JPMorgan Chase Mobile App Advances with Bond Trading Tools

The JPMorgan Chase Mobile App is transforming the way investors engage with financial markets, particularly with the introduction of bond trading features. As the largest U.S. bank by assets, JPMorgan Chase aims to enhance investor engagement through innovative online investment tools, effectively integrating self-directed investing into their platform. Users can now research and purchase bonds and brokered CDs seamlessly, all while checking their account balances. This latest initiative not only showcases the bank’s commitment to financial technology but also positions it as a competitive force against traditional online brokers. With these enhancements, JPMorgan Chase is set to attract a broader audience of self-directed investors who seek convenience and efficiency in managing their finances.

The JPMorgan Chase Mobile Application is reshaping how individuals participate in financial markets, particularly by introducing features for bond trading. As a prominent leader in the financial sector, JPMorgan Chase is focused on improving investor interaction through advanced online tools geared towards self-directed participants. The app’s new capabilities allow users to explore and acquire bonds and CDs with ease while monitoring their financial data all in one place. This strategic move highlights the bank’s dedication to leveraging financial innovation to enhance client experience. By catering to a community of self-investors, JPMorgan Chase positions itself as a formidable player in the evolving landscape of wealth management.

The Rise of Bond Trading in Financial Technology

Bond trading has emerged as a pivotal component of financial technology services in recent years. With advancements in online investment tools, investors are now equipped with greater access and control over their fixed-income portfolios. As institutions like JPMorgan Chase enhance their mobile apps, they not only streamline the trading process but also empower self-directed investors to make informed decisions quickly. This growth in bond trading tools signifies a shift toward more investor engagement, allowing users to efficiently compare yields and understand market dynamics.

Furthermore, the integration of bond trading functionalities into banking platforms signifies a broader trend within the financial sector. Traditional banking institutions, like JPMorgan Chase, are recognizing the increasing demand for sophisticated online investment tools that cater to a generation of tech-savvy investors. This move not only positions these banks as competitive players within the investing landscape but also enhances their reputation among clients who are seeking comprehensive financial solutions.

JPMorgan Chase Mobile App: A Hub for Self-Directed Investing

The JPMorgan Chase mobile app is evolving into a comprehensive hub for self-directed investing, making it easier for users to manage various aspects of their financial lives. Designed with the modern investor in mind, the app now offers functionalities like bond trading and the purchasing of brokered CDs. This evolution represents JPMorgan’s commitment to adapting to technological advancements and responding to consumer demands for integrated financial technology solutions. By providing these tools within a single platform, JPMorgan enhances user experience, fostering greater investment smartness among its clientele.

Moreover, the app’s customization features allow investors to tailor their views, making it easier to track key performance metrics, compare bond options, and execute trades efficiently. This enhancement not only promotes investor engagement but also reduces barriers to entry for new investors looking to diversify their portfolios. As self-directed investing continues to gain traction, JPMorgan Chase’s commitment to enhancing their mobile app reflects a proactive approach to meet the needs of modern investors.

Challenges and Competition in Online Investment

Despite the advancements at JPMorgan Chase, the bank faces significant challenges in the online investment arena. As it works to attract more self-directed investors, it must contend with established competitors like Charles Schwab and Fidelity, which have built extensive, user-friendly platforms over decades. While JPMorgan’s recent innovations are promising, they still have a long way to go to capture a substantial share of the market. The competitive landscape requires not only innovation but also effective marketing strategies to communicate the unique value proposition of their online investment tools.

Additionally, with the saturation of the online brokerage market, distinguishing themselves with superior services and functionality will be crucial. As investors become increasingly discerning in their use of financial technology, JPMorgan’s ability to enhance user experience and address the distinct needs of both casual and active traders will determine its future success in this arena. Understanding customer preferences and enhancing features like after-hours trading could lead to higher engagement and retention rates.

Investing in the Future: JPMorgan’s Strategic Vision

JPMorgan Chase’s vision for the future includes expanding its self-directed investing services to resonate with a broader audience. Recognizing that a significant proportion of wealthy Americans engage both with financial advisors and independently, the bank aims to cater to diverse investing preferences. This dual approach allows JPMorgan to leverage its existing advisor relationships while appealing to tech-savvy clients who prefer online investment tools. As the bank aims towards reaching $1 trillion in assets, aligning its strategies to encompass both segments is essential.

The strategic enhancements to the JPMorgan Chase mobile app embody this vision, as they seek to integrate features that not only enable bond trading but also bolster overall investment experience. By encouraging users to consolidate their financial activities within the app, JPMorgan hopes to foster deeper connections with its clients. This integration and the ensuing ability to manage various assets seamlessly represent a significant leap toward their growth aspirations in the competitive online investment space.

Importance of Investor Engagement in Wealth Management

As financial institutions adapt to the changing landscape of wealth management, investor engagement has emerged as a critical focus area. Organizations like JPMorgan Chase recognize that active participation from clients is essential to drive business growth and loyalty. By enhancing their mobile app with features that facilitate easier bond trading and investment functionalities, they aim to create a more engaging experience for users. This focus on investor engagement is not merely about increasing transactions; it’s about cultivating an informed and active investment community.

Moreover, effective investor engagement can lead to improved client satisfaction and retention rates in an increasingly competitive market. For JPMorgan, the ability to provide user-friendly online investment tools aligns with the need to attract and retain self-directed investors. As these clients become more active in managing their portfolios, they will likely contribute to the broader objectives of wealth management firms, including increasing assets under management and overall customer loyalty.

Leveraging Technology for Enhanced Financial Solutions

The integration of advanced technology within banking services presents immense opportunities for both consumers and financial institutions. For JPMorgan Chase, leveraging technology to redesign its mobile app signifies a shift toward more user-centric solutions in wealth management. Allowing customers to research and purchase bonds directly through the app not only streamlines the investment process but also improves operational efficiency, minimizing the time spent on transactions and enhancing user satisfaction.

This focus on technology reflects a broader movement within the financial sector, where companies are increasingly relying on digital solutions to meet customer demands. Financial technology tools are rapidly transforming traditional banking practices, and institutions like JPMorgan are capitalizing on this trend to remain competitive. By continually enhancing their capabilities and expanding their service offerings, these banks can attract a new generation of investors who prioritize convenience and access.

The Role of Online Investment Tools in Modern Trading

Online investment tools play a crucial role in modern trading by providing investors with real-time data and analytical capabilities. JPMorgan Chase’s initiatives to enhance its mobile app reflect a growing trend that prioritizes accessibility and transparency in financial markets. With the ability to research and compare bond yields directly within the app, investors can make more informed decisions, making the trading experience less intimidating and more engaging.

Additionally, the evolution of online investment tools empowers individuals who may have previously felt marginalized in investing. By making these resources readily accessible, firms like JPMorgan are democratizing investment opportunities, allowing a wider audience to participate in bond trading and self-directed investing. This shift not only diversifies market participants but also strengthens the financial ecosystem by fostering greater investor confidence and engagement.

Adapting to Consumer Behavior in Investment Services

As consumer behavior evolves, financial institutions must adapt their services to better align with customer expectations. JPMorgan Chase is keenly aware that today’s investors seek not only traditional banking services but also innovative online investment tools that offer flexibility and control. By embracing this shift, they have developed a mobile app that integrates self-directed investing functionalities, allowing clients to take charge of their financial futures.

Furthermore, recognizing the shift in how consumers engage with financial products, JPMorgan’s strategy reflects a commitment to understanding and responding to client needs. This adaptability not only positions them to capture a growing client base but also enhances loyalty among existing customers. As investing habits continue to evolve, staying ahead of trends will be key for JPMorgan Chase to maintain its competitive edge in the rapidly changing financial landscape.

Navigating the Future of Self-Directed Investing

Navigating the complexities of self-directed investing requires robust tools and continuous educational resources. JPMorgan Chase is committed to enhancing its mobile app with features that empower investors to manage their portfolios effectively. As they push towards creating an environment conducive to informed decision-making, the bank’s focus on educating consumers about bond trading and other investment options is critical. This commitment builds investor confidence and encourages wider participation in the financial markets.

Moreover, as self-directed investing captures a larger segment of the retail investor market, institutions like JPMorgan must innovate continuously to meet evolving expectations. The bank’s willingness to invest in technology to improve the user interface and experience reflects a recognition of the competitive landscape in which they operate. By actively engaging clients and fostering an environment that promotes financial literacy, JPMorgan can successfully navigate the future of investing and achieve its strategic goals.

Frequently Asked Questions

What features does the JPMorgan Chase Mobile App offer for bond trading?

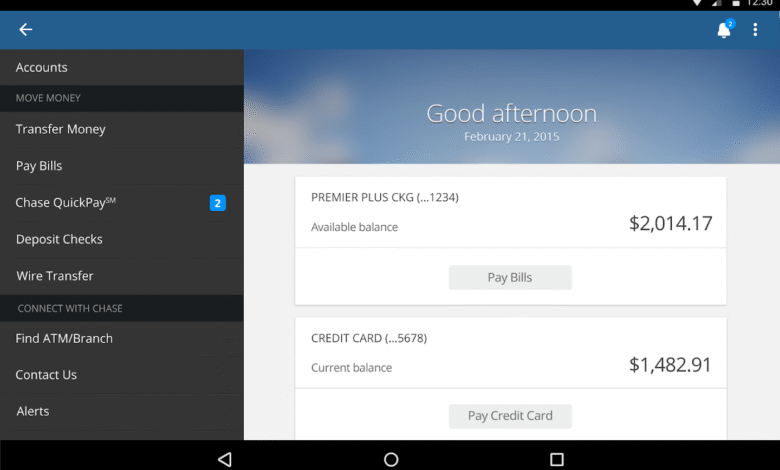

The JPMorgan Chase Mobile App enhances the bond trading experience by providing users with tools to research and purchase bonds and brokered CDs directly within the app. Users can customize their screens, compare bond yields, and seamlessly integrate these tasks with their regular banking activities like checking account balances.

How does the JPMorgan Chase Mobile App support self-directed investing?

The JPMorgan Chase Mobile App promotes self-directed investing by allowing users to manage and execute trades independently. With features designed for ease of use, customers can engage in online investment tools that facilitate buying and selling securities, including stocks and fixed-income assets.

Is the JPMorgan Chase Mobile App suitable for frequent investors?

Yes, the JPMorgan Chase Mobile App is tailored for frequent investors by offering a streamlined and intuitive platform where they can execute trades, research investment opportunities, and manage their accounts. This is part of JPMorgan Chase’s dedicated effort to improve investor engagement among users who trade multiple times a month.

What advancements have been made to the JPMorgan Chase Mobile App for financial technology integration?

Recent advancements in the JPMorgan Chase Mobile App include enhanced financial technology features that support bond trading and self-directed investment options. These updates aim to simplify the investment process, making it easier for users to manage their portfolios and conduct transactions within a single, comprehensive platform.

How does the JPMorgan Chase Mobile App enhance investor engagement?

The JPMorgan Chase Mobile App enhances investor engagement by providing tools that allow users to research, compare, and purchase bonds as well as manage their investment portfolios effectively. This comprehensive approach encourages users to interact with their investments more frequently and conveniently.

Can you trade stocks after hours using the JPMorgan Chase Mobile App?

The JPMorgan Chase Mobile App is expected to introduce features that allow users to execute after-hours stock trades, thereby offering greater flexibility and convenience for investors who want to capitalize on market movements outside of regular trading hours.

What strategies is JPMorgan Chase using to attract self-directed investors through its mobile app?

JPMorgan Chase employs strategies such as offering up to $700 for transferring funds to its self-directed investing platform and enhancing its mobile app with comprehensive online investment tools. These strategies aim to consolidate financial activities and draw more engaged investors to the bank’s services.

| Key Point | Details |

|---|---|

| Launch of New Tools | JPMorgan Chase is enabling bond trading and purchase of brokered CDs through its mobile app. |

| User Customization | Users can customize screens and compare bond yields within the same banking app. |

| Refocused Online Strategy | JPMorgan aims to enhance its reputation among active traders and investors. |

| Leadership | The firm is working to catch up with competitors in online investing. |

| Growth Ambition | Targeting $1 trillion in assets by attracting a more engaged investing clientele. |

| Competitive Environment | JPMorgan has a small share compared to other online brokers in asset management. |

| Strategic Changes | The bank revamped its investment strategy by hiring experienced professionals. |

| Outreach Efforts | Offering incentives up to $700 for transferring funds to its platform. |

Summary

The JPMorgan Chase Mobile App has significantly enhanced its features by integrating bond trading, allowing investors to purchase bonds and CDs seamlessly. This move represents JPMorgan Chase’s commitment to expanding its online investment services, aiming to capture a larger market share and reach $1 trillion in assets. Through user customization and additional financial tools, the app not only simplifies the investment process for clients but also strengthens JPMorgan’s competitive position in the online brokerage space.