Intuit Quarterly Results Show Strong Growth and Guidance

Intuit quarterly results released on Thursday demonstrated outstanding performance that surpassed analysts’ expectations, causing a notable surge in the Intuit stock price by approximately 4% during after-hours trading. The Intuit earnings report highlighted earnings per share of $11.65, significantly beating the anticipated $10.91, while the company’s revenue reached $7.8 billion against an expectation of $7.56 billion. This marks a substantial 15% revenue growth from the previous year’s $6.7 billion, showcasing the company’s resilience and demand for its products, particularly Intuit TurboTax. Looking forward, Intuit guidance for the full fiscal year has been revised upward, with projected revenue estimates between $18.72 billion and $18.76 billion. Investors and analysts alike are adjusting their expectations positively based on these strong results, setting an optimistic tone for Intuit’s future prospects.

Recently, Intuit unveiled impressive financial results that resonated positively with market analysts, reflecting a robust performance and strong fiscal management. The latest earnings disclosure showed notable increases in both earnings per share and overall revenue, reinforcing confidence in the company’s direction. With a strong focus on its flagship products, including TurboTax, Intuit is poised to leverage revenue growth and maintain a competitive edge in the financial software sector. As the company sets ambitious financial targets for the upcoming year, stakeholders are eager to understand the implications of Intuit’s strategic decisions. This latest financial update serves as a crucial indicator of the company’s ongoing success and adaptability in a dynamic market.

Intuit Quarterly Results Exceed Expectations

Intuit recently announced its quarterly results, showcasing a robust performance that not only met but exceeded analysts’ expectations. The adjusted earnings per share stood at $11.65, which was a significant improvement over the $10.91 anticipated by experts. Additionally, the company reported revenues of $7.8 billion, surpassing the forecast of $7.56 billion. This impressive quarterly performance reflects Intuit’s strong market position and solid operational execution, particularly in the areas of its flagship products like TurboTax and QuickBooks.

The revenue growth of 15% compared to $6.7 billion in the same period last year indicates a healthy demand for Intuit’s services, especially as this latest quarter coincided with the critical tax filing deadline in the United States. With the rising complexity of tax regulations and the increasing need for efficient financial management solutions, more consumers and businesses are turning to Intuit’s offerings. This situation underscores the company’s pivotal role in the financial software space.

Strong Guidance Reflects Confidence in Future Growth

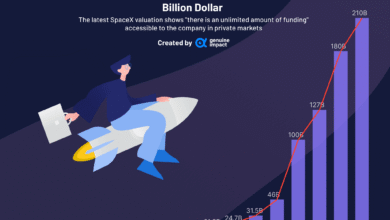

In conjunction with its quarterly results, Intuit provided optimistic guidance for its full fiscal year, projecting revenues to fall between $18.72 billion and $18.76 billion. This forecast marks a notable increase from their previous estimate of $18.16 billion to $18.35 billion. Analysts, as compiled by LSEG, had anticipated revenues closer to $18.35 billion, making Intuit’s revised guidance a lifting surprise that reflects confidence in the company’s growth trajectory. This forward-looking perspective is expected to positively impact Intuit’s stock price as investor sentiment remains buoyed by strong performance metrics.

The proactive measures taken by Intuit, including significant investments in AI as echoed by CEO Sasan Goodarzi’s comments, position the company strongly for ongoing revenue growth. By leveraging advanced technology to enhance customer experience and streamline operations, Intuit aims to maintain its competitive edge in financial software. This blend of innovative product enhancement and solid financial forecasts lays the groundwork for continued success, all of which augurs well for investors looking at the long-term potential of Intuit stock.

Impact of TurboTax on Intuit’s Revenue Growth

TurboTax has played a pivotal role in driving Intuit’s revenue growth, particularly evident in the latest quarterly results. As the go-to software for tax preparation, TurboTax has attracted a significant user base, especially during the tax season when consumers are seeking reliable, efficient, and easy-to-use solutions. The increase to $7.8 billion in revenue during this quarter reflects not just the effectiveness of TurboTax, but also its strategic marketing efforts that have drawn in new customers while retaining existing ones with strong satisfaction rates.

Furthermore, the integration of user feedback and investment in new technology, such as AI capabilities in TurboTax, is enabling Intuit to cater more effectively to the demands of its customer base. This ongoing improvement not only enhances user experience but also supports sustained revenue increase year-over-year. As more customers continue to rely on TurboTax for their tax filing needs, Intuit is well positioned to capitalize on this trend, further solidifying its status as a leader in financial software.

Understanding Intuit’s Stock Price Movement

Following the announcement of its quarterly results, Intuit’s stock price surged approximately 4% in after-hours trading, reflecting investor confidence in the company’s financial health and growth prospects. Such fluctuations in stock price are often indicative of market reactions to earnings reports, particularly when results surpass expectations. For investors, this rise in stock price is a positive indicator, showcasing market validation of Intuit’s strong performance and future guidance.

Moreover, the stock price’s reaction following the earnings release is a critical aspect for stakeholders. It is essential for potential investors to monitor these movements as Intuit’s strong quarterly results and positive outlook could encourage more trading activity. A sustained upward trend in Intuit’s stock price may attract further investment, enhancing the company’s market position and giving it greater leverage for future endeavors in innovation and expansion.

AI Investments Driving Innovation at Intuit

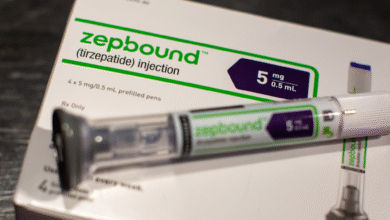

Intuit’s commitment to investing in artificial intelligence (AI) is a major factor driving its innovative edge in the financial software market. As CEO Sasan Goodarzi noted, many customers are seeking solutions that simplify their financial processes, prompting Intuit to enhance its technology portfolio. By harnessing AI, Intuit is able to offer more personalized experiences and increase operational efficiency within its products such as TurboTax and QuickBooks.

The integration of AI not only streamlines user experience but fosters greater customer loyalty, which is crucial for sustained revenue growth. As Intuit continues to advance its AI capabilities, the company is likely to set new benchmarks in the financial software industry, ultimately driving further sales and enhancing its competitive advantage. The strategic positioning around AI largely influences investor perception, as stakeholders recognize the potential for substantial growth within an increasingly digital economy.

Quarterly Call Insights from Intuit Leadership

Investors eagerly anticipate the quarterly call with Intuit leadership, scheduled for 4:30 p.m. ET, where insights into the company’s performance and strategic direction will be discussed. These calls typically provide a platform for executives to delve deeper into the earnings report details, guidance for the upcoming quarters, and overarching strategic initiatives. This transparency helps in building investor trust and maintaining market stability.

During these calls, listeners can expect the leadership team to elaborate on the drivers behind the recent revenue growth, including the performance of TurboTax, and how they plan to navigate any potential challenges. Additionally, updates on competitive positioning and relevant market trends may be discussed, providing investors with valuable information that could influence their investment decisions moving forward.

Analyzing Analyst Expectations for Intuit

Analysts continue to closely monitor Intuit’s performance metrics and future guidance, looking for indicators that will inform their expectations. With the latest quarterly results, analysts’ estimates can greatly influence market perception of Intuit’s stock performance. The latest earnings report that exceeded expectations challenges analysts to reassess their projections, providing a more optimistic view on Intuit’s revenue growth and overall market opportunities.

The shift in revenue forecasts, now projected between $18.72 billion and $18.76 billion, reinforces analysts’ faith in Intuit’s potential. The upcoming fiscal quarters present both challenges and opportunities, making it crucial for analysts to evaluate how Intuit will leverage its core products, such as TurboTax and QuickBooks, to deliver results that satisfy investor appetite for growth and stability.

The Role of QuickBooks in Intuit’s Overall Strategy

QuickBooks, like TurboTax, plays a vital role in Intuit’s overall strategy and revenue generation. Its user-friendly interface and robust capabilities make it the preferred accounting solution for many small to medium-sized businesses. The combination of reliable performance, integration with other Intuit products, and continuous updates keeps QuickBooks at the forefront of the market, further strengthening Intuit’s financial position.

The growing adoption of QuickBooks, particularly in a digital-first economy, accentuates its relevance in Intuit’s corporate strategy. As businesses increasingly shift their accounting and finance functions online, Intuit’s focus on enhancing QuickBooks aligns with changing consumer demands and contributes to the company’s impressive revenue figures. Through strategic innovation and customer engagement, QuickBooks remains a cornerstone product that supports Intuit’s brand equity and market leadership.

Implications of Intuit’s Strong Performance for Investors

Intuit’s strong quarterly performance has significant implications for investors, providing a robust picture of the company’s resilience and growth potential. The positive earnings report, which exceeded analysts’ expectations, combined with an upward revision of revenue guidance, signals potential for enhanced returns on investment. With investors keen on stable growth, Intuit’s latest results and strong market presence make it an attractive proposition in the financial software sector.

Moreover, as Intuit continues to innovate, particularly through advancements in AI and improvements in its flagship products like TurboTax and QuickBooks, the company is set to harness emerging market trends. For investors, understanding these dynamics not only helps gauge current performance but also provides insight into future profitability. Consequently, monitoring Intuit’s strategies can be essential for making informed investment decisions in this rapidly evolving market.

Frequently Asked Questions

What were the key highlights from the latest Intuit quarterly results?

The latest Intuit quarterly results revealed an adjusted earnings per share of $11.65, surpassing the expected $10.91, and reported a revenue of $7.8 billion, which exceeded the forecast of $7.56 billion. This reflects a 15% revenue growth from $6.7 billion in the same period last year.

How did Intuit’s quarterly results affect its stock price?

Following the announcement of Intuit’s quarterly results, the stock rose approximately 4% in after-hours trading, indicating positive market reaction to the company’s strong performance and optimistic guidance.

What is Intuit’s projected revenue growth for the full fiscal year?

Intuit projected revenue for the full fiscal year between $18.72 billion and $18.76 billion, an increase from the previous estimate of $18.16 billion to $18.35 billion. This guidance reflects a stronger outlook compared to analyst expectations of $18.35 billion.

When does Intuit hold its quarterly investor call?

Intuit will hold its quarterly call with investors at 4:30 p.m. ET, where they will discuss the latest quarterly results and provide insights into future strategies.

How does Intuit plan to enhance its product offerings following the quarterly results?

In response to customer feedback during the latest quarterly results, Intuit has invested in AI technologies, focusing on enhancing their product offerings such as TurboTax and QuickBooks to better meet customer needs.

What is the significance of Intuit’s quarterly results in terms of revenue growth?

The significance of Intuit’s quarterly results highlights a 15% year-over-year revenue growth, demonstrating the company’s strong market position and effective business strategies, particularly in their main products like TurboTax.

What can shareholders expect from Intuit’s guidance following the latest earnings report?

Shareholders can expect a positive outlook from Intuit’s guidance, as the company has raised its revenue projections for the full fiscal year, indicating confidence in sustaining growth and profitability.

What were analysts’ expectations for Intuit’s earnings report?

Analysts expected Intuit to report an earnings per share of $10.91 and revenue of $7.56 billion, both of which were surpassed in the latest earnings report, showcasing the company’s strong performance.

| Key Metrics | Intuit’s Performance | Analysts’ Expectations |

|---|---|---|

| Earnings per share | $11.65 adjusted | $10.91 expected |

| Revenue | $7.8 billion | $7.56 billion expected |

| Revenue Growth (YoY) | 15% from $6.7 billion | |

| Fiscal Year Revenue Projection | $18.72 billion – $18.76 billion | $18.35 billion expected |

Summary

Intuit quarterly results indicate a strong performance with earnings and revenues surpassing analyst expectations. The impressive earnings per share of $11.65 and revenue of $7.8 billion showcase Intuit’s growth, particularly with a 15% increase year-over-year. Additionally, the company revised its full fiscal year revenue projection to be higher than previously estimated, indicating robust operational momentum and positive market response, reflected in a 4% stock increase in after-hours trading. CEO Sasan Goodarzi highlighted the investment in AI as a key driver of their strategy as they cater to customer demands.