Lisa Cook Investigation: Fed Officials Weigh In on Allegations

The ongoing Lisa Cook investigation has ignited discussions among Federal Reserve officials regarding the integrity of the central bank amid allegations against Fed Governor Lisa Cook. Recent comments have emerged from both current and former officials, including Eric Rosengren, who urged caution in drawing conclusions before concrete facts are established. As the investigations unfold, concerns about the Fed’s monetary policy independence come to the forefront, especially with President Trump’s looming threats regarding Cook’s position amid mortgage fraud allegations. Many, including Cleveland Fed President Beth Hammack, have emphasized the importance of protecting Cook’s reputation and safeguarding the Fed’s unbiased role in economic governance. With the stakes high and Federal Reserve news closely watched, the implications for monetary policy and the potential political fallout remain critical as the situation develops.

The scrutiny surrounding the Fed Governor Lisa Cook investigation has sparked significant dialogue in the financial community. As the Federal Reserve grapples with allegations of mortgage fraud against Cook, voices from various officials highlight the need for transparency and adherence to due process. Former Boston Fed President Eric Rosengren, among others, has cautioned against premature judgments, while Cleveland Fed President Beth Hammack reaffirms Cook’s competence and integrity. This situation raises key questions about the autonomy of monetary governance in light of political pressures and public expectations. With Donald Trump’s administration’s controversial stance towards Fed leadership, the path ahead looks complex for safeguarding the Fed’s operational integrity.

Insights on the Lisa Cook Investigation from Fed Officials

The investigation surrounding Fed Governor Lisa Cook has drawn significant attention from current and former officials of the Federal Reserve. Many have expressed the importance of not jumping to conclusions regarding the allegations of mortgage fraud. Eric Rosengren, the former Boston Fed President, emphasized in a recent interview that public discourse should be grounded in facts rather than speculation. His remarks highlight a broader sentiment within the Fed about preserving the integrity of its operations, especially in light of the fast-paced news environment where claims can swiftly shape public opinion.

Furthermore, Cleveland Fed President Beth Hammack came forward to defend Cook, underscoring her qualifications as an economist and her integrity. Hammack articulated the critical nature of maintaining the Fed’s independence, particularly as political pressures mount. This situation has elicited reflections on the intersection between politics and monetary policy, showcasing how accusations can blur the lines of governance and professional expertise in the Federal Reserve.

The Political Ramifications of Trump’s Allegations

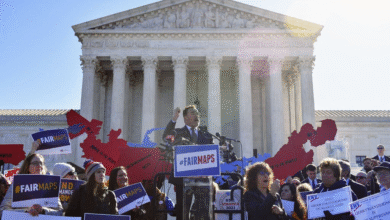

The allegations against Lisa Cook have not only posed a challenge for her personal career but have also raised significant political implications. President Donald Trump’s threats to dismiss Cook if she does not resign reveal a troubling intersection of politics and monetary policy. This situation is exacerbated by Trump’s past criticisms of Fed Chair Jerome Powell, suggesting that a distinct agenda could ensue if the independence of the Federal Reserve is undermined. The volatile nature of these developments emphasizes how partisan perspectives can impact essential monetary decisions affecting the economy.

As Wall Street watchers keep a close eye on these unfolding events, the concerns regarding the Fed’s independence intensify. The implications of potential leadership changes in the central bank could very well influence monetary policy trajectories, particularly in responses to rising inflation. It poses a critical dilemma for the financial system; a compromise in the Fed’s independence may lead to politically motivated monetary policies that could undermine investor confidence and economic stability.

Economists Weigh In on Monetary Policy Independence

Amid the unfolding investigation of Lisa Cook, economists have reiterated the significance of maintaining independence in the Federal Reserve. Former Vice Chair Roger Ferguson stressed that public understanding of the Fed’s critical role in managing inflation is paramount. In his discussion, Ferguson addressed the historical context of inflation and how it disproportionately affects middle and lower-income households, further pointing to the central bank’s essentiality in navigating such issues away from political interference.

Ferguson’s insights resonate deeply as many observers fear that politicizing the Fed could introduce challenges similar to those faced by central banks globally where independence is compromised. The willingness of Congress and the public to defend the autonomy of the Fed will ultimately dictate its ability to uphold effective monetary policies that are vital for economic health.

Eric Rosengren’s Perspective on Fed Leadership Decisions

Former Boston Fed President Eric Rosengren approached the Lisa Cook investigation with a measured perspective, advising that without substantiated facts, any speculation would be premature. His focus on the need for actionable information underscores the complexities involved in leadership decisions within the Fed. Rosengren’s remarks serve as a reminder of the importance of objective analysis in the face of swirling political narratives.

His cautious outlook reflects a broader call for patience amidst allegations that have intensified scrutiny on Cook’s position. The sentiment shared by Rosengren resonates throughout the Fed, suggesting a desire for factual clarity that transcends immediate political pressures. As Cook navigates the current investigation, the emphasis on evidence-based evaluations remains a cornerstone for the Fed’s operational integrity.

The Role of the Federal Reserve Amid Political Pressures

The ongoing allegations against Lisa Cook also highlight the vital role the Federal Reserve plays in maintaining financial stability amid political turbulence. The institution’s commitment to a data-driven approach becomes particularly crucial when political pressures threaten its independence. Current Fed officials have expressed the need for a clear delineation between governance and political influence, especially in a climate where economic decisions become intertwined with political agendas.

The calls for Cook’s resignation, alongside Trump’s criticisms, illustrate how central bank leaders must navigate the precarious balance between their obligations and external demands. Ensuring that the Fed operates independently can foster greater public confidence in its ability to tackle economic challenges, reinforcing the narrative that monetary policy should remain free from political winds.

Political Influences and Financial Markets

As the investigation into Lisa Cook unfolds, financial markets are reacting to the uncertainty created by potential changes in leadership within the Federal Reserve. Predictions surrounding Cook’s likelihood of dismissal fluctuated notably in prediction markets, demonstrating just how deeply interlinked the performance of markets is with the stability of Fed governance. Market participants are particularly sensitive to political signals, which can foreshadow shifts in monetary policy direction.

This situation has intensified scrutiny on how accusations and threats can affect investor perceptions and market movements. The interdependencies between political commentary and market behavior underscore the importance of a steadfast Fed that can implement effective monetary policies unimpeded by distressing claims. Ensuring the Fed remains insulated from political pressures will better serve the interests of economic health and market stability.

Future Implications for Fed Governor Lisa Cook

The future of Lisa Cook as a Fed governor hangs in a balance increasingly swayed by political narratives and public perception. With potential consequences looming over her position, shadows of uncertainty threaten to overshadow the Fed’s mission. The outcomes of this investigation may not only impact Cook personally but could also coincide with broader changes in leadership that reshape the Federal Reserve’s approach to monetary policy under political scrutiny.

Should Cook remain in her position unscathed, it could herald a new chapter for the Fed—a framework that emphasizes independence in a politically charged environment. Conversely, if political pressures lead to her resignation, it could pave the way for a governance shift that may influence the Fed’s approach to managing inflation and other economic challenges. The coming weeks will be crucial in determining both Cook’s fate and the future direction of the Federal Reserve.

Public Sentiment on Federal Reserve Independence

The current investigation into Lisa Cook has sparked discussions about the general public sentiment towards the Federal Reserve’s independence. Observers like Ferguson have noted that the recent inflationary environment has heightened awareness among citizens of the Fed’s role and the necessity of its impartiality. Many argue that public perception can significantly sway how effectively the Fed addresses economic issues when shielded from political influences.

Fostering a robust understanding of the Fed’s essential functions can encourage public advocacy for its autonomy, especially as inflation continues to dominate economic discussions. By ensuring a well-informed public, the Fed can better maintain its independence and navigate towards effective responses that serve the broader economic interests of the country.

Navigating Allegations Without Compromising Integrity

In the wake of allegations against Fed Governor Lisa Cook, the response from current and former officials emphasizes the necessity of navigating such challenges while maintaining institutional integrity. Leaders like Eric Rosengren have advised against impulsive reactions to allegations, underscoring a commitment to evidence-based governance. This approach protects not only Cook’s reputation but the Federal Reserve’s credibility as a whole.

As Fed officials rally around the principle that the institution must rise above personal controversies, it highlights an intrinsic value of the Federal Reserve—its ability to operate independently of external pressures. Upholding this integrity may serve to deflect the politicization that threatens to destabilize monetary policy efforts and reinforce the Fed’s position as a foundational pillar of economic stewardship.

Frequently Asked Questions

What is the current status of the Lisa Cook investigation regarding Trump mortgage fraud allegations?

The Lisa Cook investigation is centered around allegations of mortgage fraud made by Federal Housing Finance Agency Director Bill Pulte against Fed Governor Lisa Cook. Currently, there are no concrete facts available, and former Boston Fed President Eric Rosengren emphasized the need for facts before drawing any conclusions about the allegations.

How do current Federal Reserve officials view the Lisa Cook investigation?

Current and former Federal Reserve officials have expressed strong support for Fed Governor Lisa Cook amid the ongoing investigation. Cleveland Fed President Beth Hammack described Cook as an ‘outstanding economist’ and stressed the importance of maintaining monetary policy independence, highlighting concerns about external pressures on the Fed.

What impact could the Lisa Cook investigation have on the Federal Reserve’s independence?

The Lisa Cook investigation has raised concerns about the independence of the Federal Reserve. Former Fed Vice Chair Roger Ferguson emphasized the necessity of protecting the Fed’s independence to effectively manage monetary policy, especially in light of inflation issues that affect the public.

What has President Trump stated regarding Fed Governor Lisa Cook amidst the investigation?

President Trump has threatened to dismiss Fed Governor Lisa Cook if she does not resign, exacerbating the situation surrounding the Lisa Cook investigation. His criticisms reflect his ongoing tension with the Fed, particularly targeting Chair Jerome Powell’s actions.

What has been Eric Rosengren’s stance on the allegations against Lisa Cook?

Eric Rosengren, former Boston Fed President, has called for patience in the Lisa Cook investigation, stating that without established facts, it is premature to draw conclusions or make determinations about Cook’s future as a Fed governor.

How does the Lisa Cook investigation relate to monetary policy independence?

The Lisa Cook investigation is significant as it has implications for the Federal Reserve’s monetary policy independence. Concerns surrounding external pressures, particularly from political figures like President Trump, may influence how the Fed operates and its decision-making processes.

What might be the potential outcomes of the Lisa Cook investigation for her role at the Federal Reserve?

The potential outcomes of the Lisa Cook investigation could range from resignations to termination from her position, particularly if the allegations gain traction or result in findings that impact her integrity or qualifications as a Fed governor.

| Key Point | Details |

|---|---|

| Reactions from Fed Officials | Former Fed officials stress the need for facts before drawing conclusions about Lisa Cook’s situation and emphasize her integrity. |

| Trump’s Pressure | President Trump has stated he will dismiss Cook if she does not resign amidst ongoing mortgage fraud allegations. |

| Investigation Declared | The Justice Department confirmed a criminal investigation against Cook following allegations from Bill Pulte. |

| Independence of the Fed | Officials stress the importance of preserving the Fed’s independence amid political pressures regarding Cook. |

| Public Opinion | Concerns are rising on Wall Street regarding the Fed’s independence and interest rate policies under Trump’s influence. |

Summary

The Lisa Cook investigation underscores the complex interplay between politics and the Federal Reserve’s independence. Amid allegations of mortgage fraud, support from former and current Fed officials emphasizes the crucial need for established facts before drawing conclusions. As Trump continues to exert pressure regarding Cook’s position, the importance of maintaining the Fed’s autonomy in economic policies becomes increasingly significant for market confidence and public trust.