Premarket Trading: Key Movers to Watch This Morning

In the fast-paced world of finance, **premarket trading** serves as a crucial window into how the stock market is shaping up for the day ahead. This phase of trading allows investors to react to various events, including the latest **stock market news** and **earnings reports**, before the official opening bell. Observations of **premarket stock movers**, such as **electric vehicle stocks** and **financial technology stocks**, can provide insights into market sentiment and potential directions for the day. For instance, major shifts in shares, like those seen with Li Auto and Tapestry, underline the significance of premarket analysis. By tuning into these early trading sessions, investors can better position themselves to navigate a volatile market landscape.

The premarket phase of stock trading acts as a preparatory stage for investors to gauge potential market movements before they happen. This early trading period often reveals valuable insights into company performance, especially following significant **earnings announcements** and shifts in expectations regarding **financial technology enterprises** and **electric vehicle manufacturers**. Observing shifts among **premarket stock movers** can highlight trends and create opportunities for early engagement. As shareholders track changes closely, they can capitalize on initial reactions to emerging **stock market news** and adjust their strategies accordingly. The insights gained from premarket dynamics help investors make informed decisions in an ever-evolving financial environment.

Premarket Trading Insights: Key Movers in the Market

Premarket trading sets the stage for market dynamics and investor sentiment ahead of the regular trading hours. Today, several notable companies have made headlines, influencing stock market news and shaping investor decisions. One of the significant declines observed is with Li Auto, whose shares fell approximately 2% after JPMorgan downgraded its rating. This decision was fueled by concerns over increasing competition in the electric vehicle sector, showcasing how analysts’ outlooks can significantly impact premarket stock movements.

In stark contrast, Bullish experienced a massive surge of 14% in extended trading, riding on the wave of an 83% climb during its market debut. Such drastic fluctuations demonstrate the volatility present in premarket trading, where news of earnings reports, analyst upgrades, or downgrades can lead to rapid changes in stock prices before the market officially opens.

Electric Vehicle Stocks: A Closer Look at Li Auto

Electric vehicle stocks have been under intense scrutiny lately, and Li Auto’s recent performance exemplifies the challenges within this rapidly evolving sector. Analysts are increasingly cautious, as highlighted by JPMorgan’s downgrade of the company to neutral, reflecting concerns about competition and market saturation. The electric vehicle industry’s growth has attracted many players, leading to price competition that may affect profitability. This premarket update is crucial for investors keeping a close eye on the electric vehicle sector’s earnings reports and future guidance.

Moreover, the decrease in Li Auto’s share price during premarket trading signals potential turbulence ahead. It emphasizes the importance of evaluating financial fundamentals alongside market sentiment. As electric vehicle stocks continue to dominate the headlines, investors must be prepared for volatility, making it essential to stay informed on developments such as production numbers, regulatory changes, and technological advancements.

Financial Technology Stocks: The Rise of DLocal

In the realm of financial technology, DLocal has emerged as a standout performer, experiencing over a 23% surge following solid second-quarter earnings reports. This remarkable performance is a testament to the growing appetite for financial technology solutions that enhance operational efficiency and broaden services. Analyst upgrades from institutions like HSBC highlight the strength of DLocal’s cost management and innovative product offerings, revealing how financial technology stocks can capitalize on evolving market demands.

DLocal’s performance serves as a reminder of the transformative impact that robust earnings can have on stock prices. As the financial landscape evolves, particularly in emerging markets, investors should monitor how other financial technology companies position themselves to seize growth opportunities. This dynamic sector is fraught with competition but also rich in potential for savvy investors willing to navigate its complexities.

Earnings Reports: The Influence of Company Forecasts

Earnings reports play a pivotal role in shaping market expectations and influencing stock prices. Tapestry, the parent company of brands like Coach and Kate Spade, experienced a sharp decline exceeding 10% following a forecast that fell short of analysts’ projections. This underscores how a company’s inability to meet anticipated earnings can trigger investor anxiety and significant stock movements during premarket trading.

The importance of accurate forecasting cannot be overstated; it is a critical aspect investors assess when evaluating a company’s performance. Similarly, Deere’s adjustments to their earnings outlook demonstrate the necessity for transparency with investors. Companies that maintain clear communication regarding their financial health can mitigate volatility, fostering investor confidence which is invaluable in the complex landscape of the stock market.

Analyzing Market Reactions to Downgrades: Case Studies

Market reactions to analyst downgrades often provide valuable insights into investor confidence and sentiment. Taking the case of Li Auto as an example, its recent downgrade by JPMorgan resulted in a notable drop in premarket trading. Such reactions highlight that investor psychology can be heavily influenced by perceived risk in highly competitive sectors like electric vehicles. Analyzing these moves helps investors gauge how much weight to give to analyst opinions and affect their trading strategies accordingly.

Similarly, Coherent’s significant fall of over 19% brought about by disappointing earnings and guidance showcases how downgrades and earnings misses can shake investor confidence. Understanding the mechanics behind these market reactions is essential for investors looking to navigate the complexities of stock trading, especially in markets characterized by high volatility and rapid changes.

Key Takeaways from Today’s Trading Activity

Today’s premarket trading has shown stark contrasts between gaining and losing stocks, providing key takeaways for investors. The performance of companies like DLocal and Bullish illustrates how strong earnings and market sentiment can drive impressive gains, suggesting that positive news can frequently pave the way for stock appreciation. On the other hand, firms such as Tapestry and Coherent remind investors that even slight deviations from expectations can lead to severe drops in share value.

Consequently, these shifts underscore the necessity for diligent monitoring of earnings releases and analyst forecasts. As investors navigate this landscape, leveraging insights from stock market news and premarket movements will be critical for informed decision-making. Ultimately, understanding the broader context of these shifts can help investors craft effective strategies while mitigating potential risks.

The Impact of New Market Entrants

The arrival of new companies into the stock market can significantly shake up existing dynamics, and today’s premarket trading is reflective of that reality. The impressive debut of Bullish, marked by an extraordinary stock leap, illustrates how new market participants can attract attention and sway investor sentiment. This entrance not only impacts individual stock prices but also the overall market landscape, influencing how other stocks are perceived.

Moreover, as new companies emerge, existing firms like Li Auto may face enhanced scrutiny and competition, particularly in innovation-driven industries such as electric vehicles. Understanding how these new entrants affect investor behavior and market trends is crucial for those looking to capitalize on potential opportunities or defend their positions against rising competitiveness.

Understanding Investor Sentiment in Stock Trading

Investor sentiment plays a crucial role in stock trading, influencing decisions and market movements significantly. The rapid price changes observed in premarket trading highlight how quickly emotions can shift based on news and analysts’ opinions. Stocks such as Ibotta and Coherent provide case studies illustrating how negative sentiment related to earnings misses can lead to significant share price declines, thus reminding investors of the psychological component of trading.

Conversely, stocks like DLocal demonstrate the positive impact of strong quarterly performance on investor confidence and market sentiment. As investors await various earnings reports and assess the results of ongoing market shifts, understanding sentiment analysis becomes vital for making informed trading decisions, thereby enabling them to anticipate potential market adjustments effectively.

Navigating Analyst Ratings and Stock Predictions

Navigating analyst ratings is integral for investors seeking to optimize their trading strategies. The distributions of rating changes can signal a shift in market perception, influencing decisions on stock purchases or sales. For example, the downgrade of Li Auto by JPMorgan indicates a cautious outlook, which may prompt investors to reassess their strategies in light of potential growth hurdles in the electric vehicle market.

In contrast, positive upgrades, like that of DLocal by HSBC, may encourage investors to consider increasing their positions. Understanding these ratings and the context behind them can help investors align their strategies with expert insights, enhancing the likelihood of successful investments in a competitive landscape.

Frequently Asked Questions

What impact does premarket trading have on stock market news?

Premarket trading can significantly influence stock market news by providing early indicators of how shares might perform during regular trading hours. Analysts closely monitor premarket stock movers to gauge market sentiment, especially after earnings reports or company announcements.

How do premarket stock movers relate to financial technology stocks?

Premarket stock movers often include financial technology stocks, which can see heightened activity based on earnings reports and market predictions. For instance, strong earnings from a financial tech company in premarket trading can lead to increased investor interest and influence market trends.

What should investors look for in premarket trading of electric vehicle stocks?

Investors should monitor premarket trading of electric vehicle stocks for significant price movements caused by analyst ratings, competition reports, or earnings forecasts. For example, if a major EV company like Li Auto faces a downgrade, it may lead to a notable decline in shares during premarket hours.

Why are earnings reports important for premarket trading decisions?

Earnings reports are crucial for premarket trading decisions as they provide insights into a company’s financial health. Discrepancies between actual earnings and analyst expectations, like those seen with Ibotta, can lead to sharp movements in stock prices before the market opens.

What is the significance of premarket trading for stocks like Deere and Tapestry?

The significance of premarket trading for stocks like Deere and Tapestry lies in its ability to reflect investor reactions to company outlooks. For example, Deere’s lowered forecast triggered a decline in premarket trading, allowing investors to adjust their positions ahead of the regular trading session.

How does an analyst upgrade or downgrade affect premarket trading activity?

An analyst upgrade or downgrade can significantly impact premarket trading activity, as investors may rush to buy or sell shares based on new ratings. For instance, BTIG’s upgrade of Kratos Defense led to a positive response and share price increase in premarket trading.

How can investors interpret price changes in premarket trading?

Investors should interpret price changes in premarket trading as potential indicators of market sentiment and future stock performance. Sudden spikes or drops, especially after earnings reports, can provide insights into how a company’s news is perceived by the market.

What resources are available for tracking premarket stock movers?

Several resources are available for tracking premarket stock movers, including financial news websites, stock market apps, and dedicated premarket trading platforms. These tools provide real-time updates and analysis of stocks, including electric vehicle and financial technology stocks.

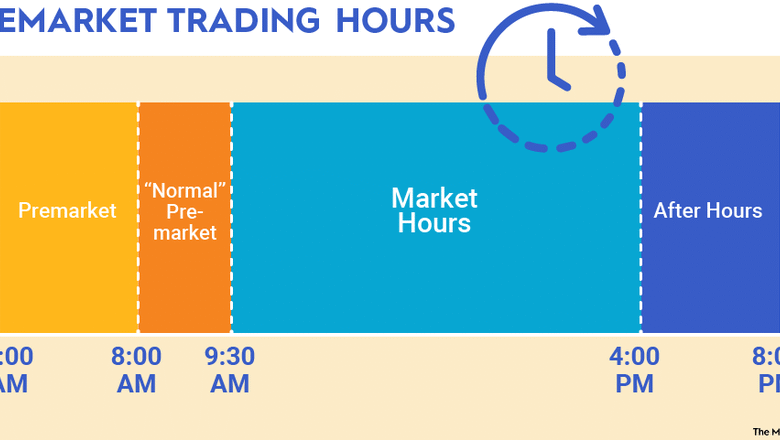

How does premarket trading differ from regular trading hours?

Premarket trading occurs before the official market opens and can exhibit different liquidity and volatility levels compared to regular trading hours. Volume may be lower, leading to sharper price movements in response to news such as earnings reports.

What should I consider when looking at premarket trading in the context of financial technology stocks?

When evaluating premarket trading in the context of financial technology stocks, consider recent earnings reports, analyst ratings, and market trends. Stocks like DLocal may experience increased volatility based on revenue growth and cost management updates.

| Company | Stock Movement | Reason for Movement |

|---|---|---|

| Li Auto | -2% | JPMorgan downgraded to neutral due to stiff competition. |

| Tapestry | -10% | Full-year earnings outlook missed expectations. |

| Deere | -6% | Trimmed top end of full-year net income forecast. |

| Ibotta | -34% | Missed Q2 earnings and revenue estimates. |

| Coherent | -19% | Fiscal Q4 margins and EPS forecast fell short of estimates. |

| Bullish | +14% | Surged on first trading day, rising over 83%. |

| Kratos Defense and Security Solutions | +3% | Upgraded to buy by BTIG amid expanding defense budgets. |

| DLocal | +23% | Better-than-expected Q2 earnings; upgraded by HSBC. |

Summary

Premarket trading is significantly impacted by company earnings and analysts’ actions. Companies like Ibotta and Tapestry faced sharp declines due to missing earnings expectations, while Bullish saw substantial gains, reflecting investor enthusiasm. Understanding these dynamics in premarket trading can offer valuable insights into market trends and investor sentiment.