Cadillac Luxury Brand: Reviving the American Icon

Cadillac luxury brand is on a determined mission to reclaim its position as the premier American luxury car manufacturer, navigating a decade-long journey marked by innovation and revitalization. As luxury vehicles generally provide higher profit margins, Cadillac’s revival is not just a bet on its rich heritage, but also a strategic maneuver to compete fiercely in the luxury vehicle market against both established and new players. The brand’s focus on electric vehicles Cadillac signifies a bold move into the future of automotive technology, aligning with modern consumer demands for sustainability and performance. Under the guidance of GM’s revitalization strategies, the brand is steadily reshaping its portfolio, reinforcing its commitment to quality and exclusivity. Cadillac’s journey is a critical chapter in the broader narrative of American luxury cars, reflecting a blend of tradition and cutting-edge innovation that resonates with affluent audiences.

The Cadillac luxury brand represents a legacy of American craftsmanship and innovation in the world of premium automobiles. As it strives to enhance its image, this esteemed marque is undertaking significant changes to position itself as a leader in the competitive realm of high-end vehicles. With a burgeoning focus on electric mobility, Cadillac is aiming to attract eco-conscious consumers while simultaneously paying homage to its storied past. The brand’s current trajectory reflects a comprehensive approach to revitalization, making it a compelling figure in the evolving landscape of the luxury vehicle market. Emphasizing both luxury and sustainability, Cadillac embarks on a journey that not only speaks to automotive enthusiasts but seeks to redefine the essence of American luxury.

The Cadillac Revival: Reclaiming Luxury Status

In recent years, Cadillac has undertaken significant efforts to revitalize its brand image and regain its status as the quintessential American luxury car manufacturer. This ambitious journey is not just about redesigning vehicles but redefining how consumers perceive luxury. Cadillac’s strategy aligns closely with the shifting dynamics of the luxury vehicle market, where buyers now seek not only comfort and style but also technological innovation and sustainability. As Cadillac focuses on electric vehicles and upscale offerings, it aims to cater to a generation of affluent consumers who prioritize eco-friendliness alongside luxury.

The revival of Cadillac echoes a broader trend within the automotive industry, where traditional luxury brands are increasingly challenged by new entrants and shifting consumer preferences. By enhancing its portfolio with all-electric vehicles, Cadillac is not only competing with established luxury rivals like BMW and Mercedes-Benz but also with groundbreaking brands like Tesla. The push towards electric vehicles, highlighted by models like the Lyriq and the forthcoming Celestiq, represents Cadillac’s commitment to innovation and a firm belief in its capacity to redefine American luxury.

Cadillac and the American Luxury Car Market

As Cadillac seeks to navigate the competitive landscape of American luxury cars, it is crucial to understand the unique elements that define this market. Consumers in this segment expect a combination of heritage, excellence, and cutting-edge technology, which Cadillac is poised to deliver through its revitalized brand strategy. The luxury vehicle market typically enjoys higher profit margins, making it an attractive focus for GM as it attempts to reinvigorate Cadillac’s offerings. This pursuit is not merely about increasing sales; it’s about restoring the emotional connection consumers have with the brand.

Cadillac’s commitment to luxury extends beyond vehicle design. The company is also investing in exclusive features and a high level of customer service that aligns with the expectations of a luxury clientele. This approach not only aims to set Cadillac apart from competitors but also reinforces the brand’s status as a pillar of American automotive engineering. By embedding luxury into every aspect of the consumer experience, Cadillac strives to create an indelible mark on the luxury car market.

Electric Vehicles: The Future of Cadillac

The shift towards electric vehicles (EVs) is a cornerstone of Cadillac’s strategy for the future. With global awareness of environmental issues increasing, consumer preferences are moving towards sustainable options, and Cadillac is responding by developing a range of EVs tailored to meet these demands. The Lyriq, Cadillac’s first all-electric SUV, encompasses modern aesthetics and advanced features that align with luxury expectations. Moreover, the projected release of the Celestiq signifies a commitment to performance and luxury, aiming to restore Cadillac’s reputation as a desired luxury brand.

Cadillac’s innovation in electric vehicles is a direct response to competitors like Tesla, who have dominated the premium EV segment. By offering distinctively American luxury in its electric lineup, Cadillac competes not only in terms of technology but also in the aspirational branding of electric cars. The integration of cutting-edge features, performance capabilities, and luxury design in their EVs is expected to enhance Cadillac’s position within the rapidly evolving automotive landscape.

GM’s Cadillac Strategy: Shaping the Future

General Motors’ overarching strategy for Cadillac involves a comprehensive revitalization process intended to re-establish the brand as a symbol of American luxury. Under the leadership of figures like Mark Reuss, GM is focusing on delivering unique products that distinguish Cadillac from its competitors. This approach is centered on reducing parts-sharing with other GM brands and creating a distinct identity for Cadillac, which is crucial for appealing to modern luxury consumers who seek exclusivity and personalization.

As Cadillac embarks on this journey, it is essential that GM maintains a consistent focus on quality and branding. Recent adjustments in production strategies and product offerings show a commitment to long-term brand health rather than short-term gains. The revitalization of Cadillac is not simply about launching new models; it encompasses a vision for the brand’s future, ensuring that Cadillac remains relevant in the competitive luxury vehicle market. This consistent strategic approach is vital for Cadillac’s aspiration to reclaim its title as “the standard of the world.”

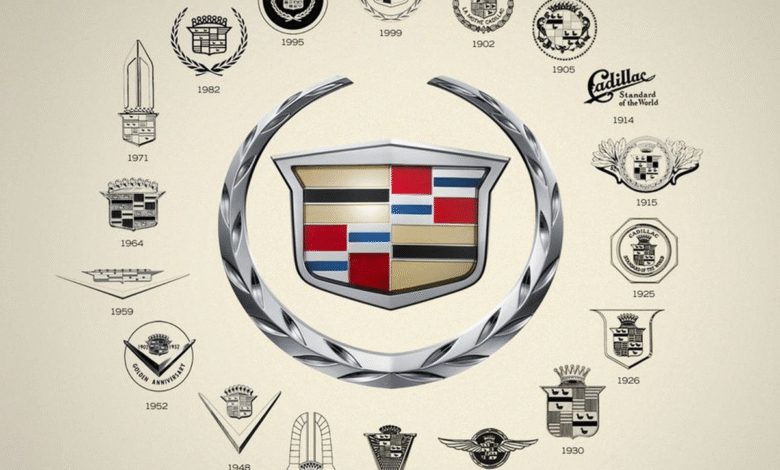

The Role of Heritage in Cadillac’s Brand Strategy

Cadillac’s legacy as a prominent American luxury brand plays a critical role in its current transformation efforts. The brand, recognized for its innovation and artistry, has a history that it can leverage to attract consumers looking for authenticity and heritage. By invoking its storied past, Cadillac aims to resonate with buyers who value tradition and craftsmanship in their luxury vehicles. This blend of heritage with modern technology is a unique selling proposition that can differentiate Cadillac from its competitors.

Moreover, preserving and honoring Cadillac’s historic strengths while integrating contemporary design principles can create a compelling narrative that appeals to both loyal customers and new audiences. This narrative is essential as Cadillac seeks to build a connection with consumers who are increasingly prioritizing brand history alongside technological advancement. Nurturing this legacy while evolving with consumer preferences will be pivotal in Cadillac’s quest for revival in the luxury vehicle market.

Cadillac’s Competitive Landscape: Navigating Challenges

The landscape for luxury automakers is fiercely competitive, with Cadillac facing various challenges as it tries to assert its dominance as a luxury brand. Competing against major players like Lincoln, BMW, and new electric vehicle disruptors like Tesla poses significant hurdles. These competitors are not just vying for market share; they are also redefining what consumers expect from luxury vehicles, emphasizing advanced technology, sustainability, and performance. Understanding and adapting to these dynamics is crucial for Cadillac’s successful navigation through this competitive terrain.

Cadillac’s approach to meeting these challenges includes a focused product strategy that prioritizes innovation and exclusivity. By offering high-performance electric vehicles and leveraging advanced technologies, the brand aims to carve out a niche in the luxury vehicle sector. This proactive stance ensures that Cadillac remains relevant and competitive as the industry evolves, aiming to strengthen its foothold against both traditional luxury brands and burgeoning competitors.

The Importance of Customer Experience in Cadillac’s Strategy

In the luxury market, customer experience often plays a more significant role than the product itself. Cadillac recognizes the necessity of providing an unparalleled customer journey from the moment potential buyers interact with the brand. This emphasis on customer experience includes personalized services, exclusive events, and tailored customer interactions, ensuring that clients feel valued and understood at every step. By enhancing the overall consumer journey, Cadillac aims to create lasting loyalty among luxury buyers.

As Cadillac continues to evolve its offerings, it must ensure that the customer experience reflects the high standards expected from a luxury brand. This includes integrating technology into the customer journey, such as online vehicle configuration tools and virtual showrooms, to offer convenience alongside luxury. By fostering a customer-centric approach, Cadillac can strengthen its reputation and develop a loyal clientele, enhancing its market position in the luxury vehicle industry.

Marketing Strategies for the Modern Luxury Consumer

Marketing plays a pivotal role in Cadillac’s strategy to capture modern luxury consumers. As traditional advertising methods evolve, Cadillac has embraced new techniques that resonate with the expectations of today’s buyers. Digital marketing, social media engagement, and influencer partnerships are becoming essential components of Cadillac’s promotional strategies, as they allow the brand to connect with a broader audience in authentic and meaningful ways. This approach will be crucial for appealing to younger luxury buyers who prioritize transparency and engagement.

Cadillac’s marketing strategy also includes reinforcing its brand messaging around its commitment to sustainability and electric vehicle offerings. With more consumers becoming environmentally conscious, aligning brand values with consumer values is increasingly important. By highlighting its focus on innovative electric vehicles and sustainability, Cadillac can attract a customer base that prioritizes both luxury and responsibility, thereby positioning itself strongly in the ever-changing luxury vehicle market.

Looking Ahead: Cadillac’s Vision for the Future

Looking towards the future, Cadillac’s vision involves establishing itself firmly at the forefront of the electric vehicle movement while preserving its identity as a luxury car brand. By committing to electric vehicles and continuing to innovate, Cadillac not only enhances its appeal to eco-conscious consumers but also signals a forward-thinking vision that aligns with global automotive trends. This foresight can help Cadillac navigate potential challenges and ensure sustained relevance in an increasingly competitive landscape.

As Cadillac continues its journey of revitalization, the brand’s focus on innovation, heritage, and consumer connection will set the path towards redefining what an American luxury car brand should embody. With a clear strategy and commitment to excellence, Cadillac is poised to reclaim its title as the quintessential American luxury brand, continually evolving to meet the demands of an ever-shifting market landscape.

Frequently Asked Questions

What initiatives are being taken to revive Cadillac as a leading American luxury brand?

Cadillac is focusing on a comprehensive strategy to revive its status in the luxury vehicle market. This includes developing unique, sporty vehicles while limiting the shared components with GM’s other brands. The brand is also committing to electric vehicles, exemplified by the rollout of the Lyriq and the upcoming Celestiq, to compete against top luxury and electric vehicle competitors.

How is Cadillac addressing the competition in the luxury vehicle market?

Cadillac is enhancing its competitiveness in the luxury vehicle market by emphasizing distinct product designs and exclusive technologies that set it apart from brands like BMW and Mercedes-Benz. The focus on all-electric models reflects Cadillac’s efforts to innovate and attract the affluent clientele that characterizes the luxury market.

What role does electric vehicle development play in Cadillac’s strategy?

Electric vehicles are central to Cadillac’s revitalization strategy, as the brand aims to capture a segment of the market driven by sustainability and tech-forward consumers. The introduction of all-electric models, starting with the Lyriq, demonstrates Cadillac’s commitment to becoming a significant player in the EV landscape alongside companies like Tesla.

Why is Cadillac focusing on higher residual values in its luxury vehicle offerings?

Cadillac is aiming for higher residual values to position itself more favorably in the luxury vehicle market. By revamping its portfolio with sporty and sleek offerings, the brand intends to enhance its resale values, reduce incentives, and ultimately reflect a stronger brand image synonymous with luxury.

What challenges has Cadillac faced in the international market, particularly in China?

Cadillac has encountered challenges with sales performance in China, which is a critical market for luxury vehicle manufacturers. Factors influencing these challenges include increased competition from local and international brands, making Cadillac’s commitment to distinct product offerings and marketing strategies essential for regaining traction.

What is the significance of the Cadillac Escalade in the brand’s revival efforts?

The Cadillac Escalade serves as a cornerstone of Cadillac’s revival strategy. As one of GM’s most recognized luxury vehicles, maintaining and enhancing the Escalade’s reputation through innovative features and design will help Cadillac position itself as the leading American luxury brand.

How will Cadillac differentiate itself in the luxury market against brands like Tesla and Lucid Group?

Cadillac plans to differentiate itself by combining American luxury styling with advanced technology, particularly in its electric vehicle lineup. The introduction of unique models like the Celestiq aims to offer personalization and exclusivity that appeals to luxury consumers while competing with emerging electric vehicle manufacturers.

What future developments can we expect from Cadillac in terms of new models?

Future developments from Cadillac will likely include a series of all-electric vehicles that showcase cutting-edge technology and design. Following the Lyriq and the premium Celestiq, Cadillac is expected to expand its electric offerings, reinforcing its commitment to electric vehicles as a core component of its luxury brand strategy.

How does Cadillac’s management approach contribute to its luxury brand strategy?

Cadillac’s management approach emphasizes consistency and a clear vision for the brand’s luxury identity. With leaders who are deeply invested in the brand’s heritage and future, the strategy aims to elevate Cadillac’s image and presence in the American luxury car market, ensuring every decision aligns with the goal of becoming the ‘standard of the world’ once again.

| Key Points | Details |

|---|---|

| Cadillac’s Objective | To reclaim its status as the premier American luxury brand. |

| Market Importance | Luxury vehicles offer higher profit margins and attract affluent consumers. |

| Historic Context | GM’s headquarters reflects Cadillac’s past prestige during its ‘Golden Era’. |

| Leadership’s Approach | Mark Reuss and team are focused on product revival and luxury brand restoration. |

| Strategic Initiatives | Focus on all-electric vehicles and distinctive product offerings. |

| Challenges Faced | Sales issues in China and obstacles with EV production and acceptance. |

| Recent Developments | Launch of all-electric Lyriq and bespoke Celestiq to rejuvenate the lineup. |

| Future Vision | Continually raising the bar and adapting to maintain presence in luxury market. |

Summary

Cadillac luxury brand is on a transformative journey to reclaim its legacy as the quintessential American luxury car manufacturer. Under the determined leadership of Mark Reuss and a renewed focus on all-electric models, Cadillac aims to redefine luxury and innovation. Despite facing fierce competition and market challenges, the brand’s commitment to distinctive quality and design is poised to elevate its standing in the automotive industry. As Cadillac refines its offerings and identity, it not only looks to past glories but also embraces future possibilities, reinforcing its vision of excellence in luxury vehicles.