Opendoor Stock Decline After Earnings Report: What to Know

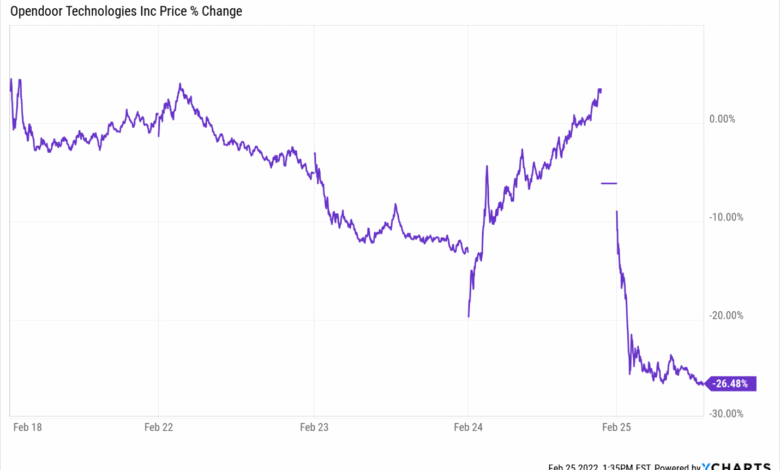

Opendoor stock decline has become a focal point for investors as the company struggles to maintain momentum following their recent earnings report. After a promising surge in July, CEO Carrie Wheeler addressed a wave of investor feedback during the company’s earnings call, expressing thanks for their support amid the downturn. However, the housing market outlook remains bleak, leading Opendoor to downgrade its marketing efforts and scale back on acquisitions. The challenges facing Opendoor are compounded by the macroeconomic environment and the pressures of the iBuying business model, which has seen fluctuating demand due to rising interest rates. As the stock plummeted over 20 percent in after-hours trading, market analysts remain cautious about the potential for recovery in the near future.

The recent downturn in Opendoor’s share prices reflects increasing concerns about the company’s future performance in the housing industry. Following their latest quarterly earnings announcement, the sentiment among shareholders has shifted, with CEO Carrie Wheeler’s comments seeking to reassure investors about the firm’s evolving strategies. Amidst a struggling real estate market, the firm is looking to pivot from its traditional home-buying model toward a more sustainable approach that minimizes capital expenditure. This shift might alleviate some of the pressure on the company, but it remains to be seen whether these changes can restore investor confidence and impact future revenue positively. As Opendoor navigates these uncharted waters, understanding the landscape of iBuying and broader economic indicators will be crucial for both the company and its stakeholders.

Opendoor Stock Decline: Understanding the Recent Drop

Opendoor’s recent stock decline has left investors perplexed, especially following a strong rally over the summer months. After reaching a peak valuation, the stock faced a sharp downturn exceeding 20% in after-hours trading. This abrupt decline is attributed to a disappointing earnings report which indicated challenging times ahead, prompting the CEO, Carrie Wheeler, to emphasize the company’s commitment to listening to investor feedback amidst these trying circumstances. The stark contrast between the stock’s previous surge and its current struggles illustrates the volatility inherent in the housing market and tech-driven models like iBuying.

The issues affecting Opendoor’s stock are also deeply interwoven with broader economic conditions. As the Federal Reserve imposes higher interest rates to combat inflation, the housing market has experienced a notable pullback. With affordability issues mounting, potential buyers have stepped back, affecting Opendoor’s business model, which relies on rapid turnover and sales of purchased homes. CEO Carrie Wheeler’s acknowledgment of these factors during the earnings call signals that Opendoor is taking necessary precautions, like reducing marketing expenditures, to navigate these economic headwinds.

Insights from Opendoor’s Earnings Report

In the latest earnings report, Opendoor reported a slight revenue increase, rising 4% to $1.57 billion. However, despite this modest gain in revenue, the net loss still stood at $29 million, indicating ongoing struggles for the company. Investors were particularly alarmed by the forecast of significant revenue decline for the upcoming quarters, highlighting a discrepancy between investor expectations and Opendoor’s ability to recapture momentum in a cooling housing market. Such earnings results raise questions about the sustainability of the once-promising iBuying business model, particularly in a challenging economic landscape.

CEO Carrie Wheeler has reassured investors that Opendoor is committed to adapting its strategy to foster growth. Recognizing the decline of the iBuying segment, Wheeler pointed to efforts being made to diversify the company’s offerings, suggesting a shift towards more referral-based transactions that require less capital. This announcement reflects a strategic pivot that could offer Opendoor more resilience against fluctuation in buyer demand, especially as mortgage rates remain persistently high. Continued investor feedback will be crucial in shaping these new initiatives and ensuring Opendoor’s long-term viability.

CEO Carrie Wheeler’s Vision for Opendoor’s Future

CEO Carrie Wheeler’s recent statements during the earnings call hint at a revitalizing vision for Opendoor. Acknowledging the importance of investor enthusiasm, she has stressed the company’s intent to enhance its narrative and reach a larger audience amid a muddled housing market outlook. This proactive approach may be essential, particularly as Opendoor explores new avenues beyond its conventional iBuying model. By embracing feedback from investors and being transparent about their strategies, Wheeler is striving to rebuild trust and confidence in the company’s prospects.

Wheeler’s commitment to evolving Opendoor’s business model is not only strategic; it also marks a critical turning point for the company. As the iBuying approach faces headwinds due to higher mortgage rates and reduced buyer activity, her emphasis on diversifying the business aligns with industry trends where adaptability is key. By shifting towards a less capital-intensive referral-oriented strategy, Opendoor could potentially mitigate risks associated with economic uncertainty while still creating value for stakeholders.

Investor Feedback: Navigating Opendoor’s Challenges

After a volatile spell in the stock market, feedback from investors has become increasingly vital for Opendoor’s trajectory. The recent plunge in stock prices following disappointing earnings has prompted a renewed focus on communication channels between the company and its stakeholders. Carrie Wheeler has recognized the importance of this dialogue, stating that the company is actively listening to insights and suggestions from investors who are eager to see the business flourish in a complex housing landscape. Timely and transparent feedback mechanisms can enable Opendoor to tailor its strategies effectively moving forward.

In the face of criticism and concerns about growing losses, investor sentiment will play a crucial role in Opendoor’s strategic adjustments. As the company seeks to alter its business practices and embrace innovative models, investor feedback can provide valuable guidance on market expectations and preferences. This engagement promotes a collaborative environment that can potentially smooth Opendoor’s path to recovery while fostering a sense of community among its investors.

The Housing Market Outlook and Its Impact on Opendoor

The current outlook for the housing market presents multiple challenges for companies like Opendoor that operate within the iBuying sector. High mortgage rates and rising costs have squeezed affordability, leading to decreased demand and a saturated market. As reported by CFO Selim Freiha, these conditions are already impacting sale numbers and listing behavior, pushing Opendoor to reassess its inventory acquisition strategies. With fewer homes being snapped up by the company, the implications for short-term revenue remain dire, pointing to a need for an agile response to shifting market dynamics.

As understanding the housing market outlook becomes increasingly crucial, it’s clear that external economic factors will directly influence Opendoor’s performance. The interplay between interest rates, buyer sentiment, and housing stock availability will determine how well the company can adapt its strategies. A robust analysis of these dynamics, coupled with a responsive business model, will be essential for navigating the current tough terrain while positioning for recovery as market conditions improve in the future.

The Future of the iBuying Business Model

The iBuying business model, which Opendoor pioneered, is now facing scrutiny as the housing landscape shifts dramatically. As the company prepares to pivot towards more referral-based transactions, industry experts are increasingly questioning the viability of reliance on traditional iBuying. In light of the recent earnings report and ensuing market changes, this reconsideration presents both challenges and opportunities for Opendoor as it seeks to define its identity in a fluctuating marketplace.

Despite the hurdles, the potential for reinvention exists for Opendoor. Changing consumer behaviors and technological advancements can provide pathways for evolving the iBuying model into something more sustainable. By reducing dependency on capital-intensive purchasing strategies and differentiating services to appeal to a broader customer base, Opendoor can leverage its strong brand presence and data-driven insights to thrive amid economic turbulence. Engaging with investor feedback will be pivotal in realizing these transformative ambitions.

The Role of Technology in Opendoor’s Strategy

Technology has been at the heart of Opendoor’s business model since its inception, and its role continues to be critical as the company charts its future direction. By leveraging advanced analytics and machine learning, Opendoor has streamlined the home buying and selling process, making it more efficient for consumers. However, as market conditions evolve, the company must reassess how technology can support adaptive strategies, particularly in reducing costs and increasing inventory turnover.

As Carrie Wheeler emphasizes the importance of innovation, Opendoor’s focus on tech-driven solutions will likely dictate its competitive advantage in an increasingly crowded marketplace. Ensuring that the technology employed not only enhances user experience but also aligns with updated business objectives will be crucial for long-term sustainability. By investing in technological enhancements, Opendoor stands to solidify its position in the housing landscape while responding effectively to investor and customer expectations.

Market Speculation: Views on Opendoor’s Stock Performance

Current market speculation suggests a wide range of opinions on Opendoor’s stock performance, particularly in light of the recent earnings report and shareholder responses. Hedge fund manager Eric Jackson’s bullish remarks, predicting remarkable highs for Opendoor’s stock, clash with the more conservative approaches observed amongst analysts who remain wary of the company’s ongoing losses. Such contrasts highlight the uncertainty facing investors and the potential volatility that can arise from drastic shifts in market sentiment.

With Opendoor’s stock experiencing significant fluctuations, investors will need to carefully consider various factors impacting its valuation. The delicate interplay between fundamental earnings, housing market conditions, and competitive pressures makes it a challenging environment to navigate. Consistent monitoring of market dynamics and insightful speculation will enable investors to form educated positions on Opendoor’s future stock performance as they seek opportunities amidst the noise.

Adapting Strategies to Meet Investor Expectations

In light of recent challenges, adapting business strategies to align with investor expectations is vital for Opendoor’s recovery. Carrie Wheeler’s acknowledgment of investor sentiment following the earnings report reflects a commitment to transparency and responsiveness, which are essential for maintaining trust and fostering a collaborative environment. As the company pursues growth opportunities and pivots away from the traditional iBuying model, ensuring that shareholders are informed and engaged will be pivotal.

To meet these evolving investor expectations, Opendoor must focus on innovative marketing techniques and effective communication strategies. By addressing concerns transparently, the company can retain investor interest and encourage long-term support despite short-term setbacks. A concerted effort to engage shareholders through detailed reporting and forward-looking guidance will foster a culture of confidence and loyalty, essential for Opendoor to thrive in the current landscape.

Frequently Asked Questions

What led to the Opendoor stock decline after the earnings report?

The Opendoor stock decline following the earnings report was primarily due to a disappointing outlook for the housing market and lower revenue forecasts. CEO Carrie Wheeler acknowledged challenges in a tough macroeconomic environment and indicated that the company is reducing marketing expenditures, leading to a significant drop in stock price.

How did CEO Carrie Wheeler address investor feedback during the recent earnings call?

During the earnings call, CEO Carrie Wheeler emphasized her appreciation for new investors and their feedback, stating the company is listening intently to their concerns as it navigates challenges in the housing market outlook. This acknowledgment comes amidst Opendoor’s stock decline after the financial report.

What implications does the housing market outlook have for Opendoor’s iBuying business model?

The housing market outlook is currently unfavorable, with high mortgage rates suppressing buyer demand, which directly impacts Opendoor’s iBuying business model. The latest earnings call indicated that such conditions are leading to lower sales and acquisitions, contributing to the recent Opendoor stock decline.

How has investor sentiment affected Opendoor’s stock performance?

Investor sentiment has been mixed following Opendoor’s recent earnings report. Despite acknowledging investor enthusiasm, CEO Carrie Wheeler noted that this optimism was tempered by a challenging economic forecast, contributing to a stark Opendoor stock decline of over 20% in after-hours trading.

What are Opendoor’s revenue projections following the earnings report?

Opendoor is forecasting revenue between $800 million to $875 million for the current quarter, indicating a decline of at least 36% compared to the previous year. This lowered revenue expectation has played a critical role in the Opendoor stock decline following the recent earnings report.

How did the recent earnings report affect Opendoor’s plans for future home acquisitions?

In light of the challenging housing market and the need to adapt its business model, Opendoor plans to acquire only 1,200 homes in the third quarter, significantly down from previous quarters. This adjustment is part of the company’s strategy to navigate the current economic climate, further contributing to the Opendoor stock decline.

What strategic changes is Opendoor making in response to its recent stock decline?

In response to the recent stock decline and market conditions, Opendoor is shifting its strategy to diversify beyond traditional iBuying into a more referral-oriented model, which is intended to be less capital-intensive. This strategic pivot was highlighted by CEO Carrie Wheeler as a crucial move for the company’s future.

| Key Point | Details |

|---|---|

| Opendoor Stock Decline | Opendoor shares plummeted over 20% in after-hours trading following the earnings report. |

| CEO’s Statement | Carrie Wheeler thanked new investors and acknowledged the challenges ahead. |

| Market Challenges | Reduced marketing expenditure amid a challenging macroeconomic environment. |

| Stock Performance | Stock surged nearly fivefold in past months but dropped significantly due to lower expectations. |

| Future Projections | Forecasted revenue decline of 36% compared to the previous year. |

| Business Strategy Shift | Moving to a more referral-oriented model to diversify business. |

Summary

Opendoor stock decline has raised concerns among investors following a disappointing earnings report and outlook. Despite expressing gratitude to new investors, the CEO’s acknowledgment of a challenging market environment and reduced marketing expenditures have cast a shadow over the company’s future performance. With anticipated revenue declines and significant after-hours stock plummeting, Opendoor must navigate these challenges to regain investor confidence and stabilize its market position.