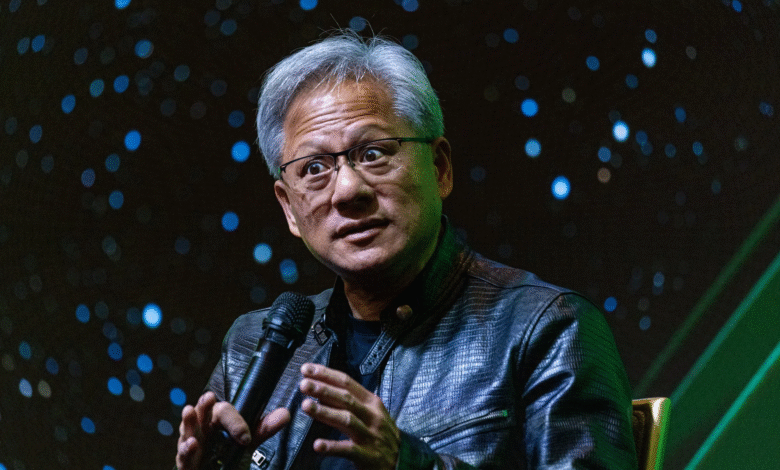

Nvidia CEO Jensen Huang Stock Sale: A $15 Million Move

Nvidia CEO Jensen Huang’s recent stock sale has generated significant buzz in the financial community, with Huang offloading 100,000 shares of Nvidia stock worth nearly $15 million in just two days. This sale is part of a larger plan announced in March, where he intends to sell up to 6 million shares before the year ends, potentially reaching a staggering $873 million based on current valuations. Despite this substantial sale, Huang maintains a dominant holding of over 800 million shares, reflecting his confidence in Nvidia’s future growth prospects. Notably, his net worth is estimated at around $126 billion, making him the 12th richest person according to the Bloomberg Billionaires Index. As Nvidia continues to dominate the AI chip market with groundbreaking GPU technology, investor interest in the company remains robust, particularly following strong earnings from recent quarters.

The notable stock transaction by Jensen Huang, the founder and CEO of Nvidia, has raised eyebrows among investors and market analysts alike. By divesting a portion of his shares in the leading AI company, Huang highlights a strategic move amidst the burgeoning demand for Nvidia’s cutting-edge graphics processing units (GPUs). This sale is part of a broader initiative where he aims to liquidate a significant number of shares throughout the year, reflecting both personal and market dynamics. With Nvidia’s recent earnings report showcasing impressive financial growth, particularly in the AI segment, the focus on Huang’s asset management strategy becomes increasingly pertinent. As the competition heats up in the evolving AI chip sector, Nvidia’s position as a front-runner remains pivotal, ensuring continued investor interest and scrutiny.

Jensen Huang’s Strategic Stock Sale

On a recent Friday and Monday, Nvidia CEO Jensen Huang executed the sale of 100,000 shares of Nvidia stock, raising approximately $15 million based on the company’s share price at that time. This stock transaction aligns with Huang’s pre-established plan to sell up to 6 million shares throughout the year, a move that could potentially value his remaining equity at around $873 million. These decisions come amidst a backdrop of Nvidia’s impressive stock performance, characterized by an over 800% increase since the launch of OpenAI’s ChatGPT, which has significantly amplified demand for Nvidia’s crucial AI chips.

Huang’s recent stock sale reflects both a calculated approach to personal finance and a response to the booming AI chip market. As Nvidia continues to capture a substantial proportion of this lucrative sector, the sale is not viewed as a sign of weakness but rather as part of a strategic plan. Notably, despite selling shares, Huang still retains an impressive stake of over 800 million shares in Nvidia, solidifying his position within the company even as he navigates the complexities of financial markets.

Nvidia’s Performance in the AI Chip Market

Nvidia has firmly established itself as a dominant player in the AI chip market, essential for training and deploying machine learning models. With the surge in interest around technologies like OpenAI’s ChatGPT, the demand for Nvidia’s GPUs has skyrocketed, driving the company’s stock to unprecedented heights. In particular, the company’s ability to innovate and deliver cutting-edge GPU technology has positioned it favorably against competitors, leading to impressive earnings reports and strong investor confidence.

According to Nvidia’s first-quarter earnings report, the company experienced a staggering 69% year-over-year increase in revenue, reaching $44 billion. This remarkable growth showcases Nvidia’s capacity to meet the skyrocketing needs of the AI industry. As more enterprises adopt AI-driven solutions, Nvidia’s GPUs remain at the forefront, sustaining strong performance in the market and contributing to its soaring stock values, despite potential challenges from export controls affecting international sales.

Analyzing Nvidia’s Recent Earnings Report Impact

The Nvidia earnings report for the first quarter has been a significant talking point among investors and analysts alike. Revealing a 69% increase in year-over-year revenue underscores the effectiveness of Nvidia’s strategy in leveraging the growing demand for AI capabilities. The 44 billion dollars reported demonstrate the company’s adeptness in navigating the dynamic landscape of the AI chip market, further solidifying its leading role in the industry.

This growth reflects not just the robust demand for Nvidia’s GPUs, but also the company’s adept response to market trends and consumer needs. Nvidia’s ongoing innovations, along with strategic moves like Jensen Huang’s planned stock sales, signify an overarching confidence in its future trajectory. As the earnings report continues to circulate, it serves to bolster investor sentiment, illustrating that Nvidia remains a pivotal force within the expanding AI landscape.

The Implications of Export Controls on Nvidia

Despite Nvidia’s remarkable growth within the AI chip market, potential export control challenges loom on the horizon. These regulations could restrict the company’s ability to access various foreign markets, posing risks to its continued revenue growth and market expansion. As a leader in the high-demand sector for AI-related technologies, navigating these regulatory environments will be crucial for Nvidia’s future success.

The impact of these controls is particularly relevant given Nvidia’s pronounced dependency on global markets, not just for sales but also for sourcing materials necessary for chip production. Should these constraints tighten, Nvidia might have to pivot its strategy, potentially affecting stock performance and investor sentiment. As regulations evolve, close monitoring of Nvidia’s responses to these challenges will be essential for stakeholders keeping an eye on the stock.

Future Outlook for Nvidia’s Stock Trends

Looking ahead, Nvidia’s stock trends will likely be influenced by various factors, including ongoing innovations in AI chip technology and market responsiveness. With the company at the forefront of AI developments, particularly following the release of systems akin to ChatGPT, there seems to be a sustained upward trajectory for its stock. Analysts continue to project that Nvidia’s role in AI technology will significantly benefit its financial outlook in the coming quarters.

However, investors should also remain cautious of external factors such as geopolitical tensions and regulatory environments that could affect Nvidia’s operations. As Jensen Huang navigates these complexities, his decisions regarding stock holdings may indicate broader strategic shifts, providing insights into the company’s priorities. Ultimately, as Nvidia consolidates its position while facing industry-wide challenges, its stock trends will offer critical reflections of both its achievements and hurdles.

The Significance of Nvidia’s GPU Technology Advancements

Nvidia’s advancements in GPU technology are significant not only for the company’s growth but for the broader landscape of AI development. By continually pushing boundaries in performance and efficiency, Nvidia enables companies to harness the full potential of their AI applications, facilitating breakthroughs across industries. This commitment to innovation is reflective in the advancements seen in their recent GPU technology launches.

Moreover, as demand escalates for high-performance computing, Nvidia’s ability to deliver cutting-edge GPUs will remain a vital differentiator in the market. The company’s strategic focus on creating bespoke solutions for AI applications reinforces its competitive edge, ensuring that it remains a preferred choice among developers and enterprises alike. As the AI chip market evolves, Nvidia’s technological prowess will be integral to shaping future advancements in AI and machine learning.

Jensen Huang’s Wealth and Stock Holdings

Jensen Huang’s recent stock sale has drawn attention not only because of the dollar amount involved but also due to the scale of his holdings in Nvidia. With a net worth estimated at $126 billion, he ranks 12th on the Bloomberg Billionaires Index. Despite the planned sale of 6 million shares, Huang retains a substantial ownership stake, which signifies his ongoing belief in Nvidia’s future and the resilience of its business model.

Such wealth and stock holdings suggest a strong confidence in both the performance of Nvidia stock and the long-term viability of the company within the tech landscape. It also raises questions about Huang’s strategic foresight, as he manages his wealth while simultaneously steering the company’s direction amidst a vibrant but competitive marketplace in the technology sector.

Impact of AI Technology on Nvidia’s Market Position

AI technology has become a pivotal component of Nvidia’s market strategy, drastically reshaping the demand landscape for its products. The company’s GPUs are critical not only for gaming but also for advanced applications in computing, showcasing their versatility. The rise of AI has given Nvidia a strategic advantage, allowing it to capitalize on the burgeoning need for advanced processing capabilities across various sectors.

As businesses worldwide continue to adopt AI solutions, Nvidia stands to benefit significantly from its early investments in GPU technology tailored for AI applications. The company’s ability to innovate in this space has established it as a leader, positioning Nvidia at the intersection of technology and AI. Driven by market demands and Huang’s visionary leadership, Nvidia’s market position is likely to strengthen, affirming its status in the tech ecosystem.

Understanding Nvidia’s Competitive Advantages

Nvidia’s competitive advantages stem from its pioneering role in GPU technology and its strategic focus on the AI chip market, distinguishing it from competitors. With a strong reputation for performance and reliability, Nvidia has developed a dedicated consumer base, further solidifying its dominance in areas like gaming and data center applications. The company’s commitment to continuous innovation positions it as a frontrunner in the evolving landscape of AI.

To maintain its edge, Nvidia consistently invests in research and development, enhancing its product offerings while responding to emerging market trends. This proactive approach creates barriers for new entrants and fosters ongoing partnerships within the tech industry, enabling Nvidia to leverage collaborations with major players in AI. As the demand for sophisticated AI solutions increases, Nvidia’s competitive landscape remains robust, ensuring it remains a crucial component in the tech industry’s growth narrative.

Frequently Asked Questions

What was the recent Nvidia CEO Jensen Huang stock sale about?

Nvidia CEO Jensen Huang sold 100,000 shares of Nvidia stock recently, amounting to nearly $15 million based on the share price. This sale is part of Huang’s broader plan to divest up to 6 million shares of the company by the year’s end.

How much of Nvidia stock does Jensen Huang still hold after the sale?

After the recent stock sale, Jensen Huang still holds over 800 million shares of Nvidia stock, maintaining significant ownership in the company despite his plans to sell more shares.

How does the Nvidia earnings report relate to Jensen Huang’s stock sale?

The Nvidia earnings report indicates a strong financial performance, showing a 69% year-over-year revenue increase, which could correlate with Huang’s decision to sell shares while capitalizing on the company’s high market valuation.

What impact has the Nvidia GPU technology had on Jensen Huang’s stock sales?

Nvidia’s GPU technology has driven substantial growth, leading to an 800% increase in stock since the release of ChatGPT. This booming demand for Nvidia’s AI chips may influence Jensen Huang’s strategic decisions regarding his stock sales.

Why did Jensen Huang plan to sell a large number of Nvidia shares?

Jensen Huang announced plans to sell up to 6 million Nvidia shares as part of a financial strategy revealed earlier in the year, which aligns with his financial portfolio management amidst the company’s growing market valuation.

What is the significance of the Nvidia stock surge following the AI boom?

The Nvidia stock surge of over 800% since December 2022 illustrates the increasing demand for AI technologies and GPUs, positioning the company at the forefront of the AI chip market and affecting stock sales by executives like Jensen Huang.

How much has Jensen Huang sold in Nvidia shares compared to last year?

Jensen Huang sold approximately $700 million in Nvidia shares last year under a prearranged plan, making this recent sale of $15 million a continuation of his strategic stock sales.

What challenges is Nvidia facing despite its stock growth?

Despite its impressive stock growth, Nvidia faces export control challenges that may limit access to foreign markets for its AI chips, which could impact future sales and earnings.

How does the market value impact Jensen Huang’s net worth?

Jensen Huang’s net worth, approximately $126 billion, is significantly influenced by the performance of Nvidia’s stock, as his wealth primarily derives from his substantial holdings in the company.

What are the anticipated outcomes of Jensen Huang’s planned stock sales for Nvidia?

The anticipated outcomes of Jensen Huang’s planned stock sales could involve generating significant cash for personal investments or capitalizing during a peak period for Nvidia stock, which is seeing increased demand due to its AI chip technology.

| Key Point | Details |

|---|---|

| Stock Sale | Jensen Huang sold 100,000 shares for nearly $15 million. |

| Shareholding Plan | Huang plans to sell up to 6 million shares by year’s end, valued at $873 million. |

| Current Holdings | After the sales, Huang still holds over 800 million shares. |

| Net Worth | Huang’s net worth is approximately $126 billion. |

| Historical Context | Last year, Huang sold around $700 million of Nvidia shares. |

| Market Trends | Nvidia’s stock has surged over 800% since the launch of ChatGPT. |

| Revenue Growth | Nvidia reported a 69% year-over-year revenue increase to $44 billion. |

| Challenges | Nvidia faces potential export control challenges affecting AI chip market access. |

Summary

The Nvidia CEO Jensen Huang stock sale has raised significant attention following his recent sale of 100,000 shares worth nearly $15 million. This sale is part of a larger strategy where Huang plans to divest up to 6 million shares by the end of the year, showcasing his ongoing personal investment decisions amidst Nvidia’s remarkable growth trajectory. Huang’s substantial holdings and the successful performance of Nvidia in the AI chip market underscore the company’s key role in the expanding artificial intelligence sector.