors can learn the importance of maintaining confidence and composure during periods of market volatility, as evidenced by their reactions to Trump’s tariff policies. This resilience allows them to take advantage of market downturns by making strategic investments rather than succumbing to panic.

How do retail investors benefit from their confidence during economic challenges?

Retail investors benefit from their confidence during economic challenges by capitalizing on lower asset prices during downturns. Their willingness to hold or buy shares amid fears of a recession, driven by policies like Trump’s tariff strategies, can lead to significant gains when the market rebounds.

What trends have been observed in individual investors’ behavior during periods of market downturn?

During periods of market downturn, such as the recent events influenced by Trump’s tariff policy, individual investors have displayed a trend of holding their investments and even purchasing additional shares. This behavior highlights a strong confidence in the market and reflects a stark difference in approach compared to institutional investors.

How has individual investors’ confidence in the market changed due to Trump’s recent economic policies?

Individual investors’ confidence has shown resilience despite Trump’s recent economic policies, particularly concerning tariffs. The majority of retail investors appear to trust in a long-term recovery, maintaining positions without significant trading activity, which contrasts with the caution seen among institutional investors.

| Key Point | Details |

|---|---|

| Individual Investor Confidence | Individual investors have maintained their positions despite market volatility, trusting President Trump’s tariff policies. |

| Data from Vanguard | 97% of Americans refrained from trading in the past 100 days, reflecting confidence in the market. |

| Behavior Comparison | While individual investors have remained resilient, institutional investors are becoming cautious and betting against the market. |

| Market Fluctuations | The S&P 500 briefly entered bear market territory but is now about 10% below its all-time high, with retail investors capitalizing during downturns. |

| Economic Concerns | Predictions of a recession are increasing, with analysts citing potential impacts from tariffs on consumers. |

| Advice from Experts | Economists warn that ongoing trade disputes may harm U.S. reputation and economic stability. |

Summary

Individual investors’ confidence is evident as they maintain their positions amid market volatility, showing trust in President Trump’s policies. This resilience represents a notable contrast to institutional investors, highlighting the emotional and behavioral differences between these two groups. As market dynamics continue to evolve, understanding the factors influencing individual investors’ confidence will be crucial in assessing future investment strategies.