Japanese Government Bond Market: The World’s Most Dangerous Market

The Japanese Government Bond market, known for its profound impact on global investment landscapes, has emerged as a focal point of concern among market analysts. Weston Nakamura has labeled it the “most dangerous market in the world,” drawing attention to its enormous size and the risk factors associated with JGB yields, which continue to lag behind U.S. Treasuries. This disconnect, compounded by lax investor awareness, raises alarms about potential JGB risks capable of triggering global financial contagion. Meanwhile, the Bank of Japan’s (BOJ) monetary policy, particularly its measures like Quantitative and Qualitative Easing, have shaped the market’s behavior, leading to unexpected volatility. As the echoes of Nakamura’s analysis reverberate across financial markets, it becomes crucial for investors to stay vigilant and informed about the intricacies of this perilous bond landscape.

The Japanese bond market, often referred to as JGBs or Japan’s sovereign debt instruments, plays a significant role on the international financial stage. Characterized by its massive issuance and the influence of the Bank of Japan’s policies, it poses unique challenges and risks for global investors. Market observations highlight the interconnectedness of JGB yields with major financial dynamics, revealing how changes in this arena can precipitate broader economic shifts. Analysts like Weston Nakamura stress the importance of understanding JGB intricacies, especially in light of potential global financial contagion and reactions to U.S. Treasury movements. Consequently, comprehending these elements is key for anyone looking to navigate the complexities of today’s financial markets.

Understanding the JGB Market Dynamics

The Japanese Government Bond (JGB) market is often misunderstood, primarily due to its size and complexity. Analysts like Weston Nakamura highlight how the massive scale of the JGB market, coupled with investor ignorance, creates a precarious situation that could lead to global financial contagion. The JGB market’s influence extends far beyond Japan, as fluctuations in JGB yields can impact macroeconomic conditions around the world. For instance, a drop in JGB yields could signal a dire scenario for related global markets, as investors scramble to understand the underlying causes and consequences.

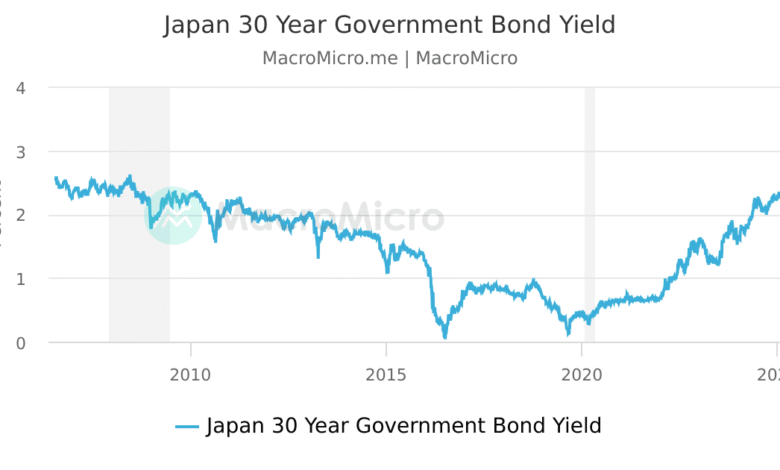

Moreover, the persistent mispricing of JGBs is alarming. Despite Japan’s exorbitant debt-to-GDP ratio of 250%, JGB yields lag significantly behind U.S. Treasuries. This anomaly has drawn attention from global investors who may not fully comprehend the risks involved. Nakamura emphasizes that the movements in long-dated JGBs are increasingly seen as leading indicators for the long end of the U.S. Treasury curve, suggesting a tighter correlation between these two critical markets. This linkage demonstrates that even peripheral markets can drive fundamental changes in primary global markets.

The Risks Associated with Ignoring JGBs

Nakamura’s assertion that the JGB market is the ‘most dangerous market in the world’ stems from the ignorance surrounding its dynamics. Investors often overlook the implications of their complacency towards JGBs, believing that the stability witnessed in Japan signifies a lack of risk. This mindset can lead to severe financial repercussions when the unexpected occurs, as the JGB’s sheer size means it holds the potential to sway global asset classes. It is this blind spot, as highlighted by industry veterans, that could trigger a market meltdown due to sudden shifts in sentiment.

Additionally, the Bank of Japan’s current monetary policies, particularly Quantitative and Qualitative Easing (QQE) and Yield Curve Control (YCC), have exacerbated the risks inherent in the JGB market. These policies have led to an artificial suppression of yields and created a scenario where Japanese financial institutions hold substantial amounts of long-term bonds. Should the BOJ decide to taper its purchasing program, as suggested for July 2024, the market risks could escalate dramatically. Investors may find themselves unprepared for the liquidity challenges and volatility that would ensue.

Impact of BOJ Monetary Policy on Global Markets

One of the most critical aspects of the JGB market is how the Bank of Japan’s (BOJ) monetary policy decisions reverberate across global financial systems. For instance, the BOJ’s intention to reduce bond purchases is not merely a domestic issue; it carries significant implications for international investors. As the BOJ navigates its exit strategy from a prolonged period of qualitative easing, the effects are felt immediately, with financial markets in the U.S. and elsewhere reacting to shifts in JGB yields. Nakamura’s observations underscore this interconnectedness, indicating that traders should keep a close watch on developments in Tokyo.

Such BOJ decisions can lead to increased volatility in rate-sensitive assets, as the market adjusts in real-time to altered liquidity conditions. Investors who ignore the linkage between JGB yields and U.S. Treasuries could find themselves blindsided as the shifts in policy catalyze rapid changes in pricing dynamics. It is becoming increasingly clear that monitoring the JGB market is crucial for those seeking to make informed trading choices, especially given the potential for abrupt market malfunctions driven by fundamental shifts in monetary policy.

Navigating JGB Yields and Global Financial Stability

As the JGB market becomes a focal point for global investors, understanding the yield movements is vital for maintaining financial stability. Given that JGB yields are now seen as predictive indicators for U.S. Treasuries, any significant changes in the Japanese market can resonate through capital markets worldwide. For example, fluctuations past the 3% yield mark have historically influenced U.S. long-term rates, highlighting the need for vigilance in monitoring these yields amidst shifting central bank policies. The interconnected nature of these markets serves as a reminder of the importance of thorough analysis.

Furthermore, the perception that Japan’s fiscal situation poses little threat is misleading. As Nakamura notes, while immediate liquidation or default seems unlikely due to the yen-denominated debt policies of the BOJ, broader market malfunctions remain a pressing concern. Global investors can no longer afford to dismiss the JGB market as peripheral, as any disruption could lead to cascading consequences across financial systems. Through diligent observation of JGB yields, they can navigate potential financial crises more effectively.

The Role of Investor Education in JGB Risks

Investor education is crucial in understanding the complexities and risks associated with the Japanese Government Bond market. Nakamura points to the ignorance prevailing among many investors, which not only creates a blind spot but also magnifies the risks of sudden market shifts. As the JGB market remains largely unmonitored, creating awareness about the risks tied to JGB yields, such as volatility triggered by BOJ policy changes, is vital for risk management. Investors must recognize the critical role of education in managing exposure to financial contagion that stem from the JGB market.

Moreover, as the global financial landscape continues to evolve, investors need to expand their knowledge base beyond traditional markets. Understanding the nuances of the JGB market will allow them to anticipate how policy decisions in Japan might impact broader economic conditions. By fostering an environment where education about JGB risks is prioritized, investors can make more informed decisions and mitigate potential pitfalls associated with complacency and ignorance.

Assessing the Global Financial Contagion Risks

The potential for global financial contagion arising from issues within the JGB market cannot be underestimated. As cited by Nakamura, the correlation between JGB yields and U.S. Treasury rates has tightened, indicating that movements in Japan’s bond market can reverberate through the global financial landscape. This interconnectedness poses a risk not only to financial security in Japan but also to international investors who may be unprepared for the ripple effects of a JGB market malfunction.

With JGBs influencing global interest rates, the implications of disruptions in their stability carry weight far beyond Japan. Investors must recognize that complacency regarding the JGB market could lead to unforeseen consequences and a possible liquidity crisis, impacting asset prices worldwide. Understanding these contagion risks is essential for developing strategies to protect investments and navigate a landscape increasingly influenced by Japan’s monetary policy.

Implications of JGB Liquidity for Investors

Liquidity is a critical consideration for any investor watching the JGB market. According to Nakamura, the potential for liquidity to vanish rapidly due to monetary policy shifts underscores the importance of monitoring developments in Tokyo. Investors must understand that news directly from the BOJ can spark immediate reactions in global markets, leading to increased volatility and uncertainty. This risk is particularly pronounced for those trading U.S. Treasuries, as any changes in JGB conditions could result in significant price adjustments stateside.

Additionally, the current state of liquidity in the JGB market can greatly affect investors’ decision-making processes. As the BOJ contemplates its monetary stance, traders need to be proactive in managing their portfolios by keeping a watchful eye on fluctuations in JGB yields and corresponding market dynamics. Recognizing the interplay between Japanese bond yields and global financial stability is essential for developing sound investment strategies that mitigate risks posed by liquidity issues.

Analyzing the Relationship Between JGBs and Global Economics

The relationship between the Japanese Government Bond market and global economic conditions is complex and multifaceted. As Nakamura articulately notes, the JGB market operates not in isolation, but as part of a broader interconnected system that influences macroeconomic indicators across various regions. Understanding this relationship requires a keen analysis of the key drivers behind JGB yield movements and how they correlate with other global bond markets.

Additionally, as the BOJ adjusts its policies in response to evolving economic landscapes, the implications for both domestic and international investors can be substantial. JGB yields serve as critical barometers for assessing the general health of the global economy, as shifts in these rates often signal broader trends, including inflationary pressures and central bank strategies elsewhere. Thus, continuous analysis of the JGB market is indispensable for those looking to navigate the complexities of a volatile economic environment.

Future Considerations for JGB Risk Management

As we look ahead, the management of risks associated with the JGB market becomes increasingly paramount for investors. Given the evolving nature of the Japanese economy, shifts in BOJ policies, and global market interdependencies, establishing robust risk management strategies becomes essential. Investors should consider continuous monitoring of JGB yields while remaining attuned to geopolitical and economic developments in Japan, which could have ripple effects worldwide.

Furthermore, as the financial landscape fluctuates, developing agility within investment strategies will be essential. Adaptable approaches will enable investors to respond effectively to changes in JGB market dynamics, minimize exposure to potential downturns, and take advantage of emerging opportunities. As Nakamura poignantly states, the JGB market’s influence is considerable, and investors must not overlook its critical role in determining the trajectory of global financial stability.

Frequently Asked Questions

What are the main risks associated with the Japanese Government Bond market (JGB)?

The Japanese Government Bond (JGB) market carries significant risks primarily due to its size and investor ignorance. Analysts like Weston Nakamura highlight dangers such as mispricing of JGB yields, the influence of BOJ monetary policy on market stability, and potential global financial contagion should the market experience volatility. JGBs are often overlooked, allowing complacency to foster instability that could ripple through global markets.

How does the Bank of Japan’s monetary policy affect JGB yields?

The BOJ’s monetary policy, particularly its Quantitative and Qualitative Easing (QQE) and Yield Curve Control (YCC), has suppressed JGB yields by maintaining low interest rates. This has pushed domestic investors, such as banks and insurers, towards longer maturity bonds. Consequently, the manipulation of JGB yields distorts pricing and heightens the risk of market disruption as conditions change.

What does Weston Nakamura mean by saying the JGB market is perilous due to ‘blind spots’?

Nakamura refers to the JGB market as perilous due to investors’ lack of awareness about its complexities and potential impacts. This ‘blind spot’ creates a risky environment, as significant movements in JGBs, often ignored by global investors, can lead to abrupt changes in other markets, facilitating global financial contagion as observed during market shifts.

What is the connection between JGB yields and global financial markets?

The connection between JGB yields and global financial markets has tightened, especially between Japanese and U.S. Treasury yields. Movements in long-term JGBs can now signal trends in U.S. rates, suggesting that ignoring JGB dynamics may expose investors to unforeseen risks in U.S. markets. The interdependence indicates that shifts in the JGB market can have far-reaching consequences for global bond investors.

Why are JGBs considered ‘the most dangerous market in the world’?

JGBs have been labeled ‘the most dangerous market in the world’ due to their vast market size, significant investor complacency, and the exacerbating effects of BOJ monetary policy. This combination can lead to sudden volatility, posing risks not only to Japanese investors but also globally, as failures in this market could trigger widespread financial instability, affecting various asset classes.

Can the Japanese Government Bond market lead to a global financial contagion?

Yes, the Japanese Government Bond (JGB) market could lead to global financial contagion due to its vast interconnectedness with other markets. As JGB yields influence U.S. Treasury rates and broader global financial metrics, any sudden shifts caused by market malfunctions can ripple through the financial system, impacting assets and investor confidence worldwide.

Is a Japanese default likely in the current JGB market?

While a Japanese default seems unlikely at present due to the yen-denominated nature of its debt and the BOJ’s authority to create yen, the focus should be on market malfunction. The risks associated with the JGB market stem from potential liquidity breakdowns and policy shifts that can unpredictably affect both domestic and global markets.

How are JGB yields impacting U.S. Treasury yields?

JGB yields are increasingly influencing U.S. Treasury yields as market movements in Japan are found to precede changes in U.S. rates. For example, recent surges in JGB yields have corresponded with significant increases in U.S. Treasury yields, emphasizing the importance of monitoring JGB dynamics to understand broader trends in global bond markets.

What role does investor awareness play in the Japanese Government Bond market’s stability?

Investor awareness plays a crucial role in the stability of the Japanese Government Bond (JGB) market. A lack of focus on this vast market allows for complacency that can escalate risks associated with mispriced JGBs and inefficiencies in trading, potentially leading to volatility and impacts on global financial conditions.

What indicators should investors watch in relation to the JGB market?

Investors should monitor several indicators related to the JGB market, including JGB yield movements, BOJ monetary policy announcements, the correlation with U.S. Treasury yields, and currency signals such as the yen’s performance. Understanding these dynamics can provide insight into broader financial health and potential stresses in the market.

| Key Point | Description |

|---|---|

| Market Risk | The 40-year JGB market is described as highly dangerous due to its size and investor ignorance. |

| Investor Ignorance | Veteran journalist Guy Johnson’s acknowledgement of never following the 40-year JGB highlights a significant blind spot in market awareness. |

| Mispricing Issues | JGB yields lag behind U.S. Treasuries despite Japan’s high debt-to-GDP ratio, indicating systemic mispricing. |

| Impact of Policies | The BOJ’s QQE and YCC policies have suppressed term premiums, leading to instability and nationalization of parts of the bond market. |

| Liquidity Concerns | Scaling back of BOJ purchases in 2024 reflects underlying liquidity issues rather than inflation control. |

| Global Implications | Movements in JGBs now directly influence U.S. Treasury yields, emphasizing the interconnectedness of global bond markets. |

| Default Risks | Nakamura does not foresee an outright Japanese default due to yen-denominated debt, but warns of market malfunctions. |

| Investor Strategy | Investors should be vigilant about JGBs to avoid being caught off guard by shifts in market conditions. |

Summary

The Japanese Government Bond market has been described as one of the most dangerous in the world due to its massive size and the significant ignorance surrounding it. Market analyst Weston Nakamura highlights how this obscure yet vital market is capable of igniting global financial instability. Its current mispricing, influenced heavily by the Bank of Japan’s unconventional monetary policies, poses a real threat not only to Japan but also to global financial markets. Investors are urged to pay close attention to the JGB market, as its fluctuations can have serious ramifications worldwide, particularly affecting U.S. Treasury rates. Ignoring the dynamics of the Japanese Government Bond market could have dire consequences for global investors.