July Interest Rate Cut: Fed Governor Bowman’s Perspective

The anticipation surrounding the July interest rate cut is building, as Federal Reserve Governor Michelle Bowman has publicly expressed her support for lowering rates if inflation remains low. Her comments highlight a broader discussion among Fed officials regarding interest rate policy amid the evolving economic conditions. With inflation concerns easing, there is growing speculation that the Federal Reserve may make significant adjustments to its monetary strategy in the upcoming meeting. As economists and market analysts closely monitor these developments, the potential impact on the economy and labor market remains a critical focus. All eyes will be on the Federal Reserve in July to see if they heed calls for a rate cut, particularly as they navigate this uncertain economic landscape.

As discussions heat up around the potential for a decrease in interest rates during July, various stakeholders are keenly observing the Federal Reserve’s next moves. Various indicators suggest a favorable environment for a shift in monetary policy, particularly if inflation rates continue to show stability. Recent statements from key figures, including Governor Michelle Bowman, propose a reduction in rates as a proactive measure to support the economy amidst shifting market conditions. This proposed adjustment has gained traction among Fed officials who are concerned about sustaining robust economic growth. With the July policy meeting approaching, speculation surrounding interest rate changes is intensifying, prompting analysts to consider the implications for both borrowing costs and broader financial market dynamics.

The Case for a July Interest Rate Cut

Federal Reserve Governor Michelle Bowman has voiced strong support for a potential interest rate cut during the upcoming July FOMC meeting, contingent upon the status of inflation levels. This perspective resonates with her fellow Federal Reserve Governor, Christopher Waller, who similarly hinted at the possibility of an interest rate cut if current economic conditions remain stable. Negotiating the delicate balance between encouraging growth and controlling inflation is becoming a pivotal theme in the Fed’s strategy, and both Bowman and Waller’s recommendations reflect a thoughtful approach to Federal Reserve interest rate policy.

Bowman’s advocacy for a July interest rate cut appears to be influenced by several economic factors, including a sustained low inflation environment and the necessity to stimulate a robust labor market. Alongside this, the Federal Reserve must also navigate external pressures, such as President Trump’s push for rate reductions to lessen the national debt burden. As she considers the implications of a rate cut, Bowman emphasizes the need for adaptive monetary policy that reflects prevailing economic conditions while also safeguarding against the inflationary risks that could arise from expanding fiscal policies.

Monitoring Economic Conditions Amidst Inflation Concerns

In her remarks, Michelle Bowman underscored the importance of closely monitoring current economic conditions as the country transitions through various fiscal and policy changes. With inflation concerns lingering in the economy, Bowman’s position advocates for cautious optimism, suggesting that if inflationary pressures stay contained, a reduction in the policy rate could be beneficial for supporting ongoing economic growth. This approach highlights the complex interplay between interest rate policy and the overarching health of the economy, which requires a nuanced understanding of market dynamics.

Bowman’s focus on economic conditions also extends to the labor market, where she has noted indications of potential weaknesses. As the Federal Reserve prepares for its next meeting, the evolving nature of the economy, influenced by both domestic policies and global considerations, must be evaluated. The current economic landscape reflects apprehension over inflationary trends, yet Bowman’s comments indicate a possibility that well-calibrated interest rate cuts could invigorate employment figures and foster sustainable economic expansion.

Implications of Federal Reserve Policies on Inflation

The Federal Reserve’s approach to interest rate policy is fundamentally linked to its role in managing inflation. Governor Michelle Bowman has pointed out the need to adjust policy rates in alignment with incoming economic data, especially as inflation concerns evolve. While some have feared that external factors, such as tariffs, could significantly disrupt the inflationary landscape, Bowman suggests that their impact may not be as pronounced or immediate as originally predicted. This insight indicates a potential reassessment of how external policies affect domestic inflation trends.

Moreover, the consideration of interest rate cuts is not merely a response to current inflation levels, but also a strategy aimed at preventive measures for future economic stability. By adjusting rates to a neutral level, Bowman’s outlook aims to ensure that the economy can withstand unforeseen challenges, thereby reinforcing consumer confidence and robust demand. In this regard, the Federal Reserve’s interest rate policy serves as both a reactive and proactive tool, capable of navigating complex economic challenges while remaining vigilant to the ever-present threat of inflation.

The Role of Financial Markets in Interest Rate Decisions

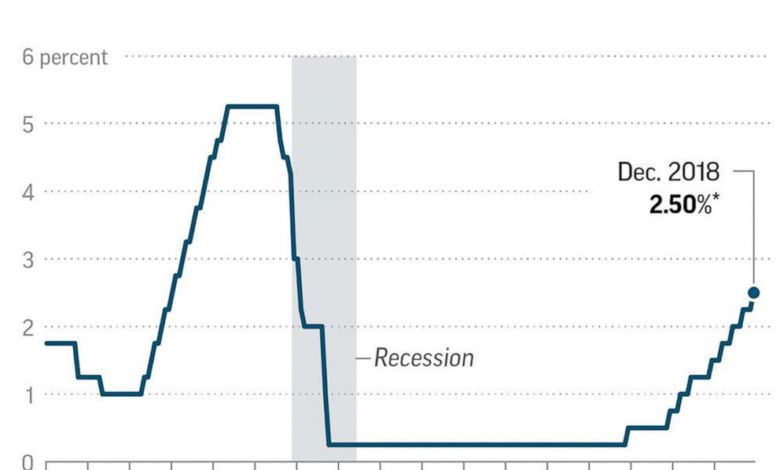

Financial markets play an integral role in shaping the Federal Reserve’s interest rate decisions, particularly as stakeholders weigh the probabilities of policy shifts. With current forecasts indicating a 23% chance of an interest rate cut during the July meeting and a 78% likelihood of a reduction by September, market expectations are poised to influence the decisions made by the FOMC. As Governor Michelle Bowman prepares for upcoming discussions, the insights from financial markets will provide crucial context for assessing the overall economic momentum.

In light of these market expectations, Bowman’s analysis of economic conditions will need to reconcile prevailing investor sentiment with the broader economic indicators. The delicate balance between market perceptions and economic realities often necessitates an adaptable approach. As financial markets respond to both domestic and international pressures, Bowman’s commitment to closely monitor evolving circumstances reflects a deliberate strategy to maintain monetary policy’s effectiveness amidst fluctuating market dynamics.

Balancing Economic Growth and Inflation Control

Balancing economic growth with inflation control is a central challenge for the Federal Reserve. Governor Michelle Bowman has emphasized the significance of maintaining a delicate equilibrium between stimulating the economy and ensuring that inflation does not rise to levels jeopardizing market stability. Her endorsement of a July interest rate cut, should inflation levels remain low, signifies a strategic decision aimed at fostering a healthy labor market while preventing excess inflationary pressures that could undermine economic progress.

Bowman’s views resonate within the broader context of Federal Reserve interest rate policy, where the objective is to adapt to changing economic conditions while mitigating potential risks. This delicate balancing act necessitates careful consideration of emerging data and potential economic indicators, underscoring the importance of vigilance in policy formulation. Ultimately, the Federal Reserve’s approach must reflect a commitment to nurturing economic growth while safeguarding stability against inflationary threats.

Expectations and Predictions for Federal Reserve Meetings

As the Federal Open Market Committee (FOMC) gears up for its next meeting on July 29-30, market watchers are closely monitoring the implications of Governor Michelle Bowman’s advocacy for a rate cut. The current perceptions surrounding the Fed’s interest rate stance will undoubtedly shape investor behavior and economic expectations in the lead-up to the meeting. Given the mix of economic indicators and surrounding geopolitical conditions, the Fed’s decisions in July could have lasting repercussions on market stability and overall economic sentiment.

Market analysts are anticipating that the forthcoming FOMC meeting will reflect the ongoing discussions regarding the economy and inflation concerns. With Federal Reserve policymakers, including Bowman, hinting at the potential for a rate cut if inflation remains contained, predictions are fueled by diverse economic indicators indicating a need for stimulating measures. As the financial environment shifts, prudent forecasting will prepare investors and analysts alike for varying outcomes from the decision-making processes at the Federal Reserve.

Impacts of Tariffs on Inflation Dynamics

In discussing inflation concerns, Governor Michelle Bowman addressed the complex effects of tariffs on consumer prices and economic stability. Although the initial worries suggested that President Trump’s tariffs could lead to significant inflationary pressures, Bowman’s analysis indicates that the actual impact may be less severe than anticipated. Her observations underscore the importance of considering delayed market responses and pre-stocked inventories in evaluating the overarching inflationary landscape.

Tariffs often introduce volatility into markets, spurring both supply chain readjustments and consumer price fluctuations. Bowman’s insights suggest that while the Fed remains cautious of these external impacts, recent economic resilience demonstrates a broader ability to navigate through such challenges without immediate inflation spikes. Understanding these dynamics enables a more informed perspective on how Federal Reserve interest rate policy can effectively mitigate risks associated with tariffs and broader trade issues while steering clear of unnecessary rate hikes.

The Influence of Government Policy on Federal Reserve Decisions

The intersection of government policy and monetary decision-making presents a critical backdrop for the Federal Reserve’s actions, particularly in the context of interest rate adjustments. Governor Michelle Bowman’s observations regarding the evolving economic landscape highlight a growing recognition of how fiscal measures can shape monetary policy decisions. As the Administration’s policies develop, the Federal Reserve must remain attuned to the broader implications of these changes on economic conditions and inflation rates.

Bowman’s commitment to monitoring economic indicators in light of government initiatives reflects a proactive stance that acknowledges the fluid nature of the economic environment. By understanding how domestic policy trends may influence market stability, the Federal Reserve can make more informed decisions on interest rate policy that align with both short-term necessities and long-term economic health. This interconnectedness ultimately reinforces the need for a dynamic approach to managing monetary policy amid changing governmental landscapes.

Navigating Uncertainty in the Economic Landscape

In an economic landscape marked by volatility and uncertainty, the Federal Reserve’s ability to navigate challenges is paramount. Governor Michelle Bowman’s remarks highlight the importance of adaptability in the face of evolving economic conditions. As she continues to assess labor market dynamics and inflation concerns, her focus underscores the necessity of a responsive policy framework designed to address potential pitfalls while concurrently promoting growth.

The current uncertainties surrounding the economy—exacerbated by domestic policies and international relations—underscore the importance of flexibility in the Federal Reserve’s interest rate strategy. Bowman’s commitment to closely monitoring not just inflation levels but the overarching economic climate reflects a holistic approach to ensuring that fiscal and monetary policies work in concert. In doing so, the Federal Reserve can better foster stability and resilience, regardless of the challenges at hand.

Frequently Asked Questions

What is the significance of the July interest rate cut according to Michelle Bowman?

Michelle Bowman, a Federal Reserve Governor, believes the July interest rate cut is significant for supporting a healthy labor market if inflation remains low. She stated that lowering the policy rate would help bring it closer to a neutral setting and foster economic stability.

How do inflation concerns impact the decision for a July interest rate cut?

Inflation concerns play a crucial role in the decision to implement a July interest rate cut. The Federal Reserve, particularly through voices like Michelle Bowman, indicates that a sustained low inflation environment is a key condition for considering a reduction in interest rates.

What are the current economic conditions that might affect the July interest rate cut?

Current economic conditions, including labor market health and inflation rates, heavily influence the potential for a July interest rate cut. Governor Bowman is closely monitoring these factors, as they are vital for determining whether the Fed should adjust its interest rate policy.

How does Michelle Bowman view the relationship between interest rate cuts and labor market health?

Michelle Bowman views interest rate cuts as a tool to maintain a healthy labor market. She supports the idea that lowering interest rates in July could help sustain employment levels and facilitate economic growth, contingent on stable inflation.

What other Federal Reserve members are supporting discussions about a July interest rate cut?

In addition to Michelle Bowman, Federal Reserve Governor Christopher Waller has expressed support for discussions regarding a July interest rate cut, suggesting that the Fed may be inclined to lower rates if economic conditions permit.

What are the expectations for the Fed’s decision on the July interest rate cut as of now?

As of now, traders predict only a 23% chance of the Fed implementing a July interest rate cut based on current economic conditions and inflation concerns. However, there is a stronger expectation of a potential cut in September, with a 78% likelihood noted.

How does President Trump’s position influence the discussion on the July interest rate cut?

President Trump advocates for a substantial interest rate cut to reduce financing costs related to national debt, which adds pressure on the Federal Reserve to consider a July interest rate cut. Despite this, Fed officials like Bowman are focusing on economic conditions rather than political pressure.

What are the potential outcomes of the July interest rate cut discussions?

The potential outcomes of the July interest rate cut discussions include stabilizing the labor market, adjusting monetary policy to align with neutral rates, or delaying any cuts until economic conditions, particularly inflation, warrant further deliberation.

| Key Point | Details |

|---|---|

| Fed Governor Support | Governor Michelle Bowman supports a July interest rate cut if inflation remains low. |

| Other Support | Governor Christopher Waller also supports the idea of a July cut. |

| Bowman’s Speech | Bowman spoke at an event at Georgetown University, emphasizing the need for monitoring economic conditions. |

| Interest Rate Target | The Fed maintained interest rate target between 4.25% and 4.5% during the recent meeting. |

| Tariff Impact | Bowman suggested tariffs may take longer to affect inflation than expected. |

| July FOMC Meeting | The Federal Open Market Committee is scheduled to meet again on July 29-30. |

| Market Predictions | Traders see a 23% chance of a rate cut in July and 78% in September. |

Summary

The July interest rate cut is on the horizon as Fed Governor Michelle Bowman emphasizes the necessity of a reduction if inflation remains low. With growing support for this measure from other Federal Reserve officials, and the market predicting possible cuts, the upcoming Federal Open Market Committee meeting will be critical in determining the future direction of interest rates. Economic conditions and evolving policies will continue to shape the Fed’s decisions.