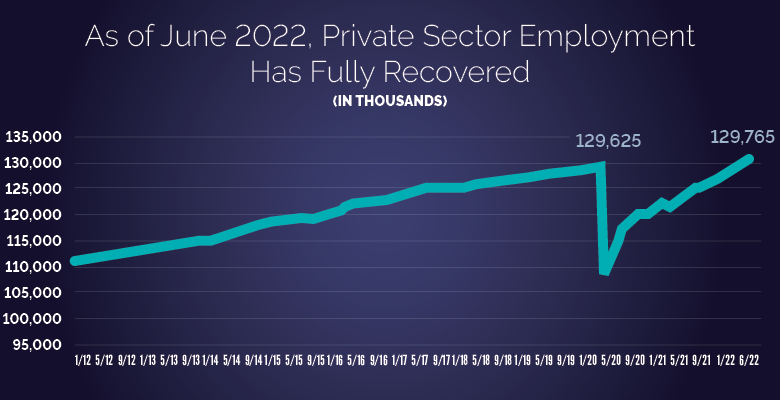

Private Sector Job Growth Surges with 155,000 New Jobs

In March 2025, private sector job growth took a positive turn, with companies adding 155,000 jobs, a remarkable rise from the previously adjusted figure of 84,000 in February. This boost not only exceeded the Dow Jones forecast of 120,000 but also highlighted a resilient labor market statistics amid concerns over economic stability. According to the latest ADP employment report, the increase in private payroll gains reflects widespread hiring across various sectors, reinforcing optimism about wage growth. Notably, earnings for those who switched jobs surged by 6.5%, showcasing the potential benefits of job mobility in a thriving economy. Such robust growth indicates that the job market remains vibrant, offering promising opportunities just as the economy braces for ongoing shifts in policy.

The latest insights into the employment landscape reveal a vibrant expansion in workforce opportunities, particularly within the private sector. As businesses ramp up hiring efforts, the addition of new positions indicates a healthy momentum in the economy that counters fears of a slowdown. This growth is evidenced by significant labor market activities observed in March 2025, where a substantial number of jobs were created, reflecting a solid trend in both private employment and broader economic health. Furthermore, the recent ADP metrics illustrate not just the quantity of jobs, but also the profitable wage increases accompanying these employment opportunities. Collectively, these developments underscore a reinforcing cycle of economic growth, benefiting job seekers and businesses alike.

Overview of Private Sector Job Growth in March 2025

In March 2025, private sector job growth witnessed a substantial boost as 155,000 jobs were added, significantly exceeding the Dow Jones forecast of 120,000 jobs. This figure notably represents a recovery from the revised number of 84,000 positions added in February, showcasing a resilient labor market. Such strong job creation is a positive indicator of economic health, especially in the face of potential headwinds like tariffs that could hamper business expansion and consumer confidence in hiring.

The job growth reported is not just a statistical anomaly; it reflects broader trends identified within the latest ADP employment report, which highlights diverse hiring activities across various sectors. Professional and business services dominated the gains, contributing 57,000 positions, followed closely by financial activities, which added 38,000 jobs. This widespread hiring activity alleviates concerns about slowing job growth and suggests firm optimism among private employers to expand their workforce.

Frequently Asked Questions

What does the March 2025 ADP employment report say about private sector job growth?

The March 2025 ADP employment report indicates an impressive private sector job growth, with 155,000 jobs added, significantly up from February’s revised figure of 84,000. This surpasses the Dow Jones forecast of 120,000, showing a strong rebound in the labor market.

How does wage growth relate to private sector job growth in March 2025?

In March 2025, wage growth was notable, as earnings increased by 4.6% for those who remained in their positions and by 6.5% for workers who switched jobs. This trend reflects a competitive labor market that supports private sector job growth and worker mobility.

What factors contributed to private payroll gains in March 2025?

Private payroll gains in March 2025 were driven by widespread hiring across various sectors, such as professional and business services, which added 57,000 jobs, and financial activities, which contributed 38,000. This robust recruitment supports the overall narrative of private sector job growth.

Are current labor market statistics indicating a slowdown in private sector job growth?

Current labor market statistics do not indicate a slowdown in private sector job growth. The ADP report for March 2025 shows stronger-than-expected job gains, alleviating concerns about deceleration in hiring amid economic uncertainties.

What impact do tariffs have on private sector job growth?

Concerns have been raised that President Trump’s aggressive tariffs could deter firms from hiring, potentially hampering private sector job growth. However, the March 2025 ADP report showed a positive job gain, suggesting that, for now, employment growth continues unabated despite these tariff discussions.

How does the balance of open positions to available workforce affect private sector job growth?

The recent statistics reveal that the number of open positions is nearly equal to the available workforce, a change from previous years where job openings vastly outnumbered unemployed individuals. This balance is crucial for sustaining private sector job growth by ensuring that employers can fill roles effectively.

What can we expect from the upcoming BLS report on private sector job growth for March 2025?

The upcoming BLS report, expected to show a payroll growth of 140,000 jobs in March 2025, will provide more detailed insights into private sector job growth. Unlike the ADP report, the BLS includes government jobs and offers a broader perspective on employment trends.

How did service providers contribute to private sector job growth in March 2025?

In March 2025, service providers accounted for 132,000 of the 155,000 new jobs added in the private sector. This significant contribution highlights the robust demand for service-oriented roles within the growing labor market.

| Key Point | Details |

|---|---|

| Private Sector Job Growth | 155,000 jobs added in March 2025, up from 84,000 in February, exceeding forecast of 120,000. |

| Wage Growth | Wages rose by 4.6% year-over-year for existing employees; 6.5% for job switchers. |

| Industry Contributions | Major job additions: Professional and business services (57,000), Financial activities (38,000), Manufacturing (21,000), Leisure and hospitality (17,000). |

| Job Losses by Sector | Trade, transportation, and utilities lost 6,000 jobs; Natural resources and mining lost 3,000 jobs. |

| Labor Market Overview | Open job positions are nearly equal to the labor force, indicating a strong labor market. |

| Upcoming Reports | Upcoming BLS report expected to show 140,000 nonfarm payroll growth in March, down from 151,000 in February. |

Summary

Private sector job growth has shown a significant upward trend in March 2025, highlighting an improving economic landscape. With the addition of 155,000 jobs, this marks an encouraging departure from the previous month’s figures and boosts confidence in the job market. The wage growth, particularly for those changing jobs, indicates a dynamic labor market despite recent job losses in some sectors. Overall, the data paints a positive picture for private sector job growth as it positions itself robustly against economic uncertainties.