Jerome Powell Inflation Remarks: Fed’s Commitment Explained

In his recent remarks on inflation, Federal Reserve Chair Jerome Powell emphasized the central bank’s dedication to maintaining strict inflation control as uncertainty looms around the impact of tariffs on consumer prices. Speaking before Congress, Powell characterized the economy as robust, yet acknowledged that inflation has persistently exceeded the Federal Reserve’s target of 2%. He reiterated that officials would remain cautious, evaluating the potential effects of tariffs before making significant adjustments to Federal Reserve policy, particularly concerning upcoming FOMC rate decisions. This assessment comes amid a positive economic outlook, highlighting a strong labor market approaching full employment, while Powell underscored the need to prevent temporary price spikes from morphing into long-term inflationary trends. His comments reflect a balancing act as the Fed seeks to navigate the complexities of inflation management and economic stability amid evolving global trade dynamics.

Recently, the Chair of the Federal Reserve, Jerome Powell, articulated critical insights on the state of inflation, spotlighting the monetary authority’s commitment to controlling price levels. His commentary came amid ongoing discussions about tariff impacts and their potential to alter the economic landscape. Amid a strong job market, Powell’s remarks painted a hopeful economic picture, yet he warned that inflation continues to linger above acceptable thresholds. As Federal Reserve strategy evolves, policymakers remain attuned to the multifaceted influences shaping the current economic outlook, particularly as they prepare for upcoming FOMC decisions. This careful approach underscores the importance of understanding varied economic factors, from trade policies to domestic growth indicators, in formulating effective inflation control measures.

Jerome Powell’s Inflation Remarks and Their Implications

During his recent address, Federal Reserve Chair Jerome Powell reiterated the central bank’s steadfast commitment to controlling inflation, emphasizing that patience is crucial as the effects of tariffs on prices remain uncertain. Powell’s remarks were aimed at congressional committees, where he addressed the current economic climate, which he described as robust alongside a labor market nearing full employment. The inflation levels, however, still exceed the Fed’s target of 2%. The imminent threat of tariffs, as indicated by Powell, may lead to inflationary pressures that could hinder achieving a stable economic outlook.

Powell’s careful approach underlines the necessity for the Federal Reserve to evaluate the long-term impacts of President Trump’s tariffs before making any significant adjustments to their monetary policy. His statement, “Policy changes continue to evolve, and their effects on the economy remain uncertain,” reflects a cautious stance towards the Federal Reserve’s approach to inflation control and rate decisions by the FOMC. This positions the Fed to analyze detailed economic data, ensuring a well-informed stance that balances inflation alongside employment levels.

The Federal Reserve’s Strategy on Inflation Control

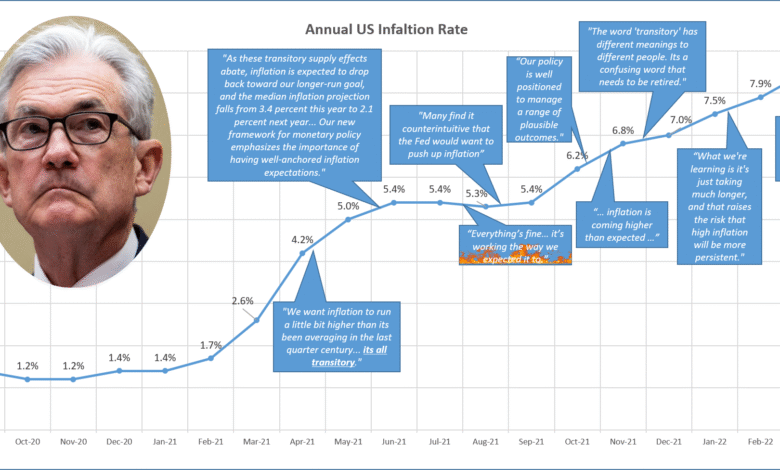

The Federal Reserve has been proactive in its strategies to control inflation, particularly with the underlying aim of stabilizing the economic environment amidst fluctuating pressures. Jerome Powell highlighted that ordinary measures will be taken to ensure that inflation does not exceed projections, which currently estimate an uptick to 2.3% by May. This viewpoint aligns with the Fed’s dual mandate—seeking to uphold low inflation while fostering full employment. The interplay between tariff impacts and inflation rates forms a critical area of focus for the FOMC as it deliberates future rate decisions.

By maintaining an unchanged interest rate, the Federal Reserve demonstrates a strategic move reflecting their assessment of the economy’s current conditions and the improbability of immediate inflation spikes. The FOMC recognizes that tariffs historically lead to temporary price increases, and their goal is to prevent such surges from morphing into persistent inflation issues. As Powell noted, the need for a balanced approach is essential for sustaining long-term economic growth opportunities that benefit the broader American populace.

Analyzing The Impact of Tariffs on Economic Outlook

Jerome Powell’s commentary on tariffs unveils the complex relationship between trade policies and economic performance. With tariffs instituted by the Trump administration, there is an ongoing uncertainty about their potential to influence inflation and overall economic activity. Economists are cautious, given that tariffs can lead to short-term price increases while also potentially fueling long-term inflationary trends, which complicates the Federal Reserve’s mandate of fostering economic stability.

As the Federal Reserve evaluates the data associated with tariffs, it becomes increasingly clear that the effectiveness of such policies must be scrutinized in conjunction with broader economic indicators. Powell’s remarks suggest a holistic view, where the Fed will consider multiple facets of economic health before any adjustments are made to their policies. There’s a focus on generating a solid economic outlook that doesn’t sacrifice inflation targets while ensuring robust labor market conditions.

FOMC Rate Decisions and Their Economic Significance

The Federal Open Market Committee (FOMC) plays a critical role in shaping monetary policy through its rate decisions, which are crucial in managing inflation and influencing the economy. Jerome Powell emphasized that the FOMC is responsible for maintaining long-term inflation expectations and preventing any short-term inflation hikes from evolving into persistent economic challenges. Specifically, measures taken by the FOMC reflect these intentions, as they navigate through economic uncertainties influenced by tariffs and trade dynamics.

Recent developments indicate that the FOMC has unanimously opted to keep interest rates unchanged, a decision that stems from recognizing that economic indicators, such as the consumer price index, show muted inflationary pressures. While this approach seeks to balance inflation control against the need for economic growth, the opinions within the FOMC, as shown in the ‘dot plot’ analysis, reveal a divergence among policymakers regarding future cuts. Such insights signal the complexity involved in FOMC rate decisions and their profound implications for the economic landscape.

Understanding Inflation Trends and Economic Health

Inflation trends play a pivotal role in evaluating overall economic health, serving as an essential indicator for both markets and policymakers. Jerome Powell’s observations regarding the 2.3% forecast for inflation by May illustrate the critical balance that the Federal Reserve must maintain to ensure economic stability. By focusing on core inflation measures, which exclude volatile elements like food and energy prices, the Fed aims to provide a clearer picture of underlying economic conditions.

Moreover, the relationship between inflation and employment remains a vital area for analysis, as Powell pointed out the need for price stability to achieve sustained labor market conditions. As inflationary pressures evolve, the Fed must craft strategies that not only address immediate concerns but also align with the broader objective of long-term economic resilience. This ongoing evaluation underscores the essential nature of timely data and the need for a dynamic approach to inflation management.

The Role of Tariffs in Shaping Inflation Effects

Tariffs have a significant role in shaping inflation effects, as noted by Jerome Powell in his remarks to Congress. The uncertainty surrounding the potential impact of tariffs on prices makes it crucial for policymakers to adopt a cautious approach when interpreting economic data. Historically, tariffs have been associated with one-off price increases, but Powell’s focus suggests a need to analyze whether these increases could develop into sustained inflationary trends if not managed effectively.

As the Federal Reserve continues to monitor the ramifications of tariffs, Powell asserts the importance of understanding how these trade measures could intertwine with economic performance. The forthcoming analysis will provide insights that will inform future Federal Reserve policies, ensuring that appropriate steps are taken to balance the economic impact with the overarching goals of full employment and inflation control. This distinction is vital for aligning monetary policies with actual economic conditions, ultimately fostering a resilient economy.

Market Reactions to Federal Reserve Policies

Market reactions to Federal Reserve policies often reflect the collective sentiment about economic health and future trajectories. In light of Jerome Powell’s recent comments, market futures indicated only a 23% chance of a rate cut at the forthcoming July meeting, demonstrating a level of confidence in the Fed’s cautious approach towards navigating inflation challenges. This response underscores the critical role that Federal Reserve communications play in shaping market expectations and influencing investment strategies.

Furthermore, with individual voting members of the FOMC split over potential rate cuts, there is a clear indication of differing perspectives on addressing inflation and economic growth. The market’s anticipation of pivotal decisions further reflects the uncertainty surrounding tariffs’ effects and their subsequent economic implications. A nuanced understanding of these dynamics is essential for investors and stakeholders as they consider adaptive strategies in response to Federal Reserve signals.

Future Economic Indicators to Monitor

As Jerome Powell and the Federal Reserve navigate the complexities associated with economic adjustments, several indicators merit close observation in the coming months. Tracking inflation rates will remain paramount, particularly as forecasts suggest a rise in inflationary measures. Beyond inflation, metrics related to consumer spending, wage growth, and employment rates will serve as critical barometers of economic health, informing potential adjustments to Federal Reserve policy.

Moreover, developments around tariffs and their direct outcomes on domestic pricing will be key to understanding overall market dynamics. The interplay between these factors will influence not just the decisions made by the FOMC but also the broader economic outlook. Adapting to these changes will be crucial for stakeholders across various sectors, reinforcing a comprehensive appreciation for how economic indicators affect financial markets and long-term planning.

Conclusion: Balancing Inflation Control and Economic Growth

In conclusion, Jerome Powell’s remarks and the Federal Reserve’s strategic decisions highlight the ongoing balancing act between inflation control and promoting economic growth. As policymakers navigate the effects of tariffs and fluctuating inflation, a careful analysis is required to ensure that their actions align with the broader objectives of maintaining a healthy economy. The Fed’s commitment to transparency in its approach underscores the importance of informed decision-making based on evolving economic data.

The future of U.S. economic policy will largely depend on how effectively the Federal Reserve can respond to emerging challenges while preserving low inflation rates and fostering employment opportunities. As Powell indicated, the Fed is well-positioned to assess the economic landscape. Close monitoring of inflation trends, market reactions, and international trade dynamics will ultimately define the success of their policies in achieving sustainable economic progress.

Frequently Asked Questions

What did Jerome Powell say about inflation during his recent remarks?

In his recent remarks, Jerome Powell emphasized the Federal Reserve’s commitment to controlling inflation, highlighting that current inflation rates remain above their 2% target. He indicated that the Fed will maintain its policy stance until they fully understand the impact of tariffs on prices.

How do Jerome Powell’s inflation remarks affect Federal Reserve policy?

Jerome Powell’s inflation remarks suggest that the Federal Reserve will not rush to change its policy, as they prioritize gathering more data on the economic impact of tariffs. This cautious approach underlines the Fed’s strategy to keep long-term inflation expectations anchored.

What are the implications of tariffs according to Jerome Powell’s inflation remarks?

According to Jerome Powell, tariffs can lead to short-term price increases and potentially contribute to long-term inflation pressures. He remarked that the effects of tariffs on inflation are still unclear, which influences how the Federal Reserve may adjust its policies.

What did Jerome Powell mention about the economic outlook in relation to inflation?

Jerome Powell described the economic outlook as strong, noting low unemployment rates. However, he cautioned that inflation remains above the Fed’s targeted levels, signaling that while the economy shows resilience, inflation control is still a priority for Federal Reserve policymakers.

How is the FOMC responding to the current inflation situation as discussed by Jerome Powell?

The FOMC, as indicated in Powell’s remarks, remains vigilant regarding inflation trends and has decided to keep interest rates unchanged for now. They are focusing on the dual objectives of maintaining full employment and controlling inflation, especially while navigating the uncertainties brought by tariffs.

What is the significance of the dot plot in relation to Jerome Powell’s inflation remarks?

The dot plot is significant as it reveals future interest rate expectations among FOMC members. In his remarks, Powell referenced this tool, highlighting the divergence among members about potential rate cuts, which reflects varying perspectives on managing inflation moving forward.

How does Jerome Powell plan to address inflation control in future FOMC meetings?

Jerome Powell plans to address inflation control by monitoring economic data closely, particularly the effects of tariffs, before making adjustments to the Federal Reserve’s monetary policy. His cautious stance indicates a strategy of waiting for additional clarity on inflation trends.

| Key Point | Details |

|---|---|

| Jerome Powell’s Commitment | Powell emphasizes the Federal Reserve’s commitment to controlling inflation. |

| Inflation Levels | Current inflation remains above the Fed’s 2% target, with predictions rising to 2.3% by May. |

| Impact of Tariffs | The effects of President Trump’s tariffs on inflation are still unclear. |

| Labor Market Status | The economy is strong and labor market close to full employment. |

| FOMC Policy Stance | FOMC remains cautious and sees no urgency to adjust policy until more data is available. |

| Rate Changes Outlook | FOMC members are divided on future rate cuts, with some favoring cuts depending on inflation data. |

| Market Reactions | Market futures indicate a low chance of rate cut in July, with a higher chance in September. |

Summary

Jerome Powell’s inflation remarks make it clear that the Federal Reserve is committed to managing inflation while navigating the uncertainties posed by tariffs. He highlighted the need to collect more data before making any policy changes, maintaining a strong focus on stabilizing the economy and labor market. Despite pressures, Powell’s careful approach aims to ensure the Fed’s actions are well-informed, balancing the dual goals of full employment and low inflation. As the economic landscape continues to evolve, the Fed will strategically respond to inflation trends and labor market conditions.