Microstrategy IPO to Propel Bitcoin Expansion Strategy

The Microstrategy IPO represents a strategic move by the software intelligence company, now known as Strategy, to fuel its ongoing bitcoin investment endeavors. Announced on June 2, the initial public offering of 2.5 million shares of preferred stock is designed to raise capital for further bitcoin acquisitions and enhance working capital. The Series A Perpetual Stride Preferred Stock (STRD Stock) provides an attractive annual dividend of 10.00%, making it an enticing option for investors looking to engage with Microstrategy stock. This significant financial maneuver not only underscores the company’s commitment to its bitcoin strategy but also positions it uniquely in the competitive landscape of technology investments. As the market evolves, this IPO could mark a pivotal moment for those looking to leverage opportunities in the burgeoning realm of cryptocurrency and innovative tech financing.

In an exciting development, Strategy, formerly recognized as Microstrategy, has unveiled plans for an initial public offering (IPO) aimed at enhancing its foothold in the cryptocurrency market. This innovative offering of preferred shares will allow the company to raise substantial funds that can be directed toward further bitcoin acquisitions and operational support. By promoting preferred stock with a notable dividend feature, Strategy seeks to attract a diverse range of investors eager to participate in its growth story. With an emphasis on maximizing its bitcoin holdings, this move indicates a strong alignment with the broader trend of tech firms investing heavily in decentralized currencies. As investors become increasingly aware of the financial potential tied to these digital assets, such strategic IPOs can pave the way for significant shifts in market dynamics.

Microstrategy IPO: A Major Move in Cryptocurrency Investment

The announcement of Microstrategy’s IPO represents a significant moment for both the company and the cryptocurrency market at large. As an industry leader, the firm is renowned for its bold investments in Bitcoin, and the introduction of its preferred stock, known as STRD Stock, reflects its commitment to expanding this strategy. By launching an initial public offering of 2.5 million shares at a 10.00% annual dividend rate, Strategy is not just inviting investors to become part of its journey; it is also setting the stage for an enhanced investment cycle that could attract crypto enthusiasts and traditional investors alike.

This IPO is particularly crucial as it aims to generate funds for further Bitcoin acquisitions, allowing Strategy to bolster its already impressive cryptocurrency portfolio. With the financial backing from this IPO, investors are likely to take a keen interest in how Strategy can use this capital to increase its Bitcoin holdings. The timing of this offering also comes amid a burgeoning interest in cryptocurrencies, positioning Strategy as a pivotal player in the market for those looking to diversify their investments.

Frequently Asked Questions

What is the Microstrategy IPO about and how does it connect to Bitcoin investment?

The Microstrategy IPO refers to the initial public offering of 2.5 million shares of its 10.00% Series A Perpetual Stride Preferred Stock, aimed at funding its ongoing Bitcoin investment strategy. This IPO is designed to generate proceeds that will primarily be used for bitcoin acquisitions and supporting the company’s operational capital.

How will the proceeds from the Microstrategy IPO be utilized?

The proceeds from the Microstrategy IPO will be directed towards general corporate purposes, notably for purchasing additional bitcoin and enhancing working capital. This effort underscores Microstrategy’s commitment to increasing its bitcoin investment portfolio.

What are the key features of the preferred stock being offered in the Microstrategy IPO?

The preferred stock offered in the Microstrategy IPO, known as STRD Stock, boasts a 10.00% annual dividend rate, but these dividends are contingent upon the board’s declaration. Cash dividends are set to be distributed quarterly, starting September 30, 2025, thereby attracting investors interested in stable income coupled with Bitcoin investment.

What risks are associated with investing in Microstrategy’s preferred stock during the IPO?

Investing in Microstrategy’s preferred stock during the IPO carries risks such as the non-guarantee of dividend payments, potential redemption conditions, and market fluctuations impacting stock value. Investors should consider these risks in the context of the company’s aggressive Bitcoin acquisition strategy.

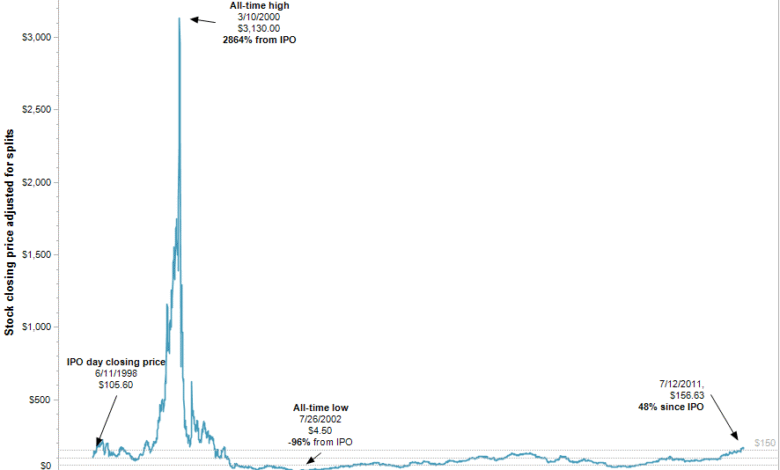

How does Microstrategy’s stock performance relate to its ongoing Bitcoin strategy?

Microstrategy’s stock performance is closely tied to its Bitcoin strategy, as significant investments in Bitcoin can influence investor sentiment and stock valuation. The company’s ongoing acquisitions of Bitcoin directly impact its market position and investor confidence in Microstrategy stock.

What happens to Microstrategy’s preferred stock during a fundamental change in the company?

In instances of a fundamental change, Microstrategy’s preferred stockholders may compel the company to repurchase shares at a price of $100 each, plus any declared unpaid dividends. This provision aims to protect investors if significant operational changes occur.

What is the impact of Microstrategy’s IPO on future Bitcoin acquisitions?

Microstrategy’s IPO is expected to significantly boost its ability to conduct future Bitcoin acquisitions by providing necessary capital. The funds raised from the initial public offering will facilitate further investment in Bitcoin, which is a core part of the company’s long-term strategy.

How have previous offerings influenced Microstrategy’s Bitcoin investment strategy?

Previous offerings by Microstrategy, such as sales of STRK and STRF shares, have successfully raised substantial funds used for Bitcoin purchases. Such fundraising efforts showcase the effectiveness of the company’s strategy to leverage the stock market to expand its Bitcoin holdings.

| Key Points | |

|---|---|

| Company Rebranding | Microstrategy is now rebranded as Strategy, reflecting its focus on Bitcoin. |

| IPO Announcement | Strategy announced an IPO of 2.5 million shares of 10.00% Series A Perpetual Stride Preferred Stock (STRD Stock) on June 2. |

| Purpose of IPO | The net proceeds will be used for corporate purposes, including purchasing Bitcoin. |

| Dividend Rates | STRD Stock offers a 10.00% annual dividend, payable quarterly if declared by the board starting September 30, 2025. |

| Redemption Conditions | The stock can be redeemed under certain conditions, such as if less than 25% of originally issued shares remain. |

| Shareholder Rights | In case of a fundamental change, shareholders can compel the company to repurchase shares at $100 plus declared dividends. |

| Recent Bitcoin Acquisition | Strategy reported purchasing 705 BTC for approximately $106,495 each, raising $36.2 million and $38.4 million from STRK and STRF shares respectively. |

| Total Bitcoin Holdings | Strategy holds 580,955 BTC, acquired for around $40.68 billion at an average price of $70,023. |

Summary

The Microstrategy IPO represents a significant step for the company, as it eyes further expansion of its Bitcoin strategy. By launching an initial public offering of its Series A Perpetual Stride Preferred Stock, Strategy is not only securing essential capital but also reinforcing its commitment to Bitcoin investments. With specified dividend rates and shareholder rights, the IPO is tailored to attract investors looking to participate in the company’s evolving story in the cryptocurrency market.