Premarket Trading Data: Earnings and Insights Today

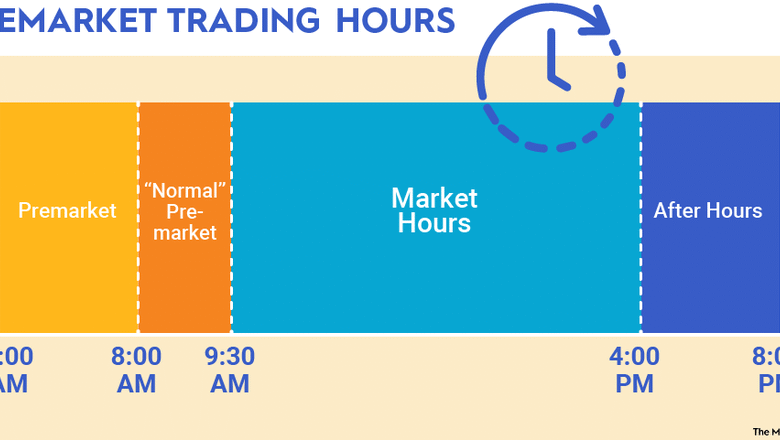

Premarket trading data offers a crucial insight into how stocks may perform when the regular market opens. Investors keep a close eye on premarket trading, analyzing shifts in stock movement as companies release earnings reports and respond to global news. For instance, stocks like Circle Internet Group and Five Below have seen significant premarket activity following their recent earnings announcements. Understanding these fluctuations can provide a preview of stock market trends, helping traders make informed decisions. By examining premarket analysis, investors can better gauge potential impacts on their portfolios before the official trading day begins.

Alternately referred to as early trading analytics, premarket sessions give investors a head start on market developments ahead of the opening bell. This period is critical for assessing how fresh corporate earnings data and economic updates can shape stock valuations. Notable movers during this pre-opening phase often reflect broader market sentiment and may highlight promising or troubling signals for potential investors. Engaging with the latest financial updates allows market participants to refine their strategies and enhance their understanding of upcoming stock trajectories. Thus, preopening activity serves as a barometer for trading expectations, setting the tone for the day ahead.

Premarket Trading Data Highlights

In today’s premarket trading session, certain companies have captured significant attention due to noteworthy movements and pivotal announcements. Premarket trading data reflects the latest reactions to earnings reports and guidance updates from various firms. For instance, Circle Internet Group’s IPO pricing at $31 per share, exceeding initial expectations, significantly boosts its market valuation to around $7 billion. Meanwhile, Five Below’s rise of 7% is indicative of strong fiscal performance, with better-than-expected earnings signaling robust stock market trends.

These fluctuations in premarket trading often set the tone for the trading day ahead. Investors and analysts closely monitor these shifts to identify potential entry points or exit strategies based on market sentiments. For example, MongoDB’s staggering 17% jump demonstrates the power of positive company earnings reports, which not only bolster investor confidence but also influence wider stock movement analysis across the relevant sectors.

Impact of Quarterly Earnings on Stock Performance

Company earnings reports serve as critical indicators of financial health, often resulting in immediate reactions in the stock market. For instance, Five Below’s strong first-quarter earnings report has not only impressed analysts by beating revenue estimates but also painted a bullish picture for the company’s future performance. As a result, its stock has gained 7% in premarket trading, reflecting investor optimism and a favorable outlook for upcoming quarters. The positive guidance offers key insights into the retailer’s revenue expectations, enticing investors to take a closer look.

Conversely, earnings results that fall short of expectations tend to have the opposite effect. PVH Corp’s share price fell 8% after it lowered its earnings guidance, signalling concerns over profitability amid rising tariffs. Such volatility in stock performance underscores the importance of thorough premarket analysis, allowing investors to position themselves effectively based on anticipated trends and market dynamics.

Market Reactions to Tariff Impacts and Guidance Changes

Tariffs have become a pivotal topic for many companies, influencing their financial forecasts and impacting stock prices. Lands’ End shares rallied approximately 8% as the company outlined its strategies to manage increased tariffs, even though it reported a slight earnings miss. This strategic communication appears to have reassured investors, reflecting a growing trend where effective crisis management can bolster stock performance. Premarket trading data reveals how markets respond to such disclosures, showcasing the interplay between corporate actions and investor sentiment.

On the flip side, Brown-Forman’s stock plummeted roughly 10% after fiscal fourth-quarter earnings did not meet analysts’ expectations. Their revenue shortfall signifies how external market factors, such as tariffs, can create volatility, thereby affecting stock movement analysis. It highlights the necessity for companies to address potential risks proactively to maintain investor confidence and minimize negative market reactions.

The Role of Analysts in Stock Market Predictability

Analysts play a crucial role in shaping market perceptions and stock ratings. Their reports often act as catalysts for stock movements, particularly during premarket trading. For example, Chewy’s stock experienced a dip of 3% after Jefferies downgraded its share rating, prompting investors to reassess their positions based on revised evaluations of valuation. Such downgrades highlight the influence that market analysts wield in shaping investor sentiment, significantly impacting short-term stock trends and longer-term investment strategies.

Furthermore, upgrades from analysts can lead to positive stock price movements, as seen with Visa’s 1% increase following an upgrade by Mizuho. The report emphasized the potential for U.S. credit card penetration and market growth, fostering investor optimism. These analyst upgrades and downgrades illustrate the vital function that informed recommendations serve in premarket analysis, ultimately guiding traders in the volatility of the stock market.

Analyzing Post-Earnings Reactions in the Stock Market

Post-earnings reactions can often shed light on investor expectations and market dynamics. For instance, Planet Labs surged by 20% after announcing stellar earnings and achieving positive cash flow. Such substantial gains indicate that the market not only values the current performance but also anticipates a sustained upward trajectory for the company. This aligns with broader stock market trends, emphasizing how beneficial earnings reports can be in catalyzing favorable investor behavior.

In contrast, CyberArk Software faced a drop of nearly 2% following its announcement of a $750 million convertible notes offering, underscoring how financing actions can lead to immediate market skepticism. Investors often react to perceived dilution of value or shifts in financial strategy. These incidents illustrate the importance of comprehensive stock movement analysis post-earnings, allowing investors to navigate the intricacies of price fluctuations immediately following financial disclosures.

Implications of Downgrades on Stock Confidence

Downgrades from investment firms can significantly shake investor confidence and lead to considerable price movements in stocks. Case in point, following Jefferies’ downgrade of Chewy, the stock witnessed a premarket decline, demonstrating the immediate repercussions of analyst sentiment. Downgrades tend to signal potential risks or overvaluation, prompting investors to reconsider their positions in the stock market. This rapid change can create heightened volatility, especially when traders react swiftly to the news.

Moreover, such downgrades can also impact broader market perceptions of a sector. When a prominent analyst advises caution on a popular stock, it can lead to a ripple effect, prompting a re-evaluation of peer companies. Understanding these dynamics is crucial for investors who rely on comprehensive premarket analysis to inform their investment decisions. Observing how stocks respond to downgrades can provide valuable insights into market trends and potential areas of concern.

Exploring Positive Surprises in Earnings Reports

Positive surprises in earnings reports can dramatically alter market perceptions and stock trajectories. For example, MongoDB’s notable earnings of $1.00 per share surpassed expectations and resulted in a robust 17% increase in stock price. Investors often welcome outperformance as it bodes well for future growth, enhancing overall confidence in the company’s strategic direction. Such surprises tend to prompt a reevaluation of analyst forecasts, leading to potential upgrades and positive sentiment in the broader stock market.

Receiving better-than-expected results can significantly boost a company’s reputation and investor appeal, creating a positive feedback loop. Verint Systems exhibited this phenomenon with an impressive 18% rise following its strong quarterly results. These occurrences emphasize the profound effect that exceptional earnings performance can have on stock trends, highlighting the importance of ongoing monitoring of company reports and adjusting strategies accordingly in the fluctuating landscape of stock market investments.

Factors Influencing Retail Sector Stocks

The retail sector remains particularly responsive to economic indicators and consumer behavior, with earnings reports serving as a primary gauge of performance. Companies like Five Below, which reported strong earnings that outstripped market expectations, noticeably affect investor sentiment in the retail space. Their ability to project future revenue growth further attracts investment, showcasing the vital role fiscal health plays in stock market trends.

Conversely, retailers facing challenges, such as rising tariffs or shifts in consumer spending, may experience stock decline. Lands’ End’s response to tariff hikes illustrates how proactive strategies can mitigate adverse effects, allowing the company to maintain investor confidence amidst volatility. Observing these patterns aids traders and investors in formulating strategies that align with anticipated retail market movements, underscoring the critical interplay of earnings reports and stock performance within the sector.

Understanding the Market’s Reaction to Tech Stocks

Technology stocks often showcase pronounced volatility, with earnings reports frequently inducing sharp stock movements. MongoDB’s strong earnings surprise is a classic example, where a 17% surge reflects investor enthusiasm for growth in the sector. The technology landscape is characterized by rapid changes, making strong earnings performances crucial for sustaining investor interest and confidence.

However, not all tech stocks respond positively. CyberArk’s decline highlights the fragility that can accompany funding announcements, serving as a reminder that financial strategies can impact market perceptions. Understanding these fluctuations is essential for tech investors, as thorough premarket analysis can provide insights into potential trending movements and help anticipate investor reactions effectively.

Frequently Asked Questions

What is premarket trading data and how does it influence stock market trends?

Premarket trading data provides insights into the performance of stocks before the market officially opens. It highlights the price movements and trading volume of stocks, reflecting investor sentiment and potential stock market trends. Understanding premarket trading helps investors gauge market expectations based on premarket news and investor reactions.

How can I interpret premarket news for stock movement analysis?

Premarket news is crucial for stock movement analysis, as it offers updates on key factors such as company earnings reports and market sentiment. By analyzing premarket news, investors can anticipate potential price changes and trading volumes in stocks, making informed decisions based on early indicators before the official market opens.

What factors contribute to significant changes in premarket trading data?

Significant changes in premarket trading data can be attributed to various factors including company earnings reports, unexpected news releases, changes in analyst ratings, and broader economic indicators. For example, when a company releases better-than-expected earnings, its stock may show strong gains in premarket trading, reflecting positive investor sentiment.

Are there specific strategies for analyzing premarket trading data effectively?

Effective strategies for analyzing premarket trading data include monitoring volatility, observing trading volumes, evaluating premarket price movements against historical performance, and keeping an eye on premarket news that may impact stock prices. Utilizing tools such as stock screeners can also help to identify patterns and opportunities for further analysis.

How do company earnings reports influence premarket trading data?

Company earnings reports are instrumental in shaping premarket trading data. Strong earnings can lead to positive premarket movements as investors react favorably, while disappointing earnings often result in declines. Monitoring earnings reports allows investors to assess company performance relative to expectations, which is crucial for making investment decisions.

What role does premarket analysis play in trading decisions?

Premarket analysis plays a vital role in trading decisions by providing early indicators of market sentiment and stock performance. Investors can use premarket analysis to adjust their trading strategies, capitalize on potential opportunities, and position themselves advantageously before the markets open.

How can I access reliable premarket trading data?

Reliable premarket trading data can be accessed through various financial news websites, brokerage platforms, and financial market applications. These platforms typically provide real-time updates on stock prices, trading volumes, and relevant premarket news, enabling investors to stay informed before making trades.

What are common themes in premarket trading data that investors should watch for?

Common themes in premarket trading data include reactions to earnings reports, analyst upgrades or downgrades, significant geopolitical events, and macroeconomic indicators. Being aware of these themes can help investors predict potential market movements and develop strategies to navigate the stock market effectively.

| Company | Premarket Change | Key Highlights |

|---|---|---|

| Circle Internet Group | +0% | IPO priced at $31, raising $1 billion, with a market value of $7 billion. |

| Five Below | +7% | Reported Q1 earnings of 86 cents/share, revenue of $971 million, above estimates. |

| MongoDB | +17% | Earnings of $1.00/share with revenue at $549 million, surpassing expectations. |

| PVH Corp | -8% | Cut Q2 earnings guidance due to tariff impacts despite strong Q1 results. |

| Lands’ End | +8% | Took measures against tariffs; Q1 loss matched forecasts. |

| Chewy | -3% | Stock downgraded from buy to hold by Jefferies due to valuation concerns. |

| Brown-Forman | -10% | Missed Q4 earnings expectations; revenue fell short as well. |

| Verint Systems | +18% | Q1 earnings of 29 cents/share exceeded expectations. |

| Visa | +1% | Upgraded to outperform citing growth potential in U.S. credit card market. |

| Dollar Tree | +2% | Received an upgrade from JPMorgan after a drop in the previous session. |

| Planet Labs | +20% | Q1 earnings beat expectations, first positive free cash flow quarter. |

| CyberArk Software | -2% | Announced $750 million convertible notes offering. |

Summary

Premarket trading data reveals significant movements among various companies. Investors are keenly watching the premarket changes as they reflect company performances and market sentiment. With Circle Internet Group launching a successful IPO, while others like Brown-Forman face challenges, understanding these market dynamics is crucial for informed investment decisions.