New Jersey Deli Fraud: Father and Son Sentenced to Prison

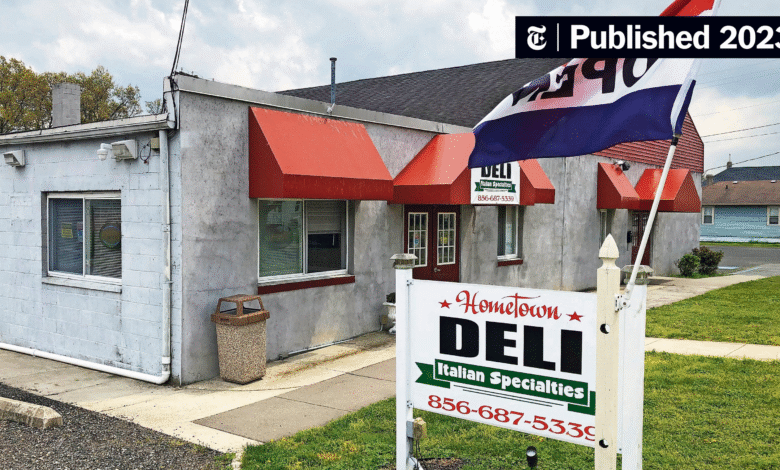

In a shocking turn of events, New Jersey deli fraud has surfaced as a major case of corporate deceit, spotlighting the actions of Peter Coker Jr. and his father, who were both sentenced for their involvement in the notorious $100 million scheme. Their business endeavor, Hometown International, which operated a modest deli, was revealed to be merely a facade for inflating stock prices to astronomical heights. The case has captured public attention, not only for the scale of the fraud but also for its implications in the broader context of financial ethics and corporate responsibility. By manipulating share values through a related shell company, E-Waste, the Cokers managed to mislead investors, highlighting severe lapses in oversight within the investment community. With losses affecting notable institutions like Vanderbilt and Duke universities, this deli fraud case serves as a stark reminder of the ongoing issues surrounding corporate fraud and the need for tighter regulatory measures.

The recent developments surrounding the Hometown International scandal illustrate a profound lapse in the integrity of corporate governance. The fraudulent activities, characterized by inflated stock prices and deceptive business practices, have sparked widespread discussions about the ethical considerations in company operations. As the saga unfolds, we are reminded of the potential pitfalls in the stock market, particularly related to shell companies and their misleading influence on investment dynamics. This striking case of deli-related deception raises crucial questions about accountability in the financial sector and highlights the essential need for stronger regulations to safeguard investors. As we examine these events, it becomes clear that corporate malfeasance can have far-reaching consequences that impact not only financial institutions but also the broader economy.

Understanding the Implications of the New Jersey Deli Fraud Case

The $100 million New Jersey deli fraud case, involving Peter Coker Jr. and his father, Peter Coker Sr., serves as a harrowing illustration of corporate malfeasance in the modern financial landscape. Their actions, which included the fraudulent inflation of stock prices for both Hometown International and its associated shell company, E-Waste, have raised serious questions about governance and oversight in public trading companies. With a market capitalization that greatly exaggerated the real value of a deli operating at a loss, this case underscores the critical need for regulators to enforce stringent measures against corporate fraud.

Moreover, the fallout from the deli fraud case has brought to light the vulnerabilities in how corporate entities can manipulate public perception through inflated financial statements. Stakeholders, including prominent investors from institutions like Vanderbilt and Duke universities, felt the sting of significant financial losses estimated at around $5 million due to these deceptive practices. This incident is not only a cautionary tale about the repercussions of corporate fraud but also highlights the inadequate checks and balances that allowed such a scam to thrive.

Frequently Asked Questions

What was the New Jersey deli fraud case involving Peter Coker Jr. and Hometown International?

The New Jersey deli fraud case involved Peter Coker Jr. and his father, Peter Coker Sr., who were sentenced for their roles in a fraudulent scheme that inflated the stock prices of their company, Hometown International, and its related shell company, E-Waste. Despite operating a small, money-losing deli in South Jersey, they achieved an unrealistic market capitalization exceeding $100 million, which misleadingly attracted investors.

How did the New Jersey deli fraud case affect investors and institutions?

The New Jersey deli fraud case significantly impacted investors and institutions, resulting in estimated losses of around $5 million. Notable investors, including prestigious universities like Vanderbilt and Duke, were affected by the deceptive practices that inflated the stock prices without any real financial performance from Hometown International.

What were the sentences given to Peter Coker Jr. and Sr. in the New Jersey deli fraud case?

In the New Jersey deli fraud case, Peter Coker Jr. was sentenced to 40 months in prison, while his father, Peter Coker Sr., received a six-month prison sentence followed by six months of home confinement. Both men acknowledged their involvement in the corporate fraud intended to attract merger partners.

What were the key actions that led to the New Jersey deli fraud charges?

Key actions leading to the New Jersey deli fraud charges include the deliberate inflation of stock prices for Hometown International and E-Waste, despite the companies being fundamentally worthless. The Cokers engaged in a multi-year scheme that involved misleading investors and regulators about the companies’ financial health.

What regulatory implications arose from the New Jersey deli fraud case?

The New Jersey deli fraud case raised significant regulatory implications by highlighting the need for better oversight in the financial sector. The sophisticated and premeditated nature of the fraud demonstrated the potential for manipulation in corporate structures and stock valuations, prompting discussions about how to prevent such schemes in the future.

What health issues did Peter Coker Jr. face during the New Jersey deli fraud proceedings?

During the New Jersey deli fraud proceedings, Peter Coker Jr. faced severe health issues attributed to alcohol abuse, which contributed to his emotional state during the court hearings. He expressed remorse for his actions, stating that the experience profoundly changed him.

What was the market capitalization of Hometown International before the New Jersey deli fraud revelations?

Before the revelations of the New Jersey deli fraud, Hometown International achieved an outrageous market capitalization of over $100 million, which was particularly striking given that it operated a small deli that was consistently losing money.

Why was the New Jersey deli fraud case deemed sophisticated by the court?

The court deemed the New Jersey deli fraud case sophisticated due to the well-planned and multi-faceted strategies employed by the defendants over several years. Judge Christine O’Hearn noted the intentional nature of the fraud, which involved complex corporate maneuvers aimed at misleading investors and inflating stock prices without any legitimate business backing.

What ethical lessons can be learned from the New Jersey deli fraud case?

The New Jersey deli fraud case serves as a cautionary tale about the critical importance of ethical standards in corporate governance. It underscores the risks of corporate fraud and the devastating impact that deceptive practices can have on investors, the financial market, and the reputations of individuals involved.

What consequences did Peter Coker Sr. face following the New Jersey deli fraud case?

Following the New Jersey deli fraud case, Peter Coker Sr. was sentenced to six months in jail, six months of home confinement, and ordered to pay a $500,000 fine along with restitution costs. He expressed deep regret for his actions, acknowledging the serious consequences on his family and financial institutions.

| Key Point | Details |

|---|---|

| Sentences Issued | Peter Coker Jr.: 40 months; Peter Coker Sr.: 6 months + 6 months home confinement |

| Fraud Amount | $100 million related to the New Jersey deli fraud |

| Company Involved | Hometown International, which owned a money-losing deli, and its shell company, E-Waste |

| Market Capitalization | Over $100 million despite low operational revenue |

| Fraud Details | Inflated stock prices through premeditated fraudulent schemes |

| Financial Impact | Approximately $5 million in losses for investors like Vanderbilt and Duke universities |

| Remorse and Consequences | Both Cokers expressed regret; Coker Jr. faced personal issues including health and citizenship renunciation |

| Judge’s Comments | Judge Christine O’Hearn noted the sophisticated and premeditated nature of the fraud |

| Public Reaction | Case sparked discussions about regulatory oversight in the financial sector |

Summary

The $100 million New Jersey deli fraud case has unveiled critical insights into corporate malpractice and regulatory oversight. This shocking scheme, involving Peter Coker Jr. and his father, resulted in significant financial losses for numerous investors while illustrating the dangers of inflated stock valuations. As the legal proceedings highlighted the premeditated nature of their fraudulent actions, it serves as a stark reminder of the need for vigilance in the financial sector to protect investors and maintain integrity in corporate practices.