Monarch Personal Finance App Raises $75 Million for Growth

Monarch personal finance app has emerged as a pivotal player in the fintech sector, securing a remarkable $75 million in its recent funding round. This significant investment is a testament to the app’s innovative approach to personal finance management, especially as it capitalizes on the recent closure of budgeting tools like Mint. With its user-friendly features and a commitment to providing a comprehensive financial tracking experience, Monarch positions itself at the forefront of the consumer fintech growth wave. As households increasingly seek effective budgeting tools, the demand for such intuitive solutions has never been higher. By focusing on paying subscribers rather than advertising, Monarch ensures the privacy and integrity of its user data, setting a new standard in the personal finance landscape.

The rise of Monarch personal finance app illustrates a shift in how individuals approach their financial health. In a landscape once dominated by traditional budgeting applications, Monarch offers a fresh alternative for managing finances efficiently. This innovative platform allows users to track their spending, investments, and savings effortlessly, making it an essential tool for today’s savvy consumers. As the consumer fintech industry grapples with evolving challenges and opportunities, applications like Monarch are leading the charge in redefining personal finance management. By shifting away from conventional models, these fintech solutions not only enhance user experience but also inspire significant transformations in financial behavior.

Monarch Personal Finance App: A Trailblazer in Fintech Fundraising

In a challenging economic landscape for fintech startups, the Monarch personal finance app has set a remarkable precedent by securing $75 million in funding. This significant round of financing highlights the app’s potential to reshape the consumer financial management sector, particularly in the wake of Mint’s closure. As investors remain cautious amidst a ‘nuclear winter’ for many consumer-focused fintechs, Monarch stands out as a beacon of hope, showcasing strategic growth and innovative service offerings.

Monarch’s recent fundraising not only cements its valuation at $850 million but also demonstrates investor confidence in its unique approach to personal finance management. The company aims to become a comprehensive solution for users, combining budgeting tools, spending tracking, and investment management all in one place. As they further establish their foothold in the market, Monarch’s ability to innovate within the financial landscape positions it as a frontrunner amid the ongoing evolution of consumer fintech.

The Rise of Consumer Fintech: Navigating a Competitive Landscape

The rise of consumer fintech has transformed how individuals manage their finances, with apps like Monarch leading the charge. With a focus on user-friendly interfaces, these platforms enable quicker budgeting and tracking of financial goals, which is especially important as users seek alternatives following the discontinuation of traditional tools like Mint. Monarch is capitalizing on a gap in the market, appealing to users who value a seamless budgeting experience and prioritize privacy over advertising.

Despite the challenges faced by many fintech startups today, the demand for innovative budgeting tools continues to grow. Monarch’s twenty-fold increase in subscribers following Mint’s closure illustrates the appetite for robust personal finance management solutions. By prioritizing a subscription-based model over ad-driven revenue, Monarch is not only maintaining user trust but also fostering a sustainable business model that can weather economic uncertainties.

Innovative Features of the Monarch App: A Game Changer in Personal Finance

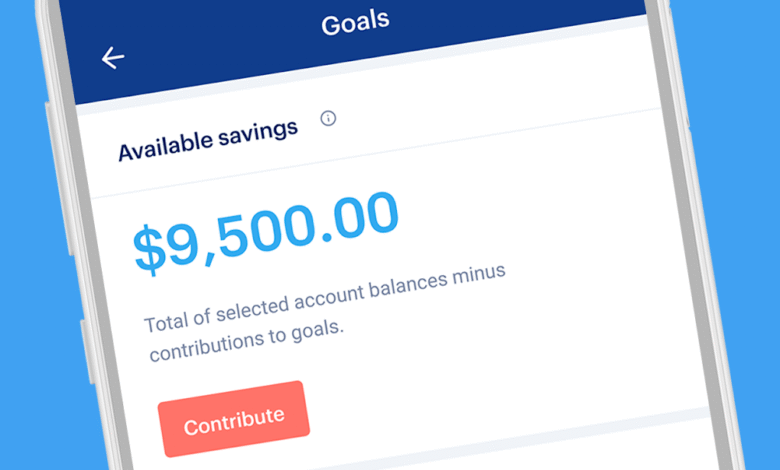

The Monarch app is redefining personal finance management with its unique features designed to enhance user experience. Unlike many traditional budgeting tools that often complicate financial oversight, Monarch focuses on simplifying the onboarding process for new users. This frictionless experience is highlighted by its easy integration with various accounts, allowing users to seamlessly track spending and set money goals without the usual hassle associated with financial applications.

Moreover, the app’s emphasis on collaboration sets it apart from competitors. Monarch allows users to share insights and financial plans easily, which fosters a community-oriented approach to personal finance management. This feature has been a significant draw for families and couples aiming to manage their goals collectively. As Monarch continues to evolve and innovate, its user-centric philosophy positions it as a leader in the consumer fintech space.

Adapting to Market Challenges: Monarch’s Resilience in Tough Times

In an era where many fintech companies are struggling, Monarch’s ability to raise $75 million amidst challenging market conditions speaks volumes about its resilience and adaptability. The financial landscape is currently marked by a ‘nuclear winter’, where investor confidence has waned, yet Monarch’s strategic pivot in offering comprehensive tools with tangible value has captivated its audience. The emphasis on subscriber growth rather than ad revenue is a testament to its commitment to enhancing user experience and building long-term relationships.

Monarch’s founders understand the importance of differentiation in the crowded fintech space, which enables them to attract investors despite broader market volatility. Their successful fundraising efforts suggest that there are still opportunities for fintech startups that possess clear, innovative offerings that align with changing consumer needs. By focusing on financial wellness without the excess baggage that often accompanies ad-based models, Monarch not only addresses immediate market concerns but also prepares itself for future growth.

Consumer Trends Shaping the Future of Personal Finance Management

Consumer trends play a crucial role in shaping the future of personal finance management applications like Monarch. As consumers become more financially conscious and tech-savvy, there has been a notable shift towards apps that provide clear insights into spending habits and personal finance goals. Monarch’s success aligns with these trends, particularly with its consumer-focused features that emphasize ease of use and accessibility—a major consideration for today’s users.

Additionally, as consumers increasingly prioritize privacy and data security, Monarch’s subscription model resonates well with users who are weary of free services that rely heavily on advertising and data monetization. This trend emphasizes the growing need for applications that empower users rather than exploit them, fostering a financial ecosystem built on trust and reliability. Monarch is strategically positioned to capitalize on these trends, aligning its features with what modern consumers value most.

Financial Privacy and Security: A Core Value of Monarch

In the current digital age, financial privacy and security have become paramount concerns for users of personal finance applications. Monarch’s subscription-based model offers a significant advantage in this regard, as it eliminates the reliance on advertising and the potential risk of users’ sensitive financial data being sold to third parties. This approach appeals to a discerning audience increasingly aware of the implications of data privacy in the fintech space.

By prioritizing user security and implementing robust protective measures, Monarch establishes itself as a trustworthy option among its competitors. As more consumers express concerns about data breaches and financial exploitation, companies like Monarch that emphasize privacy will see enhanced customer loyalty and long-term growth. This focus on protecting user information not only differentiates Monarch from free services but also strengthens its value proposition in a competitive market.

Consumer Fintech Growth: Insights into Market Dynamics

The consumer fintech market is experiencing significant growth, driven by increasing user demand for accessible financial tools. Monarch’s recent fundraising efforts reflect broader market dynamics, where investors are still eager to support promising startups that demonstrate innovative solutions to longstanding financial problems. This growth is indicative of a larger trend within the fintech sector, where users are seeking more comprehensive and user-friendly personal finance management options.

Moreover, the transition from traditional financial services to digital solutions presents both opportunities and challenges for players like Monarch. With consumers becoming more reliant on their smartphones for financial management, there is a growing expectation for apps to provide not just basic budgeting tools, but also sophisticated functionalities that enhance overall financial well-being. Monitoring these trends and adapting strategies to meet evolving consumer expectations is essential for sustained success in the fast-paced world of fintech.

Budgeting Tools: The Heart of Personal Finance Management

Budgeting tools are central to effective personal finance management, making them a vital feature of any financial app, including Monarch. These tools enable users to meticulously track their income and expenses, helping them to allocate resources more efficiently and ultimately reach their financial goals. Monarch’s user-friendly budgeting capabilities simplify the budgeting process, empowering consumers to gain deeper insights into their financial behavior.

With the growing importance of financial literacy, budgeting tools are increasingly recognized for their critical role in promoting responsible spending and saving habits. As consumers seek to take control of their financial futures, Monarch’s emphasis on intuitive budgeting solutions positions it as an essential resource in the competitive fintech landscape. By continuously enhancing these tools and integrating user feedback, Monarch can solidify its place as a leader in personal finance technology.

The Importance of Innovation in Fintech: Monarch’s Vision

Innovation continues to be a driving force in the fintech sector, and Monarch exemplifies this ethos through its forward-thinking approach. Co-founder Val Agostino’s vision mirrors a deep understanding of the market’s needs and challenges, enabling the company to design features that resonate with users. By tackling the complexities of personal finance with innovative solutions, Monarch sets a precedent for what the future of financial management can look like.

As the consumer fintech space evolves, it’s imperative for companies like Monarch to not only react to market changes but to anticipate consumer needs proactively. This involves leveraging emerging technologies and adapting existing tools to offer users a more holistic and enjoyable financial experience. Through a commitment to innovation, Monarch positions itself as a frontrunner in a sector that demands continuous improvement and adaptation.

Frequently Asked Questions

What are the main features of the Monarch personal finance app?

The Monarch personal finance app offers comprehensive budgeting tools, allowing users to track spending, investments, and financial goals all in one place. With a focus on ease of use, the app simplifies onboarding accounts and expense tracking, making financial management accessible for everyone.

How does Monarch personal finance app ensure user privacy?

Unlike many other consumer fintech apps, Monarch personal finance app operates on a subscription model. This means they do not need to sell user data or rely on advertising from third parties, ensuring a high level of privacy and data security for its subscribers.

Why has the Monarch personal finance app gained popularity since Mint was shut down?

Monarch personal finance app experienced a surge in subscribers, increasing their user base by twenty times, following the closure of Mint in early 2024. Users seeking alternatives found Monarch’s all-in-one features and privacy-focused model appealing during a period of consumer fintech growth.

What should I know before using the Monarch app for personal finance management?

Before using the Monarch app for personal finance management, it’s important to note its subscription-based service model, which contrasts with free apps like Mint. This model allows Monarch to prioritize user experience without compromising on privacy or relying on advertising.

How does the recent funding impact the growth of the Monarch personal finance app?

The recent $75 million raised by Monarch personal finance app is expected to accelerate its growth and subscriber acquisition efforts. This funding positions Monarch as a strong player in the consumer fintech space amidst challenges faced by other startups.

What challenges do consumers face in personal finance management, and how does Monarch address them?

Managing personal finances can be overwhelming and complex, but the Monarch app simplifies this process. By providing intuitive budgeting tools and an easy-to-use interface, Monarch helps users navigate financial planning effectively, addressing long-standing challenges in the fintech landscape.

How does Monarch plan to innovate in personal finance management?

Monarch is focused on innovation by enhancing user experience with easy sharing options and frictionless onboarding, setting itself apart in the crowded personal finance app market and appealing to users looking for modern solutions.

What impact did the closure of Mint have on consumer fintech growth?

The closure of Mint created a gap in the market for personal finance apps, leading to increased interest in alternatives like Monarch. This has spurred consumer fintech growth as users seek robust budgeting tools that prioritize their financial privacy.

Is Monarch a good alternative to traditional banking apps for budgeting?

Yes, Monarch is a strong alternative to traditional banking apps for budgeting. Its dedicated focus on personal finance management equips users with better tools and features to track and optimize their finances independently.

What makes Monarch different from other budgeting tools?

Monarch differentiates itself through its subscription model, which prioritizes user experience and privacy over advertising. Unlike other budgeting tools, Monarch combines features for spending tracking, investment monitoring, and goal-setting into a single, user-friendly app.

| Key Points |

|---|

| Monarch raises $75 million to boost subscriber growth after Mint’s shutdown. |

| Valued at $850 million, making it one of the largest fintech fundraising rounds in 2025. |

| Cofounders: Ozzie Osman, Jon Sutherland, and Val Agostino. |

| Monarch offers an all-in-one mobile app for money management without ads or selling user data. |

| Subscriber growth surged 20 times after Mint’s closure, as users sought alternatives. |

| The app aims to simplify onboarding and expense tracking, enhancing user engagement. |

| A significant investment round amid a ‘nuclear winter’ for consumer-facing fintech companies. |

Summary

The Monarch personal finance app continues to innovate and grow, having successfully raised $75 million in funding to significantly enhance its services. The shutdown of Mint has opened opportunities for Monarch to expand its subscriber base massively, reinforcing its position as a key player in the fintech space. As consumers increasingly seek comprehensive budgeting tools with a focus on data security and user experience, Monarch is well-equipped to meet these needs and drive satisfactory financial management solutions for families.