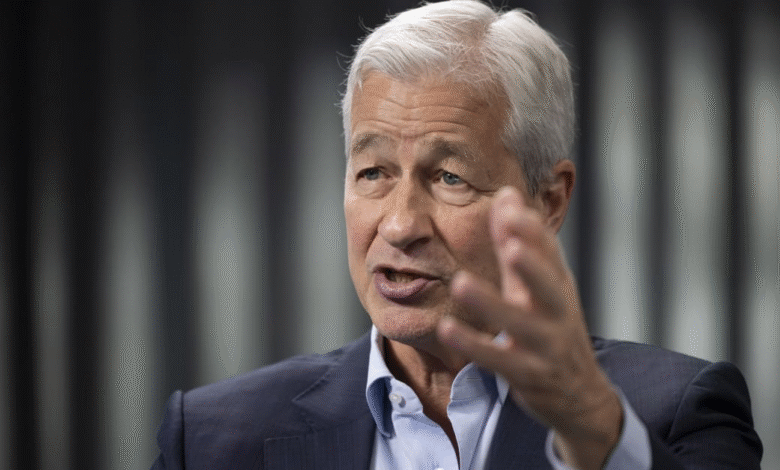

Jamie Dimon Economic Warnings: A Paradox of Success

In a series of alarming economic warnings, JPMorgan Chase CEO Jamie Dimon has consistently highlighted the vulnerabilities facing the U.S. economy. Despite these concerns, JPMorgan continues to excel, outperforming its competitors in the banking industry. This juxtaposition of Dimon’s foreboding predictions against the bank’s strong performance raises intriguing questions about the future of financial institutions. As Dimon’s cautious outlook becomes a regular feature in his public statements, it underscores the complexity of navigating economic risks in today’s market. Investors and analysts alike are left pondering the implications of his insights, especially as they reflect on JPMorgan Chase’s remarkable financial resilience.

In the realm of economic foresight, Jamie Dimon’s cautionary tales stand out, painting a picture of potential turbulence ahead for the U.S. financial landscape. His insights, spoken against a backdrop of impressive results from JPMorgan Chase, evoke a sense of urgency regarding the state of financial health. The unpredictable nature of economic fluctuations and crises has prompted Dimon to raise flags about underlying risks that may impact not only his bank but the broader banking ecosystem. As he navigates challenging waters, Dimon’s remarks serve as a critical reminder of the inherent uncertainties in economic forecasting. By addressing the fragile foundations of even the most successful financial entities, he emphasizes the necessity for vigilance amidst soaring profits.

Jamie Dimon’s Economic Warnings: A Dual Perspective

JPMorgan Chase CEO Jamie Dimon has become synonymous with cautious narratives regarding the U.S. economy. His frequent economic warnings appear to be a significant aspect of his leadership style. Dimon’s observations often range from threats of inflation and recession to the impact of geopolitical tensions. For example, when he described a potential economic “hurricane” on the horizon in 2022, it served to remind investors and analysts that despite the bank’s strong performance, vulnerabilities persisted within the economy. Dimon urges key stakeholders to consider the fragility of financial systems, particularly during times of robust earnings.

In his public communications, Dimon frequently emphasizes the rising U.S. national debt and the complex dynamics affecting global markets. His warnings often feel profoundly serious, suggesting that while JPMorgan Chase may thrive, the broader economic landscape could shift dramatically. The spin between optimism about JPMorgan’s profit margins and stark warnings about impending crises encapsulates a paradox that reflects the dual challenges facing CEOs in the financial sector. In essence, while the bank is thriving, the potential for economic downturns is ever-present, highlighting the importance of foresight.

The Evolution of JPMorgan Chase Under Dimon

Since Jamie Dimon took the helm of JPMorgan Chase in 2006, the evolution of the bank has been marked by unprecedented growth and challenges. His leadership has transformed JPMorgan into a titan of the banking industry, boasting unrivaled assets, branches, and a trailblazing position in both retail and investment services. Under his guidance, the bank has not only weathered existential threats, such as the 2008 financial crisis, but has also emerged stronger, seizing opportunities that competitors often missed. This resilience is a testament to Dimon’s foresight and the strategic positioning of JPMorgan Chase.

However, the narrative surrounding Dimon also reveals a deeper awareness of the fragility of financial institutions. Even as JPMorgan boasts record profits exceeding $58 billion, Dimon’s recurring warnings about economic instability highlight his commitment to risk management and prudent oversight. His reflections on past crises illustrate a banking environment that remains volatile, where even the most powerful institutions must navigate uncertainties. It is this blend of aggressive performance and cautious strategy that defines the contemporary banking landscape.

Understanding JPMorgan’s resilience amidst rising economic uncertainties under Jamie Dimon is pivotal. The CEO’s commentary on potential recessionary threats illustrates a fundamental commitment to maintaining stability while pursuing growth. The methodical expansion into robust technologies, such as AI, symbolizes an adaptive strategy aimed at sustaining competitive advantages in an evolving financial sector.

Dimon’s focus on sustainable growth underlines the necessity for banking institutions to embrace innovation while preparing for unforeseen challenges. This balance of aggression in the pursuit of profit and caution regarding economic risks is crucial for maintaining JPMorgan’s leading edge and mitigating potential pitfalls.

JPMorgan Chase’s Performance in the Context of Market Volatility

Despite Jamie Dimon’s persistent warnings regarding economic volatility and geopolitical tensions, JPMorgan Chase continues to report stellar financial results. In the most recent years, the bank achieved record profits, demonstrating that sound management and strategic investments can bear fruit even in challenging times. Factors like strong consumer spending and low unemployment levels in the U.S. have contributed to this resilience, enabling the banking giant to thrive against the backdrop of Dimon’s warnings about impending economic storms.

Moreover, Dimon’s cautious outlook reinforces the understanding that success in the financial sector often requires more than just good fortune; it necessitates a careful analysis of risk. Dimon’s commentary has instilled a sense of caution among investors. While the S&P 500 soared to impressive returns, those who adhered strictly to his warnings may have missed out on substantial gains, highlighting the complex interplay between risk and reward in financial markets. Indeed, peering through the lens of Dimon’s insights, it becomes clear that even in times of prosperity, vigilance is key.

The Banking Industry’s Response to Economic Uncertainty

As concerns about global economic stability grow, many financial institutions are evolving their approaches to risk management in light of Jamie Dimon’s insights. Banks are increasingly adopting strategies that prioritize caution and adaptability. With leaders like Dimon setting a precedent, financial institutions are incentivized to evaluate their operational frameworks, balancing optimism with necessary risk assessments to mitigate possible downturns. This shift highlights the significance of resilience in an industry historically prone to cycles of growth and contraction.

Innovation plays a vital role in helping financial institutions navigate uncertain waters. Many banks are investing in new technologies and solutions to refine their operational capabilities, improve service delivery, and enhance customer experiences. As demonstrated by JPMorgan’s significant investments in AI and technology, these advancements can empower banks to anticipate risks more effectively and respond aptly to market changes. With the environment of financial uncertainty, such initiatives become essential rather than optional.

Lessons on Caution and Strategy from Jamie Dimon

In analyzing Jamie Dimon’s leadership at JPMorgan Chase, one must consider the lessons on caution and strategy derived from his career-long reflections. Dimon exemplifies the importance of addressing potential risks head-on while simultaneously driving performance. His philosophy suggests that acknowledging economic precariousness can serve as a solid foundation for long-term growth and innovation. By emphasizing precaution, Dimon has cultivated a culture of awareness within JPMorgan, shaping its strategy to both maximize profits and safeguard against unforeseen challenges.

Dimon’s admonishments about the fragility of financial structures reveal an understanding that leaders in the banking industry must maintain a level of acute awareness of both internal and external factors that influence performance. Through a combination of detailed strategic planning and a robust framework for innovation, financial executives can thrive amid uncertainty. The lessons drawn from his twenty years of experience provide a valuable blueprint for not only bank executives but leaders across various industries aiming to balance risk and opportunity.

Investment Strategies Amidst Dimon’s Economic Outlook

Jamie Dimon’s continuous warnings regarding economic turbulence have implications that extend beyond the walls of JPMorgan Chase. He encourages investors to approach the market with a mindset that prioritizes cautious investment strategies. This perspective urges stakeholders to assess their risk tolerance closely and to be prepared for potential market fluctuations. Such considerations are especially important in a landscape where financial institutions are grappling with unpredictable conditions that could disrupt profitability.

As demonstrated by Dimon’s explications of trends and potential pitfalls, informed investors can seize opportunities by diversifying their portfolios and adopting a long-term vision. Recognizing the signs of caution can help mitigate losses and enable more strategic asset allocation — an approach that aligns with the principles of sound investment management. Ultimately, Dimon’s insights serve as a crucial guide for navigating these uncertain financial waters.

Long-term Impacts of Dimon’s Leadership on Financial Markets

The long-term impacts of Jamie Dimon’s leadership on financial markets extend well beyond the annual profit figures and growth metrics. His unique blend of empirical insight and cautionary advice has positioned JPMorgan Chase as not just a leader in profitability but a bellwether for the broader banking industry. As he prioritizes transparency and vigilance in his communications, Dimon’s influence prompts financial institutions to embrace a culture of accountability and preparedness.

Examining financial markets through the lens of Dimon’s leadership offers an understanding of how perception and sentiment can shape economic landscapes. By articulating potential risks and pairing them with actionable strategies, Dimon has paved the way for a transformative approach within the banking sector. This focus on accountability cultivates trust among investors, ultimately reinforcing the resilience of not only JPMorgan Chase but the entire financial system.

Future Outlook for JPMorgan Chase in a Risky Economy

Looking ahead, the future outlook for JPMorgan Chase is intertwined with both ongoing economic risks and the bank’s adaptive strategies developed under Jamie Dimon’s leadership. The financial institution is keenly aware of the broader economic environment and continuously seeks to refine its approach to remain resilient amid challenges. As Dimon communicates his assessments of potential economic downturns, JPMorgan plans to leverage its size and innovative edge to sustain its competitive posture in the market.

While uncertainties abound, JPMorgan Chase is strengthening its commitment to technology and customer engagement to drive future growth. By harnessing cutting-edge solutions, the bank aims to navigate the complexities of an evolving financial landscape robustly. Given Dimon’s track record and keen foresight, JPMorgan Chase appears positioned not merely to survive economic turbulence but to emerge as a strengthened entity capable of pioneering solutions that define the future of banking.

Frequently Asked Questions

What are Jamie Dimon’s economic warnings about the U.S. economy?

Jamie Dimon, the CEO of JPMorgan Chase, has issued numerous economic warnings regarding potential risks faced by the U.S. economy. He has forewarned about various threats, including the possibility of a recession, rising inflation, and a dangerous geopolitical climate, emphasizing that financial institutions, despite their size and power, can be fragile. Dimon’s warnings often reflect what he perceives as a turbulent economic landscape, indicating that while his bank’s performance remains robust, caution is necessary for the overall financial sector.

How does JPMorgan Chase perform while Jamie Dimon raises economic concerns?

Despite Jamie Dimon’s frequent economic warnings, JPMorgan Chase has consistently outperformed its competitors. Under his leadership, the bank has reported record profits, doubling its annual earnings over recent years. This disparity reflects a nuanced reality where Dimon’s foresight about potential economic issues does not detract from the bank’s strong operational performance, highlighting the resilience of JPMorgan in an ever-changing financial landscape.

What factors contribute to Jamie Dimon’s economic pessimism?

Jamie Dimon’s economic pessimism stems from a variety of factors, including concerns about geopolitical tensions, rising national debt, and inflationary pressures that could destabilize the financial system. His historical perspective, drawn from two decades of leading JPMorgan, informs his belief that financial institutions remain vulnerable despite their current successes, prompting him to caution investors about the potential risk of an economic downturn.

What has Jamie Dimon said about the future of the financial industry?

Jamie Dimon has expressed a cautious outlook about the future of the financial industry, indicating that extraordinary times may lie ahead. He has referred to an impending ‘hurricane’ for the U.S. economy, cautioning that recent positive trends may not be sustainable and that risks are looming, especially as global economic conditions become increasingly unpredictable.

What should investors take away from Jamie Dimon’s economic warnings?

Investors should approach Jamie Dimon’s economic warnings with a blend of caution and prudence. While his warnings often highlight potential risks in the banking industry and the broader economy, they also underline the importance of careful risk management and the potential impacts of external factors like inflation and geopolitical tensions on investment outcomes.

| Key Point | Details |

|---|---|

| Dimon’s Economic Warnings | Jamie Dimon frequently warns about the risks facing the U.S. economy, indicating a more cautious outlook despite strong bank performance. |

| Performance of JPMorgan Chase | Despite Dimon’s warnings, JPMorgan Chase has achieved record profits, outperforming its competitors consistently over the past decade. |

| Evolution of Dimon’s Warnings | Over 20 years, Dimon’s warnings have increased, reflecting his view of potential economic collapses amidst JPMorgan’s growth. |

| Factors Influencing Warnings | Economic indicators like U.S. unemployment and consumer spending have remained resilient, yet Dimon warns about potential crises such as inflation and geopolitical risks. |

| Industry Perspective | Banking is a cautious industry focusing on risk management, influencing Dimon’s approach to maintaining a cautious stance even while achieving success. |

Summary

Jamie Dimon economic warnings serve as a crucial reminder of the inherent risks facing the U.S. economy despite the impressive performance of JPMorgan Chase. While his predictions often appear pessimistic, particularly during periods of economic growth, they are rooted in a cautious understanding of the financial landscape. Dimon’s consistent alerts about inflation, geopolitical tensions, and potential crises reflect both his leadership philosophy and a commitment to safeguarding the interests of investors and the broader economy. As JPMorgan continues to thrive, the contrast between Dimon’s warnings and the bank’s success illustrates the complexities of navigating the modern financial world.