NFT Sales Surge in July but Fall Short of 2024 Highs

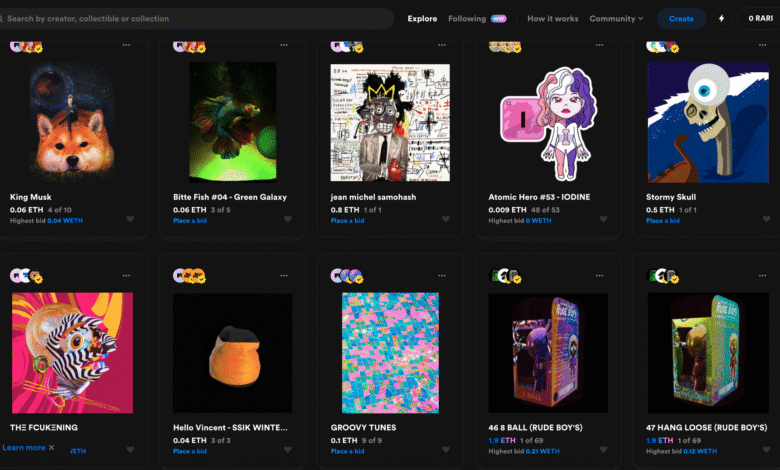

NFT sales have experienced a notable resurgence in July, boasting a remarkable 50.14% increase compared to the previous month. Yet, despite this promising spike, they remain 35.02% lower than the highs seen in late 2024, indicating the challenges that persist within the NFT market. Ethereum NFT sales led the way, contributing a staggering $296.5 million, largely fueled by popular NFT collections like Cryptopunks and Pudgy Penguins. These dynamic shifts in cryptocurrency sales reflect evolving trends in digital collectibles, revealing both the resilience and volatility of the NFT landscape. Investors and collectors alike are closely watching NFT market trends to discern whether July’s uptick marks the beginning of a sustained recovery or just a fleeting moment in the ongoing fluctuation of this fascinating domain.

The realm of digital assets has witnessed a resurgence with the recent boost in NFT transactions, indicating a potential revival in this once-booming sector. Non-fungible tokens, often referred to as digital collectibles, have found renewed interest amid fluctuating market conditions. Notably, the Ethereum blockchain stands out as a leader in this space, showcasing impressive sales figures that reflect broader trends in the cryptocurrency landscape. As collectors dive back into various NFT collections, the question remains whether this renewed enthusiasm can translate into lasting stability in the NFT market. Observers are eager to see if this revitalization can sustain momentum and lead to a robust future for the digital asset ecosystem.

Understanding the NFT Sales Landscape

The non-fungible token (NFT) market has experienced a remarkable transformation, characterized by significant spikes and drops in sales volume. The July sales increase of 50.14% over June reflects a potential resurgence of interest in the NFT buying market. However, it’s crucial to analyze the broader landscape to understand the implications of such movements in the NFT sales figures. Historically, NFT collections like Cryptopunks and Pudgy Penguins have demonstrated volatility in demand, which is often driven by trends in the cryptocurrency market as a whole, particularly Ethereum, the leading blockchain for NFTs.

In the backdrop of this resurgence lies a deeper analysis of the factors influencing NFT sales trends. The fluctuations seen in July, despite being promising, still indicate a market that is significantly down from the explosive highs of late 2024. The NFT ecosystem has been impacted by various external factors, including changes in investor sentiment, regulatory developments in cryptocurrency sales, and the overall health of the blockchain economy. Understanding these nuances is essential for stakeholders looking to navigate this intricate market.

Frequently Asked Questions

What caused the recent spike in NFT sales in July 2025?

The spike in NFT sales in July 2025 can be attributed to a 50.14% increase compared to June, largely driven by successful NFT collections such as Cryptopunks and Pudgy Penguins. Ethereum NFT sales led the surge, accounting for $296.5 million in volume, marking a significant rebound in interest within the NFT market.

How do Ethereum NFT sales compare to other blockchain NFT sales?

As of July 2025, Ethereum NFT sales dominated the market with $296.5 million, representing a 69.63% increase. In comparison, Bitcoin NFTs brought in $77.4 million, while Polygon followed with $62.1 million. This shows Ethereum’s continuing lead in NFT sales, highlighting its pivotal role in the digital collectibles space.

What are the trends influencing NFT market sales in 2025?

In 2025, the NFT market trends indicate a mixed performance. Following a substantial drop from 2021 highs, July saw a momentary recovery with a 50% uplift in sales. Key collections have shown volatility, but Ethereum’s continued growth signals a potential shift in consumer interest towards more established NFT collections.

Are NFT collections like Cryptopunks and Pudgy Penguins driving current NFT sales?

Yes, recent NFT sales have been significantly influenced by popular NFT collections such as Cryptopunks and Pudgy Penguins. These collections achieved remarkable sales increases of 491.79% and 369.58%, respectively, showcasing how top-tier digital collectibles are rejuvenating interest in NFT sales.

How do cryptocurrency sales impact the overall NFT market?

Cryptocurrency sales are intrinsically linked to the NFT market as they provide the primary means for purchasing NFTs. Fluctuations in the prices of cryptocurrencies like Ethereum can directly influence NFT sales, making the overall health of cryptocurrency markets essential for sustained NFT market growth.

What can NFTs expect in terms of future sales volume trends?

Future sales volume trends for NFTs remain uncertain. While July 2025 saw a notable increase, overall NFT sales are still substantially lower than late 2024 figures. If market conditions improve and interest in digital collectibles continues, we may see a gradual recovery in NFT sales.

How do BRC-20 NFTs compare to Ethereum NFT sales?

BRC-20 NFTs generated $18.9 million in July 2025, showcasing a growth of 68.54% in sales. While significantly lower than Ethereum NFT sales which accounted for $296.5 million, this indicates a growing diversification in the types of NFTs consumers are interested in.

What challenges does the NFT market face in 2025?

The NFT market continues to experience challenges, including a significant decline from its 2021 peak, with monthly sales struggling to reach past billion-dollar figures. As seen in July’s data, despite a rise in sales, the market is still down 35% from December 2024, indicating ongoing volatility.

Are there emerging markets for NFTs beyond Ethereum?

Yes, while Ethereum remains the leader in NFT sales, other blockchains like Bitcoin and Polygon are emerging with significant contributions. In July, Polygon recorded $62.1 million in sales, indicating that the NFT market is expanding into diverse blockchain ecosystems.

What should investors monitor in NFT collections for potential growth?

Investors should keep an eye on trends such as sales volumes, collection popularity, and emerging NFT projects. Paying close attention to historical performance and shifts in consumer interest can provide insights into which NFT collections may see future growth.

| Key Point | Details |

|---|---|

| NFT Sales Increase | July 2025 saw a 50.14% increase in NFT sales compared to June. |

| Sales Comparison to Previous Year | Despite the increase, NFT sales were down 35.02% from December 2024. |

| Ethereum’s Performance | Ethereum led NFT sales with $296.5 million, a 69.63% increase. |

| Top Collections | Cryptopunks generated $62.7 million, up 491.79%, and Pudgy Penguins saw $26.2 million, a 369.58% rise. |

| Bitcoin NFTs | Ranked second with $77.4 million in sales, an increase of 45.79%. |

| Polygon’s Sales | Ranked third with $62.1 million, although Courtyard NFTs dropped by 25.62%. |

| Market Trends | Overall NFT sales are still down significantly since their peak, with varying performance across blockchains. |

Summary

NFT sales experienced a significant lift in July 2025, showing promise with a 50.14% increase over June’s figures. However, despite this surge, sales remained substantially lower than previous highs in 2024. This ongoing trend highlights the volatility and challenges in the NFT market, emphasizing that while short-term gains can be encouraging, lasting recovery remains uncertain.