Next Fed Chair Credibility Challenges Under Trump Pressure

The next Fed chair credibility represents a pivotal concern as President Trump increasingly presses the Federal Reserve to align its monetary policy with his economic agenda. Discussions of his influence over the Fed chair appointment raise significant issues regarding the independence of the central bank, a hallmark of its operational integrity. Trump’s inclination to consider a ‘shadow Fed chair’ until Jerome Powell’s term concludes underscores the pressure on the next appointee. Analysts, such as TS Lombard economist Dario Perkins, warn that the forthcoming chair could be perceived as a mere puppet, undermining the credibility of monetary policymaking. This scenario casts a shadow over the Federal Reserve’s ability to function autonomously and protect its pivotal role in the broader economy.

In the evolving landscape of U.S. monetary reform, the credibility of the future Federal Reserve chair is at a critical juncture, particularly as political pressures mount. The anticipated Fed chair selection could significantly affect how investors perceive the institution’s impartiality, especially given Trump’s overt attempts to sway interest rate decisions. As speculation arises over the placement of a so-called ‘shadow chair’ during this transitional phase, the implications surrounding the independence of the Federal Reserve come into sharp focus. With a dual mandate to achieve stable inflation and full employment, the next appointee will need to navigate these political currents carefully. Ultimately, questions about their appointment may redefine expectations around the central bank’s resilience against partisan influences.

The Importance of Credibility in the Next Fed Chair Appointment

Credibility is a crucial asset for the Federal Reserve, as it shapes public and market perception of the Fed’s independence and effectiveness. The next Fed chair’s credibility is already in doubt, particularly given President Trump’s previous comments regarding monetary policy and his intention to influence interest rate decisions. If the new chair is seen as merely a puppet of the Trump administration, it could undermine the Federal Reserve’s long-standing reputation for impartiality in its monetary policy decisions.

This credibility issue is compounded by the discussions surrounding the potential appointment of a ‘shadow chair.’ Such a position raises questions about the integrity of the selection process and the motives behind it. Many within the investment community fear that a shadow Fed chair could lead to a perception of ideological alignment with the administration, rather than a commitment to monetary principles established to foster stable economic growth.

The Impact of Trump’s Influence on Federal Reserve Independence

The independence of the Federal Reserve is a cornerstone of its operation, allowing it to make decisions based on economic data rather than political pressures. However, Trump’s push for lower interest rates has sparked concerns regarding the Fed’s autonomy. Investors and economists alike are questioning whether the next Fed chair will be able to maintain this independence amidst mounting pressure from the Trump administration. With the current chair, Jerome Powell, grappling with such pressures, any successor could find themselves walking a fine line between adhering to traditional monetary policy and responding to Trump’s demands.

Trump’s approach to monetary policy, including the possible installation of a shadow chair, raises significant red flags for the future of the Fed. The perception that the next chair could be selected primarily to execute the administration’s monetary agenda could lead to decreased credibility in the markets, ultimately affecting investment decisions. As the Fed works to manage inflation and employment, it is vital that its leadership remains insulated from political machinations to ensure effective economic governance.

The Risks of Appointing a Shadow Fed Chair

The idea of appointing a shadow chair to exert influence over the Federal Reserve introduces several risks that could destabilize the market and affect economic predictions. This approach not only raises questions about the integrity of the Federal Reserve’s decision-making process but also heightens uncertainty for investors who rely on clear and coherent monetary policy. A shadow chair could lead to confusion regarding official policies and potentially create discord within the Federal Reserve itself, further complicating the chair’s ability to foster stable economic growth.

Moreover, the appointment of a shadow chair can damage the reputation of the appointed individual even before they officially take on the role. As Lev Menand points out, being nominated in advance casts a long shadow on the nominee, which can result in a tarnished reputation and increased pressure to conform to politically charged expectations. Thus, the risks surrounding a shadow chair extend beyond immediate political influence to include long-term implications for the credibility and authority of the entire institution.

Potential Consequences for Markets Amid Trump’s Monetary Agenda

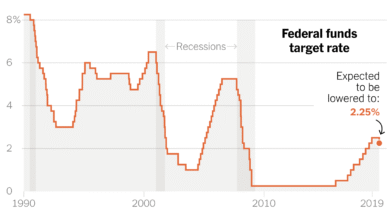

The current climate of uncertainty regarding the Federal Reserve’s future path has potential consequences for financial markets that investors cannot ignore. The possibility of significant rate cuts, as desired by Trump, poses risks that could exacerbate inflationary pressures while simultaneously destabilizing markets. Any perceived or real alignment of the new Fed chair with the administration could erode trust in the Fed, leading to volatility that is harmful for investors relying on consistent and reliable monetary guidance.

With market volatility often tied to shifts in monetary policy and the perception of the Fed’s credibility, ensuring that the next chair embodies the independence of the Federal Reserve is essential. Uncertainty surrounding interest rate decisions can lead to market reactions that are unpredictable, further complicating economic forecasts. Therefore, as discussions about possible nominations heat up, the focus must pivot to maintaining the credibility of the Fed amid external pressures.

Navigating the Challenges of the Next Fed Chair

The path forward for the next Fed chair is fraught with challenges that require a deft hand. The mounting pressure from the Trump administration to adopt a more aggressive monetary policy could overshadow the chair’s initial goals and strategies. Even before the new chair is appointed, the narrative surrounding their selection will likely focus on their ability or willingness to comply with Trump’s wishes, rather than their expertise or vision for the economy.

Ultimately, the new chair will need to navigate a complex landscape where they must balance the interests of the public, maintain the independence of the Federal Reserve, and still meet the challenges set forth by the economic realities of the moment. Creating a narrative of credibility and independence will be an uphill battle, particularly if the influence of Trump continues to loom over the Fed.

The Role of Economic Data in Federal Reserve’s Decision-Making

The Federal Reserve operates under a dual mandate to ensure maximum employment and stable prices, relying heavily on economic data to inform its decisions. The next Fed chair must remain steadfastly committed to this principle, prioritizing economic indicators over political pressures. This commitment to data-driven decision-making is essential for maintaining confidence in the Fed’s ability to steer the economy effectively, especially amidst calls for more aggressive monetary policy.

As the next chair takes the helm, the ability to interpret and react to economic data will play a critical role in their success. Balancing the recommendations of economic advisors while resisting political influence will require a strong resolve and clear communication with the public. The pressure to conform to the expectations set by Trump regarding interest rate cuts could cloud the chair’s judgment, making adherence to empirical data pivotal for gaining respect and trust in the volatile financial landscape.

Exploring Potential Successors to Powell

Among the names floated as potential successors to Jerome Powell is Treasury Secretary Scott Bessent, who has expressed support for making early nominations. Another contender is Kevin Warsh, a former Federal Reserve governor, who may appeal to those seeking a less politically entangled Fed leadership. Each of these candidates brings their own perspectives on monetary policy and the pivotal role of the Federal Reserve amid evolving economic challenges under the Trump administration.

The decision on who will step into the role of the next Fed chair should not be taken lightly, considering the implications for both monetary policy and market confidence. Each possible appointment carries its baggage, as financial markets will scrutinize their previous statements and actions to gauge their likely behavior in office. The credibility challenges that could arise from a politically motivated appointment warrant careful consideration from both Trump and the Senate, as the future of the Federal Reserve’s independence hangs in the balance.

Market Reactions to Fed Chair Nomination Scenarios

Market reactions to the potential nomination of a new Fed chair can be immediate and profound, especially if uncertainty reigns regarding the chair’s commitment to independence from politics. Investors typically react negatively to uncertainty; thus, the risk of introducing a chair perceived as aligned with Trump’s agenda can lead to market volatility. Historical data shows that significant announcements concerning Fed leadership can trigger sharp market movements, often in response to the anticipated policy direction.

Moreover, if the upcoming Fed chair is perceived to prioritize Trump’s monetary policy objectives over the traditional dual mandate of the Fed, this could further diminish market confidence. Investors are keenly aware of the implications of a politically compromised Fed and will likely adjust their portfolios based on the expected stability of monetary policy. Therefore, the next nomination process not only shapes the future of the Federal Reserve but also the broader investment landscape.

Long-Term Implications for Economic Policy with a New Fed Chair

The selection of the next Fed chair will undoubtedly have long-term implications for economic policy in America. The relationship between the administration and the new chair will shape monetary policy for years to come, influencing decisions around interest rates, inflation control, and employment strategies. This relationship can either reinforce the Fed’s independence or contribute to a perception of partisanship that could undermine the institution’s foundational principles.

As we look ahead, fostering a transparent and independent Federal Reserve will be pivotal in ensuring effective governance within the economy. The next Fed chair must strive to communicate their commitment to upholding the Fed’s mission, navigating external pressures while focusing on sound economic data. Ultimately, the challenge will be to craft a monetary stance that balances political realities while delivering stability and confidence in financial markets for the long haul.

Frequently Asked Questions

What challenges does the next Fed chair face regarding credibility?

The next Fed chair faces significant credibility issues as President Trump’s influence on monetary policy raises questions about the chair’s independence and integrity. The appointment is further complicated by fears of being perceived as merely fulfilling Trump’s agenda, potentially undermining the Federal Reserve’s traditional apolitical position.

How might Trump’s shadow Fed chair influence monetary policy?

Trump’s proposed shadow Fed chair could exert pressure on the Federal Reserve to lower interest rates, raising concerns about the institution’s independence. This situation could lead to a perception that the next Fed chair is compromising their credibility by aligning too closely with political objectives instead of focusing on economic data.

Why is the Federal Reserve’s independence important for the next Fed chair?

The independence of the Federal Reserve is crucial as it allows for unbiased monetary policy decisions that promote stable inflation and full employment. The next Fed chair should prioritize this independence to maintain market confidence, especially in light of concerns regarding potential political pressures from the Trump administration.

What is the impact of early nominations for the next Fed chair?

Early nominations for the next Fed chair, while potentially smoothing the Senate confirmation process, could lead to reputational risks. The prospective chair may face increased pressure to conform to political expectations, potentially undermining their credibility and the Federal Reserve’s independence.

What are investors’ concerns regarding the next Fed chair under Trump?

Investors are worried that the next Fed chair may lack credibility due to Trump’s direct involvement in the appointment process. This concern stems from the fear that the next chair’s monetary policy decisions may be unduly influenced by political motives rather than economic stability, leading to increased market volatility and uncertainty.

Who are potential candidates for the next Fed chair?

Potential candidates for the next Fed chair include Treasury Secretary Scott Bessent, Kevin Warsh, and National Economic Council leader Kevin Hassett. Each has different viewpoints about the implications of the Fed chair appointment process, particularly concerning the risks related to the shadow Fed chair concept.

How can the next Fed chair maintain credibility in a politically charged environment?

To maintain credibility, the next Fed chair must clearly demonstrate a commitment to the Federal Reserve’s dual mandate of stable inflation and full employment, while also negotiating political pressures effectively. Transparency in decision-making and maintaining a focus on unbiased economic data are key to preserving the Fed’s independence.

What could be the consequences of significant rate cuts under the next Fed chair?

Significant rate cuts by the next Fed chair could exacerbate inflationary concerns and provoke instability in the markets. Given Wall Street’s aversion to uncertainty, any perceptions of political influence on the Fed could further diminish confidence in monetary policy and lead to increased market volatility.

| Key Points |

|---|

| Trump’s influence on Fed’s independence raises credibility concerns for the next chair. |

| Potential appointment of a ‘shadow chair’ to pressure the Fed until Jerome Powell departs. |

| Doubts about the integrity of the next chair are already causing unease among investors. |

| Federal Reserve typically operates with a dual mandate, focusing on data rather than political pressures. |

| Concerns exist that the next chair may cater to Trump’s monetary agenda, undermining the Fed’s apolitical nature. |

| The potential for significant rate cuts could lead to increased inflationary pressures. |

| Early nominations may result in reputational damage or increased political pressures for the nominee. |

Summary

The next Fed chair credibility is at risk amid President Trump’s attempts to assert control over monetary policy. With concerns regarding the next chair’s integrity and independence already brewing, it is crucial to address these challenges to ensure the Federal Reserve can effectively meet its dual mandate. Maintaining the Fed’s reputation and avoiding politicization should be paramount as the next appointee navigates a politically charged environment.