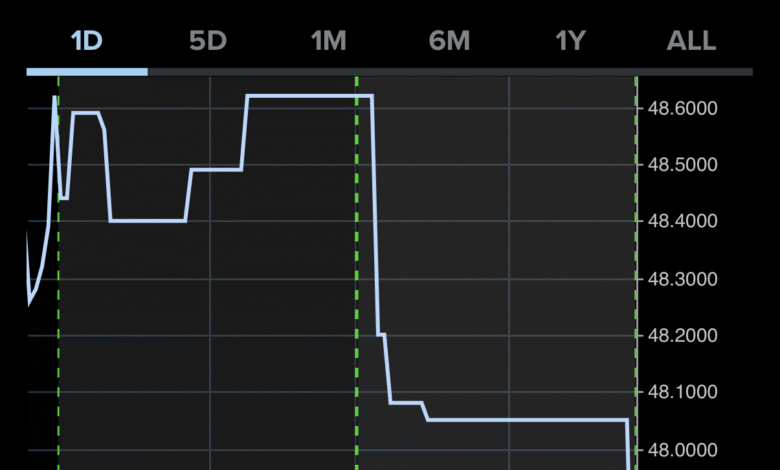

Premarket Stock Movements: Key Headlines Before the Bell

Premarket stock movements can reveal crucial insights into market trends, and today is no exception. With exciting developments in the financial landscape, companies like Starbucks and Teladoc Health are making headlines before the bell. Starbucks stock soared over 4% after positive third-quarter revenue numbers, while Teladoc Health experienced a 2.3% increase following its impressive earnings report. On the other hand, HSBC faced a nearly 2.6% decline due to disappointing financial outcomes. Additionally, Novo Nordisk’s stock continues to struggle with a 4% drop after revising its guidance, showcasing the volatile nature of premarket trading.

In the hours leading up to the market opening, trading fluctuations in stocks can serve as a barometer for investor sentiment and economic indicators. Notable shifts in share prices from companies such as Starbucks and Teladoc Health illustrate the diverse performance metrics that influence investor decisions. As organizations prepare to unveil their latest earnings and financial results, the responses of stock values can indicate broader market reactions and investor confidence. Particularly, movements in shares like HSBC and Novo Nordisk highlight the challenges some companies face against the backdrop of shifting market expectations. Understanding these pre-market dynamics offers valuable insights into potential trends ahead.

Starbucks Stock Surges on Strong Earnings

Starbucks has made headlines with a significant uptick of over 4% in its stock prices after CEO Brian Niccol announced that their turnaround strategy is ahead of schedule. The coffee giant reported a remarkable fiscal third-quarter revenue of $9.5 billion, surpassing analysts’ expectations, which were set at $9.31 billion according to LSEG consensus estimates. This impressive performance suggests that Starbucks is not only recovering from previous setbacks but also positioning itself for sustainable growth in the competitive coffee market.

The optimism surrounding Starbucks’ stock could signal a broader trend in the market as investors remain eager to capitalize on the company’s robust performance. With strong advancements in digital sales and a renewed focus on international expansions, Starbucks is leveraging its brand power and innovative menu offerings to attract a broader customer base. As a result, analysts are closely monitoring the company’s ongoing strategies, looking for signs of longevity in this upward trajectory.

HSBC Financial Results Lead to Stock Dip

HSBC’s recent financial results have resulted in a nearly 2.6% decline in its stock prices, highlighting investor concern over the bank’s second-quarter earnings falling short of expectations. The reported results were heavily impacted by significant impairment charges related to its stake in a Chinese bank, coupled with a loss of income from various business divestments made in the first half of 2024. This shows that while HSBC remains a key player in the banking sector, it is currently facing headwinds that may challenge its profitability targets.

Analysts suggest that the reaction from the market reflects a broader concern regarding global economic uncertainties and their potential impact on financial institutions like HSBC. As investors look for stability, the bank’s challenges may necessitate strategic shifts in business operations to bolster future performance. Moving forward, HSBC must address these profitability issues while reassuring investors of its long-term viability in the competitive banking landscape.

Novo Nordisk Stock Declines Amid Revised Guidance

Novo Nordisk’s shares have experienced a troubling decline of almost 4% as the company announced reduced full-year guidance, particularly concerning U.S. sales growth expectations for its bestseller, Wegovy. This market reaction underscores the importance of maintaining robust projections in the pharmaceutical sector, as even slight adjustments can seriously affect investor sentiment. Additionally, the appointment of a new CEO signals Novo’s intent to combat rising competition and revitalize its sales strategy amid these challenges.

The recent downgrading of Novo Nordisk by Bank of America to a neutral position further complicates the company’s standing in the market. Investors are now paying close attention to how the firm adapts to these changes, particularly in relation to its strategic planning and competitive positioning in the obesity treatment market. As performance metrics come under scrutiny, Novo Nordisk will need to implement strong tactics to regain market confidence and stabilize its share prices.

Teladoc Health Sees Positive Reaction After Earnings

Teladoc Health’s stock witnessed a 2.3% rise following the announcement of its second-quarter earnings, which exceeded analyst expectations. Reporting a lesser loss than anticipated at 19 cents per share, the company outperformed the predicted loss of 26 cents as determined by a FactSet survey. Additionally, Teladoc’s revenue of $631.9 million surpassed the consensus estimate of $622.6 million, showcasing the resilience of its telehealth services amid a continually evolving healthcare landscape.

The positive market reaction highlights the relevance of Teladoc’s services, especially as consumers continue to seek convenient healthcare solutions. As the telehealth sector garners more attention in the wake of changing healthcare dynamics, Teladoc’s ability to consistently deliver results ahead of expectations can reinforce investor confidence. Overall, this success reflects an ongoing trend in digital health engagement, suggesting that companies like Teladoc may further thrive as telehealth adoption continues to increase.

LendingClub Financial Results Drive Significant Stock Jump

LendingClub’s stellar financial results have propelled its stock price higher by over 23%, reflecting the company’s strong performance in the second quarter. With a remarkable 32% year-on-year increase in loan originations, the online bank reported earnings of 33 cents per share, significantly exceeding analysts’ expectations of 15 cents per share on revenues of $248.4 million. This exceptional growth illustrates LendingClub’s ability to effectively capture market share, affirming its competitive edge in the fintech landscape.

Investors are likely to remain bullish on LendingClub as it exhibits strong operational metrics and growth potential in the online lending space. The push in loan originations not only emphasizes the demand for digital banking solutions but also indicates the company’s commitment to meeting consumer needs in innovative ways. As fintech continues to evolve and expand, LendingClub’s performance could serve as a benchmark for other financial institutions aiming to enhance their digital offerings.

Visa Faces Premarket Stock Movements Amid Guidance Reaffirmation

Visa’s stock experienced a premarket dip of 1.5% after the company reaffirmed its full-year 2025 guidance, projecting a low double-digit growth in net revenue. Although Visa managed to meet expectations on revenue and profits for the fiscal third quarter, the cautious outlook may have left investors apprehensive about the company’s growth trajectory moving forward. This reaction highlights the inherent volatility in the financial services sector, where even positive news can be overshadowed by concerns over future performance.

In light of Visa’s reassessment, market analysts anticipate that the company will need to adapt its strategy to address emerging challenges, such as competition from alternative payment platforms and changing consumer behaviors. Monitoring Visa’s maneuvers in this fast-evolving landscape will be crucial for stakeholders looking to gauge the company’s ongoing performance potential. As the payments industry undergoes significant transformation, Visa must leverage its robust infrastructure and brand reputation to sustain its industry-leading position.

Mondelez International’s Earnings Prompt Market Reaction

Mondelez International reported a slight decline in its stock prices, slipping by 1% following the release of its second-quarter financial results. Despite achieving earnings and revenue figures that surpassed Wall Street’s consensus, the company encountered challenges with organic growth and gross margin margins that fell short of analyst expectations. This discrepancy signifies the difficulties food companies face as they navigate fluctuating commodity prices and shifts in consumer preferences.

The market’s response to Mondelez underscores the importance of meeting investor expectations consistently, even amid formidable external pressures. Moving forward, Mondelez must refine its approach to maintain profitability and growth within its vast portfolio of snack and confectionery products. As consumers increasingly lean towards healthier options, addressing this shift may be critical for the company to regain momentum in a competitive market.

Qorvo’s Earnings Surprise Investors with Positive Growth

Qorvo saw a nearly 10% surge in stock prices after delivering impressive guidance that exceeded analyst expectations. Anticipating adjusted earnings of $2 per share on revenue nearing $1.025 billion, Qorvo illustrated its strong position within the semiconductor industry despite broader market fluctuations. The company’s first-quarter performance, which also surpassed estimates, hints at a bright future powered by innovation in technology and increasing demand for semiconductors across various sectors.

This positive market reception is indicative of Qorvo’s ability to leverage its technological advancements for sustained growth. As industries continue to integrate cutting-edge solutions, Qorvo’s proactive approach will be essential in maintaining its competitive advantage in the semiconductor space. By focusing on strategic partnerships and investment in research and development, Qorvo is well-positioned to capitalize on future market opportunities and establish itself as a leader in the tech industry.

Peloton Experiences Stock Rebound After UBS Upgrade

Peloton experienced a notable rebound in its stock value, surging nearly 7% after UBS upgraded its shares from neutral to buy. This positive sentiment was fueled by the recommendation suggesting that the company’s stock could potentially double from its current levels. As the home fitness market evolves and consumer interest heightens post-pandemic, analysts are keenly observing Peloton’s strategies to tap into the growing demand for at-home workout solutions.

The upgrade underscores the potential for Peloton to regain its previous market standing, especially as fitness enthusiasts seek reliable and engaging home workout solutions. With innovations in product offerings and a focus on enhancing the user experience, Peloton appears to be positioning itself for a strong comeback. Investors who are bullish on the future of at-home fitness may see this as an opportunity to invest in Peloton as it works to solidify its brand and market relevance.

Frequently Asked Questions

What caused Starbucks stock movements in premarket trading?

Starbucks stock jumped over 4% in premarket trading after CEO Brian Niccol announced that the company’s turnaround plan is ahead of schedule and the company reported fiscal third-quarter revenue of $9.5 billion, surpassing consensus estimates.

How did HSBC’s financial results impact its premarket stock movement?

HSBC shares fell nearly 2.6% in premarket trading due to disappointing second-quarter profit results. The decline was attributed to impairment charges related to its stake in a Chinese bank and income loss from businesses sold in the first half of 2024.

Why did Novo Nordisk experience a stock decline in premarket trading?

Novo Nordisk shares slid approximately 4% in premarket trading following a reduction in its full-year guidance, citing lower expectations for U.S. sales growth of its Wegovy obesity drug. A new CEO announcement also aimed to address ongoing sales challenges.

What earnings report drove Teladoc Health’s premarket stock movement?

Teladoc Health shares rose by 2.3% in premarket trading after the company reported second-quarter results that exceeded expectations. Despite a narrower-than-expected loss of 19 cents per share and revenue of $631.9 million, which surpassed consensus, the stock reacted positively.

How did the strong financial results impact LendingClub’s premarket stock activity?

LendingClub stock surged over 23% in premarket trading after posting strong second-quarter financial results, highlighting a 32% increase in loan origination values year-over-year and earnings significantly above analyst expectations.

What were the recent stock movements of Visa in premarket trading?

Visa saw a decline of 1.5% in premarket trading after reaffirming its full-year 2025 guidance of low double-digit net revenue growth, despite meeting revenue and profit expectations for the fiscal third quarter.

What factors contributed to premarket stock movement for Qorvo?

Qorvo shares surged nearly 10% in premarket trading after the company issued guidance that exceeded analyst expectations, anticipating adjusted earnings of $2 per share on revenue of about $1.025 billion.

How did premarket trading affect Peloton’s stock?

Peloton shares surged nearly 7% in premarket trading after UBS upgraded its stock rating to buy from neutral, indicating potential for significant price appreciation.

What is the significance of monitoring premarket stock movements for investors?

Monitoring premarket stock movements can provide investors with critical insights into market sentiment and potential price changes based on news, earnings reports, and significant corporate announcements.

| Company | Movement | Key Points |

|---|---|---|

| Starbucks | +4% | CEO Brian Niccol announced turnaround plan ahead of schedule. Revenue for Q3 was $9.5 billion, above estimates. |

| HSBC | -2.6% | Second-quarter profits missed expectations due to impairment charges and lost income from sold businesses. |

| Novo Nordisk | -4% | Reduced full-year guidance citing lower U.S. sales growth for Wegovy drug, new CEO appointed. |

| Teladoc Health | +2.3% | Q2 results surpassed expectations with narrower loss and higher revenue. |

| Mondelez International | -1% | Organic growth and margins fell short, but overall earnings and revenue beat consensus. |

| Qorvo | +10% | Raised guidance exceeded expectations; strong first-quarter results. |

| LendingClub | +23% | Strong Q2 financial results with significant growth in loan originations. |

| Visa | -1.5% | Reaffirmed full-year growth guidance but met revenue and profit expectations. |

| Peloton | +7% | Shares upgraded by UBS with bullish forecast suggesting potential stock doubling. |

Summary

Premarket stock movements reflect varied results for major companies making headlines today. Starbucks outperformed expectations with robust revenue, while others like HSBC and Novo Nordisk faced declines following disappointment in profit forecasts. Companies such as LendingClub and Qorvo showed positive movements due to stronger-than-anticipated quarterly results, illustrating a mixed bag in the market as investors react to earnings reports.