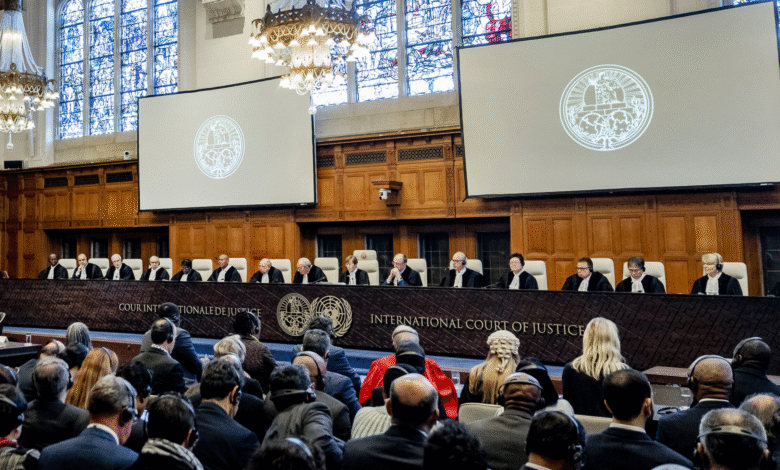

International Court of Justice Ruling Shakes Financial Markets

The recent ruling by the International Court of Justice has sent shockwaves through global financial markets, marking a significant moment in climate policy. This landmark advisory opinion emphasizes the legal obligations of states to combat climate change, including the contentious issue of fossil fuel subsidies that contribute to environmental degradation. As governments grapple with these newfound responsibilities, investors are increasingly reassessing the potential financial implications of climate change rulings. The ICJ has stated that actions against climate preservation may constitute internationally wrongful acts, thus intensifying scrutiny on companies involved in fossil fuel production. Consequently, this pivotal ruling could reshape how financial markets evaluate risks associated with climate-related policies and sustainable practices.

In a groundbreaking shift for global jurisprudence, the recent determination made by the International Court of Justice has raised critical questions regarding nations’ responsibilities toward climate action. This ruling addresses the pressing issue of fossil fuel subsidies and lays out the legal framework that countries must navigate in their climate policies. As investors become aware of the implications of this advisory opinion, the repercussions for financial markets are profound and far-reaching. Furthermore, the ICJ’s decision underscores the urgency for governments to reassess their climate commitments and adherence to legal standards, marking a crucial turning point in the conversation about climate accountability. With heightened awareness surrounding climate regulations and legal obligations, stakeholders are now prompted to consider their strategic responses in light of this transformative legal landscape.

Significance of the International Court of Justice Ruling on Climate Change

The recent advisory opinion delivered by the International Court of Justice (ICJ) marks a watershed moment in international climate law. By asserting that fossil fuel production and subsidies could be classified as ‘internationally wrongful acts’, the ICJ has set a precedent that demands increased accountability from states on climate action. This landmark ruling has profound implications, as it emphasizes that countries are not only encouraged but are legally compelled to take steps to avert the climate crisis. The interpretation of climate policy is thus elevated, signaling to nations that neglecting environmental responsibilities may lead to significant legal repercussions.

More importantly, this opinion shapes the expectations within the financial markets. Investors are now called to scrutinize the legal obligations tied to climate action as outlined by the ICJ. This new legal framework could trigger a reevaluation of investment strategies, particularly in industries heavily reliant on fossil fuels. Stakeholders are acknowledging that compliance with the ICJ’s ruling may become a pivotal factor in assessing the viability of various investments, thereby influencing investment flows and market evaluations.

Impact on Financial Markets: A Shift in Investment Strategies

As the financial markets react to the International Court of Justice’s ruling, we can anticipate a shift in investment strategies, particularly pertaining to fossil fuel-related assets. With the court underscoring that fossil fuel subsidies and permissions may be viewed as wrongful acts, investors are now faced with the challenge of reassessing the long-term sustainability of their portfolio holdings. This assessment extends to evaluating the risk profiles of companies heavily involved in carbon emissions and how they align with the emerging legal obligations defined by the ICJ.

Investors and analysts alike are acknowledging that the ruling could exert downward pressure on stocks linked to fossil fuels, potentially altering the financial landscape. The ruling serves as a warning that any failure to adapt to evolving climate policies could lead to adjustments in market valuations and financial outlooks. Moreover, the response from financial institutions is likely to mirror the legal uncertainties brought forth by the ICJ, causing a ripple effect throughout the investment community that could favor more sustainable practices.

Legal Obligations and Climate Policy Changes

The ICJ’s advisory opinion demands a reassessment of legal obligations surrounding climate policy. For instance, the unequivocal statement that governments must protect the environment and commit to reducing greenhouse gas emissions fundamentally alters the legal responsibilities of states. This shift could instigate the development of more stringent climate legislation and regulations at national and international levels. As countries work toward compliance with these legal requirements, it becomes crucial for industries to align their operations and funding with these evolving standards.

These changes in climate policy also suggest an imminent transformation in how businesses operate, particularly in sectors significantly contributing to carbon emissions. Companies may need to pivot their strategies to mitigate potential legal liabilities and align with state obligations. This evolution will be closely observed by investors, as regulatory compliance may soon dictate investment attractiveness, thereby transforming the dynamics of corporate financing and governance.

Fossil Fuel Subsidies Under Scrutiny

The International Court of Justice’s stance on fossil fuel subsidies places them directly under scrutiny, bringing forth discussions on their viability in a world increasingly concerned about climate change. Subsidies that once bolstered fossil fuel companies now face criticism, not only from a financial perspective but also from a legal standpoint. This scrutiny will likely lead to a re-evaluation of existing subsidy policies, prompting states to reconsider their fiscal commitment to fossil fuel industries that may soon come with heightened legal challenges.

Consequently, investments in fossil fuel projects might become riskier as potential legal contingencies surface. Investors may find themselves reevaluating the risk associated with companies that benefit from fossil fuel subsidies, as they may soon face pressure to conform to stricter environmental guidelines. As markets adjust to these insights, there may be a significant shift towards greener alternatives that align better with emerging legal frameworks, thus impacting overall investment trends.

Future of Climate Policy and International Cooperation

The ICJ’s ruling is a clarion call for international cooperation in tackling climate change. By defining the responsibilities of states, the court provides a framework to foster collaboration across borders that is essential in timely addressing this global crisis. The advisory opinion emphasizes that combating climate change is not only a national issue but a shared international obligation, further necessitating cooperative climate strategies among nations.

As this principle of cooperation gains traction, countries may be inspired to unify their climate actions through shared initiatives and agreements. This collaborative shift could lead to enhanced diplomatic dialogues and the establishment of frameworks that harmonize climate policies across different regions. The potential for collective action encourages investors to look more favorably upon projects that prioritize international standards for sustainability, further shaping the future of global financial markets.

Investor Reactions: Analyzing Diverse Perspectives

Following the ICJ’s landmark ruling, reactions within the investment community have been varied. Some analysts argue that this ruling signals a shift towards greater environmental responsibility, fostering new investment paradigms that prioritize sustainability. Others, however, underscore the complexity of investor opinions on climate change, suggesting a mixed response could result in divergent interpretations of the ruling’s implications for financial decision-making.

As these differing perspectives unfold, it creates a unique landscape where investment strategies could either align with or oppose the emerging legal directives dictated by the ICJ. Investors may need to navigate these complexities carefully, weighing their approaches against the polarized views within their ranks. Understanding the broader implications of the ICJ’s ruling is crucial for developing actionable insights that respond to both legal responsibilities and changing market conditions.

Challenges Faced by Polluting Industries

Industries that are heavy polluters face looming challenges in light of the ICJ’s advisory opinion. As companies grapple with the reality of heightened legal scrutiny concerning their environmental impact, the potential for increased litigation risks looms large. This advisory ruling may set a precedent where entities engaged in fossil fuel production are more likely to face legal actions for their contributions to climate change.

As these challenges arise, the pressures of compliance with evolving environmental regulations may necessitate strategic pivots within these industries. Companies may need to invest more in innovative technologies that reduce emissions and transition towards more sustainable practices. These shifts can determine their market viability, compelling heavy polluters to reconsider their long-term strategies amidst the pressing legal and environmental landscape.

Long-Term Implications for Investment and Climate Strategies

While the immediate impacts of the ICJ’s ruling on climate change may be complex to assess, the long-term implications are becoming clearer. Investors will likely need to incorporate the foundational principles articulated by the court into their ongoing evaluations of risk and return. This evolution in thinking could lead to a fundamental reshaping of corporate strategies and accountability mechanisms in the years to come.

Ultimately, the advisory opinion from the ICJ emphasizes that climate change is not merely a distant concern but a pressing reality that requires urgent action. As a result, investors are increasingly recognizing the critical need for adapting investment frameworks to incorporate sustainable practices. This shift towards sustainability could pave the way for a new era of responsible investing, aligning financial goals with broader environmental imperatives.

A Call for Transparency in Climate Reporting

The ICJ ruling underscores the urgent need for transparency in climate reporting among all sectors, particularly those with considerable environmental footprints. As legal obligations around climate change become more pronounced, companies will face increasing pressure to disclose their contributions towards greenhouse gas emissions and their strategies for compliance with growing legal standards. Transparent reporting can foster accountability and provide investors with the necessary information to make informed decisions.

Moreover, promoting transparency in climate reporting may also enhance public trust in corporate claims about sustainability. As stakeholders demand clearer insights into how companies are addressing their legal obligations and integrating climate policies into their business strategies, companies that prioritize transparency may find themselves at a distinct competitive advantage. This evolving landscape reinforces the importance of responsible practices in safeguarding not only the environment but also the future viability of corporate entities.

Frequently Asked Questions

What is the significance of the International Court of Justice ruling on climate change?

The International Court of Justice (ICJ) ruling on climate change is significant as it is the court’s first advisory opinion determining that states have legal obligations to combat climate change and protect the environment from greenhouse gas emissions. This landmark ruling establishes a legal framework that may influence future climate policy and holds governments accountable for fossil fuel production and subsidies.

How does the International Court of Justice ruling impact fossil fuel subsidies?

The ICJ ruling stated that fossil fuel production, including licensing and subsidies, could constitute an internationally wrongful act. This has notable implications for fossil fuel subsidies, as governments may face increased legal scrutiny and pressure to reevaluate their financial support for fossil fuel industries to comply with international climate obligations.

What legal obligations did the International Court of Justice establish related to climate policy?

The ICJ established that governments have a legal obligation to protect the environment and ensure the safety of present and future generations from the effects of climate change. This ruling reinforces the necessity for international cooperation among states, emphasizing that climate action is not optional but a legal requirement.

What are the potential financial markets impacts of the International Court of Justice ruling?

The ICJ’s ruling on climate change could significantly influence financial markets as investors may need to reassess the risks associated with fossil fuel assets and industries related to high emissions. Companies in these sectors may face increased litigation risks and pressure from stakeholders to alter their operations in line with the court’s advisory opinion.

How might investors view the International Court of Justice ruling on climate change?

Investors have mixed perspectives on the ICJ ruling; some see it as a critical shift in climate policy that necessitates asset revaluation, while others note differing interpretations within the investment community. The ruling could spur more cautious investment strategies regarding fossil fuels and increase demand for sustainable alternatives.

What was the response from global leaders to the International Court of Justice ruling?

Responses from global leaders varied, with some acknowledging the ICJ ruling as essential for enhancing international climate cooperation, particularly among the world’s largest carbon emitters, the U.S. and China. However, there was also skepticism about the immediate implementation and impact of the court’s opinion on national policies.

Will the International Court of Justice ruling lead to immediate changes in climate policy?

While the ICJ ruling is groundbreaking, it is an advisory opinion and non-binding. As such, immediate changes in climate policy may not occur across nations. However, the ruling does lay the groundwork for potential legal challenges and future policy reform regarding climate action and fossil fuel subsidies.

What is the role of the International Court of Justice in shaping environmental law?

The ICJ plays a crucial role in shaping environmental law by providing interpretations of legal obligations related to climate change and other environmental issues. Its advisory opinions can influence state behavior and inform international treaties, thereby forming a foundational legal basis for global climate action.

| Key Points | Details |

|---|---|

| International Court of Justice (ICJ) Ruling | First-ever advisory opinion on obligations regarding climate change. |

| Fossil Fuels as Wrongful Act | Production, licensing, and subsidies for fossil fuels may constitute an internationally wrongful act. |

| Legal Obligation for Governments | ICJ ruled that states must protect the environment and engage in international cooperation. |

| Implications for Investors | This ruling may lead to significant revaluation of fossil fuel-related assets. |

| Differing Responses | Mixed reactions from major emitters like the U.S. and China, indicating varying interpretations. |

| Potential Litigation Risks | Companies in heavily polluting sectors may face increased litigation risks. |

Summary

The International Court of Justice ruling marks a critical step in establishing legal obligations for states to combat climate change, emphasizing the potential wrongful nature of fossil fuel production. This landmark opinion could drastically shift the landscape for investors and financial markets, signaling the urgent need for reassessment of assets tied to fossil fuels. The ruling’s implications call for enhanced environmental protection measures, positioning climate action as a legal responsibility for governments worldwide.