Interest Rate Cuts: Fed Officials Share Diverging Views

Interest rate cuts are on the horizon, as most officials from the Federal Reserve anticipate a shift in their monetary policy amidst varying concerns over economic stability. The latest minutes from the FOMC meeting reveal a split among policymakers, balancing fears of inflation driven by tariffs against signs of weakness in the labor market. With inflation still lingering above the 2% target, the decision on how aggressively to implement these interest rate cuts could significantly impact economic growth. As the economy remains resilient, central bank members emphasize a cautious approach to avoid exacerbating inflation concerns. This evolving narrative suggests that while rate cuts are likely, their timing and magnitude will depend heavily on forthcoming economic data.

With discussions surrounding reductions in borrowing costs gaining momentum, the central bank’s strategy is under close scrutiny. Many economists and financial analysts are paying attention to potential adjustments in the Federal Reserve’s approach to interest rates, particularly as external pressures, such as tariffs, shape economic conditions. The balance between stimulating growth through lowered rates and managing inflationary risks remains a complex aspect of monetary policy. Stakeholders are keenly observing how these decisions will unfold in response to the latest economic indicators. The overarching goal remains not just to foster economic resilience but to navigate the intricate landscape of global trade implications.

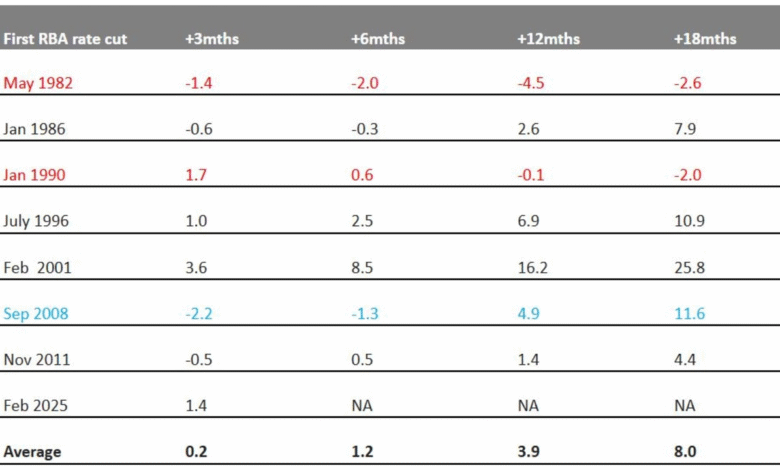

Implications of Future Interest Rate Cuts

As Federal Reserve officials continue to deliberate on the future of interest rate cuts, the implications for both consumers and businesses are significant. With the potential for rate reductions, borrowing costs could decrease, leading to higher consumer spending and investment. This scenario may stimulate economic growth, which has been a focal point in recent discussions among Fed members. However, the extent of these cuts remains uncertain, as officials express conflicting views on inflation pressures and labor market indicators. Consequently, while some believe that a couple of cuts could occur within the year, others maintain a cautious approach.

Furthermore, understanding the timing and magnitude of these cuts is crucial for market participants. If the Federal Open Market Committee decides to implement rate cuts in response to economic weakness, it may influence everything from mortgage rates to corporate loans. The relationship between interest rate policy and inflation concerns cannot be overlooked as well; if inflation remains above the Fed’s target, aggressive cuts could exacerbate the situation. Therefore, as consumers anticipate these changes, staying informed is key to making sound financial decisions.

Diverging Opinions Among Federal Reserve Officials

The June Federal Open Market Committee meeting underscored a significant divide among officials regarding the appropriate course of monetary policy. While many members agreed on the necessity of some interest rate cuts, their opinions varied widely in terms of the urgency and extent of these reductions. For instance, some officials expressed readiness to act swiftly, suggesting that rate cuts could occur as soon as the next FOMC meeting if inflation continues to stabilize. On the contrary, a faction argued that remaining close to a neutral rate might be more prudent, especially given the complexities surrounding current inflation rates.

This divergence reflects broader concerns about the economy, including labor market conditions and global economic indicators. Policymakers are aware that external factors, such as international trade dynamics and tariff impacts, could complicate their approach. The Fed’s commitment to a careful stance, as highlighted in the minutes, indicates their recognition of trade-offs between promoting growth and maintaining inflation targets. As these discussions unfold, the economic landscape remains unpredictable, influencing how effectively the Fed can navigate its challenges in monetary policy.

Economic Growth and Inflation Concerns

The balance between fostering economic growth and addressing inflation concerns stands at the forefront of the Federal Reserve’s decision-making process. Recent indicators suggest that while economic growth has shown resilience, there are underlying weaknesses that may necessitate action. For example, despite job growth exceeding expectations, slower gains in consumer spending present challenges. Fed officials have noted that tariff-induced inflation could be temporary, yet persistent inflation may require careful reassessment of monetary policy moving forward.

Furthermore, with inflation data fluctuating around the Fed’s 2% target, strategizing on interest rate cuts is increasingly complex. Officials must carefully evaluate labor market signals alongside inflation forecasts to make informed decisions. The potential that rapid economic growth could fold under elevated inflation pressures is a critical concern, necessitating a cautious approach as noted in recent Fed minutes. As such, the Fed’s actions will need to strike a balance that supports sustained economic expansion without exacerbating inflation.

The Role of Tariffs in Inflation Trends

Tariffs have emerged as a pivotal factor influencing inflation trends in the current economic discourse. As the Federal Reserve deliberates future interest rate cuts, there is growing recognition that the impact of tariffs on inflation may not be as significant as initially perceived. Many Fed officials believe that the effects could be temporary and manageable if trade negotiations lead to favorable outcomes. This viewpoint suggests that agility in responding to shifts in trade policy could alleviate potential inflationary pressures.

Moreover, the Fed’s assessment on tariffs also emphasizes the importance of adaptability within sectors that rely on international trade. Businesses are encouraged to adjust their supply chains in ways that mitigate the impacts of tariffs, which may consequently reduce upward pressure on prices. As highlighted in the meeting minutes, confidence in achieving new trade agreements could play a crucial role in stabilizing inflation expectations. Therefore, navigating these complexities is essential for the Fed’s strategy in managing monetary policy in the face of evolving trade conditions.

Federal Reserve’s Cautious Approach Post-Meeting

In the wake of the June Federal Open Market Committee meeting, Chair Jerome Powell and fellow officials reiterated their commitment to a cautious approach in adjusting monetary policy. This careful consideration stems from the dual threats of slow economic growth and persistent inflation concerns that could hinder policy effectiveness. The Fed’s decision to maintain the current interest rate range of 4.25%-4.5% reflects their recognition of the economic landscape that requires a balanced approach to monetary adjustments.

Moreover, the Fed is acutely aware that political influences, including pressure from the administration regarding rate cuts, could complicate their deliberative process. Powell has continuously stated that monetary policy should not be swayed by external pressures, emphasizing the importance of data-driven decision-making. The minutes from the meeting highlight the Fed’s willingness to remain adaptable while closely monitoring economic indicators, which is pivotal for maintaining credibility and stability in monetary policy.

Market Reactions to Potential Rate Cuts

Market participants are highly attuned to the discussions surrounding potential interest rate cuts by the Federal Reserve, and recent minutes have intensified speculation on imminent changes. The prospect of lower rates often leads to heightened market volatility as investors recalibrate their strategies, anticipating shifts in consumer spending and borrowing costs. For example, stocks often react positively to rate cut signals, as lower borrowing costs can enhance corporate profitability and stimulate economic growth.

However, this speculation also feeds into broader concerns about the health of the economy. While some market analysts predict that aggressive rate cuts could ignite renewed economic momentum, others warn of the risks associated with unchecked inflation. Consequently, the balance of market sentiment seems wary, with cautious optimism prevailing amid uncertainty regarding the impact of tariffs and global economic pressures. The Fed’s decisions will need to align closely with economic realities to avoid market disruptions that could arise from sharp or miscalibrated cuts.

Consumer Behavior and Spending Trends

As the Federal Reserve considers potential interest rate cuts, consumer behavior plays a critical role in shaping the economic trajectory. Consumer spending forms the backbone of economic activity, and any changes to interest rates are likely to influence how households manage their finances. Should the Fed lower rates, consumers could be incentivized to borrow more for big-ticket purchases, leading to increased spending that could boost economic growth in the short term.

On the flip side, current trends show a decline in consumer spending, triggered by uncertainties in the labor market and inflation concerns. The observed decrease in personal expenditures indicates that many households are adopting a more cautious approach to spending. This behavioral shift poses a challenge for the Federal Reserve as it navigates its monetary policy strategy. Understanding consumer sentiment and spending trends will be crucial as the Fed formulates its approach to interest rate adjustments in response to an evolving economic landscape.

Challenges Facing the Federal Reserve’s Policy Decisions

The Federal Reserve is navigating a complex array of challenges as it formulates its policy decisions regarding interest rate adjustments. The interplay of economic growth, labor market conditions, and inflation has created a landscape where simple solutions are elusive. Policymakers must weigh the necessity of cuts against the potential risk of igniting inflation, all while remaining responsive to external economic pressures, such as tariffs and international trading conditions.

Additionally, the internal divergence among Fed officials complicates cohesive policy positioning. While there is a consensus on the potential for rate cuts, the varying opinions on their frequency and timing reflect broader uncertainties within the economic outlook. Addressing these challenges will require a fine balance among different economic forecasts and strategic assessments, ensuring that monetary policy remains effective in promoting both growth and price stability in a dynamic environment.

The Future Outlook for Economic Indicators

Looking ahead, the direction of economic indicators will significantly influence the Federal Reserve’s approach towards interest rate cuts and overall monetary policy. Key indicators such as the unemployment rate, consumer price index, and GDP growth will all be under scrutiny as Fed officials assess the health of the economy. Positive trends in employment and spending will likely reinforce the case for cautious optimism, potentially prompting officials to move ahead with rate cuts designed to sustain growth.

Conversely, persistently high inflation or signs of economic contraction could constrict the Fed’s options, leading to a more conservative stance in monetary policy adjustments. The importance of accurate forecasting and timely responses cannot be overstated as policymakers strive to balance their dual mandates of promoting maximum employment and stabilizing prices. Thus, ongoing analysis of economic data will be essential in shaping the Federal Reserve’s future decisions as they look toward the evolving economic landscape.

Frequently Asked Questions

What are the implications of interest rate cuts announced by the Federal Reserve during the FOMC meeting?

Interest rate cuts announced by the Federal Reserve can stimulate economic growth by making borrowing cheaper, encouraging spending and investment. However, during the recent FOMC meeting, officials expressed diverging opinions on how aggressive these cuts should be, considering factors like inflation concerns due to tariffs and the state of the labor market.

How do interest rate cuts affect inflation according to the Federal Reserve’s recent discussions?

The Federal Reserve’s discussions highlighted that while interest rate cuts can boost economic activity, they may also impact inflation rates. Officials noted concerns about potential tariff-induced inflation, suggesting that any cuts would need to be carefully calibrated to avoid exacerbating inflation above the target, which remains at 2%.

When can we expect the Federal Reserve to implement interest rate cuts based on recent FOMC meeting minutes?

According to the recent FOMC meeting minutes, while most Fed officials anticipate some interest rate cuts this year, opinions vary widely on timing. Some members believe that cuts could happen as soon as the next meeting, while others suggest that a more cautious approach may be warranted, depending on economic growth and inflation indicators.

What did the Federal Reserve officials say about economic growth when discussing interest rate cuts?

During the FOMC meeting, Federal Reserve officials recognized signs of economic strength but also expressed concerns regarding potential weaknesses in economic growth and the labor market. This dual perspective influences their approach to potential interest rate cuts, as they strive to balance stimulating growth without igniting inflation.

How are tariff-induced inflation concerns impacting the Federal Reserve’s decision on interest rate cuts?

Tariff-induced inflation concerns are a significant factor in the Federal Reserve’s decision-making process on interest rate cuts. Officials indicated that while current pressures may be temporary and modest, they still warrant caution in policy adjustments, particularly as they account for the uncertain effects tariffs may have on overall inflation and economic stability.

What is the Federal Reserve’s stance on current monetary policy amidst potential interest rate cuts?

The Federal Reserve’s stance as discussed in the recent meeting is to maintain a careful and measured approach to monetary policy. While they acknowledge the potential for future interest rate cuts, the committee emphasized the importance of closely monitoring inflation and employment data to inform their decisions.

How might changes in consumer spending affect the Federal Reserve’s approach to interest rate cuts?

Changes in consumer spending, as indicated by recent declines in personal expenditures and retail sales, could influence the Federal Reserve’s approach to interest rate cuts. A slowdown in consumer spending might prompt the Fed to consider cuts more seriously to bolster economic activity and stimulate growth.

What challenges does the Federal Reserve face in setting interest rates amid economic uncertainty?

The Federal Reserve faces challenges in setting interest rates amid economic uncertainty, particularly with conflicting indicators such as rising inflation and weak job gains. Policymakers must navigate complex tradeoffs, balancing the risk of persistent inflation against the need to support economic growth and employment.

How does the upcoming FOMC meeting relate to expectations for future interest rate cuts?

The upcoming FOMC meeting is crucial as it will likely influence expectations for future interest rate cuts. With growing pressure from various economic indicators and public statements from Fed officials, market participants are keenly awaiting decisions that could signal the timing and scale of any potential rate reductions.

What role does political pressure play in the Federal Reserve’s interest rate decisions?

Political pressure plays a significant role in the Federal Reserve’s interest rate decisions, as evidenced by public remarks from figures like President Trump. However, Fed Chair Jerome Powell has maintained a commitment to independence, stating that monetary policy decisions will remain based on economic data rather than political influence.

| Key Point | Details |

|---|---|

| Divergence Among Fed Officials | Fed officials were divided on the aggressiveness of interest rate cuts, balancing concerns over tariff-induced inflation against signs of economic weakness. |

| Current Interest Rate | The Federal Reserve’s key borrowing rate is maintained at 4.25%-4.5%, unchanged since December 2024. |

| Future Rate Projections | Some officials propose a couple of cuts soon, whereas others suggest maintaining rates this year due to stable inflation and economic conditions. |

| Pressure from Political Figures | President Trump has pressured the Fed for aggressive cuts and publicly criticized Chair Powell, calling for his resignation. |

| Economic Implications | While inflation is above the 2% target, job growth exceeds predictions, and consumer spending is decreasing. |

| Uncertainty in Economic Outlook | Fed policymakers are cautious, noting they face trade-offs if inflation persists while employment outlook weakens. |

Summary

Interest rate cuts are a significant topic as the Federal Reserve navigates economic uncertainty. During the recent Federal Open Market Committee meeting, officials displayed varied opinions on how aggressively to implement these cuts amidst inflation concerns and labor market signs. While some anticipate reductions in rates to support economic conditions, others advocate for a more cautious approach. Politically, the pressure from leaders for aggressive monetary policy shifts adds another layer to the Fed’s decision-making process. Overall, the consensus reflects a careful balancing act towards potential interest rate cuts while remaining responsive to economic indicators.