July 4 Holiday Airfare: Trends and Investor Insights

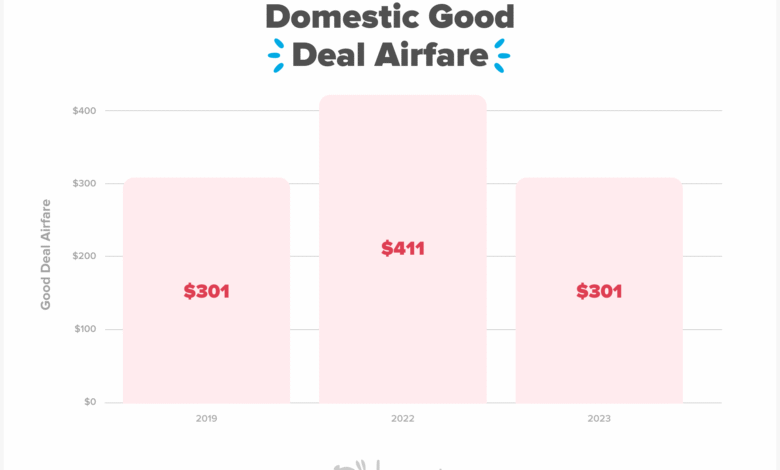

As the July 4 holiday approaches, travelers are keenly watching July 4 holiday airfare trends, which show a significant drop in ticket prices this summer. With millions set to take to the skies, the latest airline industry trends reveal that round-trip domestic fares average $265, marking a 3% decrease compared to last year. This decline is attributed to a combination of factors, including increased flight availability and a lackluster travel demand forecast amidst economic uncertainties. As potential travelers look to secure their plans, air travel spending continues to reflect wider economic impacts on airlines, especially given the erratic fluctuations in demand noted by analysts. The overall outlook may remain dismal; however, savvy flyers can benefit from these airfare drops as airlines recalibrate their service offerings.

As Independence Day nears, the spotlight shifts to holiday flight pricing, with many looking for deals amid dwindling airfare costs. This seasonal surge in travel is juxtaposed with a retreat in airline revenue, suggesting that while Americans are eager to celebrate, the dynamics of air transportation reflect a complex economic environment. The availability of budget-friendly ticket options indicates not only shifting consumer patterns but also highlights the broader implications of air travel on the industry. With the current forecasts painting a mixed picture for travel demand, savvy travelers may seize this opportunity to book their July 4 journeys for less, all while the airline sector navigates these challenges.

Understanding July 4 Holiday Airfare Trends

The July 4 holiday is one of the busiest times for air travel in the United States, with millions of travelers eager to hit their vacation destinations. As we look at the trends from this year, it’s apparent that airlines are offering competitive pricing to fill seats amid fluctuating economic conditions. This has resulted in lower airfare rates, with an average cost of $265 for round-trips during the holiday season—3% less than this time last year. Such fare drops indicate a significant shift in the airline industry’s pricing strategy, driven by an oversupply of flights and fluctuations in consumer demand.

The impact of these airfare trends extends beyond just consumer savings. As airlines prepare to report their quarterly earnings, the focus will be on how these lower fares are affecting overall revenue and profitability. The travel demand forecast for the remainder of 2025 remains uncertain, as many airlines, including Southwest and Delta, have withdrawn their predictions citing economic instability. Investors are keenly watching these developments to understand how the industry is adapting to reduced travel spending and whether effective strategies are in place to manage excess capacity.

Economic Impact on Airlines Amid Decreasing Travel Demand

As we navigate through the landscape of air travel in 2025, economic factors play a crucial role in shaping the airline industry’s forecast. Despite the positive news of increased hiring and consumers holding onto their travel plans, airline operators are contending with lukewarm travel demand. The recent data showing an 11.8% decrease in air travel spending in June compared to the previous year signals a shift in consumer behavior influenced by economic uncertainty. Airlines are forced to recalibrate their operations to ensure profitability in a climate fraught with challenges.

Airlines are responding to these economic headwinds by streamlining their flight schedules. Many have announced plans to cut unprofitable routes, especially during periods of lower demand following summer travel. This proactive measure aims to align capacity with consumer demand, while also allowing airlines to recover financially from the impacts of decreased fares. Investors will be closely monitoring the upcoming earnings reports, as these will provide insights into how airlines plan to navigate a potentially rocky second half of 2025.

Growth Opportunities in International Air Trips Post-Pandemic

Despite the challenges faced by domestic air travel, international trips continue to emerge as a lucrative segment for airlines. U.S. carriers like Delta, American, and United have reported strong performance in international markets, particularly to Europe and Asia. With average fares for international flights softening but still competitive, this segment provides airlines with opportunities for recovery and growth. The data indicates that such international trips have rebounded significantly, although prices are slightly lower compared to past years.

Interestingly, even with the lower average fares—$817 to Europe and $1,328 to Asia—airlines are witnessing a surge in bookings for these routes. This indicates that while domestic demand may be stalling, international travel remains a strong driver of revenue. As airlines adjust their strategies to capitalize on this segment, it becomes increasingly important for them to communicate these trends to investors during quarterly reports. Such insights can reassess the economic impact on overall travel spending and influence investor confidence in airline recovery efforts.

Investor Sentiments on Airline Financial Stability

In light of the ongoing fluctuations in the airline industry, investor sentiment has become a pivotal aspect of the market landscape. With airlines like Delta poised to report their earnings shortly, stakeholders are looking for signs of financial stability amidst lower fare trends and changing economic conditions. The anticipation surrounding these reports is heightened by the reality that many airlines have recently withdrawn their forecasts for 2025, leading to increased speculation among investors regarding future profitability.

Investors are particularly interested in how airlines are navigating capacity cuts, which could potentially reinvigorate financial performance by aligning supply with weakened demand. As competition intensifies and economic uncertainties persist, transparency in financial reports will be essential. Airlines need to articulate their strategies effectively, addressing proposed adjustments to routes and fare pricing while providing realistic insights into future demand forecasts to boost investor confidence.

The Future of the Airline Industry: Predictions and Insights

Looking ahead, the future of the airline industry will be shaped by a combination of consumer behavior, economic factors, and strategic adaptations from airlines. Predictions suggest that as international travel continues to recover, airlines may need to prioritize this segment for stability. Air travel spending considerations have led many to speculate that domestic travel may remain subdued, requiring airlines to lean heavily on long-haul routes to drive profitability.

Furthermore, economic indicators, such as job growth and consumer confidence, will play a crucial role in forming travel demand forecasts. Airlines keen on reestablishing profitability will need to stay agile, adapting their operations to quickly respond to market fluctuations. Collaboration with stakeholders will be key to navigate the evolving landscape of the airline industry as it confronts the dual challenges of lowered airfares and economic uncertainty.

Airline Industry Trends: A Comprehensive Overview

The airline industry is currently at a critical juncture, faced with unique challenges stemming from economic uncertainty and changing travel patterns. This necessitates a close examination of airline industry trends, particularly in how they respond to consumer preferences and pricing strategies. With many airlines grappling with declining air travel spending, there is a clear imperative for companies to innovate and enhance their offerings in order to attract and retain customers.

Key trends include the shift towards more customer-centric initiatives and sustainable practices within the airline industry. Innovations in technology and services that enhance passenger experience are set to redefine the competitive landscape. Moreover, companies must assess their pricing models continually, particularly in a low-fare environment like the one observed this summer. By aligning their operational strategies with industry trends and investing in customer satisfaction, airlines can improve their resilience and adapt to prevailing economic conditions.

Navigating Airfare Drops: Strategies for Airlines

In a climate characterized by airfare drops, airlines are compelled to adopt a multifaceted strategy to manage operations effectively. This includes evaluating the economic impact on their profit margins while ensuring they still attract travelers. Airlines have begun employing dynamic pricing models, enabling them to respond in real-time to customer demand and market conditions, thus maximizing revenue opportunities despite lower average fares.

Additionally, airlines are focusing on optimizing their route networks to improve operational efficiency. By carefully selecting and adjusting their flight paths based on demand forecasts, airlines can better align their offerings with traveler needs. This approach not only helps mitigate financial losses during periods of reduced demand but also positions airlines favorably for recovery as consumer confidence in air travel resurfaces.

Long-Term Implications of Air Travel Spending

The ongoing decline in air travel spending raises crucial questions about the long-term implications for the airline industry. Analysts warn that sustained reductions in spending could catalyze a broader restructuring within the industry, potentially leading to mergers or acquisitions as airlines seek to maintain market viability. As airlines continue grappling with the impacts of price competition, it’s vital to explore how decreasing consumer spending could influence their strategies moving forward.

Ultimately, how airlines manage their expenditures, invest in technology, and enhance the passenger experience will be essential to retaining market share. Forecasts suggest a return to pre-pandemic levels of travel spending is unlikely in the near term. Airlines must remain vigilant in monitoring economic trends while adapting their business models to foster resilience during these unpredictable times.

Consumer Behavior’s Role in the Travel Demand Forecast

Understanding consumer behavior is critical in shaping the travel demand forecast. The recent shifts in purchasing patterns due to economic uncertainty have led airlines to reconsider their marketing and pricing strategies. As travelers become more cost-conscious, the industry must adapt by offering compelling incentives, flexible booking options, and enhanced customer service to encourage bookings.

Furthermore, the demand forecast will heavily depend on how consumers balance their travel preferences with their financial situations. Airlines that can effectively gauge traveler sentiment and adapt accordingly may not only weather the current economic storm but potentially emerge stronger in the long run. Engaging with customers through loyalty programs and targeted promotions will be vital in influencing air travel trends as the industry seeks to maintain a competitive edge.

Frequently Asked Questions

What are the expected trends for airfare during the July 4 holiday?

The July 4 holiday is known for increased air travel, and this year, we’re seeing airfare drops. Average domestic round-trip fares are around $265, which is a 3% decrease compared to last year, indicating a trend of lower prices driven by high demand and oversupply of flights.

How has air travel spending changed leading up to the July 4 holiday?

In June, air travel spending experienced an 11.8% decline compared to the same period last year, reflecting a softer demand for July 4 holiday airfare. This aligns with broader concerns in the airline industry about economic uncertainty and its impact on travel demand.

What factors are influencing the airfare drops during the July 4 holiday period?

Airfare drops for the July 4 holiday are primarily influenced by an oversupply of flights coupled with insufficient demand. This year, airlines are offering lower fares to attract the record numbers of travelers taking to the skies despite economic challenges.

How does the economic impact on airlines affect July 4 holiday airfare?

The economic impact on airlines has resulted in a more competitive pricing environment for July 4 holiday airfare. With major carriers withdrawing their 2025 forecasts due to economic uncertainty, many airlines are cutting unprofitable flights and keeping fares lower to stimulate travel demand.

What does the travel demand forecast suggest for the July 4 holiday?

The travel demand forecast indicates that while many travelers are flying for the July 4 holiday, there is an overall lukewarm demand in the airline industry. This is resulting in lower airfares as airlines adjust capacity to align with consumer interest.

Will the airfare trends seen during the July 4 holiday continue through the summer?

Airfare trends suggest that the lower airfare seen during the July 4 holiday may continue through the summer. Airlines are likely to maintain competitive pricing and potentially cut unprofitable flights to adapt to changing consumer demand and economic conditions.

What are the implications of lower July 4 holiday airfare for travelers?

Lower July 4 holiday airfare is advantageous for travelers looking to save on air travel costs. However, it also reflects ongoing challenges within the airline industry, including the need for airlines to attract customers in a period of economic uncertainty.

How can I find the best July 4 holiday airfare deals?

To find the best July 4 holiday airfare deals, travelers should utilize fare trackers like Hopper, compare prices across multiple airlines, and be flexible with travel dates to capitalize on potential fare drops.

| Key Point | Details |

|---|---|

| Delta Air Lines Reporting | Delta Air Lines will begin the quarterly earnings reports for U.S. airlines on July 10. |

| Traveler Numbers | A record number of travelers are expected to fly for the July 4 holiday. |

| Fares Decline | Despite high travel numbers, fares have dropped to an average of $265 for round trips. |

| Economic Forecasts | U.S. airlines have withdrawn 2025 forecasts due to economic uncertainties. |

| Seasonal Trends | Major profits for airlines typically occur in the second and third quarters. |

| TSA Projections | The TSA expects over 18.5 million travelers during the holiday period. |

| International Travel | International trips remain strong, with fare declines noted from the previous year. |

Summary

July 4 holiday airfare has become a topic of major interest this year as airlines report record traveler numbers alongside significantly reduced fares. With an average domestic airfare of $265 for round-trip flights and a decline in international fares, the situation reflects a complex balance of high demand against economic uncertainties. As airlines prepare to report earnings, the industry is clearly navigating the challenges posed by fluctuating economic conditions, yet the continued interest in air travel remains an encouraging sign for the sector.