Omegapro Fraud Scheme: Indictment Unsealed in Puerto Rico

The Omegapro fraud scheme has garnered significant attention as an elaborate investment scam that promised vast returns on cryptocurrency investments. Recently, an indictment in the District of Puerto Rico unveiled the shocking details of how this multi-level marketing fraud operated, led by alleged masterminds Michael Shannon Sims and Juan Carlos Reynoso. Investors were reportedly defrauded of over $650 million through a deceptive strategy that involved selling so-called “investment packages” with unrealistic guarantees of 300% returns from foreign exchange trading. Not only did they run a complex investment scheme, but the defendants also engaged in lavish promotional events to mask the fraudulent nature of their operations, giving false assurances to investors regarding the safety of their funds. As authorities pursue money laundering charges against them, the ramifications of this scheme highlight the significant risks associated with ill-fated cryptocurrency ventures and the urgent need for regulatory scrutiny in the investment landscape.

The Omegapro indictment has unveiled a major scandal within the realm of deceptive investment practices notorious for luring naive investors with extravagant promises. This case exemplifies the broader issues related to cryptocurrency fraud and the dark underbelly of multi-level marketing tactics that prey on unsuspecting individuals. Allegations indicate that the individuals involved orchestrated a sophisticated investment program, disguised under a facade of legitimacy, ultimately leading to devastating financial losses for many. With serious charges on the table including conspiracy to commit wire fraud, the significant scale of this operation raises red flags about the need for protective measures against investment schemes that lack transparency and accountability. As this case unfolds, it serves as a cautionary tale for potential investors to remain vigilant against fraudulent activities disguised as promising ventures.

Understanding the Omegapro Fraud Scheme

The Omegapro fraud scheme has emerged as one of the most notorious investment scams, duping unsuspecting investors out of millions. The scheme operated primarily through deceptive marketing tactics that promised extraordinary returns on investments, often advertised as high as 300%. This illusion was perpetuated through a network of promoters who lured in participants with the allure of cryptocurrency investments, positioning Omegapro as a legitimate financial opportunity. However, the reality was starkly different, as it became clear that it was more of a multi-level marketing fraud rather than a sustainable investment model.

Court documents reveal the intricate web of deceit woven by the founders and key operators of Omegapro. They not only mismanaged investor funds but also engaged in elaborate promotional campaigns designed to portray Omegapro as a successful enterprise. The defendants’ lavish lifestyles showcased on social media platforms further misled potential investors, fostering a false sense of security. With charges of conspiracy to commit wire fraud, both Michael Sims and Juan Carlos Reynoso now face serious legal consequences for their roles in perpetuating this scheme, which has left many victims devastated.

The Role of Cryptocurrency in the Omegapro Investment Scheme

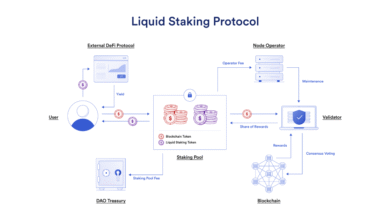

Cryptocurrency played a pivotal role in the Omegapro investment scheme, serving as both a lure for investors and a vehicle for fraudulent activities. The use of digital currencies allowed the promoters to bypass traditional financial systems and the scrutiny that comes along with them. The promise of investing in cryptocurrency was strategically employed to attract tech-savvy individuals looking to capitalize on the growing trend. However, instead of offering legitimate investment opportunities, the scheme employed tactics typical of investment fraud, utilizing digital assets as a front for deception and financial manipulation.

As the dust settles on the Omegapro indictment, many are questioning the legitimacy of cryptocurrency investments linked to multi-level marketing fraud. Investors often believe that cryptocurrencies are a safe haven due to their innovative nature and potential for high returns. However, scams like Omegapro demonstrate the risks associated with this market, especially when regulations and oversight are lax. As the legal ramifications unfold, it highlights the essential need for regulatory measures to protect future investors from falling prey to similar fraudulent investment schemes.

Consequences and Legal Ramifications of the Omegapro Indictment

The legal consequences following the Omegapro indictment are severe, with both defendants facing substantial charges that could lead to a combined sentencing of up to 40 years in prison. Not only are they charged with conspiracy to commit wire fraud, but they are also confronted with serious money laundering charges that highlight the extensive financial manipulation involved in the scheme. These legal proceedings serve as a stark reminder of the responsibilities that come with managing investor funds and the potential repercussions of failing to uphold that trust.

Beyond the personal ramifications for Sims and Reynoso, the Omegapro case significantly impacts the cryptocurrency and investment landscape as a whole. It raises awareness about the prevalence of fraud in both traditional and digital currency markets. The public’s perception of cryptocurrency may shift as stories of scams become more widely reported, prompting legitimate businesses to take measures to ensure transparency and instill investor confidence. The legal fallout from such high-profile cases will likely lead to more stringent regulations aimed at preventing similar schemes, thereby protecting future investors.

The Unfolding Story of Multi-Level Marketing Fraud

The Omegapro scheme epitomizes the rampant issues surrounding multi-level marketing fraud, where individuals are often lured into purchasing products or investments under the guise of legitimate business practices. These marketing models rely heavily on the recruitment of new investors to sustain returns, creating a pyramid-like structure that ultimately collapses when new recruitment slows. Understanding these dynamics is key for potential investors to identify red flags that indicate a fraudulent scheme disguised as a promising business opportunity.

As authorities combat multi-level marketing fraud, the Omegapro case could serve as a precedent for future investigations and litigations. Efforts to educate the public about the risks associated with such investment schemes are crucial. By raising awareness and promoting vigilance, victims may be better equipped to recognize potential scams before engaging in investments that seem too good to be true. This increasing scrutiny on MLMs could potentially lead to systemic changes within the industry, paving the way for a safer investment environment.

Analyzing the Investor Impact of Omegapro’s Fraudulent Activities

The fallout from the Omegapro fraud scheme has left a significant number of victims grappling with substantial financial loss. With over $650 million reportedly defrauded from investors, many individuals are now facing the harsh reality of their investments evaporating into thin air. The emotional toll, combined with financial strain, has created a ripple effect, impacting not just the direct victims but also their families and communities. The psychological distress of having been deceived can be just as damaging as the financial repercussions, highlighting the need for resources and support for those affected.

The ramifications extend further, as the case serves as a cautionary tale about the importance of thorough due diligence before participating in any investment schemes. Many individuals were drawn to Omegapro by promises of outrageous returns without fully understanding the risks involved. This lack of awareness emphasizes the critical need for educational resources geared towards potential investors to foster informed decision-making in the age of cryptocurrency and online investment opportunities. As investigations continue, it is pivotal that lessons learned from this scandal shape future investment practices and protect investors from similar schemes.

Lessons Learned from the Omegapro Fraud Case

The Omegapro fraud case offers crucial lessons for investors regarding the risks associated with high-return promises and reliance on multi-level marketing tactics. Preventing future occurrences of such fraudulent schemes begins with educating individuals about recognizing warning signs, such as pressure to invest quickly, unclear business models, and lack of transparency. Investors must remain vigilant and skeptical about opportunities that promise unrealistic profits, especially in the volatile realm of cryptocurrency.

In addition to individual caution, the Omegapro case underscores the responsibility of regulatory bodies to establish and enforce stricter guidelines for investment schemes. By improving oversight on multi-level marketing practices and cryptocurrency investments, authorities can work to protect potential investors from financial ruin. Ultimately, the lessons learned from Omegapro must serve to inform better practices and inspire regulatory reforms designed to mitigate the risks of investment fraud in the future.

Investigating the Link between Cryptocurrency and Money Laundering

The Omegapro case has shed light on the concerning intersection of cryptocurrency investment schemes and money laundering activities. As cryptocurrencies facilitate transactions that can be done anonymously, they have become the preferred medium for scammers looking to exploit these characteristics to obscure the movement of illicit funds. The allegations of money laundering against the defendants in the Omegapro indictment emphasize the critical need for enhanced regulation in cryptocurrency markets to prevent their misuse in fraudulent schemes.

Investigating the potential for money laundering within cryptocurrency frameworks establishes a vital conversation in the financial sector. It forces both regulators and investors to take a closer look at how cryptocurrencies are employed and the vulnerabilities they present. As law enforcement agencies intensify their efforts to combat money laundering, the Omegapro case serves as a prime example of how both education and regulatory reform are needed to address these serious risks effectively.

The Future of Investment Regulation Post-Omegapro

As the dust settles on the Omegapro fraud indictment, there is a pressing need to reevaluate investment regulations in light of such fraudulent schemes. The overlap of cryptocurrency with multi-level marketing fraud demonstrates a gap in regulatory frameworks that allows such scams to flourish. Policymakers must address these vulnerabilities to safeguard investors and promote a more secure environment for legitimate investment opportunities.

The federal indictment of Omegapro’s key players should catalyze discussions around creating more robust regulations tailored to both cryptocurrency and multi-level marketing strategies. Enhancing investor protections and fostering transparency within these markets could significantly reduce the likelihood of future fraud cases. As investors become increasingly wary of online investment opportunities, strengthening regulations will be vital in rebuilding trust and confidence in the investment landscape.

Frequently Asked Questions

What is the Omegapro fraud scheme and how does it operate?

The Omegapro fraud scheme is an international investment scheme that has been identified as a multi-level marketing fraud. It allegedly defrauded investors out of over $650 million primarily through misleading promises of high returns on cryptocurrency investments and foreign exchange trading. The scheme involved purchasing ‘investment packages’ with promises of 300% returns and utilized lavish promotional events and social media to present itself as a legitimate venture.

Who are the key figures behind the Omegapro fraud scheme?

Michael Shannon Sims and Juan Carlos Reynoso are two key figures indicted in connection with the Omegapro fraud scheme. Sims is a founder and promoter, while Reynoso managed operations in Latin America and parts of the U.S. Both have been charged with conspiracy to commit wire fraud and face serious legal consequences if convicted.

What legal charges have been brought against the promoters of Omegapro?

The promoters of the Omegapro fraud scheme, Michael Shannon Sims and Juan Carlos Reynoso, face serious legal charges including conspiracy to commit wire fraud and money laundering. These charges stem from their alleged roles in misleading investors and running a fraudulent investment scheme.

How did the Omegapro investment scheme mislead its investors?

The Omegapro investment scheme misled its investors by making false promises of substantial returns from investments, particularly in cryptocurrency and foreign exchange trading. Promoters spread misinformation through extravagant marketing and reassured investors that their funds were safe, even when there were reports of hacking and withdrawal issues.

What are the penalties for those convicted in the Omegapro fraud case?

If convicted, the individuals involved in the Omegapro fraud scheme face a maximum penalty of 20 years in prison for each count of conspiracy to commit wire fraud and money laundering. This highlights the serious legal ramifications of participating in such fraudulent activities.

Can victims of the Omegapro fraud scheme recover their losses?

Recovering losses from the Omegapro fraud scheme may be challenging for victims. Many have reported an inability to withdraw their funds and significant financial losses. Legal proceedings might provide some avenue for recovery, but the outcome would depend on various factors, including the successful prosecution of the defendants.

What steps can individuals take to avoid becoming victims of investment schemes like Omegapro?

To avoid falling prey to investment schemes like Omegapro, individuals should conduct thorough research before investing, be wary of promises of guaranteed high returns, and verify the legitimacy of any investment opportunity. Additionally, seeking advice from financial professionals can help in making informed decisions.

| Key Point | Details |

|---|---|

| Indictment Unsealed | Michael Shannon Sims and Juan Carlos Reynoso charged in Puerto Rico. |

| Fraud Amount | Investors defrauded of over $650 million through Omegapro. |

| Nature of Scheme | International investment scheme promoted by means of a multi-level marketing structure. |

| False Promises | Investors promised substantial returns with unsafe investments. |

| Promotional Activities | Lavish events and social media used to mislead the public. |

| Criminal Charges | Charges of conspiracy to commit wire fraud and money laundering. |

| Potential Penalties | Each defendant faces up to 20 years in prison per count if convicted. |

Summary

The Omegapro fraud scheme has emerged as a significant case of financial deception, implicating key figures in the wrongful manipulation of investor funds. This indictment highlights serious allegations against Sims and Reynoso, who exploited the allure of high-return investments to defraud unsuspecting individuals. The extensive financial losses and misleading practices underline the importance of vigilance when engaging in investment schemes, especially those promising unrealistically high returns.