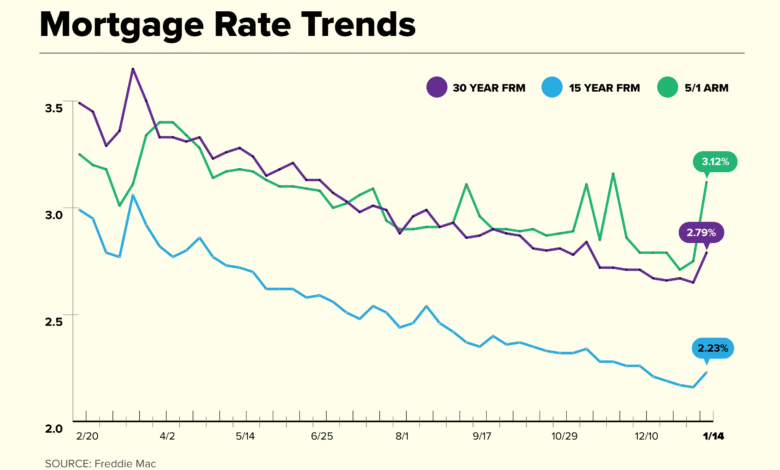

Mortgage Rates Surge Over 7%: Impact on Housing Market

Mortgage rates have recently surged past the 7% mark, recently peaking at 7.04% on May 19, 2025, which is the highest level seen since April of that year. This escalation in US mortgage rates has been largely influenced by Moody’s downgrade of the U.S. credit rating, resulting in increased bond yields that drive mortgage costs higher. Such fluctuations in current mortgage trends are a clear indicator of how underlying factors can significantly affect the housing market impact. Additionally, this spike has contributed to diminished homebuilder sentiment, which has reached its lowest point since late 2023. As mortgage demand wavers due to these rising rates, many prospective homebuyers find themselves challenged, highlighting a pivotal moment for the sector as affordability issues escalate.

As home financing costs rise, the landscape for obtaining a home loan has substantially changed. This uptick in borrowing expenses influences various aspects of real estate, from lender offerings to buyer behavior. Elevated home loan rates force many away from home purchases, illustrating the broader ramifications across the property market ecosystem. Additionally, the current state of the housing sector is characterized by cautious optimism among builders, but their confidence fluctuates in response to these market dynamics. Ultimately, understanding shifts in mortgage financing is crucial for navigating the evolving real estate landscape.

Understanding the Recent Surge in Mortgage Rates

Mortgage rates recently ascended to 7.04%, the highest point in recent history, primarily triggered by Moody’s downgrade of the U.S. credit rating. Such downgrades typically provoke a chain reaction in the financial markets, leading to rising bond yields, which are closely linked to mortgage rates. This surge has significant implications for prospective homebuyers, especially those navigating the complicated landscape of mortgage qualifications and affordability. As rates continue to climb, many buyers are discovering that the opportunities available to them are dwindling.

The spike in mortgage rates not only affects individual homebuyers but echoes broader trends within the housing market. In particular, the increase creates an atmosphere of uncertainty and caution among homebuilders and developers. The National Association of Home Builders recently reported a stark downturn in builder sentiment, which has hovered at its lowest level since late 2023. This sentiment is crucial because it reflects the overall confidence in the market, impacting decisions on new construction and renovation projects.

Impact of Current Mortgage Trends on Buyers and Sellers

Current mortgage trends indicate a shifting landscape for both buyers and sellers. As mortgage rates exceed the 7% threshold, many potential buyers find themselves priced out of the market. The impact of such high rates is particularly pronounced in the current housing market context, where affordability has already been a pressing issue. This situation discourages first-time homebuyers and those with tighter budgets from making offers, directly affecting the demand for homes. Consequently, sellers are faced with challenges in attracting buyers, leading to a stagnant market characterized by falling pending sales.

This trend has further implications, as sellers might be compelled to adjust their expectations in terms of pricing and the urgency of their sales. With a significant drop of 3.2% in pending sales for existing homes year-over-year, the market is responding to external pressures imposed by rising interest rates. Sellers may need to consider offering incentives or adjusting their prices to attract buyers in an increasingly competitive environment where mortgage eligibility is becoming stricter.

How Housing Market Dynamics Are Shaped by Mortgage Demand

The interplay between mortgage demand and housing market dynamics is crucial in understanding the current state of real estate. As mortgage demand has seen a slight uptick in early May, it quickly tapered off as rates soared past 7%. This fluctuation illustrates the sensitivity of the housing market to changes in financing costs. When mortgage rates rise, the balance of supply and demand shifts dramatically, resulting in fewer transactions and a slower market pace.

This environment poses challenges not just for buyers, but also for sellers and builders. With mortgage demand diminishing, many homebuilders may be wary of starting new projects or investing in expansions. The cascading effects on home prices and inventory levels could lead to an overall slowdown in the housing market, countering any previous positive momentum. In this context, market participants must remain aware of the broader economic factors that influence mortgage demand and how these factors can lead to rapid shifts in market conditions.

Examining Homebuilder Sentiment Amid Rising Rates

Homebuilder sentiment has been notably affected by rising mortgage rates, which have created an atmosphere of caution and skepticism within the industry. As rates surpass the crucial line of 7%, builders are reassessing their outlook for the future, leading to lower confidence levels. The decrease in sentiment is symptomatic of a broader concern regarding the affordability crisis facing many potential buyers amidst escalating borrowing costs and flat wage growth.

The implications of declining homebuilder sentiment extend beyond immediate sales figures. As builders scale back their projects or delay new developments, this could result in reduced housing supply, which would eventually impact the market balance. When fewer homes are constructed, it creates a bottleneck situation, which could lead to price increases once demand rebounds—an outcome that could further complicate accessibility for future homebuyers.

The Role of Credit Ratings in Mortgage Rates

Credit ratings play a pivotal role in influencing mortgage rates, as they affect lender confidence in the economic environment. The recent downgrade of the U.S. credit rating by Moody’s is a stark reminder of how interconnected financial systems are, and how such moves can ripple through to everyday mortgage decisions. Lower credit ratings tend to prompt lenders to increase interest rates to mitigate perceived risks, contributing to fluctuations in mortgage costs for consumers.

This reaction underscores the importance of credit ratings in shaping borrowing conditions. For prospective homeowners, the implications are significant, particularly in a market already facing elevated rates. As lenders respond to economic signals, buyers may find themselves confronted with tougher borrowing conditions or more stringent qualification criteria—factors that are particularly impactful as they navigate the home buying process.

Future Predictions for Mortgage Rates and Housing Market

As we look to the future, predictions for mortgage rates suggest potential volatility amid uncertain economic conditions. Analysts speculate that rates may continue to fluctuate based on various factors, including government policies, market sentiment, and macroeconomic indicators. The current trend of rising rates could persist if the economic landscape remains unstable, impacting mortgage affordability for many consumers.

These future trends will be crucial not just for individual buyers but for the overall health of the housing market. Should rates continue to rise, we may see more prospective buyers exit the market, further influencing homebuilder sentiment and reducing construction activity. This scenario points to a pressing need for adaptive strategies among consumers and industry players to navigate the complexities of mortgage financing in a potentially shifting economic landscape.

Understanding How Market Trends Influence Buyer Behavior

Buyer behavior in the housing market is intricately tied to broader market trends, particularly mortgage rates and economic indicators. With mortgage rates exceeding 7%, many buyers are reconsidering their purchasing strategies. High rates often lead to hesitation, as potential buyers weigh the cost of long-term financing against their current financial stability and housing goals.

This trend becomes more pronounced as buyers evaluate their options and the feasibility of home purchases amidst changing economic conditions. For some, waiting for a possible dip in rates may appear more attractive than committing to a high-interest mortgage. Such behavioral shifts can lead to altered dynamics in the housing market, creating possibilities for negotiation strategies and influencing sales cycles.

The Consequences of Mortgage Rate Fluctuations on Home Prices

Fluctuations in mortgage rates have direct consequences on home prices, creating a complex feedback loop within the housing market. As rates rise, affordability declines, prompting some buyers to retreat or lower their price offers. This can lead to a cooling of the previously heated housing market, with price adjustments becoming more common as sellers respond to reduced demand.

In contrast, if mortgage rates were to stabilize or decline in the future, we could see renewed interest from buyers, which might reignite competition and drive prices up once again. Understanding these price dynamics is vital for both buyers and sellers as they strategize their next steps in a continuously evolving market.

Navigating the Housing Market in a High-Rate Environment

Navigating the housing market in an environment of high mortgage rates requires strategic planning and comprehensive market knowledge. Potential homebuyers must assess their financial readiness and consider various financing options to secure the best possible mortgage terms. Failing to do so can lead to strife, especially as lifestyle changes and financial commitments collide with increasing borrowing costs.

For sellers, adapting strategies to meet the challenges posed by high mortgage rates becomes essential. This may involve setting competitive price points, considering buyer concessions, or enhancing property listings to attract a diverse pool of potential buyers. By remaining informed and adaptable, both buyers and sellers can find pathways to success in a complex, high-rate housing market.

Frequently Asked Questions

What are the current US mortgage rates as of May 2025?

As of May 19, 2025, US mortgage rates have crossed back over 7%, reaching 7.04%. This marks the highest rate since April 2025 and reflects recent market shifts following a downgrade of the U.S. credit rating by Moody’s.

How do current mortgage trends affect homebuilder sentiment?

Current mortgage trends, particularly the rise in rates exceeding 7%, have negatively impacted homebuilder sentiment, bringing it to the lowest levels seen since the end of 2023, as builders react to decreased affordability for potential buyers.

What is the impact of rising mortgage rates on the housing market?

Rising mortgage rates, especially those surpassing 7%, significantly affect the housing market by reducing mortgage demand among buyers, causing a decline in pending sales of existing homes and complicating the purchasing process for many.

How did the downgrade of the U.S. credit rating influence mortgage rates?

The downgrade of the U.S. credit rating by Moody’s has led to an increase in bond yields, which typically drive mortgage rates higher. This market reaction has caused current US mortgage rates to spike above the 7% mark.

Is there a correlation between mortgage demand and home sales?

Yes, there is a direct correlation between mortgage demand and home sales; as mortgage rates rise and exceed 7%, potential buyers tend to pull back, leading to a drop in home sales and a decrease in overall market activity.

| Date | Mortgage Rate | Event Triggering Rate Change | Impact on Homebuilders | Pending Home Sales Change | Market Demand |

|---|---|---|---|---|---|

| May 19, 2025 | 7.04% | Moody’s downgrade of U.S. credit rating | Lowest sentiment since end of 2023 | -3.2% year-over-year | Sharp decrease as rates exceeded 7% |

Summary

Mortgage rates are significantly affecting the housing market as they recently climbed over 7% for the first time since April 2025. This increase, attributed to a U.S. credit rating downgrade by Moody’s, not only affects home affordability for potential buyers but also negatively impacts homebuilder sentiment and pending sales. With market demand dropping sharply as rates rise, buyers are finding it increasingly difficult to participate in the housing market.