Liquid Millionaires in the U.S.: A Growing Affluent Class

Liquid millionaires in the U.S. are becoming an increasingly prominent segment of the nation’s wealth landscape. Currently, there are over 6 million affluent individuals in America defined as holding investable assets surpassing the $1 million mark. This statistic not only highlights the significant concentration of wealth in the U.S. but also indicates a remarkable 78% growth in liquid millionaires over the last decade. As millionaires statistics show, the evolving financial climate has enabled many to amass considerable wealth, further emphasizing the growth of wealth in the U.S. In this context, it’s essential to explore the behaviors, trends, and future prospects of these wealthy individuals, as they play a crucial role in shaping the economic landscape.

The financial elite in America, often referred to as liquid millionaires, embody a demographic that commands significant influence over the market. This group, characterized by possessing substantial investable assets, has surged in numbers, reflecting broader trends in U.S. millionaire growth. The increasing prevalence of these affluent individuals not only shifts economic dynamics but also offers insights into spending and investment behaviors that drive the economy. Understanding this wealthy cohort provides a deeper perspective on the affluent lifestyle and their impact on various sectors. As they continue to flourish, their role in the economic narrative becomes ever more pivotal.

Understanding Liquid Millionaires in the U.S.

In the United States, the definition of liquid millionaires refers to individuals possessing investable assets that surpass the $1 million mark. This distinct group not only reflects a significant portion of the American population, but also represents a growing trend in wealth accumulation. With the current estimate exceeding 6 million, it is evident that the landscape of wealth in the U.S. is evolving, drawing more affluent individuals from diverse backgrounds into the realm of significant financial resources.

The increase in liquid millionaires in America is indicative of broader economic shifts that favor asset accumulation. Over the last decade, there has been a staggering growth of 78% in this demographic, highlighting how changes in the market, investment opportunities, and economic policies have positively impacted wealth generation. This growth demonstrates the potential for upward mobility and financial success that exists for many individuals in today’s economic climate.

Wealth Trends Among Affluent Individuals in America

Affluent individuals in America are thriving in an environment that encourages investment and wealth accumulation. Their access to various financial instruments, real estate options, and innovative investment vehicles has set the stage for a considerable increase in overall wealth. The rise of technology and financial literacy has also played a crucial role, allowing these individuals to manage and grow their assets effectively.

Additionally, with the diversity of investment opportunities available, affluent Americans are increasingly leveraging their wealth to create additional revenue streams. This trend not only benefits themselves but also contributes positively to the economy, showcasing the critical role that millionaires play in the prosperity of the U.S. As they invest in businesses, support philanthropic endeavors, and stimulate job creation, they underline the significant impact of wealth in shaping the nation’s economic future.

The Evolution of Millionaires Statistics in the U.S.

The statistics surrounding millionaires in the U.S. reveal a fascinating narrative of evolution and resilience. Tracking the growth of this demographic over time provides key insights into the factors contributing to their success. Recent reports show an unprecedented increase in the numbers, corroborating a positive trend attributed to the expanding economy, technological advancements, and financial acumen among younger generations.

Moreover, the data indicates that the distribution of millionaires is not uniform; certain regions enjoy a higher concentration due to local economic conditions and industries. The analysis of these millionaire statistics can offer businesses and investors valuable information on market trends and consumer behavior, making it a pertinent area of study for anyone interested in wealth dynamics in the U.S.

U.S. Millionaire Growth and Its Implications

The growth of millionaires in the U.S. has significant implications for the country’s overall economic landscape. With more individuals crossing the threshold into millionaire status, there is a direct correlation to increased consumption, investment, and philanthropy. This phenomena effectively turns liquid assets into economic catalysts, driving innovation and supporting local businesses and communities alike.

Furthermore, as the number of millionaires continues to rise, it affects policy considerations in terms of taxation and investment regulations. Lawmakers and economic strategists must evaluate the impacts of this growing wealthy class on public services and infrastructure, ensuring that as wealth accumulates, it benefits society as a whole. The dynamic nature of U.S. millionaire growth thus necessitates ongoing analysis and adaptive policy measures.

Investable Assets: A Look into Affluent Americans

Investable assets in the U.S. paint a comprehensive picture of the financial capabilities of affluent Americans. These assets, which include stocks, bonds, and real estate, are integral to the definition of wealth and indicate the level of financial security individuals possess. Understanding the types of investable assets that contribute to millionaire status can inform both personal finance strategies and broader economic policies.

Furthermore, the allocation of these investable assets plays a crucial role in driving economic growth. As affluent individuals invest in various sectors, they help stimulate job creation, encourage innovation, and support entrepreneurial ventures. By examining the distribution and trends within investable assets, stakeholders can better predict market movements and align their strategies with the interests of this wealthy demographic.

The Impact of Liquid Millionaires on the Economy

Liquid millionaires in the U.S. have a profound impact on both local and national economies. Their financial decisions influence market trends, as they are often the early adopters of new investment opportunities and technologies. This group’s wealth allows them to take risks that can lead to breakthroughs in various industries, thus further fueling economic growth and stability.

Moreover, liquid millionaires often engage in philanthropic activities, supporting charitable organizations and initiatives that benefit society. Their contributions help address social issues, fund education programs, and combat poverty, highlighting the dual role they play as both economic drivers and community supporters. Understanding the influence of this affluent demographic helps paint a fuller picture of the U.S. economic landscape.

Luxury Consumption Trends Among Wealthy Americans

Luxury consumption is a defining characteristic of affluent individuals in America, with liquid millionaires significantly shaping this market. As this demographic grows, so does the demand for high-end products and services, from luxury cars to exclusive experiences. Brands and businesses catering to these needs must adapt their strategies to entice this influential group effectively.

Additionally, understanding luxury consumption trends among wealthy Americans can unveil deeper insights into their purchasing behavior. Factors such as personalization, brand story, and sustainability emerge as critical components in their buying decisions. Therefore, companies seeking to engage with affluent customers must consider these elements to create a lasting connection and loyalty within this lucrative market.

Financial Strategies for Achieving Millionaire Status

Achieving millionaire status in the U.S. often entails a blend of sound financial strategies and disciplined investment habits. Aspiring millionaires should focus on building a robust portfolio by diversifying their assets, understanding market trends, and leveraging financial advisors as needed. Education on financial management is crucial for making informed decisions that can lead to wealth accumulation over time.

Moreover, setting clear financial goals and adhering to them is imperative in the journey toward becoming a liquid millionaire. Whether it’s saving for retirement, investing in real estate, or pursuing entrepreneurial ventures, a structured financial plan ensures individuals remain on track. Persistence and adaptability in the face of economic changes can pave the way for successful wealth accumulation and ensure long-term financial security.

The Role of Technology in Wealth Generation

In today’s digital age, technology plays an essential role in wealth generation for affluent individuals in the U.S. The accessibility of online trading platforms, investment apps, and personal finance tools has democratized investment opportunities, enabling a broader audience to participate in wealth-building activities. For liquid millionaires, leveraging technology can streamline asset management and open doors to unique investment strategies.

Furthermore, fintech innovations continue to reshape traditional financial services, providing wealthy individuals with sophisticated tools for maximizing their portfolios. From automated investment algorithms to advanced analytics, technology enhances decision-making processes and enables better risk management. Ultimately, embracing technological advancements is crucial for maintaining a competitive edge in wealth generation.

Frequently Asked Questions

What defines liquid millionaires in the U.S.?

Liquid millionaires in the U.S. are individuals who possess investable assets exceeding $1 million. This definition focuses on financial liquidity, allowing for easier investments and wealth management.

How many liquid millionaires currently exist in the U.S.?

There are over 6 million liquid millionaires in the U.S., reflecting a significant demographic of affluent individuals in America who have achieved substantial wealth.

What factors contribute to the growth of liquid millionaires in the U.S.?

The growth of liquid millionaires in the U.S. can be attributed to rising stock market values, real estate investments, and overall economic expansion, resulting in a 78% increase in this category over the last decade.

What statistics exist about millionaires in the U.S.?

Recent statistics show that the U.S. has seen a thriving millionaire population, with over 6 million liquid millionaires, making it a key player in global wealth distribution.

How do investable assets in the U.S. compare to other countries?

Investable assets in the U.S. are significantly high compared to other countries, contributing to the nation’s status as a hub for liquid millionaires and wealthy individuals.

What trends are impacting U.S. millionaire growth?

U.S. millionaire growth is influenced by factors such as technological advancements, real estate market booms, and increased access to investment opportunities, leading to more affluent individuals in America.

Where can I find more information about liquid millionaires in the U.S.?

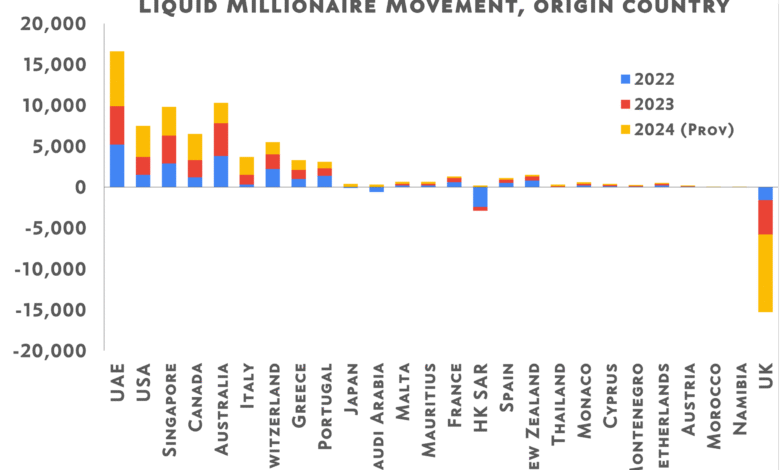

For comprehensive information on liquid millionaires in the U.S., resources such as reports from Henley & Partners and New World Wealth provide detailed insights into millionaire statistics and trends.

What is the outlook for millionaires statistics in the U.S. over the next decade?

The outlook for millionaires statistics in the U.S. remains positive, with expectations of continued wealth growth among affluent individuals as economic conditions and investment opportunities evolve.

How does the wealth of liquid millionaires in the U.S. influence the economy?

The wealth held by liquid millionaires in the U.S. plays a significant role in the economy through increased consumer spending, investment in businesses, and contributions to philanthropic efforts.

What percentage of the U.S. population are liquid millionaires?

Liquid millionaires constitute a relatively small percentage of the U.S. population, with over 6 million individuals representing a significant yet elite group among the affluent individuals in America.

| Key Points |

|---|

| The U.S. is a prime destination for affluent individuals. |

| Over 6 million liquid millionaires reside in the U.S. |

| Liquid millionaires are individuals with investable assets exceeding $1 million. |

| The number of liquid millionaires has increased by 78% over the last decade. |

| Data sourced from Henley & Partners and New World Wealth. |

Summary

Liquid millionaires in the U.S. represent a significant and growing segment of the wealthy population. As the number of individuals with over $1 million in investable assets surges, the United States cements its status as a haven for affluence. This trend underscores the attractive economic environment and investment opportunities present in the U.S., continuing to draw wealthy individuals from around the world.