Premarket Stock Movements: Starbucks, AES, and More

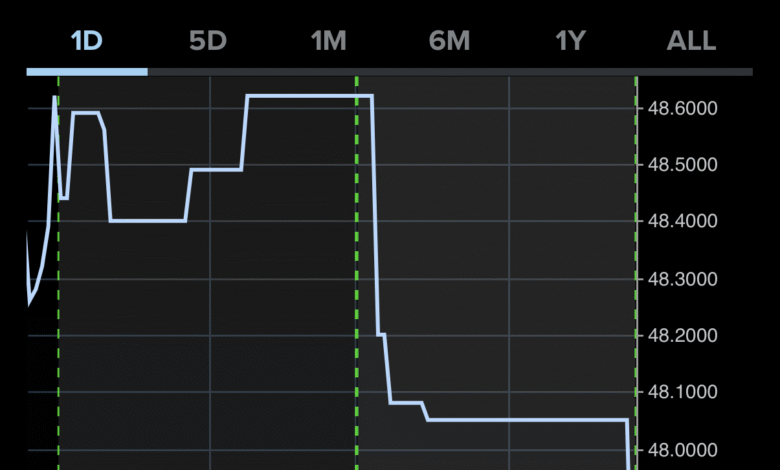

Premarket stock movements are capturing the attention of investors as they analyze which shares are making impactful strides before the official market opening. On July 9, 2025, notable names like Starbucks and AES Corporation are in the spotlight, showcasing the dynamic shifts occurring in the stock market. Investors keen on tracking premarket stocks can glean valuable insights from the latest financial news updates, identifying trends that may influence overall stock performance. With a range of companies experiencing varied trading patterns, investors are constantly seeking out relevant investing trends to inform their strategies. Monitoring these premarket stock movements can provide a critical edge, setting the tone for the day’s trading activity.

As the day begins, many investors turn their attention to early trading results, focusing on stocks that are seeing fluctuating prices prior to the market’s official opening. This preview of stock behaviors not only highlights companies primed for significant changes but also reflects broader investing trends and market sentiment. Keeping abreast of the latest stock market news, such as earnings announcements or partnership news, can be essential for portfolio management. Understanding the forces driving these pre-session shifts allows traders to adapt their strategies and optimize their stock performance analysis. Engaging with financial news updates is crucial to grasp the implications these early movements have on the overall investment landscape.

Premarket Stock Movements: Key Players to Watch

On July 9, 2025, premarket stock movements are catching the attention of investors as they seek to capitalize on early trading trends. Notably, Starbucks Corporation (SBUX) is showcasing a remarkable surge following the release of a robust quarterly earnings report. The company is reported to have achieved strong growth in sales, which has positively influenced investor sentiment, highlighting the resilience of its business model amid ongoing economic challenges. This kind of performance is particularly appealing to investors who are attuned to stock performance analysis, as it provides insights into potential long-term growth patterns.

Moreover, the renewable energy sector is also in the spotlight with AES Corporation (AES) making headlines after announcing a new initiative aimed at enhancing its sustainability portfolio. Investors have responded enthusiastically, which is reflective of current investing trends that favor companies shifting towards clean energy solutions. These premarket movements are indicative of broader shifts within the stock market, where environmentally responsible investments are increasingly influencing market conditions and investor strategies.

Analyzing Stock Market News: Focus on Healthcare and Biopharma

In addition to the impressive performance from SBUX and AES, healthcare stocks are generating buzz, particularly UnitedHealth Group (UNH) which has seen a notable increase in its stock price. The company recently revealed plans for a new partnership to expand its telehealth services, reminding investors of the growing importance of digital health solutions. Such innovations are essential in the current environment as they reflect changing consumer behaviors and an increased reliance on remote healthcare access. This evolution in the healthcare sector is a critical component of today’s stock market news, emphasizing how major companies adapt to meet consumer needs.

Additionally, Verona Pharma (VRNA) has become a significant point of discussion in financial news updates due to its recent drug trial outcomes. The volatility of VRNA’s stock highlights the inherent risks associated with biopharmaceutical investing. Analysts are closely scrutinizing the results, weighing potential product launches against investor expectations. As financial analysts continue to dissect these developments, the impact on market sentiment will be closely monitored, making it essential for investors to stay informed about stock performance analysis and the broader implications for the biopharma industry.

Investing Trends Shaping the Future of the Stock Market

As we navigate through the challenges of 2025, investing trends continue to evolve, influenced by various economic factors and emerging technologies. The shift towards renewable energy as noted with AES Corporation demonstrates a growing emphasis on sustainable investments, which are shaping future market landscape. Investors today are not only looking for profitability but are also seeking alignment with ethical standards and environmental sustainability, driving demand for companies that commit to greener practices. This trend is becoming apparent in various sectors and represents a significant transformation in how investors approach stock market strategies.

Furthermore, technology-driven investment in healthcare, as observed with UnitedHealth Group’s expansion into telehealth, is another critical trend currently shaping investor outlook. The pandemic has accelerated the adoption of digital solutions in healthcare, and companies that leverage this shift are positioned to capture substantial market opportunities. Consequently, financial news updates often highlight firms that show innovation in service delivery, providing investors with insights into potential for high returns. Adapting to these investing trends is essential for anyone looking to thrive in today’s dynamic stock market.

Financial News Updates: The Importance of Staying Informed

In a rapidly changing stock market, remaining updated on financial news is crucial for investors aiming to make informed decisions. Following news on premarket stock movements allows traders to react promptly to early trading signals that might dictate the direction of the market throughout the day. The ability to interpret stock performance analysis in real-time is a powerful tool for investors, especially when dealing with high volatility stocks like Verona Pharma (VRNA). Regular updates from reliable financial news outlets can provide essential context, helping investors understand underlying trends beyond just the numbers.

Moreover, engaging with financial news discussions online can often uncover insights that are not immediately apparent in formal reports. Investors who participate in forums or subscribe to investment newsletters often share analyses on emerging patterns and stock market dynamics, enabling a collaborative approach to investment strategies. This community-driven engagement is increasingly vital as trends in the stock market become more interconnected globally, impacting local markets in unprecedented ways. Staying connected through diverse channels can enrich one’s investment strategy and enhance comprehension of market movements.

Understanding Stock Performance Analysis Techniques

Stock performance analysis is an essential component of making sound investment decisions. It involves evaluating a range of metrics to assess the health and potential growth of a stock, which is crucial in deciding when to buy or sell securities. Investors frequently study historical performance, earnings reports, and market conditions to gain insights into a company’s future trajectory. Recent movements in stocks like Starbucks and AES can serve as case studies for new investors looking to understand how various indicators can predict strong performance trends and potential market shifts.

Moreover, the integration of qualitative factors alongside quantitative analysis enriches the overall assessment process. Factors such as market sentiment, competitor performance, and industry innovations can heavily influence stock movements and provide context to the numbers. By incorporating these elements, investors enhance their ability to make strategic decisions. This comprehensive approach to stock performance analysis ultimately aids in managing risk and capitalizing on market opportunities in a manner that aligns with current investing trends.

The Future of Renewable Energy Investments

The renewable energy sector is rapidly gaining traction, with companies like AES Corporation leading the charge through innovative projects that promise long-term growth and sustainability. As global awareness of environmental issues rises, investors are increasingly considering the impact of their investments on the planet. The recent initiatives launched by AES are demonstrative of a broader trend within the stock market that seeks to prioritize eco-friendly practices and technologies. Financial analysts are keenly observing how this sector develops, anticipating substantial returns from investments in renewable energies.

Furthermore, the movement towards sustainable investments is supported by governmental policies and incentives aimed at fostering clean energy growth. Investors looking at renewable energy stocks are benefiting from both tax breaks and rising demand for eco-conscious practices. As more companies unveil their sustainability commitments and projects, those that align with investor preferences for responsible investing will likely see significant stock performance improvements. This trend underscores the optimism surrounding renewable energy investments as they begin to dominate discussions in financial news updates.

Impact of Drug Trial Results on Biopharmaceutical Stocks

The volatility surrounding biopharmaceutical stocks, such as Verona Pharma (VRNA), typically revolves around the results of drug trials and clinical studies. Investors must exercise caution and conduct thorough stock performance analysis to determine whether a company’s potential product development trajectory aligns with their risk appetite. Following recent trial results, VRNA has seen fluctuating stock prices, leaving many investors pondering the future viability of its drug pipeline. This situation exemplifies the critical importance of staying informed about all aspects of trial outcomes, as they can dramatically shape market outlooks.

As scientists and analysts dissect the implications of trial results, financial news updates often provide clarity on potential market reactions. Investors need to follow expert commentary and analyses to formulate educated predictions about stock movements. Given the unpredictable nature of biotechnology markets, understanding the broader implications of trial results can not only aid decision-making but also guide strategic investment positioning. As such, constant vigilance in this high-stakes area of the stock market is paramount for those looking to navigate with confidence.

Navigating Market Volatility: Strategies for Investors

Market volatility is a fact of life for investors, particularly in sectors prone to rapid shifts like technology and healthcare. As we observe significant premarket stock movements, such as those surrounding UnitedHealth’s recent partnerships, investors must have strategies in place to mitigate risk. One effective approach involves diversifying portfolios to buffer against sudden losses; by spreading investments across various sectors, the overall impact of a downturn in any single area can be minimized. This strategy is particularly relevant in today’s unpredictable market climate.

Another critical strategy involves staying continually educated about market trends and utilizing financial news updates to anticipate movements. Investors should assess not only individual stock performance but also broader economic indicators and sector-specific developments. For instance, keeping an eye on healthcare innovations can help investors capitalize on new opportunities whilst remaining aware of potential setbacks. Positioning oneself to adapt to market fluctuations, by leveraging tools such as stop-loss orders or portfolio reviews, becomes invaluable in navigating the erratic nature of stock trading.

The Role of Investor Sentiment in the Stock Market

Investor sentiment plays a significant role in driving stock price movements, especially during periods of uncertainty or change, such as those reflected in premarket stock movements. Factors such as news reports, social media discussions, and economic indicators can heavily influence how investors perceive the market’s future. Stocks like Starbucks and AES exhibit how positive earnings and strategic initiatives can sway sentiment favorably, reflecting confidence in business sustainability and growth. Understanding these psychological aspects is essential for investors wanting to navigate stock market dynamics effectively.

Moreover, investor sentiment can create self-fulfilling prophecies in trading. For example, if a significant number of investors believe that a particular stock will perform well, their collective buying actions might drive prices upward, regardless of the company’s underlying fundamentals. Conversely, negative sentiments can lead to sell-offs and diminished stock value. Thus, being attuned to market sentiment alongside traditional financial analysis can provide investors with a more comprehensive view of potential stock movements and guide prudent trading strategies.

Frequently Asked Questions

What are premarket stock movements and why do they matter?

Premarket stock movements refer to the changes in stock prices that occur before the official opening of the stock market. These movements matter to investors as they can indicate trends and sentiments that may affect stock performance throughout the day, offering insights into potential investing trends.

How do I find information on premarket stocks?

You can find information on premarket stocks by checking financial news websites, stock market apps, or dedicated market sections on platforms like Yahoo Finance and CNBC. These sources often provide real-time updates on stock performance analysis, including significant movers in premarket trading.

Which stocks are trending in premarket trading today?

As of July 9, 2025, stocks like Starbucks Corporation, AES Corporation, Verona Pharma, and UnitedHealth Group are making significant moves in premarket trading. These companies are attracting attention due to factors like strong earnings reports and new initiatives.

What impact do premarket movements have on the stock market?

Premarket movements can significantly affect the stock market by setting the tone for trading once the market opens. Large premarket gains or losses can influence investor sentiment and lead to increased volatility during regular trading hours.

How do earnings reports influence premarket stock movements?

Earnings reports can dramatically influence premarket stock movements as strong results often lead to an uptick in stock prices, while disappointing results may cause prices to drop. For instance, Starbucks’ recent earnings report has led to notable activity in premarket trading.

What role does news play in shaping premarket stock movements?

News plays a crucial role in shaping premarket stock movements. Announcements regarding new partnerships, product trials, or corporate strategies, such as UnitedHealth’s telehealth expansion, can drive investor interest and impact stock prices significantly before market hours.

What tools can investors use to analyze premarket stock performance?

Investors can use various tools like stock charting software, financial news platforms, and brokerage services that offer detailed stock performance analysis to evaluate premarket stock performance. These tools help track premarket movements and assess potential investment opportunities.

Are premarket stock movements reliable indicators for intraday trading?

While premarket stock movements can provide valuable insights, they are not always reliable indicators for intraday trading due to lower volume and liquidity. It’s essential to consider additional factors, such as overall market trends and subsequent news developments, before making trading decisions.

What is the difference between premarket and after-hours trading?

Premarket trading occurs before the market officially opens, while after-hours trading takes place after the market has closed. Both can exhibit significant price movements driven by news and events, but premarket trading often has less volume, which can lead to volatility.

How can I stay updated on financial news related to premarket stocks?

To stay updated on financial news related to premarket stocks, consider subscribing to market newsletters, following financial news outlets on social media, or using stock market news apps that provide real-time alerts on significant stock movements and investing trends.

| Company | Ticker | Key Points |

|---|---|---|

| Starbucks Corporation | SBUX | Strong quarterly earnings indicating robust growth. |

| AES Corporation | AES | New renewable energy initiative projected for significant growth. |

| Verona Pharma | VRNA | Stock volatility after recent drug trial results. |

| UnitedHealth Group | UNH | Stock increase due to new telehealth service partnership. |

Summary

Premarket stock movements on July 9, 2025, revealed significant activity from major companies. Notably, Starbucks, AES, Verona Pharma, and UnitedHealth are leading the charge with pivotal announcements impacting their stock prices. Investors should monitor these developments closely as they reflect broader market trends.