Premarket Stock Movements: Major Movers Today

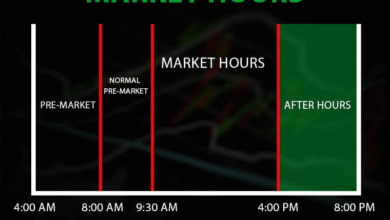

Premarket stock movements can set the tone for the trading day, offering valuable insights into investor sentiment and market dynamics. Major players like General Motors, GameStop, and Nvidia are already making waves in the premarket trading scene, reflecting a mix of anticipation and uncertainty. For instance, General Motors shares plummeted over 6% following a recent tariff announcement, while GameStop experienced a 7% decline after revealing plans to invest heavily in cryptocurrency. As market analysts sift through the latest stock market news, these fluctuations can help investors make informed decisions. Keeping an eye on these early indicators is crucial for anyone looking to navigate the complexities of today’s financial markets.

Before the opening bell, the stock landscape can shift dramatically, often driven by breaking news or company announcements. In the realm of early trading activity, shifts in stocks like General Motors could indicate broader trends in the automotive sector, while fluctuations in GameStop and Nvidia may reflect investor reactions to corporate strategies and market conditions. The reactions of these companies are pivotal in premarket trading, as they can signal potential volatility or opportunity as traders position themselves for the day ahead. Keeping track of these initial moves not only highlights emerging trends but also provides context for understanding the intricacies of market performance. Thus, observing how these stocks react to news and events offers pivotal clues for savvy investors.

Premarket Stock Movements: Key Players to Watch

In the premarket trading session, notable companies are experiencing significant fluctuations that investors should keep an eye on. General Motors, a giant in the automotive industry, saw its stock price drop over 6% following the announcement of a substantial 25% tariff on foreign vehicles. This decision by the government is anticipated to impact auto stocks across the board, creating ripple effects throughout the stock market. As these tariffs take effect next week, the market may brace for further volatility as investors react to the implications for both domestic and foreign automakers.

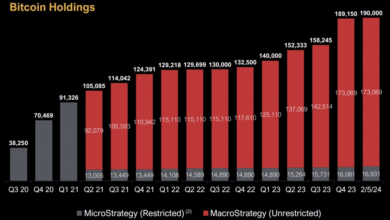

Similarly, GameStop’s shares fell 7% in premarket trading as investors reacted to the company’s recent announcement of raising $1.3 billion in debt to buy Bitcoin. This decision comes on the heels of an impressive 11.7% rally the prior day, showcasing the usual ups and downs of the stock market. As GameStop explores new avenues for growth through cryptocurrency investments, it raises questions about the sustainability of its stock trajectory amidst fluctuating market sentiments.

The Impact of Tariffs on Auto Stocks

The recent announcement of tariffs by President Trump has shaken up the auto sector significantly, leading to steep declines in major automakers like General Motors and Stellantis. With a new 25% tariff set to affect all cars not manufactured in the U.S., investors are now weighing the financial repercussions these changes will bring to manufacturers and their stock prices. This sudden move signals both the urgency of political decisions in influencing market behavior and how such policies can drastically impact the stock market’s performance.

As trading commences, auto stocks are set for a turbulent road ahead, with analysts speculating on the potential long-term effects these tariffs could have. Early trends show that investor confidence is wavering, reflecting a reactive market that could lead to further declines in stock values. Additionally, this situation compels investors to reevaluate their positions within the auto industry, setting the stage for potential rebounds or continued downturns based on further political actions in the coming days.

GameStop’s Shift to Cryptocurrency: A Risky Venture?

In an unexpected turn, GameStop has declared plans to purchase Bitcoin as part of its financial strategy, resulting in a 7% drop in its shares during premarket trading. While some investors may view this move as a bold leap into the future of finance, others are expressing concern over the long-term stability of such a strategy. The swift rise and fall of cryptocurrency has left many wary, as evidenced by the company’s previous 11.7% rally, suggesting that this new initiative may come with significant risks.

The decision to leverage corporate debt for cryptocurrency investments signifies a notable shift in GameStop’s business model, and may reflect a broader trend of traditional companies venturing into digital assets. However, with uncertainties around regulatory measures and market volatility, investors must tread carefully. GameStop’s endeavor warrants close observation, as it could set a precedent for how legacy companies adapt to shifting economic landscapes.

Nvidia’s Market Reaction: Potential Supply Issues

Nvidia, a leader in the technology space, has faced a challenging premarket session, with shares down by 1.7% following concerning reports about potential shortages of its H20 chip. As one of the primary suppliers of graphics processing units (GPUs) for artificial intelligence and gaming applications, any sign of supply issues can send ripples through the stock market. The company’s stock performance is indicative of broader concerns regarding supply chain stability in the tech industry.

Investors are closely monitoring any developments surrounding Nvidia, especially with increasing demand for AI-driven technologies. The potential implications of chip shortages from key suppliers like H3C in China could hinder Nvidia’s growth trajectory and impact its ability to meet market demands. As competition intensifies in the tech sector, proactive measures and transparency about potential supply challenges will be vital for maintaining investor confidence.

Jefferies’ Earnings Report: A Mixed Bag

Jefferies has recently reported a decline in earnings, sending its stock down by 3.8% during premarket trading. While the bank posted earnings of 57 cents per share alongside $1.59 billion in revenue, these figures marked a decrease from the same period last year. Such a downturn raises concerns about the firm’s growth prospects amid a dynamic financial landscape, where competition and market fluctuations significantly influence performance.

The reaction to Jefferies’ financial results underscores the sensitivity of the financial services sector to market sentiment. As investors digest Jefferies’ performance, they will be weighing its ability to rebound and capitalize on emerging opportunities in an increasingly competitive environment. Furthermore, Bank of America’s insights and potential market corrections following Jefferies’ earnings could lead to broader implications for bank stocks within the sector.

Verint Systems: Earnings Miss Sparks Sell-off

Verint Systems faced a notable downturn of 10.2% in premarket trading due to disappointing fourth-quarter earnings. The announcement revealed that the company earned 99 cents per share—far below analyst expectations of $1.27—with significant revenue misses as well. This stark discrepancy highlights the vulnerabilities that can occur within technology-focused companies when performance does not meet market projections.

The sell-off of Verint reflects how crucial analyst expectations are within the stock market. As investors reassess the company’s future guidance and the underlying factors contributing to this earnings miss, the road ahead could be challenging for Verint. The need for robust strategic planning and execution is critical as the company seeks to regain investor confidence in an evolving tech landscape.

Liberty Energy: A Bright Spot Amidst Market Decline

In contrast to the substantial stock movements seen elsewhere, Liberty Energy has shown resilience with a 2% increase following an upgrade from Morgan Stanley. Analysts have characterized Liberty Energy as an attractive investment, particularly in light of evolving power demands and the shifts occurring within the energy sector. This optimistic outlook amidst fluctuating market conditions provides a potential beacon of hope for investors.

The upgrade reflects a broader trend where energy service companies may benefit from increased demand as sectors evolve and reshape in response to global energy needs. Investors will be eager to see if Liberty Energy can continue to capitalize on these trends and maintain its upward trajectory. In a market where volatility reigns, this growth potential may provide a reason for cautious optimism among investors.

Alibaba’s AI Initiative: Stock Growth Despite Market Pressures

In the wake of recent market fluctuations, Alibaba managed a modest increase of 1% in premarket trading thanks to the launch of its new open-source AI model, ‘Qwen2.5-Omni-7B.’ Designed for edge devices, this initiative signals Alibaba’s commitment to pushing boundaries within the technology investment sphere. As investors increasingly look to innovative companies, this move outlines the potential for growth despite prevalent market concerns.

The embrace of AI technologies could provide Alibaba with leverage as it competes against other tech giants. With ongoing developments in software and hardware leading to transformative impacts in multiple industries, Alibaba may harness emerging opportunities to strengthen its position in the market. Stakeholders will be watching closely to see how this new AI model impacts Alibaba’s broader business strategy and stock performance moving forward.

Stock Market News: Navigating a Volatile Landscape

As we navigate these tumultuous waters in the stock market, staying updated with market news is paramount. The recent trends in premarket trading highlight the complex interplay between economic policies, corporate strategies, and individual company performances. Investors must equip themselves with the latest information to make informed decisions and minimize risks associated with market fluctuations.

This volatile environment calls for a diversified approach in stock selection, particularly in sectors like technology and automotive that face immediate challenges. With high-stakes decisions being made and economic factors constantly shifting, analysts are advising vigilance as companies adapt to changing market dynamics. Monitoring developments in stocks such as General Motors, GameStop, and Nvidia can provide critical insights that determine the direction of investment portfolios.

Frequently Asked Questions

What are the key factors affecting premarket stock movements for General Motors?

General Motors’ premarket stock movements have been significantly impacted by political decisions, such as the recent announcement of a 25% tariff on imported cars by President Trump. This news resulted in a drop of over 6% in GM’s stock price during premarket trading.

How did GameStop’s premarket trading activity reflect its recent business strategies?

GameStop experienced a 7% decline in premarket trading, which is related to its announcement of raising $1.3 billion in debt to buy bitcoin. This move follows a notable 11.7% rally in the previous session, demonstrating the volatility in its premarket stock movements influenced by corporate finance strategies.

What implications do Nvidia’s premarket stock movements have on investor confidence?

Nvidia shares ticked 1.7% lower in premarket trading, driven by concerns over potential shortages of its H20 chip, as reported by H3C, a major Chinese server manufacturer. This decline may raise questions about Nvidia’s supply chain reliability and affect investor confidence.

How are premarket stock movements influencing Jefferies’ market position?

Jefferies’ premarket stock movements, including a 3.8% drop following its earnings report, indicate investor reaction to financial performance. The earnings per share of 57 cents and revenue of $1.59 billion represent a decline from the prior year, signaling potential concerns about the bank’s growth prospects.

What was the market reaction to Alibaba’s new AI model during premarket trading?

During premarket trading, Alibaba’s U.S.-listed shares rose by 1% after the launch of its new open-source AI model, ‘Qwen2.5-Omni-7B’. This reflects positive market sentiment towards innovations in the tech sector, influencing Alibaba’s premarket stock movements.

What can we infer about Verint Systems’ premarket stock movements based on their earnings report?

Verint Systems saw a significant plunge of 10.2% in premarket trading, attributed to weak earnings results that fell short of analyst expectations. The company’s earnings of 99 cents per share and revenue of $254 million led to negative perceptions, impacting its premarket stock movements.

Why did Advanced Micro Devices experience premarket stock movements in response to Jefferies’ downgrade?

Advanced Micro Devices (AMD) experienced a 3.4% decline in premarket stock movements following Jefferies’ downgrade from buy to hold. The firm cited rising competition as a concern, impacting investor outlook on AMD’s future performance.

What factors contributed to Liberty Energy’s positive premarket stock performance?

Liberty Energy’s stock rose by 2% in premarket trading thanks to an upgrade from Morgan Stanley, which rated it as an attractive investment due to anticipated growth in power demand. This upgrade has positively influenced premarket stock movements.

How did UBS Group’s downgrade by Bank of America affect its premarket trading?

UBS Group’s premarket stock fell nearly 2% after Bank of America downgraded it to underperform. This downgrade highlighted potential regulatory risks in Switzerland, thereby impacting investor sentiment and contributing to the stock’s negative premarket movements.

| Company | Premarket Movement | Reason for Movement |

|---|---|---|

| General Motors | -6% | 25% tariff on imported vehicles announced by President Trump. |

| GameStop | -7% | Plans to raise $1.3 billion in debt to buy bitcoin. |

| Jefferies | -3.8% | Earnings decline to 57 cents per share for Q1. |

| Nvidia | -1.7% | Warnings of possible chip shortages from H3C. |

| Alibaba | +1% | Launched a new open-source AI model. |

| Verint Systems | -10.2% | Weak Q4 earnings and full-year guidance. |

| Advanced Micro Devices | -3.4% | Downgraded by Jefferies due to rising competition. |

| Liberty Energy | +2% | Upgraded by Morgan Stanley for power demand growth. |

| UBS Group | -2% | Downgraded by Bank of America due to regulatory risks. |

Summary

Premarket stock movements today showed significant volatility in the market as a result of both regulatory developments and company-specific announcements. General Motors and Jefferies faced declines while GameStop’s drop aligns with its shake-up plans regarding bitcoin investments. Meanwhile, Liberty Energy saw an upgrade, countering the trend in some tech stocks like Nvidia and AMD that suffered losses. Overall, these movements reflect the dynamic state of premarket trading that investors closely monitor for potential market shifts.