Pinterest Earnings Report: 15% Share Increase in Q1

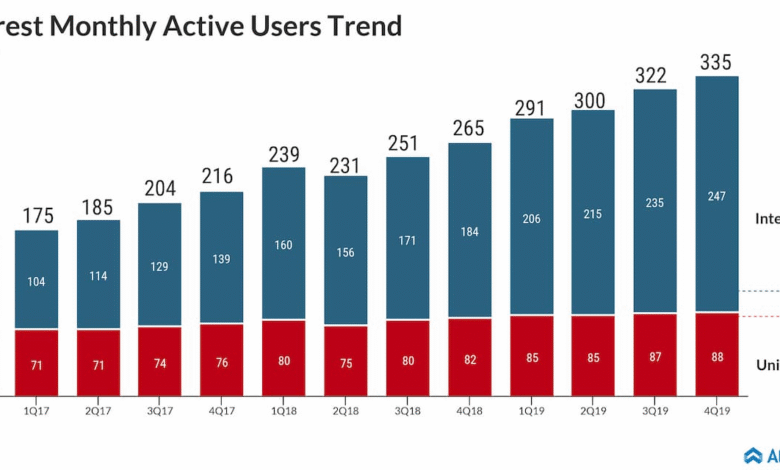

The Pinterest earnings report has recently captured the attention of investors and analysts alike, as the social media giant announced a positive first-quarter performance that exceeded expectations. Following the release, Pinterest shares surged by 15% in after-hours trading, reflecting market confidence in the company’s advertising revenue growth and user engagement strategies. For Q1, Pinterest reported revenues of $855 million, slightly surpassing analyst forecasts and highlighting its resilience in a competitive digital advertising landscape. With 570 million monthly active users, the platform continues to showcase impressive user growth, which is crucial for its ongoing success. As Pinterest navigates the evolving digital advertising trends and economic challenges, its recent performance signals a promising trajectory for the company’s future endeavors.

A recent financial disclosure from Pinterest has stirred interest among stakeholders, showcasing the company’s pivotal developments in its user engagement and revenue streams. This quarter’s performance report reflects not only a robust advertising strategy but also a calculated adaptation to market demands amidst fluctuating economic conditions. With a notable increase in user base, Pinterest is proving itself a formidable player in the online marketing space. The rise in share value post-earnings announcement underscores the platform’s potential for sustained growth, making it a subject of keen observation for those tracking shifts in digital engagement trends. As the landscape for online advertisers evolves, Pinterest’s innovative approach could redefine its impact within the industry, appealing to new demographics and investing in user-centric experiences.

Pinterest Q1 Earnings Report Overview

Pinterest’s recent earnings report has revealed some promising figures amidst a competitive digital advertising landscape. The company reported a revenue of $855 million for the first quarter, narrowly surpassing analyst expectations by 1%. This came as a significant relief to investors, particularly when juxtaposed against the backdrop of economic uncertainty. Pinterest’s adjusted earnings per share (EPS) of $0.23, although slightly below the analyst expectation of $0.26, showcased the resilience of the platform’s monetization strategies.

Additionally, Pinterest’s announcement that it anticipates revenue to fall between $960 million and $980 million for the upcoming second quarter highlights the company’s confidence in sustained growth. This forecast exceeds the consensus of $966 million by analysts, signaling optimism about Pinterest’s ability to navigate through challenges. The growth in projected sales is a testament to the platform’s unique positioning in the crowded social media and digital advertising market.

Frequently Asked Questions

What did the Pinterest earnings report reveal about the company’s revenue and user growth?

The Pinterest earnings report showed that the company generated $855 million in revenue for Q1, surpassing the expected $847 million. Additionally, Pinterest reported 570 million monthly active users, exceeding Wall Street’s estimate of 565 million users, demonstrating significant user growth.

How did Pinterest shares react to the latest earnings report?

Following the announcement of its first-quarter earnings, Pinterest shares increased by 15% in after-hours trading, driven by optimistic guidance for future sales that surpassed analyst expectations.

What are the advertising revenue projections for Pinterest in the second quarter?

Pinterest project its second-quarter advertising revenue between $960 million and $980 million, with a midpoint that exceeds analysts’ predictions of $966 million, indicating strong confidence in its revenue outlook.

How does Pinterest’s Q1 earnings compare to analyst expectations regarding earnings per share?

Pinterest reported an adjusted earnings per share of $0.23 for Q1, which was lower than the expected $0.26, highlighting a slight shortfall in earnings according to analyst consensus.

What challenges did Pinterest highlight in its earnings call regarding digital advertising trends?

During the earnings call, Pinterest’s finance chief mentioned that the company is not immune to the macroeconomic environment, with some digital advertising spending being impacted by tariffs affecting Asian e-commerce retailers, which reflects broader digital advertising trends.

What impact did the Pinterest earnings report have on the stock market compared to its competitors?

While Pinterest shares surged by 15% after the earnings report, other tech companies like Snap and Reddit experienced more volatile reactions, with Snap’s stock dropping after it failed to provide guidance amidst macroeconomic uncertainties.

How did Pinterest’s Q1 performance reflect its business transformation efforts?

Pinterest’s first-quarter performance, including user growth and revenue exceeding expectations, reflects its ongoing transformation from a platform with declining users to a resilient business, as highlighted by CEO Bill Ready during the earnings call.

What was the average revenue per user reported by Pinterest for Q1?

Pinterest recorded a global average revenue per user of $1.52 for the first quarter, aligning with analyst expectations, indicating effective monetization strategies despite economic challenges.

How has the U.S.-China trade dispute affected Pinterest according to the earnings report?

The earnings report indicated that Pinterest has experienced some impact from the U.S.-China trade dispute, with finance chief Julia Brau Donnelly mentioning that certain Asian retailers had reduced their digital advertising expenditures due to trade tensions.

What steps is Pinterest taking to enhance its advertising products amid challenging economic conditions?

Pinterest’s leadership is focusing on enhancing advertising products and establishing the platform as a preferred shopping destination, particularly for Gen Z, to drive user engagement and revenue growth in a challenging economic landscape.

| Key Metric | Pinterest Q1 Results | Analysts Consensus | ||

|---|---|---|---|---|

| Revenue | $855 million | $847 million | ||

| Earnings per Share (EPS) | $0.23 (adjusted) | $0.26 | ||

| Monthly Active Users | 570 million | 565 million | ||

| Sales in U.S. and Canada | $663 million | $664 million | ||

| Revenue in Europe | $147 million | $141 million | ||

| Adjusted EBITDA | $172 million | $164 million | ||

| EBITDA Margin | 20% | 19.4% | ||

| Global Average Revenue per User | $1.52 | Expected | ||

Summary

The Pinterest earnings report reveals significant insights into the company’s current performance and future outlook. With shares surging by 15% following the positive earnings announcement, Pinterest has demonstrated resilience in a challenging market. The company’s ability to exceed analysts’ expectations in revenue and user growth amidst ongoing economic headwinds highlights its effective strategies for monetization and user engagement. As Pinterest continues to adapt to the evolving digital advertising landscape, its focus on becoming a leading shopping destination positions it well for sustained growth. Overall, the Pinterest earnings report reflects a cautiously optimistic outlook in the face of macroeconomic challenges.