Liquid Staking Protocols: Growth and Market Dynamics

Liquid staking protocols have emerged as a transformative force in the Ethereum ecosystem, providing a unique way for users to stake their assets while maintaining liquidity. Recent data shows that these innovative systems have witnessed a steady increase in participation, with total staked ETH rising significantly over the past 14 weeks. Dominating this space, Lido maintains a staggering 61.22% market share, firmly securing 8.76 million staked ether valued at $41.59 billion. However, competitors such as Binance Staked ETH and Rocket Pool are also making their mark, contributing to a diverse range of offerings in the Ethereum staking landscape. With the total value of liquid staking now reaching $67.948 billion, understanding the dynamics of these protocols is essential for maximizing returns on staked assets.

In the realm of Ethereum’s staking advancements, the introduction of liquid staking solutions represents a critical evolution in the management of digital assets. These enables users to earn rewards on their staked altcoins while simultaneously retaining the flexibility to trade or utilize them within decentralized finance (DeFi) ecosystems. Among leading platforms, Lido stands out not only for its extensive market share but also for the immense volume of assets it manages. Alongside it, Binance’s staking service and Rocket Pool continue to carve out niches that cater to varying investor preferences. This robust network of liquid staking options not only fuels the Ethereum ecosystem but also empowers participants to optimize their investment strategies.

The Rise of Liquid Staking Protocols

Liquid staking protocols are revolutionizing the way users manage their Ethereum investments. Over the last 14 weeks, we have observed a significant increase in the amount of ether flowing into these platforms, surging from 13.62 million ETH to an impressive 14.31 million. This growth not only highlights the attractiveness of liquid staking but also emphasizes the strategic advantage it offers to stakers, allowing them to retain liquidity while earning staking rewards. With approximately 0.57% of circulating ETH entering these protocols since mid-May, it’s clear that investors are increasingly recognizing the benefits of this innovative staking model.

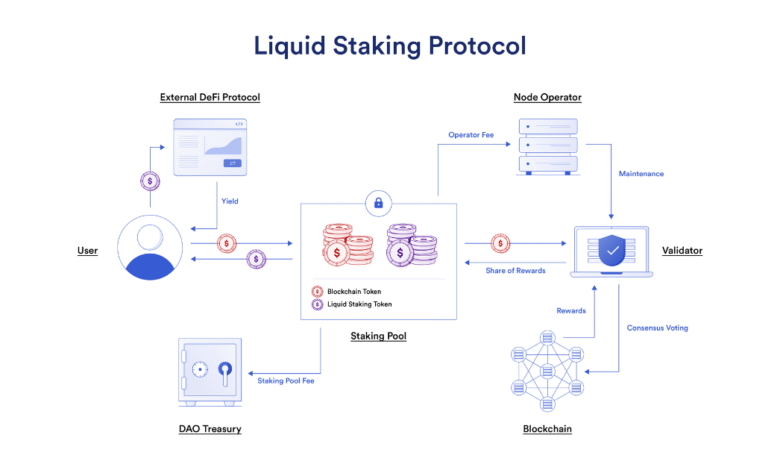

The process of liquid staking allows users to stake their ETH while simultaneously utilizing the staked assets for other investments. This dual approach is particularly appealing in the decentralized finance (DeFi) landscape, where liquidity is crucial for maximizing returns. The continued inflows into liquid staking protocols reflect a broader trend of diversification within the Ethereum ecosystem, as investors seek to capitalize on the opportunities presented by decentralized applications while maintaining exposure to staked ETH.

Lido’s Dominance in Ethereum Staking

Lido Finance stands out as a clear leader in the liquid staking space, securing a remarkable 8.76 million staked ether, valued at approximately $41.59 billion. This translates to a substantial market share of 61.22%, underscoring Lido’s position as the go-to platform for Ethereum stakers. Even though there has been a slight dip of 0.87% in recent weeks, Lido’s market dominance remains untouched, showcasing the trust and credibility it has built within the Ethereum community. As investors continue to look for reliable staking options, Lido consistently attracts substantial investments, solidifying its status.

The success of Lido is also a catalyst for attracting new entrants to the liquid staking market. Other protocols, such as Binance Staked ETH and Rocket Pool, are keen to capture some of the momentum that Lido has established. Binance Staked ETH, for instance, has staked 3.3 million ETH recently, indicating growing competition. However, Lido’s established user base and the trust associated with its platform make it formidable, as it continues to lead in both market share and staked value.

Understanding Staked ETH and Its Implications

Staked ETH represents the capital locked in Ethereum 2.0’s proof-of-stake network, where users earn rewards by validating transactions. The total amount of staked ETH has significant implications on the market dynamics, influencing everything from transaction fees to the overall health of the Ethereum ecosystem. With the recent figures showing that over 14.31 million ETH is now staked across various protocols, we can see that the future of Ethereum is beginning to lean towards a more decentralized model, supported by liquid staking innovations.

With a total value of approximately $67.948 billion, the assets in liquid staking denote a major shift in how users perceive staking and its potential returns. The diversification of protocols, including Binance and Rocket Pool, indicates a growing confidence among investors. The emergence of these platforms not only democratizes access to staking rewards but also encourages healthy competition that may lead to better services and lower fees for users in the long term.

Emerging Competitors: Binance and Rocket Pool

While Lido dominates the liquid staking market, it is crucial to acknowledge the rising competitors like Binance Staked ETH and Rocket Pool. Binance, with 3.3 million ETH staked, has demonstrated consistent growth in its staked assets, gaining an impressive 11.37% in just 30 days. The centralized nature of Binance offers a straightforward option for users entering the staking space, combining liquidity with the security and reliability of a well-known exchange.

Rocket Pool, although smaller with approximately 652,585 ETH, shows the strength of decentralized alternatives. Despite a minor decline of 0.48%, Rocket Pool retains its community-driven focus, which caters to users looking for more decentralized staking options. As competition heats up, both Binance and Rocket Pool will need to continuously innovate and provide unique features that attract and retain users in an increasingly crowded market.

The Impact of Market Capitalization on Staking Rewards

The market capitalization of liquid staked assets plays a pivotal role in determining staking rewards and overall liquidity across Ethereum staking protocols. As the total value of staked ETH continues to rise, protocols like Lido, Binance, and Rocket Pool are likely to adjust their rewards structures to remain competitive and attract more stakers. Currently, with staked assets exceeding $67 billion, the potential for higher staking yield harmonizes with the increased demand from users looking to generate passive income.

Moreover, as more ETH gets staked, the diminishing supply can lead to upward pressure on Ethereum’s price, boosting the appeal of staking for investors seeking capital appreciation. This creates a feedback loop wherein higher market capitalization encourages users to stake more ETH, which, in turn, enhances the potential returns for future investors. Understanding these dynamics is essential for stakers aiming to optimize their involvement in the Ethereum ecosystem.

Key Metrics from Liquid Staking Protocols

Understanding the key metrics from liquid staking protocols provides valuable insights into the performance and user engagement across different platforms. For example, metrics from sources like DeFiLlama reveal that approximately 690,000 ETH has flowed into over 33 different liquid staking protocols, showcasing a diverse range of options for stakers. This influx indicates a growing acceptance of liquid staking as users seek the flexibility it offers compared to traditional staking models.

Among the various protocols, metrics highlight Lido’s continuing dominance, while others like Liquid Collective and Stakewise V2 offer users alternatives that cater to different needs and preferences. By monitoring these metrics, investors can make informed decisions about where to allocate their funds, taking into account market trends and potential rewards associated with their chosen staking protocol.

Understanding the Liquid Collective and Stakewise V2

Liquid Collective and Stakewise V2 are significant players in the liquid staking landscape, catering to different segments of users seeking to stake their ETH. Liquid Collective, with 365,918 ETH committed, reflects a strategy focused on building a community around staking that emphasizes collaborative growth and support. This unique approach to liquid staking not only promotes user engagement but also aims to differentiate the protocol in an increasingly competitive environment.

Conversely, Stakewise V2, with 321,413 ETH staked, has faced challenges recently with a 16% decline over the past month, showing that not every protocol has maintained steady growth. Nonetheless, it offers unique features such as flexible staking rewards and scalability options that may appeal to specific user demographics. As these protocols adjust to market conditions, their ability to attract user investments will depend on responsiveness to feedback and the value they provide to stakers.

The Role of Decentralized Finance (DeFi) in Staking

Decentralized Finance (DeFi) plays an integral role in promoting liquid staking protocols, as it fundamentally reshapes how users interact with their assets. As stakers choose to engage with these protocols, they not only benefit from earning staking rewards but can also utilize their staked ETH as collateral for lending, trading, or yield farming within the DeFi ecosystem. This multifaceted use of assets enhances liquidity in the market, making staking increasingly attractive to a broad range of investors.

Furthermore, as DeFi continues to evolve, the integration of liquid staking protocols with other decentralized applications opens up new avenues for users to maximize their earnings. By maintaining liquidity while earning rewards, users can effectively optimize their financial strategies within the Ethereum ecosystem. The symbiotic relationship between DeFi and liquid staking not only benefits individual stakers but helps promote broader adoption of Ethereum-based applications.

Future Trends in Ethereum Liquid Staking

As the Ethereum ecosystem continues to develop, several trends in liquid staking are shaping the future landscape. The increasing adoption of protocols like Lido, Binance, and Rocket Pool is likely to influence the evolution of staking rewards and service offerings. Additionally, we may see a trend towards more user-friendly interfaces and tools that simplify the staking process, attracting those who may not yet be familiar with DeFi or liquid staking.

Moreover, regulatory developments and the ongoing transition to Ethereum 2.0 will likely impact how liquid staking operates. As the environment becomes clearer for stakeholders, we might observe a surge in new protocols emerging to capture market share or innovate on existing models. Keeping an eye on these developments will be crucial for investors looking to leverage staking as part of their broader investment strategy in the Ethereum ecosystem.

Frequently Asked Questions

What are liquidity staking protocols and how do they work?

Liquid staking protocols allow users to stake their Ethereum (ETH) while maintaining liquidity by issuing staked tokens. These tokens represent the staked ETH, enabling users to participate in decentralized finance (DeFi) activities without losing their staking position. Popular platforms include Lido, which dominates the market with a 61.22% share.

How has the Lido market share in Ethereum staking changed recently?

Lido continues to dominate the liquid staking market with 8.76 million staked ETH, valued at $41.59 billion. Although it experienced a minor dip of 0.87% last week, it holds a substantial market share compared to competitors like Binance, which has 3.3 million staked ETH.

What percentage of circulating ETH is currently within liquid staking protocols?

As of now, approximately 11.86% of the 120,707,167 circulating ETH has been staked via liquid staking protocols, totaling around 14.31 million ETH.

How does Binance’s staked ETH compare to other liquid staking protocols?

Binance’s liquid staking protocol holds 3.3 million staked ETH, worth $15.67 billion. It has shown impressive growth with a 3.42% increase over the past week and an overall 11.37% rise in the last 30 days, positioning it as the second-largest liquid staking provider after Lido.

What is Rocket Pool staking and how much ETH does it manage?

Rocket Pool staking ranks third among liquid staking protocols, managing 652,585 ETH valued at approximately $3.09 billion. Despite a slight decrease of 0.48% over the past week, it remains a significant player in the Ethereum staking landscape.

Which liquid staking protocols are currently experiencing growth?

Among liquid staking protocols, Binance staked ETH and Coinbase Wrapped Staked ETH are experiencing notable growth, with Coinbase showing over a 9% increase in value recently. Liquid Collective is also witnessing steady growth by maintaining a stable amount of staked ETH.

What risks are associated with liquid staking protocols?

While liquid staking protocols offer liquidity, risks include smart contract vulnerabilities, changes in market conditions affecting token value, and the concentration of staked ETH within major players like Lido, which might lead to potential market impact as withdrawal conditions change.

How does staked ETH impact the overall Ethereum ecosystem?

Staked ETH contributes to the security and functionality of the Ethereum network. With 14.31 million ETH staked in liquid staking protocols representing a significant 11.86% of circulating supplies, it plays a crucial role in validating transactions and facilitating network upgrades.

What are the advantages of using liquid staking protocols like Lido or Rocket Pool?

Liquid staking protocols like Lido and Rocket Pool provide users with the advantage of earning staking rewards while keeping liquidity through issued tokens. This allows users to engage in other DeFi activities, enhancing capital efficiency while still participating in Ethereum staking.

| Protocol | Staked ETH (million) | Value (USD) | Market Share (%) | Recent Change (%) |

|---|---|---|---|---|

| Lido | 8.76 | 41.59 billion | 61.22 | -0.87 |

| Binance Staked ETH | 3.30 | 15.67 billion | 24.13 | +3.42 |

| Rocket Pool | 0.65 | 3.09 billion | 4.56 | -0.48 |

| Liquid Collective | 0.37 | 1.74 billion | 0.58 | +0.05 |

| Stakewise V2 | 0.32 | 1.53 billion | 0.47 | -16.00 |

| mETH Protocol | 0.30 | 1.42 billion | 0.44 | -19.21 |

| Stader | 0.16 | 768 million | 0.24 | N/A |

| Coinbase Wrapped Staked ETH | 0.14 | 683 million | 0.20 | +9.00 |

| Frax Ether | 0.09 | 446 million | 0.13 | N/A |

| Origin Ether | 0.038 | 181 million | 0.05 | N/A |

| Crypto.com Liquid Staking | 0.036 | 172 million | N/A | +4.72 |

| Stakestone STONE | 0.030 | 142 million | N/A | -14.52 |

Summary

Liquid staking protocols have become a significant component of the Ethereum ecosystem, experiencing a notable uptick in total ether staked from 13.62 million to 14.31 million ETH over the last 14 weeks. This growth reflects an increasing trend toward liquid staking, allowing investors to participate in DeFi opportunities while still earning staking rewards.