IRS 1099-DA Form: Prepare for Crypto Tax Changes Ahead

As the landscape of cryptocurrency evolves, the introduction of the IRS 1099-DA form is set to revolutionize how traders report their digital asset transactions. Starting in 2026, this form will become a crucial component of crypto tax compliance, as it aims to facilitate IRS tracking of cryptocurrency activities across various wallets and exchanges. Designed to detail gross proceeds, cost basis, and transaction specifics, the Form 1099-DA filing process will enhance tax reporting for traders, ensuring transparency within the crypto space. With the focus on crypto capital gains, it is imperative that taxpayers prepare diligently to comply with these regulations. Ignoring these upcoming changes could lead to serious penalties, urging traders to stay informed on the implications of this pivotal form.

With the impending launch of the IRS Form 1099-DA scheduled for 2026, cryptocurrency enthusiasts and traders are poised for a major shift in their tax responsibilities. This new reporting requirement will entail meticulous tracking of digital exchanges and asset sales, reinforcing the importance of thorough tax reporting in the ever-changing world of virtual currencies. As brokers handle this new wave of documentation, understanding the nuances of asset transactions will no longer be optional but necessary for regulatory compliance. As traders navigate these new waters, they must prioritize transparency and accuracy to mitigate potential tax liabilities related to capital gains. This evolution in tax reporting marks a significant moment for the crypto community, urging all participants to adapt accordingly.

Understanding IRS 1099-DA Form and Its Implications

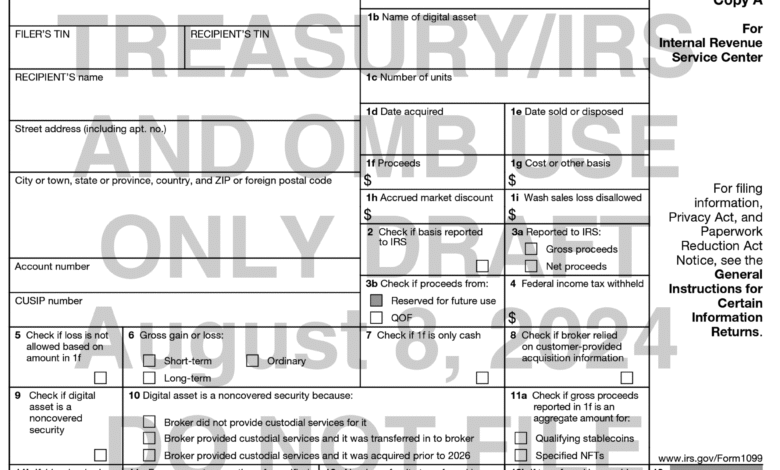

The IRS 1099-DA form is a significant document that will start being issued in 2026 for reporting digital asset transactions. This form is designed to capture details such as gross proceeds from sales, cost basis, and the transaction specifics for cryptocurrencies and NFTs. Essentially, it will serve as a crucial reporting tool for the Internal Revenue Service to track cryptocurrency holdings and transactions more effectively, ensuring tax compliance among traders and crypto users.

As traders prepare for this upcoming requirement, it’s important to recognize the implications of the 1099-DA form on personal tax obligations. Failure to accurately report transactions can lead to severe penalties, including automated notices and increased scrutiny from the IRS. Thus, understanding how to fill out Form 1099-DA accurately is key for avoiding complications down the line, including potential fines or issues related to underreporting.

The Role of IRS in Tracking Cryptocurrency Transactions

The IRS has ramped up its efforts to track cryptocurrency transactions across various platforms and wallets, which marks a significant shift in how digital assets are monitored. This heightened enforcement stems from the recognition that many crypto transactions are currently unreported, which impacts tax collections. With the introduction of the 1099-DA, the IRS will have more data at its disposal, leading to a more comprehensive overview of crypto transactions made by individuals.

By mandating reporting through Form 1099-DA, the IRS aims to enhance transparency and compliance in the cryptocurrency market. Traders must understand that IRS tracking mechanisms will no longer rely solely on self-reporting; rather, official documentation from brokers and exchanges will provide a clearer transaction history. This shift necessitates that traders adopt rigorous record-keeping practices to ensure they can substantiate their reports with the necessary documentation.

Consequences of Non-Compliance with IRS Regulations

Non-compliance with IRS regulations regarding cryptocurrency transactions can have severe financial repercussions. Traders who fail to report their trades risk receiving an automated CP2000 notice, where the IRS will assume the trading profits based on available data and generate a tax bill. This can lead to unexpected expenses and a complicated process to dispute or clarify tax obligations, making it crucial for traders to report their earnings accurately.

Furthermore, non-compliance increases the risk of being placed on the IRS watchlist for potential underreporting, which can lead to ongoing scrutiny and potential audits. The tax landscape for cryptocurrency is shifting towards more stringent enforcement, and those who do not proactively report their earnings—despite minor disagreements with their 1099-DA forms—may find themselves facing unwanted attention from the IRS.

Proactive Compliance Strategies for Crypto Traders

For traders looking to navigate the complexities of the upcoming IRS regulations, proactive compliance strategies are essential. This includes maintaining detailed records of all transactions, including acquisition dates and the cost basis for each asset. By being diligent and organized, traders can more easily complete Form 1099-DA and avoid disputes with the IRS.

Additionally, traders should consider engaging with tax professionals who specialize in crypto tax compliance. These experts can provide valuable insights into how to optimize tax reporting while ensuring adherence to the latest regulations. By staying informed about best practices in tax reporting for traders, individuals can mitigate the risk of errors that could lead to penalties or audits.

Simplifying the 1099-DA Filing Process

Navigating the complexities of filing the 1099-DA can feel overwhelming to many crypto investors, especially those using multiple exchanges and wallets. However, breaking down the process into manageable steps can simplify this task. Understanding which transactions require reporting and how to calculate gains and losses can significantly ease the burden of completing this form.

Investors should develop a standardized procedure to track their transactions across platforms. Utilizing software solutions designed for cryptocurrency tax reporting can automatically compile transaction data and generate the necessary reports for IRS submission. This technology can significantly reduce the potential for human error while also ensuring that all relevant transactions are captured, which is vital for filing the 1099-DA accurately.

Tax Strategies for Cryptocurrency Capital Gains

Understanding tax strategies related to cryptocurrency capital gains is critical for traders looking to minimize their tax liabilities. Long-term capital gains taxes generally apply to assets held for over a year, resulting in lower tax rates compared to short-term gains, which are taxed at ordinary income rates. Traders need to consider their holding period before executing trades to optimize their tax positions.

Moreover, implementing tax-loss harvesting strategies can serve as a valuable tool in managing capital gains effectively. By strategically selling losing investments to offset gains realized from profitable trades, investors can reduce their overall tax burden. This proactive approach requires careful tracking of all transactions and a solid understanding of IRS regulations surrounding capital gains.

Implications of IRS Tracking Across Chains

As the IRS begins its tracking of cryptocurrency across various chains and wallets, the implications for traders are significant. This move suggests a future where the anonymity often associated with cryptocurrencies will decline, prompting users to be more diligent in their reporting practices. This shift in regulatory focus aims to close loopholes that have historically allowed traders to underreport earnings or evade taxes.

Traders should be aware that as IRS tracking becomes more sophisticated, the importance of transparency in cryptocurrency transactions will grow. Compliance with reporting requirements such as the Form 1099-DA will not only be mandatory but will also serve as a protective measure against potential audits or penalties. Embracing this transparency can lead to a smoother trading experience and peace of mind regarding tax obligations.

Future of Crypto Tax Compliance

The future of cryptocurrency tax compliance is rapidly evolving, driven by the IRS’s increasing demand for transparency and accurate reporting. The introduction of Form 1099-DA in 2026 marks a pivotal moment for traders as it predicates a systematic approach to handling capital gains from digital assets. As regulations tighten, adherence to tax compliance measures will become imperative for all crypto enthusiasts.

Traders who adapt to these changes and stay informed about regulatory requirements will be better positioned to succeed in the transforming landscape of cryptocurrency taxation. The emphasis on staying compliant not only prevents potential penalties but also builds a foundation for legitimate and sustainable trading practices in the burgeoning crypto economy.

Consulting with Crypto Tax Professionals

Given the complexities surrounding cryptocurrency taxation and the impending changes brought by IRS regulations, consulting with tax professionals specializing in crypto tax matters is invaluable. These experts can provide tailored advice that considers individual trading strategies and overall tax situations. Their expertise is crucial for navigating the intricacies of Form 1099-DA and ensuring accurate reporting.

Additionally, tax professionals can help traders understand their liabilities and explore tax-advantaged strategies to optimize returns. Enlisting professional help can offer reassurance that all aspects of tax reporting are being handled correctly, significantly reducing the risk of non-compliance and enhancing overall financial well-being for crypto investors.

Frequently Asked Questions

What is the IRS 1099-DA form and how does it relate to crypto tax compliance?

The IRS 1099-DA form is a new tax reporting requirement that will be introduced in 2026, specifically for reporting digital asset transactions, such as cryptocurrencies and non-fungible tokens (NFTs). It aims to enhance crypto tax compliance by providing the IRS with detailed information on gross proceeds from sales, cost basis, and transaction details. This form will be issued by brokers, including exchanges and wallet providers, and is crucial for ensuring accurate tax reporting for traders.

How will the IRS track cryptocurrency using the 1099-DA form?

Starting in 2026, the IRS will utilize the 1099-DA form to track cryptocurrency transactions across different wallets and chains. Brokers will report transactions including sales and exchanges, detailing asset type, quantity, and acquisition dates. This initiative aims to increase transparency in crypto tax reporting and ensure that taxpayers accurately report their capital gains.

What are the penalties for failing to file Form 1099-DA for crypto capital gains?

Failure to file Form 1099-DA can lead to significant penalties, including IRS notices like the CP2000, which automatically calculates owed taxes based on incomplete information. Non-compliance may also result in being flagged for underreporting, potentially leading to further scrutiny and automated bills from the IRS. It is essential for taxpayers to accurately report their crypto transactions to avoid these repercussions.

How should crypto traders prepare for the upcoming IRS Form 1099-DA filing requirements?

Crypto traders can prepare for the IRS 1099-DA filing by tracking their transactions meticulously, including cost basis and acquisition dates. For those using multiple platforms, it’s advisable to proactively manage records and possibly opt into a Safe Harbor provision to mitigate potential penalties. Staying informed about tax regulations and maintaining accurate records can help ensure compliance when the form becomes mandatory.

What is the Safe Harbor provision in relation to Form 1099-DA for crypto tax reporting?

The Safe Harbor provision is a recommended option for taxpayers to avoid retroactive penalties associated with the IRS 1099-DA form. By opting into this provision, taxpayers can simplify their reporting obligations and protect themselves from possible fines. This is particularly useful for traders who may have complex transaction histories across multiple platforms.

What should I do if I disagree with the transactions reported on my 1099-DA form?

If you disagree with the transactions reported on your IRS 1099-DA form, it is essential to still file your tax return and report your actual transactions. By doing so, you reduce the risk of being flagged for underreporting by the IRS. It’s advisable to keep detailed records to support your claims in case of any discrepancies.

How does FIFO accounting apply to the IRS 1099-DA form?

FIFO, or first-in, first-out accounting, is the method required by brokers when reporting transactions on the IRS 1099-DA form. This means that for tax purposes, the first assets acquired are considered the first ones sold. Understanding this accounting method is crucial for traders, as it impacts the calculation of capital gains and how transactions are reported to the IRS.

What can I do to avoid being added to the IRS watchlist for crypto underreporting after filing my 1099-DA?

To avoid being added to the IRS watchlist for crypto underreporting, it’s crucial to accurately report all transactions on your IRS 1099-DA form. This includes ensuring that all sales, exchanges, and transfers are correctly documented along with their respective cost basis. Maintaining clear records and complying with the filing requirements will help prevent IRS scrutiny.

| Key Point | Details |

|---|---|

| Introduction of IRS 1099-DA form | Starting in 2026, a new form, 1099-DA, will be required for reporting digital asset transactions. |

| Importance of Compliance | Traders should report sales to avoid penalties and IRS scrutiny, especially underreporting. |

| Tracking Across Wallets | The IRS will track crypto across different wallets and exchanges, requiring detailed reporting. |

| FIFO Accounting Rule | Brokers must follow FIFO accounting on a wallet basis, affecting how taxes are calculated. |

| Consequences of Non-Compliance | Failing to report could result in IRS-issued CP2000 notices, with automated tax calculations. |

| Advice for Investors | Investors using a single exchange should find compliance easier, but multi-platform users need to track their cost basis actively. |

Summary

The IRS 1099-DA form marks a pivotal moment in the regulation of cryptocurrency transactions beginning in 2026. Traders will need to prepare for comprehensive reporting to ensure compliance and avoid potential penalties. With the IRS set to closely monitor digital asset transactions, it becomes crucial for crypto investors to understand their reporting obligations. Proper preparation and proactive tracking of cost basis will be essential in navigating this evolving landscape of digital asset taxation.