Norway Wealth Fund Defense Investment Debate Heats Up

Norway’s wealth fund defense investment is emerging as a crucial topic in the face of escalating global security threats. With the Government Pension Fund Global boasting a staggering $1.8 trillion, the world’s largest sovereign wealth fund is grappling with a longstanding ban on investments in companies producing nuclear weapons components. This restriction, which has existed since the early 2000s, is now being reconsidered, especially as countries ramp up their military capabilities amidst rising geopolitical tensions. The calls for revising the Norway investment ban are echoing through parliament, fueled by the recent conflicts in Ukraine and China’s rearmament efforts. As the defense industry witnesses skyrocketing profits, the debate around ethical and ESG factors in investment becomes ever more pertinent, highlighting the intricate balance between national security and responsible investment.

The conversation surrounding investments from Norway’s sovereign wealth fund into the defense sector is gaining traction as global defense expenditures rise. With the conservative faction advocating for a policy shift, many argue that the existing prohibition on investing in firms linked to weapons manufacturing, such as those associated with nuclear arms, is increasingly outdated. These discussions are further amplified by the pressing threats posed by international conflicts, prompting a reevaluation of Norway’s criteria for ethical investments. Critics of the ongoing investment restrictions assert that logic dictates an alignment between national security needs and investment strategies in the defense industry. As Norway navigates these pressures, it is essential to consider the broader implications on both defense capabilities and responsible governance.

The Case for Revising Norway’s Investment Ban

Norway’s Government Pension Fund Global, known as the world’s largest sovereign wealth fund, has a significant ethical debate surrounding its investment policies. Since the early 2000s, the fund has been barred from investing in firms that produce components for nuclear weapons. However, in light of changing global security dynamics, particularly with Russia’s invasion of Ukraine, many have called for a reassessment of these restrictions. Critics argue that maintaining such a ban in today’s geopolitical climate is not only illogical but also potentially detrimental to national security interests.

The Conservative party’s push to lift the ban highlights the urgent need for Norway to recalibrate its defense investment strategy. As nations globally ramp up their defense spending in response to heightened geopolitical tensions, it becomes increasingly crucial for Norway’s sovereign wealth fund to potentially support defense companies that are integral to maintaining Western security. This ongoing debate encompasses broader concerns about how Norway balances ethical considerations with the imperative of national defense.

Frequently Asked Questions

What is the status of Norway’s wealth fund defense investment regarding companies producing nuclear weapons?

Since the early 2000s, Norway’s Government Pension Fund Global, the world’s largest sovereign wealth fund, has been constrained by an investment ban that prevents it from investing in companies that produce components for nuclear weapons. This restriction is part of the fund’s ethical guidelines.

Why is there a push to lift the Norway investment ban on defense companies?

The push to lift the Norway investment ban on defense companies arises from the current geopolitical climate, particularly Russia’s invasion of Ukraine and the rearming efforts of countries like China. Political figures are advocating for changes to allow the $1.8 trillion sovereign wealth fund to invest in defense firms that are deemed vital for national security and allied defense.

How do ESG factors influence Norway’s wealth fund defense investments?

ESG factors have traditionally led Norway’s sovereign wealth fund to exclude defense stocks from its portfolio due to ethical concerns surrounding investments in war-related industries. However, the recent escalation of global tensions has prompted discussions about reassessing these ESG factors in the context of national security and the defense industry’s increasing significance.

What has been the political response to the ban on Norway’s wealth fund investments in defense?

Political responses to the ban include calls from right-wing parties to lift restrictions preventing Norway’s wealth fund from investing in certain defense companies. Advocates argue that maintaining the ban is illogical in light of current security threats and that lifting it could enhance Norway’s defense capabilities.

What are the implications of the Norway investment ban on global defense contractors?

The Norway investment ban limits the $1.8 trillion sovereign wealth fund’s ability to invest in major global defense contractors, such as BAE Systems and Lockheed Martin. As these companies are engaged in essential defense production, excluding them from investment could hamper the fund’s potential returns while concurrently potentially undermining Norway’s defense-related capabilities.

Could Norway’s wealth fund invest in companies involved in cluster munitions despite the ban?

No, Norway’s wealth fund is explicitly barred from investing in companies involved in the production of cluster munitions among other controversial armaments. This is due to the ethical frameworks guiding the investment decisions of the fund, prioritizing adherence to international treaties and ethical investment standards.

What are the potential consequences of revising the ethical framework for Norway’s sovereign wealth fund?

Revising the ethical framework to allow Norway’s sovereign wealth fund to invest in defense firms could lead to increased capital flow into the defense industry and potentially higher returns for the fund’s beneficiaries. However, it may also spark ethical and public discourse regarding the fund’s alignment with its stated values on peace and human rights.

| Key Point | Details |

|---|---|

| Ban on Investments | Norway’s wealth fund has been barred from investing in companies producing critical nuclear weapon components since the early 2000s. |

| Political Pressure | Opposition parties argue that the ban is illogical given current geopolitical threats, advocating for a lifting of restrictions. |

| Context of Defense Spending | The call comes amid increasing defense spending and tensions stemming from Russia’s invasion of Ukraine. |

| Ethical Framework | Current ethical guidelines also prevent investments in firms producing cluster munitions and anti-personnel landmines. |

| Future Security Needs | The Conservative party suggests revising the fund’s ethical framework to include companies vital to Western defense. |

| Implications of ESG Factors | Historically, defense stocks were excluded based on ESG criteria but recent trends show changing attitudes among fund managers. |

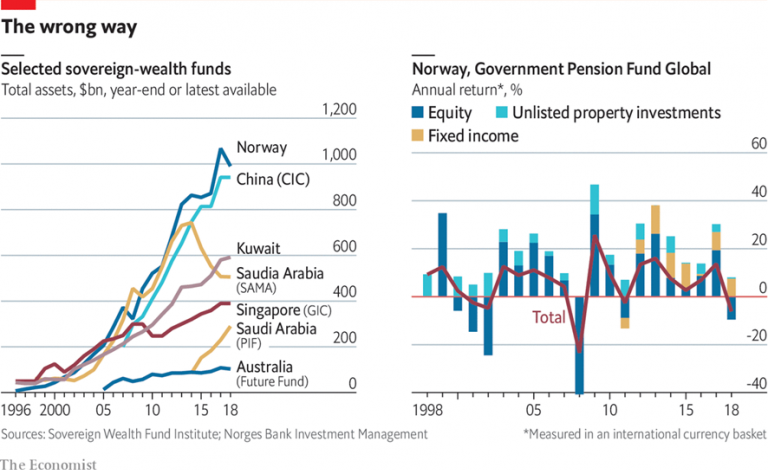

| Global Investment Strategy | The fund, one of the largest investors globally, was established to manage surplus oil and gas revenues. |

Summary

Norway wealth fund defense investment has become a contentious topic, as calls for revising the ban on defense-related investments grow amid a changing global security landscape. Policy makers argue that given the current geopolitical tensions, it is crucial for Norway’s $1.8 trillion sovereign wealth fund to adjust its investment strategies to include key defense companies. The debate taps into concerns surrounding ethical guidelines and the necessity to secure national interests, emphasizing the importance of considering how investments can align with both economic benefits and security needs.