MEV and Front-Running in DeFi: Impact on Traders’ Profit

In the evolving landscape of decentralized finance (DeFi), issues surrounding MEV and front-running present significant obstacles for traders seeking fairness and profitability. Maximum Extractable Value (MEV) and front-running explained highlight a recurring theme troubling cryptocurrency enthusiasts: the prevalence of unfair trading practices. As traders navigate decentralized exchanges, they often encounter challenges like cryptocurrency slippage and the risks of sandwich attacks, undermining the core principles of transparency and equity in crypto trading. These DeFi trading challenges not only affect individual transactions but also threaten the integrity of the entire ecosystem. Addressing MEV and front-running in DeFi is crucial for restoring trust and ensuring that all market participants can compete on a level playing field.

Within the dynamic realm of DeFi, the manipulation of transaction sequences, often referred to as MEV and unjust preemptive trading strategies, has emerged as a critical concern for investors. This phenomenon manifests through various unfair practices that can significantly skew the trading experience, leading to adverse outcomes for unsuspecting traders that suffer from excessive slippage or unexpected losses. Additionally, by addressing issues such as inequitable advantages in order execution and transparency concerns, stakeholders can work towards achieving a fair and balanced trading environment. The ongoing discourse about trading fairness in crypto emphasizes the need for innovative solutions to combat these disruptive practices. Ultimately, fostering a more equitable DeFi space is essential for empowering traders and enhancing the overall integrity of the cryptocurrency market.

Understanding MEV and Front-Running in DeFi

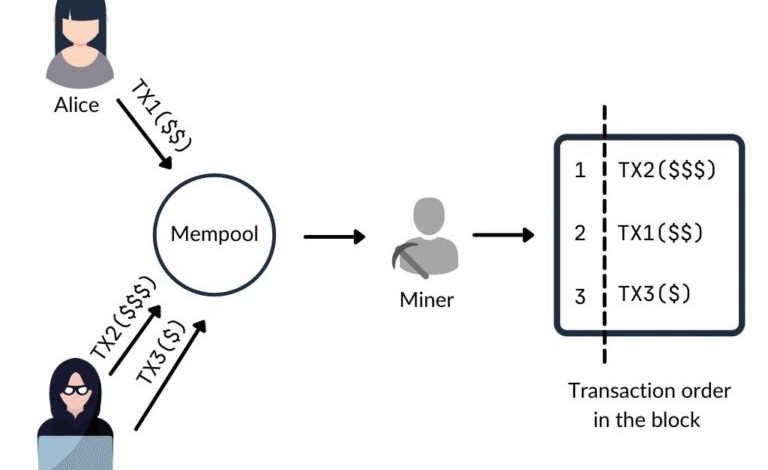

Maximum Extractable Value (MEV) and front-running are two significant challenges within decentralized finance (DeFi) that can severely impact the fairness of trading experiences. MEV refers to the profit that miners or validators can extract by choosing the order in which they execute transactions in a block. This manipulation can lead to front-running, where a malicious actor can place their trades ahead of a legitimate transaction to profit at the expense of the original trader. Understanding these concepts is crucial for anyone engaging with DeFi platforms, as they highlight the importance of transparency and ethics in crypto trading.

Front-running not only undermines the potential profits of honest traders but also contributes to a broader atmosphere of distrust within the DeFi landscape. As more participants become aware of the implications of MEV and front-running, the overall goals of decentralization and fairness in finance are called into question. Traders should remain vigilant and equipped with knowledge about how these mechanisms operate, enabling them to recognize suspicious patterns in transactions and adjust their strategies accordingly.

The Impact of Slippage on DeFi Trading

Slippage is another pressing issue within the DeFi trading arena, often exacerbated by the very characteristics that make decentralized exchanges appealing. When traders execute transactions, they do not always receive the expected price due to fluctuations and the liquidity of the market. This phenomenon can be particularly detrimental during times of high volatility or when large orders are placed, resulting in execution prices that can deviate significantly from the market’s stated price. Such unexpected slippage can erode the profitability of trades, making it a critical component to monitor.

To minimize slippage, traders are encouraged to use strategies like setting slippage tolerance limits and opting for orders that allow for better price execution, such as limit orders instead of market orders. Moreover, understanding the liquidity levels across different exchanges is paramount in avoiding undesirable outcomes caused by slippage. By actively managing exposure to slippage, traders can better navigate the decentralized finance landscape and improve their overall trading effectiveness.

Strategies to Mitigate MEV and Front-Running Risks

To combat the risks posed by MEV and front-running, traders can employ various strategies aimed at improving their trading outcomes. One effective approach is utilizing decentralized exchanges (DEXes) that prioritize the protection of user order flow. These platforms often implement encrypted order systems, which keep transaction details hidden until execution, thus limiting opportunities for malicious actors to capitalizing on exposed orders. Ensuring the usage of such innovative technologies can significantly enhance trading fairness and reduce the occurrence of MEV exploitation.

In addition to selecting the right exchange, diversification across trading venues can also mitigate risks. By not concentrating trades in a single platform, traders can lessen the chances of falling victim to front-running associated with any one exchange’s vulnerabilities. Utilizing limit orders, where feasible, can be another layer of protection, ensuring that trades are executed at desired price points rather than suffer from slippage effects. Education about the platforms’ underlying mechanics is crucial; traders should actively seek information on how exchanges manage and prevent front-running to make informed decisions.

Ensuring Fairness in DeFi Trading

As the crypto market continues to mature, the focus on trading fairness becomes even more critical. Participants in the DeFi space are increasingly advocating for transparency and equitable practices, recognizing that underlying technological issues often lead to unfair advantages. The battle against practices like MEV and front-running is not just about individual profits; it’s also about preserving trust in the entire DeFi ecosystem. Traders must remain proactive and advocate for transparency among exchanges, ensuring that their platforms are committed to fairness.

Furthermore, fostering a culture of ethics within the trading community can lead to positive change. Educational efforts that empower traders to understand the risks and mechanics involved can promote a more just and equitable trading environment. As individuals become better equipped to recognize and combat unfair practices, the overall integrity and trustworthiness of decentralized finance can be enhanced, ultimately benefiting all participants.

Decentralized Exchanges: Are They Just as Risky?

Decentralized exchanges have garnered attention as alternatives to traditional trading platforms, yet they are not without their own sets of risks. While they promise lower fees and enhanced trading freedom, the presence of MEV and slippage poses critical challenges that can contradict the foundational ethos of decentralization. Traders often find that, despite the appeal of DEXes, they must remain vigilant against practices like front-running that can lead to skewed execution of trades.

In assessing whether DEXes are indeed safer or simply a new frontier for existing issues, it’s essential to weigh the transparency they offer against the challenges they present. While some decentralized platforms are adopting innovative measures to combat these problems, traders must remain aware of potential exploitation inherent in the infrastructure. Monitoring whether DEXes implement robust anti-front-running safeguards and educational resources will significantly affect their trading experience.

The Role of Technology in Enhancing DeFi Trading Fairness

Advancements in blockchain technology are pivotal to creating fairer trading environments within DeFi. Innovative solutions like zero-knowledge proofs and batch order executions have emerged as methods for enhancing transaction privacy and reducing the impact of MEV and front-running. By concealing trade details pre-execution from potential exploiters, these technologies present a more equitable trading environment for all participants.

Moreover, the integration of machine learning and artificial intelligence can play a crucial role in identifying and mitigating indicators of unfair trading practices. As these technologies evolve, they can assist traders in analyzing patterns that signal potential risks, allowing for better strategic planning. Ultimately, the ongoing development and application of technology will be essential in securing a more transparent and fair trading landscape for decentralized finance.

Navigating the Challenges of DeFi Trading

The journey through DeFi trading is fraught with challenges, and understanding the dynamics of MEV, slippage, and front-running is essential for success. As traders navigate this complex landscape, they must remain adaptable, constantly educate themselves, and stay informed about emerging tools and strategies. This proactive approach can help them mitigate risks and enhance their trading effectiveness while contributing to a fairer ecosystem.

Additionally, staying connected with the crypto community and engaging in discussions around trading ethics and innovations can provide traders with insights and support from like-minded individuals. By fostering a collaborative environment, all participants can elevate the standards of fairness and transparency in DeFi trading, ultimately shaping a more robust and equitable market for everyone.

The Future of Trading in DeFi

The future of trading within the DeFi landscape is uncertain yet promising, with ongoing discussions on how to align technological advances with the need for fairness and transparency. As more traders become aware of MEV effects and the importance of trading practices, there is a strong push towards developing protective measures that can redefine the trading experience on decentralized platforms. Innovations aimed at minimizing extraction risks and promoting ethical trading are crucial to realizing the full potential of DeFi.

Furthermore, as institutional capital flows into the crypto space, their demand for reliable and fair trading platforms will likely influence the evolution of decentralized exchanges. The need for greater confidentiality and better risk management practices may spark a wave of innovation. Success in this new frontier requires collaboration between developers, traders, and regulators to craft a trading environment that prioritizes fairness, reinforces trust, and responds proactively to the inherent challenges faced by all market participants.

Awareness and Education in DeFi Trading

In the ever-evolving landscape of decentralized finance, awareness and education are paramount for traders looking to navigate its complexities. The knowledge of MEV, front-running, and slippage must be disseminated more widely in order to empower individuals with the skills necessary to recognize and counteract these potentially detrimental practices. Educational initiatives, workshops, and community discussions can serve as platforms for sharing insights and strategies geared towards mitigating risks in DeFi trading.

Moreover, traders should seek out credible resources and guidance from industry experts to build a solid foundation for informed decision-making. This collective effort can lead to a more knowledgeable trading community, ultimately pushing for better practices among exchanges and creating a push towards trading fairness. As a result, traders who invest time in understanding these dynamics will be well-equipped to thrive in the DeFi landscape.

Frequently Asked Questions

What is Maximum Extractable Value (MEV) and how does it impact DeFi trading?

Maximum Extractable Value (MEV) refers to the maximum profit that can be made from reordering or including transactions within a blockchain block. In DeFi trading, MEV can severely impact traders by creating a disadvantageous trading environment. It often leads to issues like front-running, where malicious actors observe pending trades and place their own orders to capitalize on price movements, thus eroding profits and trust in DeFi platforms.

How does front-running affect fairness in DeFi exchanges?

Front-running occurs when a trader places orders based on knowledge of pending transactions to profit from the expected price changes. This practice compromises trading fairness in DeFi by allowing certain traders to gain an unfair advantage, resulting in poor execution prices and frustrating experiences for unsuspecting traders. This undermines the core principles of transparency and fairness that decentralized finance aims to uphold.

What are the warning signs of MEV and front-running in DeFi trading?

Traders can look for key warning signs of MEV and front-running in DeFi, such as experiencing slippage beyond expected levels and having trades executed at unfavorable prices. Additionally, monitoring transactions immediately before and after one’s trade can help identify ‘sandwich attacks,’ a common front-running tactic. Recognizing these patterns is crucial for traders aiming to protect their investments.

How can traders protect themselves from the effects of MEV in DeFi?

Traders can mitigate the risks associated with MEV by choosing decentralized exchanges (DEXes) that implement encrypted order flow, which keeps order details private until execution. Additionally, diversifying trading venues, utilizing limit orders, and understanding the underlying infrastructure of the exchanges can help traders navigate potential MEV and front-running challenges more effectively.

What role does slippage play in DeFi trading challenges?

Slippage refers to the difference between the expected price of a trade and the actual execution price. In the context of DeFi trading, high slippage can indicate potential manipulation or front-running activities. It’s essential for traders to monitor slippage closely, as excessive slippage could be a sign of underlying issues with MEV, indicating an unfair trading environment that could negatively impact overall profits and trading effectiveness.

Why is trading fairness in crypto important for the future of DeFi?

Trading fairness in crypto is vital for the sustainability and growth of decentralized finance (DeFi). Unfair practices like MEV and front-running threaten the foundational principles of transparency and trust that attract users to DeFi platforms. Ensuring fairness encourages broader adoption and participation, ultimately fostering a healthier ecosystem where all participants have equal opportunities to succeed.

How do transaction transparencies in blockchain contribute to MEV exploitation?

Blockchain’s inherent transparency can inadvertently allow MEV exploitation, as public mempools broadcast pending transactions before execution. This visibility provides opportunities for malicious actors to manipulate transactions for their benefit. Understanding this challenge is crucial for traders, as recognizing the structural limitations of existing systems can inform better trading strategies and platform choices.

What strategies can traders use to counteract front-running in their trades?

To counteract front-running, traders should employ strategies such as using exchanges with enhanced privacy measures to conceal pending orders, setting slippage tolerance limits, and conducting trades in less volatile conditions. Additionally, understanding the mechanics of the trading platform and opting for time-sensitive transactions can help minimize exposure to front-running vulnerabilities.

What is the significance of trading execution quality in relation to MEV?

Execution quality is significant in relation to MEV as it directly impacts traders’ outcomes when executing orders. As crypto markets evolve and become more efficient, prioritizing execution quality can help traders avoid losing profits to MEV extraction. Educating oneself about how execution mechanisms work can give traders a competitive edge in a landscape often affected by harmful practices.

| Key Issue | Description |

|---|---|

| Maximum Extractable Value (MEV) | Unfair advantage allowing miners to profit by extracting value from transactions, which can lead to profit erosion for regular traders. |

| Front-Running | A practice where traders prioritize their own transactions before others, causing worse prices for the latter. |

| Slippage | Unexpected price movement that results in trade executions at prices worse than anticipated due to rushed transactions. |

| Sandwich Attacks | Occurs when a trader’s transaction is placed between two others, leading to loss of potential profit. |

| Encrypted Order Flow | A solution to mitigate MEV by keeping orders private until execution, minimizing front-running risks. |

| Risk Management | Emphasizes importance of strategic trading to preserve capital and ensure long-term success in volatile markets. |

Summary

MEV and Front-Running in DeFi represent significant challenges that undermine the benefits of decentralized finance. The presence of unfair practices like MEV extraction and front-running has created an uneven playing field for traders, resulting in lost profits and trust. While the crypto landscape continues to evolve, it is crucial for traders to understand these issues, utilize tools such as encrypted order flow, and adopt effective risk management strategies to safeguard their investments and navigate this complex environment.