Krispy Kreme Stock Decline: Concerns Over McDonald’s Partnership

Krispy Kreme stock decline has recently captured significant attention as shares plummeted 24% following the company’s announcement to reassess its partnership with McDonald’s. After withdrawing its full-year forecast, Krispy Kreme cautioned that economic “softness” is challenging its expansion efforts, halting the introduction of its beloved doughnuts in new McDonald’s locations for the second quarter. As it stands, only 2,400 out of nearly 13,500 domestic McDonald’s outlets currently offer Krispy Kreme products, a figure that reflects a stunted collaboration instead of exponential growth that had been anticipated. The company’s declining sales have contributed to a staggering market value drop below $600 million, raising concerns among investors about the future trajectory of its business. Additionally, Truist’s downgrade of Krispy Kreme from buy to hold has stirred further inquiries into management’s current strategies and overall execution amid these challenging times.

The recent downturn in Krispy Kreme’s stock reflects broader challenges faced by the iconic doughnut company, particularly as its alliance with McDonald’s encounters unexpected challenges. As Krispy Kreme grapples with diminishing sales figures, the uncertainty surrounding its future has led to considerations of restructuring its operational tactics. With this partnership under scrutiny, the doughnut maker is not only reassessing its growth outlook but is also contemplating critical decisions regarding potentially closing unprofitable outlets. The ongoing economic concerns have dampened dining-out enthusiasm, also impacting McDonald’s, which recently noted a decline in same-store sales. Stakeholders are now keenly observing how Krispy Kreme navigates these turbulent waters while striving to enhance consumer demand and profitability.

Impact of Krispy Kreme Stock Decline on Future Operations

Krispy Kreme’s stock tumble of 24% marks a significant setback for the popular doughnut chain, reflecting investors’ concerns about the company’s current operational strategies and its future trajectory. This decline comes on the heels of a critical reassessment of its partnership with McDonald’s, which was originally poised to enhance Krispy Kreme’s market presence. With the decision to halt the expansion of Krispy Kreme doughnuts into new McDonald’s locations for the second quarter, the company’s efforts to leverage its presence within McDonald’s approximately 13,500 outlets are now in jeopardy.

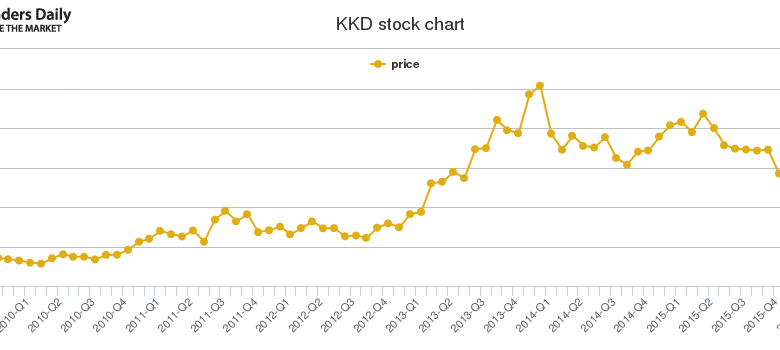

In light of this situation, Krispy Kreme is faced with a pressing need to rethink its strategies amid fluctuating market conditions. The decision to withdraw its full-year forecast underscores a worrying trend of sales decline and highlights a need for immediate action to shore up profitability. With shares plummeting over 70% in the past year, the company must find innovative solutions to regain investor trust while also maintaining customer engagement through its existing partnerships.

Reassessing the McDonald’s Partnership: Challenges Ahead

Krispy Kreme’s collaboration with McDonald’s was once seen as a lucrative avenue for revenue growth, promising to revolutionize the way consumers access the beloved doughnuts. However, recent developments have forced the company to reassess this partnership. The projected introduction of Krispy Kreme doughnuts into all U.S. McDonald’s locations by 2026 now appears compromised, as the company grapples with economic “softness” that has hindered the anticipated sales surge. This situation is exacerbated by McDonald’s own reported drop in domestic same-store sales by 3.6% in the first quarter, which leaves little room for optimism about boosting foot traffic for Krispy Kreme products.

Moreover, this reassessment reflects broader economic challenges that are affecting quick-service restaurants across the board. Consumer spending on dining out has dipped, prompting many establishments, including Krispy Kreme, to streamline operations and reduce costs. Maintaining a successful partnership with McDonald’s will require innovative marketing strategies and potentially rethinking the logistics of doughnut distribution to ensure product visibility and appeal in a competitive market.

Consequently, this reassessment of the partnership may signal a pivotal turning point for Krispy Kreme, necessitating bold leadership decisions to revitalize brand strategy while addressing immediate financial concerns.

Krispy Kreme’s Market Value and Investor Sentiment

The dramatic decline in Krispy Kreme’s stock has significantly impacted the company’s market value, which has now dropped below $600 million. This diminished valuation is concerning not just for investors but also for the company’s ability to attract future partnerships and negotiate better terms with existing ones. The recent downgrade by Truist from a buy to a hold rating highlights growing skepticism about Krispy Kreme’s management strategies and overall execution. Investors are now closely scrutinizing the leadership’s capacity to address profitability concerns while navigating a volatile economic landscape.

With such a large percentage of value lost in a relatively short timeframe, Krispy Kreme must strive to rebuild investor confidence. Initiatives to drive up sales, such as optimizing partnerships and diversifying product offerings, will be crucial in reversing this trend. Failing to address these financial challenges may lead to further declines in investor sentiment, potentially pushing the company into uncharted, precarious waters.

Addressing Krispy Kreme Sales Decline Through Strategic Changes

Krispy Kreme is currently confronting a stark reality characterized by a notable sales decline. The setbacks have prompted company leaders to implement strategic changes aimed at revitalizing the brand and stimulating demand. One of the company’s foremost strategies involves analyzing the performance of its locations, including the potential closure of less profitable shops. This approach not only focuses on cutting costs but also reallocates resources to strengthen efforts in high-performing stores to maximize profitability.

It is essential for Krispy Kreme to capitalize on its distinct brand identity while adapting to the changing market demands. Consumers are increasingly favoring unique experiences and high-quality products, so the doughnut chain could explore exciting flavor offerings or limited-time collaborations to appeal to its core demographic. By leveraging these strategies, Krispy Kreme hopes to reverse its sales decline and regain its standing in the market against increasing competition.

Financial Strategies for Krispy Kreme Amid Economic Softness

As Krispy Kreme navigates through economic challenges described as “macroeconomic softness,” its financial strategies must evolve to meet shifting consumer behaviors and spending patterns. With a reported net loss of $33 million for the quarter ending March 30, the urgency to reassess these strategies has never been higher. The company’s leadership is actively seeking to streamline operations and implement cost-cutting measures to stabilize finances while also focusing on marketing initiatives that engage loyal customers.

Innovative approaches such as promoting seasonal specials or enhancing delivery services can create new revenue streams, ensuring that Krispy Kreme remains top of mind for customers. Balancing cost management with effective marketing could help stem the bleeding caused by recent downturns, ultimately leading to a more robust business model that withstands economic fluctuations.

The Role of Leadership in Krispy Kreme’s Recovery Plan

Leadership plays a pivotal role in steering Krispy Kreme through these turbulent times. CEO Josh Charlesworth’s acknowledgment of the need to collaborate effectively with McDonald’s is indicative of a broader strategy aimed at revitalizing the brand’s growth and addressing investor concerns. Optimal leadership would involve transparent communication regarding operational challenges while also outlining a clear vision for recovery that entails both short-term fixes and long-term objectives.

Furthermore, the management must foster a culture of innovation within the workforce to encourage out-of-the-box thinking that caters to evolving consumer tastes. By creating an environment where employees feel empowered to contribute ideas, Krispy Kreme can cultivate new loyalty programs, create buzzworthy products, and ultimately invigorate brand engagement with fans and new customers alike.

Economic Factors Influencing Krispy Kreme’s Performance

The interplay of economic factors profoundly influences Krispy Kreme’s market performance, shaping consumer behavior and spending. Decreasing discretionary income and rising inflation can cause diners to make more conservative eating choices, directly impacting the sales of indulgent items like doughnuts. Krispy Kreme’s management must contend with these economic realities while strategizing to pull the brand out of its current sales slump.

Analysts and industry experts are keenly observing how the chain adapts to these economic pressures, focusing on its response to macroeconomic trends. Positioning itself as a value-driven option while still delivering quality is crucial in winning back customers. By leveraging insights into consumer trends and adjusting accordingly, Krispy Kreme can work towards bolstering its overall performance amidst external economic challenges.

Krispy Kreme’s Future Outlook: Navigating Uncertainty

As Krispy Kreme faces ongoing uncertainty, its outlook hinges on navigating through a landscape marked by both challenges and opportunities. The company’s recent move to retract its 2025 outlook highlights the caution warranted in uncertain times. However, with significant brand equity and a loyal customer base, there remains potential for revitalization.

Fostering strong relationships with key partners, notably McDonald’s, while seeking alternative channels for growth are crucial steps forward. Embracing a multi-faceted approach that includes digital marketing, promotions, and community-focused initiatives can effectively address the current market conditions, paving the way for Krispy Kreme’s resurgence in the years to come.

Frequently Asked Questions

What caused the Krispy Kreme stock decline following the McDonald’s partnership announcement?

The Krispy Kreme stock declined 24% after the company announced it would reassess its partnership with McDonald’s, halting the rollout of its doughnuts to new locations. This decision was influenced by economic softness and a retraction of the full-year financial forecast.

How has Krispy Kreme’s sales decline affected its market value?

Krispy Kreme’s sales decline has significantly impacted its market value, which has dropped to below $600 million. The company’s stock has plummeted over 70% in the past year, largely due to disappointing sales and the company’s downgraded outlook following its partnership with McDonald’s.

What did Truist say about Krispy Kreme’s stock following its downgrade?

Truist downgraded Krispy Kreme’s stock from buy to hold due to concerns regarding management’s strategy and execution. This downgrade contributed to the stock’s decline amidst reports of declining sales and the company’s reassessment of its partnership with McDonald’s.

What are the implications of Krispy Kreme’s withdrawal of its full-year forecast?

Krispy Kreme’s withdrawal of its full-year forecast signals potential ongoing challenges in sales and profitability. The company attributed this decision to macroeconomic softness, which has directly impacted the partnership expansion with McDonald’s and overall consumer spending.

How many McDonald’s locations currently offer Krispy Kreme doughnuts?

As of March 30, over 2,400 out of McDonald’s approximately 13,500 domestic locations offer Krispy Kreme doughnuts. However, the planned expansion into additional locations has been halted due to the recent reassessment of the partnership.

What financial challenges is Krispy Kreme currently facing?

Krispy Kreme is facing significant financial challenges, including a reported net loss of $33 million in the quarter ending March 30. The decline in sales has prompted the company to explore cost-cutting measures and streamlining operations, further pressuring its partnership with McDonald’s.

What was the impact of economic conditions on Krispy Kreme’s partnership with McDonald’s?

Economic conditions have negatively impacted Krispy Kreme’s partnership with McDonald’s by reducing consumer spending on dining out, which has resulted in below-expectation sales. These conditions have forced the company to halt its planned expansion and reassess its operational strategy.

How did Krispy Kreme’s stock perform over the past year and what factors contributed to this trend?

Krispy Kreme’s stock has dropped over 70% over the past year, due to underwhelming sales, a weak economic environment, and a downgrade from Truist which raised concerns about the company’s management strategy following the partnership with McDonald’s.

What potential steps is Krispy Kreme considering to improve its business situation?

To improve its business situation, Krispy Kreme is considering measures such as cutting costs through more streamlined operations, reassessing unprofitable locations, and implementing strategies to drive higher demand amid concerns about the economic outlook.

| Key Points |

|---|

| Krispy Kreme stock declined by 24% after announcing a reassessment of its partnership with McDonald’s and withdrawal of its full-year forecast due to economic softness. |

| The expansion of introducing Krispy Kreme doughnuts in McDonald’s U.S. locations has been halted for the second quarter. |

| As of late March, over 2,400 McDonald’s locations offered Krispy Kreme doughnuts, but the rollout has faced delays. |

| CEO Josh Charlesworth remains optimistic about the long-term potential, but acknowledges the need for a strong collaboration with McDonald’s to drive sales. |

| Krispy Kreme shares have dropped over 70% in the past year, reducing market value below $600 million. |

| Truist downgraded Krispy Kreme stock from buy to hold due to concerns about management’s execution and strategy. |

| The Q1 results reported a 3.6% decline in same-store sales for McDonald’s, affecting Krispy Kreme’s sales expectations. |

| Krispy Kreme reported a net loss of $33 million for the quarter, leading to a reevaluation of operational strategies, including potential store closures. |

| The company has withdrawn its 2025 outlook amid ongoing economic concerns and uncertainty in the partnership with McDonald’s. |

Summary

The recent Krispy Kreme stock decline has raised significant concerns among investors, as the company withdraws its full-year forecast and reassesses its partnership with McDonald’s in light of economic softness. The stock’s staggering drop of 24% reflects not just immediate worries, but also highlights broader issues in consumer spending and operational strategy, raising questions about the future of both the Krispy Kreme brand and its ambitious goals for expansion within McDonald’s.