XChat Bitcoin Encryption: Enhancing User Privacy and Security

XChat Bitcoin Encryption is set to revolutionize secure messaging on the X platform. Announced by Elon Musk, this innovative feature leverages “Bitcoin style” encryption to bolster user privacy and security like never before. With the integration of advanced capabilities such as vanishing messages, users can enjoy a safer communication environment, making it an appealing option for those concerned about their privacy. The new XChat will not only support audio and video calls but will also allow users to share various file types securely, enhancing the overall experience. As the discussions around the X platform privacy features unfold, it’s clear that XChat Bitcoin Encryption is a significant step toward modernizing digital communication.

The introduction of XChat Bitcoin Encryption marks a turning point in how we approach secure communication on the X platform. This state-of-the-art messaging service combines elements reminiscent of cryptocurrency security, promising enhanced privacy outcomes for its users. With features like ephemeral messaging and robust file sharing, it aims to create a more confidential interaction space. As Elon Musk and his team roll out these improvements, the focus remains on user trust and data protection. This new direction in messaging brings forth a range of tools designed not only for safety but also for a seamless user experience.

Elon Musk’s Vision for XChat: A New Era of Secure Messaging

Elon Musk has always been at the forefront of innovation, and his latest announcement about the XChat feature on the newly branded X platform underscores this sentiment. With its integration of “Bitcoin style” encryption, XChat aims to elevate user privacy and security to unprecedented levels. Unlike conventional messaging apps, the emphasis on encryption not only protects messages in transit but also ensures that users can communicate safely without fear of unauthorized access. This commitment to secure messaging is crucial in an age where data breaches and privacy concerns are rampant.

The anticipation surrounding the XChat feature also highlights the evolving digital landscape where user confidentiality is becoming a priority for developers and users alike. The inclusion of features such as vanishing messages, which automatically delete content after a specified time, and the capability to send various file types, transforms standard communication into a more dynamic experience. Coupled with audio and video calling, XChat is positioned to become a comprehensive tool that meets the needs of modern users while maintaining a strong focus on security.

Understanding ‘Bitcoin Style’ Encryption in XChat

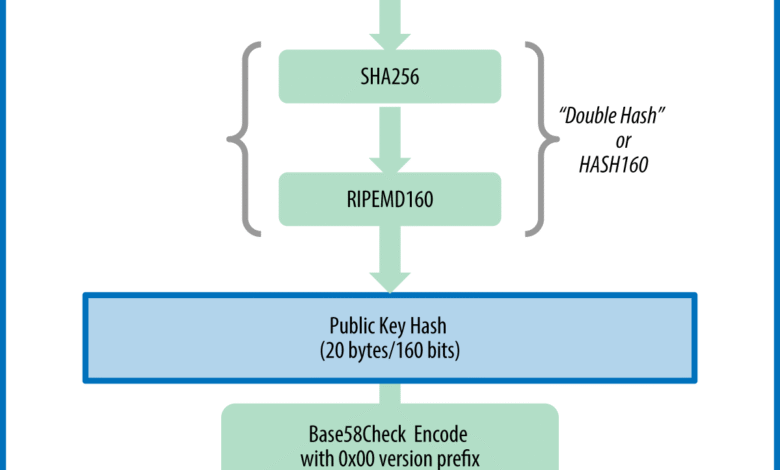

While Musk’s declaration of integrating ‘Bitcoin style’ encryption in XChat sounds promising, it raises questions within the crypto community. Notably, Samson Mow’s comment that “Bitcoin isn’t encrypted” brings to light the distinctions between what is commonly understood as Bitcoin security versus conventional encryption methods. Bitcoin operates on a decentralized blockchain system that prioritizes transparency, which is fundamentally different from the cryptographic encryption techniques often utilized by messaging apps. Thus, while the term may resonate with crypto enthusiasts, its practical implications for user privacy need further clarification.

Understanding the nuances of ‘Bitcoin style’ encryption is essential for users who prioritize privacy in their communications. It suggests that while the encryption might bring about an added layer of security, it may not necessarily conform to traditional encryption protocols. Users, particularly those accustomed to secure messaging like Signal or WhatsApp, might find varying levels of certainty in the security they anticipate from XChat. Therefore, it is important for the development team behind XChat to effectively communicate how their encryption differs and what specific technology underpins their commitment to privacy.

X Platform Privacy Features: What Users Can Expect

The X platform’s approach to privacy with the introduction of XChat incorporates various innovative features that enhance user control over their communications. Among these, the introduction of vanishing messages stands out, allowing users to send messages that self-destruct after a preset duration. This feature takes privacy to the next level, as it eliminates the risk of sensitive information lingering in chat history, making it ideal for discussions that require discretion. The inclusion of multiple file types for sharing also aligns with modern user demands, enabling seamless communication while maintaining privacy.

Additionally, the architecture of XChat, being developed in Rust, specifically aims to bolster security against common vulnerabilities often exploited in messaging applications. This programming language is renowned for its memory safety and concurrent programming capabilities, which means that user interactions within XChat could potentially be more secure and less prone to attacks. As these privacy features are rolled out, it is clear that they are in direct response to the growing demand for secure messaging solutions in an increasingly digital world.

The Role of Vanishing Messages in XChat’s Security Strategy

Vanishing messages represent a transformative approach to secure messaging, and their integration into XChat signifies a renewed focus on user privacy. This feature ensures that messages sent through the platform will disappear after the recipient has viewed them, reducing the likelihood of data being compromised long after the conversation has concluded. In a society where digital overreach is a persistent threat, such features can empower users, offering them greater peace of mind and control over their private discussions.

Moreover, vanishing messages could combat the growing concerns surrounding data retention and surveillance. In light of numerous data breaches and privacy scandals in recent years, the option for messages to delete themselves can be a significant selling point for users who prioritize confidentiality. By adopting this feature, XChat not only enhances user experience but positions itself as a serious contender in a crowded field of messaging applications that often compromise on security for ease of use.

Comparing XChat and Traditional Messaging Applications

As XChat prepares to enter the competitive messaging app landscape, it’s important to compare its features against traditional applications like Messenger and WhatsApp. Traditional messaging platforms typically rely on end-to-end encryption; however, they do not often offer the advanced privacy features that XChat promises, such as vanishing messages. This unique attribute allows XChat to stand out in a market that is increasingly saturated with apps that prioritize usability but often overlook robust security measures.

Furthermore, the deployment of ‘Bitcoin style’ encryption in XChat challenges the norm established by traditional messaging platforms. Users are becoming more informed about their choices in communications and may opt for a platform like XChat that not only adapts to modern needs but also harnesses innovative technologies. By putting security at the forefront of their service offerings, XChat could attract users seeking not just convenience but also an assurance that their conversations are secure from prying eyes.

How Rust Programming Enhances XChat’s Security Features

The choice of Rust as the development language for XChat showcases a commitment to building a secure and efficient application. Known for its focus on performance and safety, Rust provides developers with the tools to create applications that are less prone to security vulnerabilities, especially those related to memory management. This foundation aims to minimize exploits that can often affect other programming languages, inherently strengthening XChat’s security profile.

Using Rust, the developers of XChat can ensure faster execution and clearer code, which may also include thorough testing and debugging processes before deployment. This commitment not only enhances overall application reliability but also creates an environment where features like encryption can be effectively implemented. As a result, users accessing XChat can expect a messaging experience that is not only intuitive but also fortified against potential security threats.

The Future of Communication: What XChat Means for Users

The advent of XChat signifies a pivotal moment in the evolution of digital communication, particularly as it incorporates cutting-edge privacy features that traditional platforms have yet to embrace. Users now have the opportunity to engage in secure messaging that aligns with contemporary concerns surrounding data security and privacy. With features like vanishing messages and file sharing all underpinned by sophisticated encryption, XChat is poised to reshape how individuals communicate digitally.

Moreover, as the platform continues to evolve, it’s likely that further enhancements will be introduced to solidify its reputation as a leader in privacy-friendly communication solutions. With a focus on securely sharing information, XChat holds promise for a future where privacy is not an afterthought but a fundamental component of online interaction. The implementation of advanced security features will encourage more users—particularly those wary of data retention—to choose XChat as their preferred messaging app.

The Crypto Community Responds to XChat’s Security Claims

The introduction of ‘Bitcoin style’ encryption has sparked a varied reaction from the crypto community, with some experts questioning its effectiveness in real-world applications. Critics argue that while the term evokes a sense of security inherent in crypto technology, it may not fully address the unique needs of users seeking reliable messaging. The skepticism is not unfounded; many believe that a deeper understanding of encryption methodologies is necessary to truly gauge the level of security users can expect.

This dialogue enhances the accountability of developers as they introduce new features to communicate transparency to their users. Clear explanations of how XChat’s encryption works and its practical applications will be crucial as it builds credibility within the user base. Engaging openly with the crypto community demonstrates a willingness to adapt and evolve, which is a vital aspect of increasing trust and adoption in practical digital environments.

User Adoption: Challenges and Opportunities for XChat

As XChat rolls out its innovative features, user adoption represents both challenges and opportunities for its developers. On one hand, the emphasis on privacy and security may attract users disillusioned with mainstream apps that fail to prioritize these aspects. However, on the other hand, convincing existing users of traditional platforms to migrate to a new application can be difficult. Ensuring that XChat not only meets but exceeds user expectations in terms of functionality and security will be crucial.

Moreover, as users increasingly become aware of privacy implications in digital communication, providing engaging and informative content around XChat’s features may encourage adoption. By highlighting how XChat allows users to reclaim control over their personal communication with features like vanishing messages and Bitcoin-inspired encryption, developers can capitalize on a growing trend where privacy is paramount. This dual challenge will shape how effectively XChat establishes itself as a leader in secure communication.

Frequently Asked Questions

What is XChat Bitcoin Encryption on the X platform?

XChat Bitcoin Encryption is a new feature introduced by Elon Musk on the X platform that incorporates advanced encryption techniques inspired by Bitcoin. This aims to enhance user privacy and security in messaging.

How does XChat Bitcoin Encryption improve secure messaging?

XChat Bitcoin Encryption improves secure messaging by implementing strong encryption protocols, which enhance the confidentiality of conversations. Features like vanishing messages add an additional layer of privacy, ensuring messages are not stored indefinitely.

What are the privacy features of XChat on the X platform?

The privacy features of XChat on the X platform include Bitcoin-style encryption, the ability to send vanishing messages, and secure file sharing. These features collectively enhance the security of communications compared to traditional messaging apps.

Can I use audio and video calling with XChat Bitcoin Encryption?

Yes, XChat Bitcoin Encryption supports audio and video calling, providing users with secure communication options while maintaining privacy through advanced encryption methods.

Are messages sent through XChat really private with Bitcoin encryption?

While XChat incorporates Bitcoin style encryption to bolster privacy, it’s crucial to understand that the effectiveness of this encryption method is debated. Critics in the crypto community point out that Bitcoin itself isn’t fully encrypted, raising questions about the absolute privacy of messages in XChat.

What types of files can be sent using XChat Bitcoin Encryption?

Using XChat Bitcoin Encryption, users can send various file types securely. The feature is designed to support diverse file transfers while ensuring privacy through robust encryption protocols.

What programming language is used for the new XChat feature on the X platform?

The new XChat feature is built using Rust, a programming language known for its performance and safety, contributing to a more secure messaging experience within the X platform.

Why is Elon Musk emphasizing encryption in XChat?

Elon Musk emphasizes encryption in XChat to enhance user privacy and security, responding to growing demands for safer communication tools on social platforms. This focus reflects his commitment to improving user experience while safeguarding personal information.

What is the significance of vanishing messages in XChat Bitcoin Encryption?

Vanishing messages in XChat Bitcoin Encryption are significant because they allow users to send messages that disappear after being read, reinforcing privacy and reducing digital footprints in the realm of secure messaging.

What should users know about Bitcoin encryption in relation to XChat?

Users should know that while XChat features ‘Bitcoin style’ encryption for enhanced privacy, the term can be misleading. Discussions in the crypto community question the actual level of encryption provided, reminding users to stay informed about the implications of the technology.

| Key Feature | Description |

|---|---|

| Bitcoin Style Encryption | Incorporates encryption features similar to those used in Bitcoin, aimed at enhancing user privacy. |

| Vanishing Messages | Messages that disappear after a certain time for added privacy. |

| File Sharing | Users can send various file types including images, documents, and more. |

| Audio and Video Calling | Supports real-time audio and video communications between users. |

| Built with Rust | Utilizes the Rust programming language for better performance and security. |

| User Confidentiality | Focuses on keeping user communications private as a top priority. |

Summary

XChat Bitcoin Encryption aims to revolutionize how users communicate on the X platform by enhancing privacy with advanced security measures. The integration of “Bitcoin style” encryption, while critiqued by some, signals a strong movement towards safeguarding user data. With features like vanishing messages, diverse file sharing, and audio-video calling, this new rollout underlines Elon Musk’s commitment to providing a secure and efficient messaging experience.