Intel Stock Soars After Trump Announces Government Stake

Intel stock is making headlines as it experiences a notable surge following recent announcements regarding a potential government stake acquisition by the Trump administration. This news has sparked increased interest in market dynamics, reflecting a broader shift in U.S. government investment strategies regarding key industries, particularly in chip manufacturing. After reports surfaced that the government aims to acquire a 10% stake in Intel, the stock rose approximately 6%, indicating investor optimism tied to these developments. Additionally, this acquisition could significantly impact Intel’s future, particularly as the company seeks to enhance its position amid competition from global giants. With such developments intertwined with recent Intel acquisition news, investors are keenly watching the unfolding events surrounding Intel’s share price surge and its implications for the semiconductor industry.

The news surrounding Intel’s recent stock performance reflects a growing trend in U.S. government involvement in the technology sector. The potential for a significant investment from the Trump government marks a pivotal shift for this prominent chipmaker, as officials discuss acquiring a considerable equity share. Investors are closely monitoring how this agreement might influence the broader chip manufacturer landscape and competitive positioning against firms like Taiwan Semiconductor Manufacturing Company. Furthermore, with substantial funding linked to the CHIPS Act slated for supporting domestic manufacturing, the implications of these developments are poised to ripple through the market. As stakeholders eagerly await further announcements, the future trajectory of Intel’s share price and its ability to innovate in a booming tech environment remains to be seen.

Understanding the Trump Government’s Stake in Intel

Recently, President Trump announced an initiative for the U.S. government to acquire a 10% stake in Intel, a move that has sparked interest among investors and analysts alike. This acquisition aims to support the struggling chip manufacturer, reinforcing the government’s hands-on approach to bolstering the American semiconductor industry. By obtaining this stake, the Trump administration not only seeks to stabilize Intel’s financial health but also to drive the company towards greater innovation and production capacity in an increasingly competitive global market.

The proposed deal represents a considerable shift in U.S. industrial policy, highlighting the government’s intent to take a proactive role in corporate America, especially in critical sectors such as technology and manufacturing. The implications of this acquisition are significant, signaling a new chapter for Intel, as the company grapples with technological advancements and competitive pressures from international rivals like Taiwan Semiconductor Manufacturing Company. The discussions surrounding this potential investment are a pivotal moment for Intel, as it could mean substantial implications for its future strategy and operational capabilities.

Impact of U.S. Government Investment on Intel Stock

The announcement of a government investment in Intel has resulted in a notable surge in Intel stock prices, jumping by approximately 6% following initial reports. This spike is a reflection of investor confidence that the Trump administration’s involvement could provide the necessary support for Intel’s operations, potentially leading to increased production capabilities and innovation. With a market capitalization exceeding $100 billion, the partnership with the U.S. government could be a significant catalyst for Intel as it navigates its path forward amidst fierce competition.

Moreover, the transaction would be facilitated under the CHIPS Act, which was previously enacted to enhance domestic semiconductor manufacturing. Commerce Secretary Howard Lutnick emphasized that the U.S. government seeks more than just a financial stake; it prioritizes ensuring that investments translate into tangible advancements in chip technology. This focus indicates a strategic alignment between public interests and corporate goals, which could, in turn, sustain the rising trend in Intel’s share price, attracting further investments and enhancing its market position.

Intel’s Chip Manufacturing Capabilities

Intel has long been a pivotal player in the semiconductor industry, particularly within the U.S. context, being the only American company capable of manufacturing the most advanced chips domestically. As the competition intensifies with global leaders like TSMC, Intel faces the challenge of modernizing its technology to meet the evolving demands of the market, particularly in sectors driven by artificial intelligence and consumer electronics. The potential U.S. government stake could aid Intel in addressing this gap, as financial backing may lead to accelerated technology development and production efficacy.

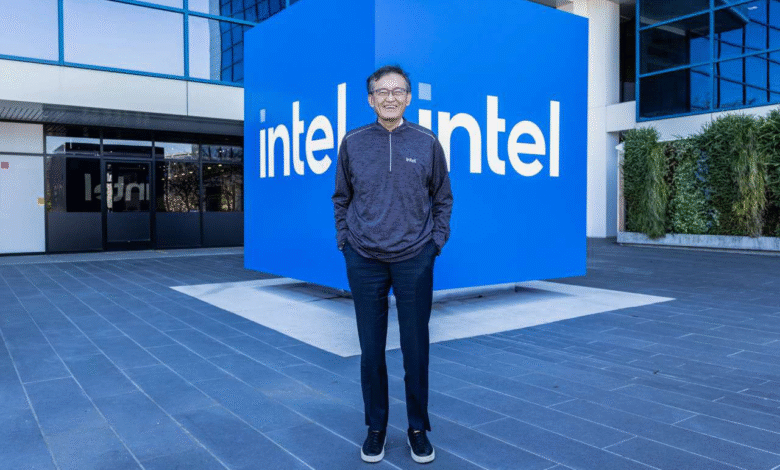

In recent years, Intel has announced ambitious plans to establish a network of advanced chip factories in Ohio, branded as the ‘Silicon Heartland.’ This initiative underlines the importance of advanced manufacturing in the U.S. and the potential for job creation within the local economy. However, as reiterated by CEO Lip-Bu Tan, the aggressive expansion plans depend on market conditions, illustrating a cautious approach amid ongoing challenges. The support from the federal government could provide the necessary assurance for stakeholders and investors regarding Intel’s strategic directions and growth potential in chip manufacturing.

The Role of SoftBank and Other Investors in Intel’s Future

In addition to the government stake proposed by the Trump administration, Intel has attracted other significant investments, notably from SoftBank, which recently revealed plans to invest $2 billion in the chipmaker. This injection of capital not only reflects growing confidence among investors regarding Intel’s market strategy but also aims to enhance its competitiveness in an industry where technological advancements are crucial. As Intel navigates its recovery, such partnerships will be pivotal in consolidating its position and supporting its development plans.

The collaboration with SoftBank signals a renewed interest from major investors in American semiconductor companies, particularly in light of the increasing demand for chips across various technology sectors. With a substantial investment from both governmental and private entities, Intel is poised to leverage this backing to bolster its research and development efforts, expand its manufacturing capabilities, and ultimately increase its market share in the rapidly evolving semiconductor industry.

Future Prospects for Intel and the Semiconductor Industry

The U.S. government’s potential investment in Intel could herald a new era of growth for both the company and the broader semiconductor industry. As Intel works to modernize its facilities and technology, the backing of significant financial partners will be crucial. The collaboration under the CHIPS Act is strategically aimed at ensuring that the U.S. maintains its competitive edge in semiconductor manufacturing amid growing global challenges. Stakeholders are keenly monitoring how these developments unfold and their potential impact on Intel’s long-term sustainability.

Despite the challenges that lie ahead, including technological competition from abroad and evolving market needs, Intel’s strategic initiatives backed by government investments and collaborations with entities like SoftBank position the company for future success. As the semiconductor landscape continues to evolve, Intel’s commitment to innovation and manufacturing excellence remains vital to its mission of delivering cutting-edge technology solutions to the market. This transformative phase could ultimately define Intel’s trajectory in the coming years.

Analysis of Intel Share Price Surge

Following news of the proposed government stake acquisition, Intel’s share price has seen a significant surge, reflecting investor optimism about the company’s future. Increased government involvement, especially under the Trump administration, suggests a more robust approach to supporting domestic manufacturing and technology sectors. Investors are reacting positively to the idea that such an investment could provide Intel with the financial stability needed to innovate and recover from past performance issues.

Moreover, the rising share price may also indicate a broader market shift towards U.S. technology firms as investors recognize the critical role these companies play in supporting national economic interests. As Intel continues to pursue advanced chip manufacturing, attracting both public and private investments, the potential for growth could redefine the company’s financial landscape. Analysts predict that sustained confidence in Intel’s strategic direction will play a key role in maintaining momentum in its stock performance.

The Importance of the CHIPS Act for Intel

The CHIPS Act represents a crucial turning point for companies like Intel seeking to reclaim their competitive edge in the global semiconductor market. This legislation is designed to bolster domestic manufacturing and innovation within the U.S., encouraging partnerships between the government and tech companies. As Intel prepares to engage with the U.S. government regarding potential equity investments, the CHIPS Act serves as a foundation for these discussions, highlighting the importance of federal support in revitalizing America’s technology landscape.

By aligning its operational strategies with the objectives of the CHIPS Act, Intel demonstrates its commitment to strengthening its chip production capabilities while simultaneously contributing to national economic goals. With a government stake, Intel may find new avenues for growth and development, enhancing its position as a leader in semiconductor manufacturing. As this narrative unfolds, the relationship between government policy and corporate America will be increasingly scrutinized for its impact on technological advancements and economic resilience.

The Future of Intel’s Ohio Factories

Intel’s ambitious plans to set up a series of chip manufacturing facilities in Ohio are critical not only for the company’s strategy but also for the revitalization of the American manufacturing sector. While the administration is keen on facilitating investments in technology, Intel’s goal to establish a so-called ‘Silicon Heartland’ underscores the importance of local economic growth and job creation. The ongoing discussions about government investment could further bolster Intel’s position in Ohio, ensuring that these facilities develop into leading-edge production sites for advanced semiconductor technologies.

Despite recent comments from CEO Lip-Bu Tan indicating that construction timelines may slow pending market conditions, the overarching narrative emphasizes the potential of these factories as pivotal contributors to Intel’s recovery and growth strategy. As the semiconductor industry continues to evolve, Intel’s commitment to establishing strong manufacturing bases in the U.S. may not only enhance its competitive standing but also align with national interests in fostering domestic production capabilities.

The Global Landscape of Semiconductor Manufacturing

The semiconductor industry is increasingly characterized by fierce competition, particularly among major players such as Intel and TSMC. As the demand for advanced chips grows, maintaining leadership in this landscape requires continual advancements in technology and manufacturing processes. The proposed investment by the U.S. government through the acquisition of a stake in Intel signals a commitment to strengthening domestic manufacturing capabilities, enabling Intel to better compete on a global scale.

Understanding the global landscape is essential for stakeholders engaging with Intel’s future. The government’s willingness to intervene through investments aims to ensure that Intel can match or exceed the innovation levels seen in international competitors. As market dynamics shift in response to technological advancements and geopolitical considerations, the strategic decisions made by Intel will be instrumental in determining its success within the global semiconductor market.

Frequently Asked Questions

What impact did the Trump government stake announcement have on Intel stock?

The announcement of a potential U.S. government stake in Intel significantly boosted Intel stock, with shares rising by about 6%. This surge followed Bloomberg’s report on the Trump administration’s intention to acquire a 10% equity stake in the chip manufacturer, highlighting government interest in stabilizing Intel’s market position.

How does the U.S. government investment affect Intel’s future prospects?

The U.S. government investment, which includes a proposed 10% stake in Intel, could provide the chipmaker with essential funding and support under the CHIPS Act. This initiative aims to enhance domestic semiconductor manufacturing, thereby strengthening Intel’s position in the industry and potentially improving its share price in the long term.

What are the latest Intel acquisition news updates?

Recent Intel acquisition news indicates that the Trump administration plans to acquire a 10% stake in the company. This development, along with SoftBank’s recent $2 billion investment, reflects growing interest in Intel’s recovery efforts and its strategic initiatives in advanced chip production.

How does the Intel share price surge relate to government initiatives?

The Intel share price surged primarily due to news of a potential U.S. government investment in the form of a stake acquisition. This proactive industrial policy from the Trump government signals strong federal support for Intel, which is crucial for its recovery and competitiveness in the semiconductor market.

What role does the CHIPS Act play in Intel’s market strategy?

The CHIPS Act plays a pivotal role in Intel’s market strategy by providing financial support for building advanced chip manufacturing facilities. Intel aims to capitalize on this funding to enhance its production capabilities and regain a competitive edge against rivals, which can positively influence Intel stock in the future.

Why is the U.S. government taking a stake in Intel?

The U.S. government is taking a stake in Intel to secure a foothold in the crucial semiconductor industry, ensuring national security and economic stability. This move is part of a broader strategy to support domestic production and innovation in response to the growing demand for advanced chips.

What are the future implications of the Trump government stake for Intel shareholders?

For Intel shareholders, the Trump government stake may bring increased confidence in the company’s future as federal investments can lead to financial stability and growth opportunities. However, shareholders should remain attentive to the ongoing negotiations and market conditions that could affect Intel’s operational strategies.

| Key Point | Details |

|---|---|

| Trump’s Announcement | The U.S. government plans to acquire a 10% stake in Intel. |

| Stock Surge | Intel shares rose by approximately 6% following the announcement. |

| Ongoing Discussions | Meetings between President Trump and Intel CEO Lip-Bu Tan are scheduled to discuss the agreement. |

| Government Policy Change | This acquisition signals a significant shift in U.S. industrial policy with proactive government involvement in corporate affairs. |

| CHIPS Act Funding | The government’s stake in Intel is linked to funding for initiatives outlined in the CHIPS Act. |

| Competition | Intel is competing with Taiwan Semiconductor Manufacturing Company for technological leadership. |

| Factory Plans | Intel is investing in a new network of chip factories in Ohio, projected to create advanced AI chips. |

Summary

Intel stock is currently experiencing a notable rise due to President Trump’s announcement regarding the U.S. government’s plan to acquire a 10% stake in the company. This investment reflects a significant shift in U.S. industrial policy, as the government aims to play a more active role in the chip manufacturing sector. As Intel continues to navigate its challenges and competitors, including Taiwan Semiconductor, this government support may provide a much-needed boost to its growth strategies and long-term initiatives.