Jerome Powell ECB Panel: Insights on Global Economy

The Jerome Powell ECB panel is poised to capture the attention of financial markets as the Federal Reserve Chairman addresses pressing economic issues at the European Central Bank forum. Set against the picturesque backdrop of Sintra, Portugal, Powell’s participation in this global economy discussion comes at a critical time when interest rates policy is under intense scrutiny. With notable implications for both domestic and international economies, his insights will greatly inform investors and policymakers alike. This anticipated speech follows recent decisions by the Fed to maintain stable interest rates, despite external pressures to adopt a more aggressive stance. As the July 2025 ECB forum unfolds, all eyes will be on Powell’s commentary for clues about future monetary strategies that could influence the broader economic landscape.

At the upcoming ECB forum in Portugal, Fed Chair Jerome Powell will engage in vital dialogues surrounding monetary policy and global economic trends. The event, scheduled to start at 9:30 AM ET, marks an important moment for policymakers as they navigate challenges in interest rate adjustments amid changing economic signals. This discourse serves as a platform for influential leaders in finance to exchange views on the economy’s trajectory, shaping decisions that could resonate worldwide. With markets hanging on every word, Powell’s presence emphasizes the interconnectedness of international financial systems and the role of effective policy in sustaining growth. As discussions unfold, stakeholders will look for insights into how central banking strategies might adapt to an ever-evolving global landscape.

Jerome Powell’s Insights at the ECB Panel

At the European Central Bank (ECB) panel held in Sintra, Portugal, Federal Reserve Chairman Jerome Powell delivered significant insights regarding the current trends in the global economy. His speech, part of a broader discussion on international monetary policy, emphasized the Fed’s cautious approach to interest rate adjustments in light of recent economic data. As the global economy faces uncertainties, Powell’s remarks were aimed at reassuring markets that the U.S. central bank remains vigilant and well-prepared to navigate potential challenges.

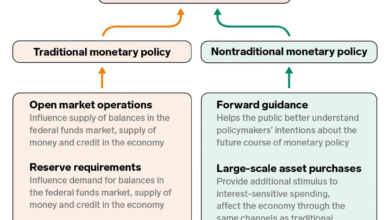

During the event, Powell highlighted the importance of coordinated efforts among central banks, acknowledging that decisions made by the Fed in response to economic conditions could have ripple effects across the Atlantic. The conversation at the ECB forum in July 2025 not only revolved around interest rate policies but also touched on broader themes such as inflation expectations and labor market dynamics. This underscores the interconnectedness of global financial systems, reinforcing the need for ongoing dialogue and cooperation.

The Impact of Fed Policies on Global Interest Rates

The decisions made by the Federal Reserve regarding interest rates have far-reaching implications for the global economy. As the ECB forum highlighted, changes in U.S. monetary policy can influence borrowing costs in other regions, affecting everything from consumer spending to international trade. Jerome Powell’s statement at this crucial panel reinforced the notion that while the Fed maintains its current stance on interest rates, vigilance is necessary to monitor how external factors might prompt reevaluation in the future.

With the backdrop of ongoing economic recovery efforts and geopolitical tensions, Powell’s insights emphasized the delicate balancing act central banks must perform. The Fed’s decision to keep interest rates steady may be seen as a protective measure against inflation, but it also invites discussion among other central banks, such as the European Central Bank. The deliberations at the ECB forum in July 2025 serve to remind participants of the importance of aligning policies that stabilize both the U.S. and European economies.

The Significance of the Sintra Portugal Forum

The Sintra forum, where Powell spoke, is renowned for bringing together leading monetary policymakers and economists to discuss pressing economic issues. This year’s ECB panel provided a unique platform for high-level engagement on critical topics like interest rates, inflation, and economic growth. The setting in Portugal was both symbolic and practical, as European and U.S. policymakers aim to coordinate their responses to a rapidly changing economic landscape.

As discussions unfolded, attendees assessed current trends in inflation and employment, drawing parallels between American and European economies. The dialogue was particularly timely, given the recent pressures on ECB policy as they navigate the post-pandemic recovery. Powell’s participation underscored the essential nature of cooperative monetary policy discussions in addressing global economic challenges.

Navigating Economic Challenges Ahead of Jobs Data

As the July 2025 jobs data approached, Powell’s commentary at the ECB panel painted a cautious yet optimistic view of the U.S. labor market. The Fed chairman recognized the critical role that employment figures play in guiding monetary policy decisions. By maintaining stable interest rates for now, Powell indicated that the Federal Reserve would be keeping a close eye on upcoming jobs reports to shape future policy directions.

The importance of employment data cannot be overstated, especially during periods of economic uncertainty. Powell’s ability to convey this message at the ECB forum reflects the interconnected nature of labor markets and economic health, not only in the U.S. but globally. Stakeholders anticipate that a positive jobs report could influence sentiment and strengthen both household spending and investment, ultimately contributing to a more dynamic recovery.

Interest Rate Outlook in Global Context

The dialogue on interest rates is ever-evolving, especially in light of Jerome Powell’s views shared during the ECB panel discussions. Expectations regarding future interest rate movements are a central concern for economists, policymakers, and investors alike. Powell’s cautious approach to potential rate cuts indicates a recognition of the delicate balance required for sustainable economic growth in the U.S. and beyond.

In the broader context of global interest rates, the moves made by the Federal Reserve can resonate across markets, affecting decisions made by the European Central Bank and other monetary authorities. As the ECB forum concluded, the emphasis on shared outcomes was apparent, bearing in mind that coordinated policy measures could enhance economic stability worldwide.

The Role of Central Banks in a Post-Pandemic Economy

In the wake of the COVID-19 pandemic, central banks worldwide, including the Fed and the ECB, play a pivotal role in steering economic recovery efforts. During his remarks at the ECB panel, Powell underscored the importance of adaptive monetary policies that reflect changing economic conditions. His approach towards interest rate policies emphasizes caution and preparedness, essential for navigating the post-pandemic landscape.

As policymakers consider strategies to promote growth while curbing inflation, central bank dialogues become increasingly important. The insights shared at the ECB forum highlight that collaboration among central banks can enhance the effectiveness of monetary policy responses, ensuring that economies in both the U.S. and Europe can move towards a more resilient future.

Future Prospects for the Global Economy

Looking ahead, the future of the global economy remains uncertain, but discussions like those at the ECB forum provide valuable perspectives. Jerome Powell’s remarks emphasize an optimistic yet cautious outlook, with a focus on economic data that could prompt policy shifts. As central banks continue to assess their strategies in response to changing conditions, forecasting becomes an essential exercise for policymakers.

The discussions around interest rates and economic indicators shared by Powell and other experts shed light on potential scenarios that could unfold in the coming months. Investors and stakeholders alike will be closely monitoring these insights as they look to gauge the robustness of economic recovery in both the U.S. and Europe.

Collaborative Approaches to Monetary Policy

The necessity for collaboration among central banks has become increasingly evident in the discussions held at the ECB panel. Jerome Powell’s presence exemplifies the joint efforts required to tackle complex economic challenges that transcend national borders. The interactions between the Fed and the ECB encourage innovative ideas for enhancing market stability and growth.

Joint approaches to monetary policy can lead to more comprehensive strategies that accommodate the unique economic circumstances of each region. By observing how the Fed and the ECB navigate their priorities, other central banks may also glean essential insights that inform their own policy frameworks, reinforcing global economic stability.

Understanding Inflation Trends and Responses

Inflation remains a pressing concern in the discussions among central banks, with Powell at the forefront of this critical dialogue. In his speech at the ECB forum, he emphasized the importance of monitoring inflation trends closely, understanding that they are a determinant factor in interest rate policies. The varying inflation rates observed globally require tailored responses to maintain economic stability without stifling growth.

The complex interplay between consumer prices and interest rates demands that central banks remain agile in their strategies. Insights shared at the ECB panel provide guidance on how to effectively respond to inflationary pressures while fostering an environment conducive to employment and growth. Understanding these trends is vital as policymakers shape their economic agendas.

Frequently Asked Questions

What did Jerome Powell discuss at the ECB panel in Portugal?

At the ECB panel in Portugal, Federal Reserve Chairman Jerome Powell addressed key issues regarding the global economy and the current interest rates policy. His remarks emphasized the U.S. central bank’s position to maintain steady interest rates amidst economic fluctuations and the pressures of political influence.

How does Jerome Powell’s speech at the ECB forum impact global interest rates policy?

Jerome Powell’s speech at the ECB forum is significant as it reflects the Federal Reserve’s stance on interest rates policy, which can influence global financial markets. By maintaining steady rates, Powell signals confidence in the U.S. economy, potentially affecting the ECB and other central banks’ decisions on their own monetary policies.

When was Jerome Powell scheduled to speak at the ECB forum in Sintra, Portugal?

Jerome Powell was scheduled to speak at the ECB forum in Sintra, Portugal, on Tuesday, July 1, 2025, at 9:30 a.m. ET. This event gathered central bank leaders to discuss various aspects of the global economy.

What are the main themes discussed at the ECB forum where Jerome Powell spoke?

The main themes discussed at the ECB forum where Jerome Powell spoke include the global economy’s current state, interest rates policy, and the economic outlook amid various policy shifts. The forum provides a platform for central bankers to address these pressing issues internationally.

What led to Jerome Powell’s comments at the ECB panel in Sintra?

Jerome Powell’s comments at the ECB panel were influenced by recent decisions from the U.S. Federal Reserve to maintain interest rates steady, despite external pressures for cuts, particularly from political figures. His insights were timely as they preceded important job data releases that could impact future monetary policy.

How might the ECB forum in July 2025 affect future monetary policy decisions?

The ECB forum in July 2025, featuring Jerome Powell, may impact future monetary policy decisions by shaping the dialogue around economic trends and interest rate strategies. Central bank leaders often use such forums to signal their intentions and coordinate policies, which can lead to adjustments in interest rate decisions globally.

| Key Points | Details |

|---|---|

| Event | Jerome Powell speaks at ECB panel in Sintra, Portugal. |

| Date and Time | Tuesday, 9:30 a.m. ET |

| Context | Discussion on global economy and policy shifts. |

| Interest Rates | U.S. Federal Reserve keeps rates steady amid pressures. |

| Remarks Significance | Statements precede critical upcoming jobs data. |

Summary

Jerome Powell’s upcoming speech at the ECB panel will be pivotal as it addresses the current dynamics of the global economy. As the world watches closely, Powell’s insights on the Federal Reserve’s steady interest rate position against political pressures will provide a roadmap for future economic policy. This discussion aims to alleviate concerns amid an uncertain economic landscape, making the Jerome Powell ECB panel a significant event for policymakers and investors alike.