Inflation Expectations Decrease as Trump Eases Tariff Threats

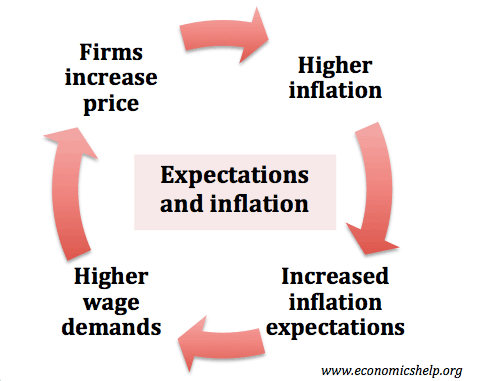

Inflation expectations can significantly shape consumer behavior and economic strategies, as seen in the recent New York Fed survey results. In May, Americans expressed a notable decline in their fear of inflation, largely attributed to President Trump easing certain tariff threats. This shift resulted in the one-year inflation outlook dropping to 3.2%, signaling a more positive consumer inflation outlook. While inflation expectations remain above the Federal Reserve’s target of 2%, the survey reflects a growing confidence amongst consumers in the economy, stemming in part from decreasing concerns over Trump tariff effects. With the personal consumption expenditures (PCE) price index holding steady, those monitoring economic trends will find the fluctuations in inflation sentiment particularly telling.

Anticipations surrounding price increases, or inflation forecasts, play a critical role in understanding consumer attitudes and market dynamics. The recent findings from the New York Federal Reserve shed light on how public sentiment about rising costs has evolved, especially with changes in political leadership and trade policies. The decrease in predicted inflation levels—down to 3.2% for the upcoming year—illustrates a notable shift in the collective consumer outlook. This sentiment adjustment is not only influenced by international trade factors but also by broader indicators such as the core personal consumption expenditures (PCE) index, which affects household economic confidence. As varying factors like safety nets and economic policies change, public expectations about future price levels can reveal much about overall economic health.

The Shift in Inflation Expectations: Insights from the New York Fed Survey

The latest report from the New York Fed reveals significant changes in the outlook for inflation among consumers. According to the Fed’s Survey of Consumer Expectations, inflation expectations for the upcoming year have dropped to 3.2%, a notable decline of 0.4 percentage points from the previous month. This shift reflects a growing sense of stability in the economic environment as recent tariff threats from President Trump have receded. The reduced fears of inflation among consumers suggest a potential easing of pressure on both the Federal Reserve and the broader economy.

Despite the decrease, inflation expectations remain above the Federal Reserve’s target of 2% per year, indicating that while consumers are feeling less anxious, they still perceive inflationary risks in the economy. Understanding these consumer sentiments is crucial, as they can significantly influence spending behavior and overall economic confidence. With ongoing economic challenges, including those posed by tariffs, monitoring these projections is vital to assess future monetary policy decisions.

Understanding the Impact of Tariff Policy on Inflation Trends

The interplay between tariff policies and inflation rates has been a subject of intense debate, particularly with President Trump’s administration navigating complex trade negotiations. As highlighted by New York Fed officials, recent easing of proposed tariffs appears to contribute to a more favorable perception of inflation among consumers. The data shows that even as the tariff revenue has increased, overall inflation has begun to stabilize, leading to a reassessment of how trade policies influence consumer price expectations.

Moreover, the collapse of severe tariff threats seems to bolster consumer confidence, suggesting that political decisions play a pivotal role in shaping economic outcomes. The Fed’s PCE price index, which is a critical measure of inflation, has remained relatively low, further illustrating that increasing tariffs may not consistently lead to the inflationary pressures initially feared. Observing these trends helps economists and policymakers understand the nuances of consumer behavior in response to tariff regulations.

Consumer Sentiment and Economic Confidence Amidst Inflation Fears

The latest findings from the New York Fed survey reveal an interesting correlation between consumer sentiment and economic confidence. As fears regarding inflation have receded, there has been a notable uptick in the confidence levels of the American workforce. For instance, only 14.8% of respondents now expect to lose their job within the next year, a decline that reflects not just diminished inflation concerns but an overall optimistic outlook on employment stability.

This heightened confidence extends to the stock market as well, with a reported 36.3% of respondents expressing optimism regarding market performance in the coming year. This represents a slight increase from previous indicators, underscoring the importance of consumer sentiment in driving economic activity. When consumers feel secure about inflation and employment, they are more likely to engage in spending, which is essential for economic growth.

Long-term Inflation Forecasts: What the New York Fed Reveals

The New York Fed survey also assesses longer-term inflation forecasts, providing critical insights into how consumers perceive economic stability over time. The three-year outlook for inflation has nudged down to 3%, while the five-year forecast reflects a slight decrease to 2.6%. Although these figures remain above the Federal Reserve’s comfort zone, they demonstrate a longer-term trend of moderating inflation expectations. Understanding these projections allows economists to gauge consumer behavior and adapt strategies accordingly.

Such forecasts are pivotal for establishing monetary policy and guiding inflation-targeting strategies. The Fed’s decision-making process hinges significantly on such consumer perceptions, as sustained inflation readings above the 2% target may prompt a shift in interest rate policies. Thus, close monitoring of both short- and long-term inflation expectations can help mitigate potential risks and support economic stability.

Examining the Core PCE Index and Its Implications for Inflation

At the heart of the Fed’s inflation strategy is the Personal Consumption Expenditures (PCE) price index, which indicates the overall inflation rate affecting consumer spending. As of April, the core PCE index, which excludes volatile food and energy prices, stood at 2.5%, signaling that underlying inflation pressures remain relatively tame. This consistency in core inflation numbers suggests that despite surface-level concerns, the economy is not experiencing runaway price increases.

Understanding the implications of the PCE index on consumer inflation outlook is critical for both consumers and policymakers. If core inflation remains subdued, it may give the Fed the leeway to maintain interest rates at lower levels, encouraging spending and investment. Conversely, any upward pressure in inflation could lead to tighter monetary policies, impacting everything from mortgage rates to consumer loans.

Surging Optimism in Consumer Spending: A Surprising Market Turnaround

Consumer spending is the engine of the American economy, accounting for a significant portion of economic growth. As evidenced by the New York Fed survey, optimism surrounding inflation has spurred an increase in consumer confidence, which is reflected in spending patterns. With more consumers reassured about their financial situations and employment stability, there is potential for increased expenditure on goods and services, driving economic recovery.

With a decline in expected inflation rates, coupled with a decrease in the perceived likelihood of job loss, households may be more inclined to make significant purchases. This bolstered consumer sentiment will likely lead to upward revisions in economic growth forecasts. The interplay between inflation expectations and spending behavior illustrates the importance of consumer psychology in shaping robust economic conditions.

Understanding Food and Energy Price Dynamics in Inflation Context

The recent survey highlights the nuances of inflation expectations across various sectors, especially food and energy, which are critical components affecting overall consumer sentiment. Despite a dip in overall inflation expectations, respondents indicated that they anticipate food prices to increase by 5.5% in the next year. This reflects the ongoing challenges surrounding agricultural supply chains and global pricing pressures, which can contribute to heightened consumer apprehension.

Simultaneously, energy prices are projected to ease, with expectations of a 2.7% rise in gas prices over the following year. This differential in expectations for food and energy prices can be indicative of consumer behavior and spending. As essential expenditures, food and energy directly impact disposable income, which can alter consumption trends across the economy.

The Role of Employment Expectations in Economic Stability

Beyond inflation, employment expectations play a crucial role in shaping overall economic stability. The New York Fed survey indicates that a lower percentage of consumers expect job losses, dropping to 14.8%. This reduction may fuel spending and investment among consumers, who feel more secure in their employment situations. Stability in employment fosters consumer confidence, which is vital for economic growth.

Additionally, with a decrease in the likelihood of missing debt payments (now at 13.4%), consumers are likely to engage in more robust financial planning and spending. A resilient job market coupled with improved financial expectations can create a positive feedback loop that supports economic vitality and mitigates recession risks.

Political Climate and Its Influence on Consumer Inflation Outlook

The findings from the New York Fed survey underscore the impact of political decisions on consumer inflation expectations. As President Trump eased stringent tariff policies, consumer fears about rising prices have moderated significantly, pointing to a direct correlation between governance and economic outlook. Consumers are highly perceptive to political events, and their confidence can fluctuate based on perceived risks associated with trade policies.

This demonstrates the need for policymakers to consider the broader economic implications of their decisions. Maintaining open communication and clarity around trade policies can help stabilize consumer sentiment and support the economic recovery. The role of leadership in managing inflation concerns is crucial to fostering an environment conducive to sustained growth.

Frequently Asked Questions

What do inflation expectations indicate about consumer behavior in the New York Fed survey?

Inflation expectations, as highlighted in the New York Fed survey, reflect how consumers perceive future price changes. In May, these expectations dropped, with the one-year inflation outlook falling to 3.2%. This shift suggests reduced apprehension regarding inflation, potentially influencing consumer spending and saving decisions.

How do Trump’s tariff effects relate to inflation expectations according to recent surveys?

Trump’s tariff effects have historically impacted inflation expectations. However, the recent New York Fed survey reveals that easing tariff threats contributed to diminished inflation fears, with one-year expectations decreasing by 0.4 percentage points to 3.2% in May, illustrating how tariff policy can influence consumer outlook on inflation.

What is the significance of the PCE price index in relation to inflation expectations?

The PCE price index is the Federal Reserve’s preferred measure of inflation, currently at 2.1%. Its relationship with inflation expectations is critical; as the index indicates a decrease, such as recent dips in inflation expectations noted in the New York Fed survey, it suggests improving economic conditions and a potential alignment with the Fed’s 2% target.

How does economic confidence affect inflation expectations?

Economic confidence can significantly shape inflation expectations. In the New York Fed survey, enhanced confidence—evidenced by a drop in anticipated job losses and an increase in stock market optimism—may lead consumers to adopt a more favorable view on inflation, contributing to lower expectations and encouraging spending.

What key factors are influencing consumer inflation outlooks based on the New York Fed survey?

Recent shifts in consumer inflation outlooks are influenced by global trade policies, specifically Trump’s tariff decisions, and current economic conditions reflected in the New York Fed survey. The decline of the one-year inflation outlook to 3.2% indicates that consumers are feeling less anxious about price increases in the near future.

Why is the New York Fed survey important for understanding inflation expectations?

The New York Fed survey is crucial for grasping inflation expectations as it gathers direct input from consumers about their outlook on price changes. This data helps economists and policymakers assess economic sentiment and adjust monetary policy accordingly to manage inflation effectively.

| Key Point | Details |

|---|---|

| Inflation Expectations Decline | The one-year inflation outlook fell to 3.2%, a decrease of 0.4 percentage points from April. |

| Long-term Inflation Outlooks | Three-year inflation forecast decreased to 3.0%; five-year forecast down to 2.6%. |

| Economic Indicators | The personal consumption expenditures price index stood at 2.1% in April, the lowest since February 2021. |

| Expectations for Price Changes in Specific Categories | Respondents expect food prices to rise 5.5%; gas price increases anticipated to ease to 2.7%. |

| Employment and Financial Confidence | Expectations of job loss decreased to 14.8%, and confidence in stock markets improved. |

Summary

Inflation expectations have shown a significant decline, indicating a stabilization in consumer sentiment towards future price increases. This shift comes amidst easing tariff proposals from President Trump, contributing to improved outlooks on inflation over the next one to three years. While inflation expectations remain above the Federal Reserve’s 2% target, the recent data suggests a positive turn as consumers grow less fearful about rising prices.