Investment Scams on Facebook: Urgent Action Needed by Meta

Investment scams on Facebook have surged in recent years, alarming state attorneys general and everyday users alike. Prominent figures like Warren Buffett are often exploited in these fraudulent schemes, luring unsuspecting investors into a web of deception and loss. Despite efforts toward Meta fraud prevention, scammers effortlessly navigate past automated checks and human reviews, leaving countless victims ensnared by fake ads. Reports suggest that these schemes frequently involve pump and dump tactics, where malicious actors inflate stock prices only to dump their holdings, devastating small investors. As cyber scams on social media become more rampant, the urgent call for Meta to enhance scrutiny and protective measures against Facebook scam ads becomes increasingly vital, demonstrating the need for vigilance in digital investments.

The emergence of fraudulent investment opportunities on platforms like Facebook highlights a disturbing trend in online financial deception. These scams, which often masquerade as credible offers involving high-profile individuals, put many at risk of significant financial loss. Users engaging with these advertisements may find themselves caught in elaborate schemes aimed at exploiting their trust. With increasing reports of fake investment ads and bogus profit claims, the issue underscores the importance of social media companies in safeguarding their users from becoming victims of such nefarious practices. As the landscape of online scams evolves, it is crucial for platforms to enforce strict verification processes to protect vulnerable individuals from financial exploitation.

The Rising Threat of Investment Scams on Facebook

In recent years, investment scams on Facebook have surged alarmingly, exploiting the platform’s vast user base. As highlighted by New York Attorney General Letitia James, these fraudulent ads employ the likenesses of renowned investors like Warren Buffett to lend credibility to their schemes. In essence, scammers hijack the trust that users place in familiar figures, luring them into high-risk financial traps that often lead to devastating financial losses.

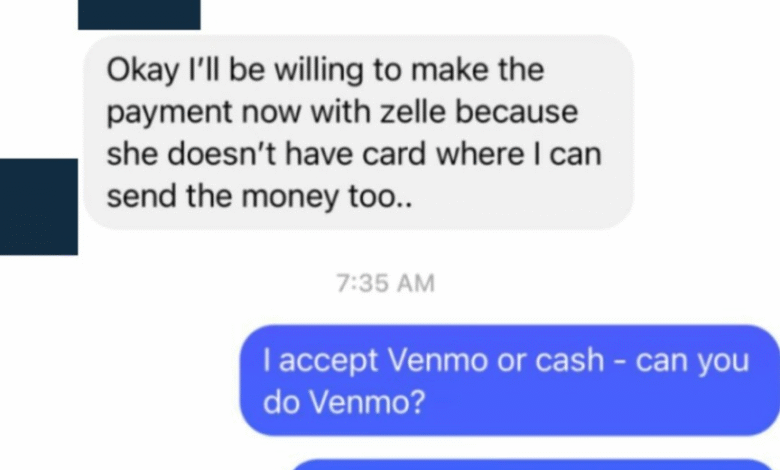

These scams often manifest as alluring advertisements that promise extraordinary investment returns, enticing users to join exclusive chat groups on Meta’s messaging platforms. What many individuals do not realize is that they are stepping into a fabricated reality where their hard-earned money could be funneled into pump and dump schemes, where the real investors behind these ads create a false sense of market enthusiasm, only to exit with profits, leaving unsuspecting participants in financial ruin.

Meta’s Response to Escalating Investment Fraud

In light of the escalating crisis regarding cyber scams on social media, particularly on its platforms, Meta is under immense pressure from state officials to take decisive action. Spurred by a bipartisan coalition of state attorneys, including those from California and Michigan, there is a growing consensus that Meta needs to implement stricter ad review processes to mitigate the risk posed by these fraudulent ads. These individuals are demanding enhancements to Meta’s automated systems, advocating for increased human oversight to catch scam ads that might slip through the cracks.

While Meta claims to be investing in advanced technologies and partnerships to tackle this issue—ranging from enhanced ad scrutiny to educating users about common scams—it remains to be seen how effective these measures will be. The challenges of regulating content on such a massive scale raise concerns about whether Meta can genuinely protect users from the sophisticated tactics employed by scam artists exploiting the platform.

Understanding Pump and Dump Schemes on Social Media

Pump and dump schemes have become increasingly prevalent on social media platforms like Facebook. In these schemes, fraudsters team up to artificially inflate the price of a low-value stock through false promotions. Once the stock price reaches a perceived peak due to hype generated by investors who are unaware of the scam, the perpetrators sell off their shares at a profit. This results in steep losses for unsuspecting investors who are left holding worthless stocks when the price collapses.

Such schemes thrive in an environment where misinformation can spread rapidly, and social media platforms provide the perfect backdrop for their execution. As users seek high returns on investments, they can easily fall victim to emotionally charged advertisements that exploit their hopes of quick wealth. As a result, the call for stricter regulations and oversight by Meta is not merely a legal necessity but a moral imperative to protect vulnerable investors from losing their financial security.

The Role of Legal Actions Against Fraudulent Advertisements

The legal landscape surrounding online fraudulent advertisements is becoming increasingly complex, with state attorneys general actively pursuing cases against platforms like Meta. High-profile lawsuits, such as those filed by investors who have lost substantial amounts due to scams, are pushing for heightened accountability among social media companies. These legal actions emphasize the importance of adequate consumer protections and serve as a wake-up call for platforms to enforce stricter advertising standards.

In a notable instance, an Australian billionaire’s lawsuit against Meta highlights the potential for substantial financial penalties should the courts find the company negligent in their oversight of scam advertisements. These legal pressures not only aim to secure compensation for victims but also serve to galvanize reforms within Meta, pressing them to prioritize user safety and adhere to higher ethical advertising standards.

Call for Enhanced User Awareness

In the wake of rising scams, there is a concerted effort to empower users through educating them on the telltale signs of fraudulent advertisements. Initiatives aimed at improving user awareness on identifying investment scams on Facebook are essential for protecting individuals from becoming victims. By fostering an environment where users are informed and cautious, social media platforms can significantly reduce the success rate of these scams.

Additionally, educating users about common schemes such as pump and dump, and the use of celebrity endorsements in scams can serve as preventative measures. Social media companies, including Meta, must take it upon themselves to develop tools and resources that inform and guide users in making better-informed financial decisions.

Meta’s Efforts in Technology and Collaboration

Meta has proposed several measures to combat the rising tide of investment scams, showcasing its commitment to using technology in the battle against fraud. This includes investments in enhanced AI algorithms designed to identify suspicious advertisements before they reach users. Such proactive approaches are vital, especially in a digital landscape where cyber scams thrive on the anonymity and vast reach of platforms like Facebook.

Moreover, Meta’s efforts to collaborate with banks and law enforcement indicate an acknowledgment of the wider ecosystem within which these scams function. By joining forces with financial institutions, Meta aims to create a unified front against fraud, enabling a more comprehensive approach to protecting consumers across all platforms related to Meta. This collaborative model could significantly reduce the impact of scams, creating a better environment for legitimate investment opportunities.

The Economic Impact of Investment Scams

Investment scams represent not just individual losses, but also contribute to broader economic challenges. As consumers lose confidence in investing due to repeated scams, this leads to reduced participation in legitimate financial markets. Consequently, the ripple effects of financial losses can be felt across the economy, hindering growth and innovation in legitimate sectors. As these scams proliferate, the overall financial literacy of consumers tends to decline, further perpetuating a cycle of vulnerability and exploitation.

Addressing the economic ramifications of investment scams requires coordinated efforts among various stakeholders, including governments, regulatory bodies, and social media platforms. Investment in consumer education and stricter regulations surrounding advertising can mitigate losses while encouraging ethical business practices. Ultimately, the transformation of social media platforms into safe environments for investment advertisement is key to restoring trust among investors.

Combating Cyber Scams on Social Media

Combating cyber scams on social media necessitates a multifaceted strategy that incorporates prevention, accountability, and consumer education. With social media platforms serving as a primary medium for fraudulent activity, initiatives aimed at reducing the incidence of scams must evolve to meet the growing sophistication of scammers. Engaging users through education about the risks and signs of scams is paramount, empowering them to be vigilant while browsing through investment opportunities.

At the same time, social media companies must enhance their internal mechanisms for detecting and removing fraudulent content. This includes refining automated ad review processes with added layers of human oversight to ensure that fraudulent schemes do not slip past detection. As the public becomes more aware of potential scams, social media platforms are equally responsible for ensuring that they uphold the highest standards of safety and integrity in advertising.

The Future of Investment Advertising on Social Media

The future of investment advertising on social media hangs in the balance as regulatory scrutiny intensifies and consumer trust wanes. How platforms like Meta navigate these challenges could determine their standing in the eyes of the public and the regulators. As the landscape continues to evolve, it is imperative for social media companies to foster transparency and trustworthiness in advertising practices, moving away from opportunistic profit models that prioritize revenue over user safety.

Moreover, developing robust frameworks for investment advertisements that include verification processes and a more stringent review of celebrity endorsements can significantly reduce the prevalence of scams. Through a proactive stance on fraud prevention and a commitment to consumer protection, social media platforms can shape a safer investment environment that generates confidence among users and encourages responsible participation in the financial markets.

Frequently Asked Questions

What are investment scams on Facebook and how do they work?

Investment scams on Facebook often use fraudulent advertisements that promise high returns on investments, sometimes falsely claiming associations with reputable figures like Warren Buffett. These scams entice users to join private chat groups where perpetrators promote risky stock schemes, such as pump-and-dump operations, which lead to significant losses for uninformed investors.

How does Meta fraud prevention work against investment scams on Facebook?

Meta fraud prevention involves automated and human review systems designed to detect and eliminate fraudulent advertisements related to investment scams on Facebook. However, reports indicate that scammers frequently bypass these measures, prompting increased calls for Meta to enhance its scrutiny and improve protections for users.

What steps should I take if I encounter a Facebook scam ad promising incredible investment returns?

If you find a Facebook scam ad, especially those promoting dubious investment opportunities or associated with known figures like Warren Buffett, do not engage. Instead, report the ad to Facebook, warn others, and consider discussing the offer with a financial advisor to avoid falling victim to cyber scams on social media.

Are pump and dump schemes common in investment scams on Facebook?

Yes, pump and dump schemes are a prevalent form of investment scams on Facebook. These schemes involve artificially inflating the price of low-value stocks, encouraging investors to buy, and then the scammers sell off their shares for profit, resulting in significant losses for latecomers.

What is being done about the rise of investment scams on Facebook?

A coalition of 42 state attorneys general is urging Meta to take decisive action against investment scams on Facebook, emphasizing the need for improved ad review processes. They have highlighted the urgency of safeguarding retail investors from losing money to fraudulent schemes, calling for collaboration between Meta, banks, and law enforcement to combat these cyber threats.

How can Facebook users protect themselves from investment scams?

Facebook users should exercise caution when encountering investment opportunities, particularly those that seem too good to be true. It’s crucial to verify the legitimacy of any investment and seek advice from financial professionals. Utilizing Meta’s resources for educating users about common scams can also provide added protection.

What role does Warren Buffett play in investment scams on Facebook?

Warren Buffett is often misrepresented in investment scams on Facebook, with fraudsters using his image and endorsements to lend credibility to their schemes. These scams typically mislead users into believing they have access to exclusive investment tips from the billionaire, leading to significant financial risks.

What are the recent trends in cyber scams on social media like Facebook?

Recent trends in cyber scams on social media, particularly on Facebook, include the rise of sophisticated fraudulent advertisements mimicking legitimate investment opportunities. Scammers exploit the platform’s vast user base, utilizing images of famous investors and creating high-pressure tactics to lure in unsuspecting users.

Is Meta doing enough to combat investment scams on Facebook?

Despite efforts by Meta to combat investment scams on Facebook, including technology investments and user education, criticism persists about the efficacy of these measures. Lawmakers and consumer advocates argue that more robust actions, including increased human review of ads, are necessary to protect users from financial fraud.

What should I do if I’ve fallen victim to an investment scam on Facebook?

If you have fallen victim to an investment scam on Facebook, report the scam to Facebook and document all details of the interaction. Additionally, contact your bank or credit card company to assess potential recoveries and consider reporting the incident to your local authorities for further investigation.

| Key Point | Details |

|---|---|

| Rise of Investment Scams | A group of 42 state attorneys general, led by New York AG Letitia James, is urging Meta to combat the increasing investment scams on Facebook. |

| Involvement of High-Profile Figures | Scammers are using images of well-known figures like Warren Buffett and Elon Musk to lure investors into fraudulent schemes. |

| Mechanism of Scams | Victims are directed to WhatsApp groups through fake ads that promise exclusive investment opportunities. |

| Impact on Retail Investors | Criminals profit from ‘pump-and-dump’ schemes, causing significant financial losses to unsuspecting investors. |

| Meta’s Response | Meta is facing scrutiny for failing to effectively manage these scams and is being pressured to enhance its ad review process. |

| Call to Action | Attorney General James urges Meta to improve ad scrutiny or halt all investment advertisements. |

| Collaborative Efforts Required | Meta’s Andy Stone states that combating scams requires collaboration with banks, governments, and law enforcement. |

Summary

Investment scams on Facebook have become a troubling issue, with state attorneys general holding Meta accountable for their rise on the platform. The fraudulent use of high-profile personas in advertisements has led to millions of dollars in losses for retail investors. As scams continue to proliferate, a push for enhanced measures against them is critical in protecting users from financial harm.