Iran-Israel War Impact on Stocks: Market Awaits Clarity

The Iran-Israel war impact on stocks has emerged as a pivotal concern for investors navigating the volatile waters of the current market. With the S&P 500 inching toward historic highs, uncertainty surrounding geopolitical conflicts often sways investor sentiment, prompting caution amid potential economic repercussions. As Wall Street grapples with these developments, the broader economic outlook remains in the spotlight, influencing market trends and the Federal Reserve’s policy decisions. As the conflict escalates, any ripple effect on oil prices could create further turbulence, compelling investors to reevaluate their strategies. In this complex environment, keeping a close eye on how such geopolitical events influence market dynamics is crucial for capitalizing on emerging opportunities.

The ramifications of the ongoing hostilities between Iran and Israel are reshaping the landscape for equity markets, posing significant implications for investors. As the situation unfolds, market participants are acutely aware of how this unrest could alter economic forecasts and sway the performance of major indices like the S&P 500. The interactions between geopolitical tensions and investor confidence are being monitored closely, especially as the Federal Reserve weighs its monetary policies in response to external pressures. In this delicate climate, shifts in market trends are inevitable, with heightened caution surrounding assets potentially being influenced by international turmoil. Thus, the interplay of these global events will undoubtedly continue to shape investment strategies and financial decision-making in the weeks to come.

Further Implications of the Iran-Israel War on Global Stocks

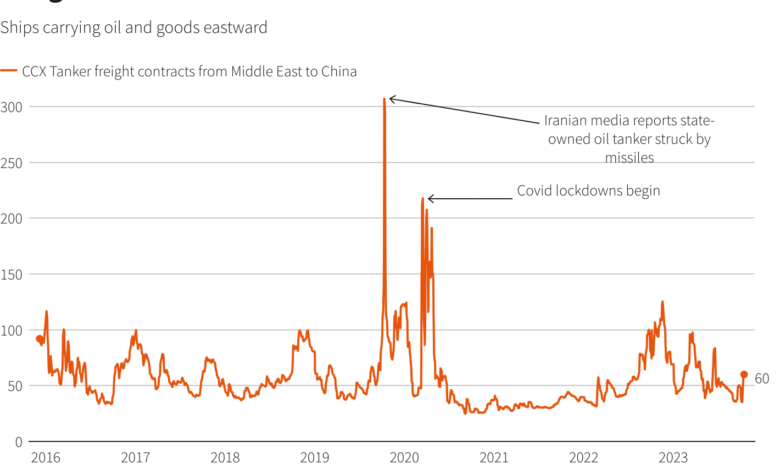

The ongoing Iran-Israel war has introduced an undercurrent of uncertainty in the stock markets. Investors are concerned about potential escalations that could further destabilize the Middle East, impacting global trade and investor sentiment. As a result, Wall Street is closely monitoring developments, especially as the conflict could affect key sectors such as energy and commodities. For instance, any disruption in oil supply due to military actions or sanctions might lead to increased prices, further straining economic recovery efforts in the U.S. and globally.

This heightened geopolitical tension has also made traders more cautious, leading them to adopt a wait-and-see approach. With the S&P 500 approaching record highs, the potential for setbacks necessitates a careful analysis of market trends against recent conflicts. Analysts suggest that any unexpected escalation in the Iran-Israel conflict could negatively influence stock performance, causing volatility as investors recalibrate their strategies in anticipation of how it may impact economic growth and inflation.

Analyzing Investor Sentiment Amid Global Conflicts

Investor sentiment is an essential gauge of market stability, especially when external geopolitical factors such as the Iran-Israel war come into play. Current reports indicate that while some investors remain optimistic about the stock market’s resilience, there is an underlying caution stemming from increased uncertainty about economic forecasts and Federal Reserve policy. Wall Street’s cautious optimism is overshadowed by fears that major conflicts could cause disruptions, leading to downturns that could ultimately hurt the overall economic outlook.

Moreover, this sentiment reflects mixed reactions to recent economic data, such as slowing retail sales and rising jobless claims, which suggest that the economy may be softening. As analysts watch inflation metrics closely, the Federal Reserve’s next steps in terms of interest rate policies will heavily rely on how these developments unfold. Consequently, deciphering how investor sentiment reacts to both economic indicators and geopolitical strife will be crucial for predicting market trends in the weeks ahead.

Impact of Economic Outlook on Market Trends

The current economic outlook plays a pivotal role in shaping market trends, as seen with the recent fluctuations in the S&P 500. Despite some promising returns in recent months, various economic indicators have shown signs of weakening, prompting analysts to suggest a more cautious approach moving forward. Market reactions to disappointing data, such as diminishing consumer confidence and mixed earnings reports from major corporations, could greatly influence stock performance in the near term.

With the Federal Reserve poised to make significant decisions regarding interest rates, understanding these economic signals becomes even more critical. As traders grapple with an increasingly complex economic environment, the interplay between inflation, consumer spending, and international trade policies will dictate the trajectory of stocks moving forward. Thus, staying informed on both domestic economic conditions and global events, like the Iran-Israel war, is necessary for anyone involved in the financial markets.

The S&P 500: Navigating to New Heights Amid Challenges

The S&P 500 is at a crossroads, hovering close to its historical peak despite facing numerous challenges, including the Iran-Israel war and potential economic turbulence. Analysts believe that the resilience seen in this index reflects strong underlying fundamentals, bolstered by sectors like technology and industrials that have been leading the charge in stock recoveries. However, with market participants keenly aware of external risks, sustained advances will likely depend on navigating the uncertainties presented by global conflicts and domestic economic pressures.

The dynamics of the S&P 500 will also be influenced by investor reactions to forthcoming earnings reports from significant players like FedEx, Nike, and Micron. These reports will serve as a barometer for underlying economic strength and provide insights into whether the upward momentum can be maintained. If the trends remain favorable, the index could potentially break through its all-time high, but any negative developments related to broader economic issues or geopolitical tensions could result in increased volatility and a reassessment of market positions.

Federal Reserve Insights: Interest Rates and Inflation

The Federal Reserve’s forthcoming decisions regarding interest rates are expected to have a substantial impact on market movements, particularly as investors await clarity on inflation measures such as the personal consumption expenditure price index. This measure is crucial for assessing the broader economic implications of ongoing geopolitical tensions, including the Iran-Israel conflict. In a shifting landscape, the Fed’s policies will be instrumental in shaping investor sentiment and overall market trends.

Moreover, recent remarks from Fed officials suggest a more optimistic view on inflation, indicating that policymakers might consider easing rates if inflation pressures remain under control. This perspective aims to foster economic growth without triggering significant spikes in consumer prices. As Wall Street evaluates these signals, the focus will be on how effectively the Fed can balance inflation control against the need for continued economic momentum, especially in a climate of rising external threats.

Market Recovery: The Role of Key Sectors

The stock market’s recent recovery has been notably driven by key sectors such as technology, which have demonstrated resilience despite broader economic concerns. Notably, semiconductors have emerged as critical players in this upward trend, and companies like NVIDIA are essential barometers for the sector’s strength. Analysts are closely monitoring semiconductor prices and output to assess their influence on stock stability, given their pivotal role in innovation and supply chains.

As markets eye a potential return to all-time highs, the performance of these critical sectors will significantly determine the overall trajectory of major indexes like the S&P 500. With heightened investor scrutiny of sector-specific trends, any changes in technology or industrial sector momentum could carry considerable implications for market sentiment. This ongoing sectoral strength, in conjunction with government policy actions, will be vital in navigating the market landscape against the backdrop of geopolitical tensions like the Iran-Israel war.

Trade Relations and Their Influence on Market Performance

Ongoing trade relations between the U.S. and other countries, especially in light of the potential for tariffs and economic sanctions, pose significant risks to stock market performance. As the prospect of military engagement involving Israel and Iran looms, additional trade complications could surface, contributing to market volatility. The influence of tariffs on consumer pricing adds another layer to the existing economic challenges, creating uncertainty that informs investor behavior and market trends.

Investors are acutely aware that any escalation in trade tensions has the potential to disrupt established supply chains, leading to rising costs and reduced profitability among corporations. In this climate, market trends will hinge on how businesses adapt to these challenges and what strategies emerge to minimize impact. The interconnectedness of global markets means that developments in trade relations will play a critical role in shaping investor sentiment and could dictate market trends in the subsequent weeks.

Consumer Insights: The Driving Force Behind the Markets

Consumer strength is a vital component of economic health, influencing the trajectory of stock markets significantly. Even amidst concerns about geopolitical conflicts and trade uncertainties, understanding consumer behavior can provide insights into market resilience. Recent indicators suggest that while consumers exhibit some hesitancy due to the Iran-Israel situation, there remains a robust underlying demand propelling certain sectors, particularly retail and technology, higher.

As earnings reports from major companies like FedEx and Nike are anticipated, investors will keenly analyze these outcomes to gauge consumer sentiment. These reports are indicative of broader trends within the economy and will help define market expectations leading into the second half of the year. A strong consumer base could support stock market performance; however, any signs of weakness may prompt a reevaluation of existing market positions.

Geopolitical Risks and Their Effect on Economic Prospects

Geopolitical risks significantly impact economic prospects, creating undeniable uncertainty in financial markets. The ongoing conflict between Iran and Israel serves as a pertinent example, as investors assess how such tensions could influence global trade and economic relations. These developments add a layer of complexity to market forecasts, as they intertwine with domestic economic indicators that hint at a softening economy.

The potential for escalating conflicts not only creates immediate concerns regarding operational disruptions in affected regions but also leads to longer-term implications for international business relations. Investors must weigh the ramifications of such conflicts against potential market growth fueled by strong sectors and recovering economic indicators. Therefore, understanding the dynamic relationship between geopolitical risks and economic prospects is critical for anticipating trends in stock markets.

Frequently Asked Questions

How does the Iran-Israel war impact stocks in the S&P 500 index?

The Iran-Israel war can significantly impact stocks in the S&P 500 index by creating volatility and uncertainty in the market. As investors monitor geopolitical tensions, they may become cautious, resulting in fluctuations in stock prices. Economic outlook concerns can lead to reduced investor sentiment, affecting trading volumes and price stability.

What are the economic outlook forecasts amid the Iran-Israel conflict?

Amid the Iran-Israel conflict, economic outlook forecasts remain cautious. Analysts emphasize the importance of geopolitical stability for economic growth. Increased tensions can lead to higher oil prices and inflationary pressures, which could negatively affect consumer sentiment and the performance of stocks across the S&P 500.

How does investor sentiment react to the Iran-Israel war when it comes to market trends?

Investor sentiment tends to be negatively affected by the Iran-Israel war, often leading to bearish market trends. The uncertainty regarding military involvement and its potential economic consequences can cause investors to pull back, thus impacting the overall performance of stocks in the S&P 500 and other indices.

What role does the Federal Reserve play in the stocks market during the Iran-Israel conflict?

The Federal Reserve plays a crucial role in stabilizing the stocks market during the Iran-Israel conflict by influencing interest rates and monetary policy. Investors look to the Fed for signals on potential rate cuts or hikes depending on economic conditions, which can directly affect investor sentiment and stock performance.

How should investors adjust their strategies based on the Iran-Israel war’s impact on stock markets?

Investors should consider diversifying their portfolios and closely monitoring geopolitical developments related to the Iran-Israel war. Strategies may include allocating more funds to defensive sectors known to perform well during market volatility, while also staying informed about the economic outlook and potential Federal Reserve actions.

What are the potential long-term impacts of the Iran-Israel war on stock market trends?

The long-term impacts of the Iran-Israel war on stock market trends could lead to sustained volatility and changes in industry leadership within the S&P 500. Ongoing conflicts may affect oil prices, company earnings, and ultimately influence the broader economic outlook, which can reshape market trends and investor behavior.

How can rising oil prices from the Iran-Israel conflict affect stocks?

Rising oil prices resulting from the Iran-Israel conflict can negatively impact stocks by increasing costs for businesses and consumers. Higher energy prices may lead to inflationary pressures, prompting the Federal Reserve to adjust monetary policy, which could in turn affect overall market performance and investor sentiment.

What indicators should investors watch related to the Iran-Israel war when evaluating market trends?

Investors should monitor key indicators such as oil prices, consumer confidence, inflation rates, and Federal Reserve announcements related to interest rate policies. These factors can provide insights into how the Iran-Israel war influences market trends and the broader economic outlook.

| Key Point | Details |

|---|---|

| Market Response to Iran-Israel War | Investors are monitoring the conflict closely, which is causing uncertainty in the stock markets. |

| S&P 500 Status | Currently 2% below all-time highs, influenced by geopolitical tensions and economic indicators. |

| Investor Sentiment | Cautious optimism prevails as investors hope for a de-escalation and are hopeful for a rate cut by the Fed. |

| Economic Indicators | Weakening economic data signals may impact investor decisions and market performance, particularly in retail and construction sectors. |

| Upcoming Economic Reports | Several key economic reports due next week, including consumer spending and home sale data. |

Summary

The Iran-Israel war impact on stocks is significant as investors remain cautious amid escalating tensions and economic uncertainty. While the S&P 500 shows resilience, hovering near record levels, the market’s direction increasingly hinges on both geopolitical developments and domestic economic indicators. The interplay between these factors will dictate investor sentiment and could shape the broader economic landscape in the coming weeks.