Premarket Trading: Major Stock Moves to Watch This Morning

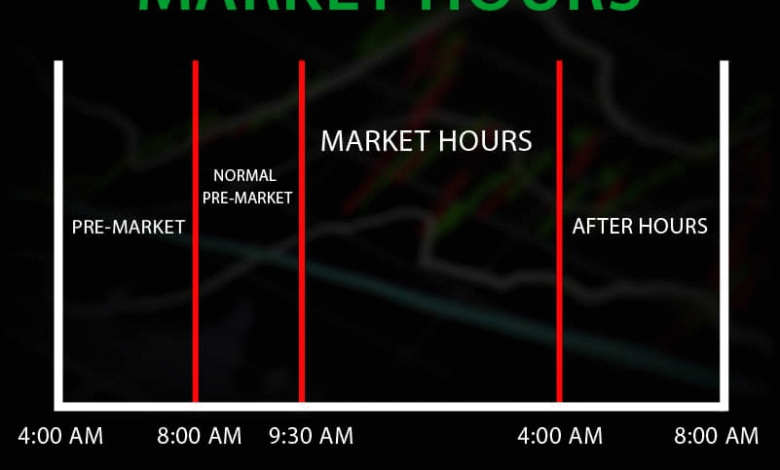

Premarket trading is a critical phase in the financial markets, allowing investors to assess stocks making moves before the official market opens. In recent premarket activity, notable companies such as Keurig Dr Pepper, Okta, and Verint Systems have captured the attention of traders. Keurig Dr Pepper is facing a decline of over 3% due to news about its $18 billion acquisition of JDE Peet’s, while Verint Systems has surged 12% on reports of a potential buyout by Thoma Bravo. Meanwhile, Okta’s stock climbed by 2% following a favorable upgrade from analysts, signaling a bullish outlook. Additionally, Nio’s new SUV launch has propelled its shares up by more than 9%, reflecting strong investor enthusiasm and an active premarket environment.

The early morning trading session is an essential part of the stock market where investors can make informed decisions based on overnight news and corporate developments. This stage, often referred to as premarket activity, is marked by significant movements in stocks, such as those of Keurig Dr Pepper, Okta, and Verint Systems. Key announcements, including acquisitions, upgrades, and product launches, drive investor sentiment, influencing stock valuations before the official market opens. For instance, Verint Systems’ anticipated acquisition has sparked a notable surge, while Keurig’s strategic move raises eyebrows amidst a slight decline. Furthermore, new product introductions, like Nio’s latest SUV, reflect a broader trend of dynamic trading opportunities in the premarket.

Keurig Dr Pepper News: Major Acquisition Impact

Keurig Dr Pepper’s recent announcement to acquire JDE Peet’s for approximately $18 billion stirred significant market reactions, leading to a decline in its share price by more than 3% in premarket trading. This strategic move highlights the company’s ambition to strengthen its position in the beverage industry while expanding its operational footprint internationally. The implications of this merger are substantial, as Keurig plans to separate its business into two publicly traded companies, which investors are keenly watching.

The acquisition is anticipated to reshape the competitive landscape of the beverage sector. By integrating JDE Peet’s robust portfolio of coffee and tea products, Keurig aims to leverage synergies, streamline operations, and ultimately enhance shareholder value. While the initial market response was negative, analysts are noting that the long-term benefits of this acquisition could potentially offset short-term stock fluctuations, making it a situation to monitor closely in the upcoming quarters.

Premarket Trading Highlights: Stocks on the Move

In premarket trading, several stocks are making headlines, reflecting broader market sentiments. Companies like Verint Systems and Okta are at the forefront, showcasing significant movements. Verint saw a surge of around 12% after rumors surfaced regarding a potential acquisition by private equity firm Thoma Bravo, indicating strong investor interest in companies likely to undergo transitions that could enhance their market positions.

Okta’s stock rose 2% following a notable upgrade from Truist, which emphasized that the company is nearing a pivotal moment in its financial trajectory. The analysts predict that challenges faced in the previous periods are about to ease, suggesting a positive outlook for the second half of fiscal 2026. This environment of premarket trading not only highlights specific stocks but also underscores the volatility and opportunities that investors should consider in their trading strategies.

Verint Systems Acquisition: What it Means for Investors

The reported acquisition of Verint Systems by Thoma Bravo is a significant development for both the company and investors. With shares surging by 12% in premarket trading, this news suggests that investors are optimistic about the deal’s potential to unlock value. The rumored acquisition, which values the company at about $2 billion, could lead to a more aggressive growth strategy under private equity ownership. Market analysts are closely watching how this acquisition could transform Verint’s operations and competitive positioning.

If the acquisition is finalized, it may set a precedent for similar deals in the tech and software sectors, indicating a trend of consolidation. For investors holding shares in Verint, this news represents a potential windfall, as private equity firms often inject capital and strategic direction to enhance business performance. This deal, coupled with broader market trends, is part of a dynamic landscape that could significantly impact stock performance going forward.

Okta Stock Upgrade: Implications for the Future

Okta’s recent stock upgrade from Truist is a crucial indicator of positive momentum within the company and the broader identity management service market. With a price target set to $125, up from $100, the analysts have articulated a bullish view on Okta’s financial health and growth potential. They suggest that the company is approaching an inflection point, where previous operational challenges are likely to diminish, paving the way for enhanced performance in upcoming fiscal periods.

This upgrade not only reflects confidence in Okta’s management strategies but also hints at the market’s anticipation of improved profitability. For investors, this upgraded rating might signal a prime opportunity to capitalize on Okta’s projected growth trajectory, especially considering the increasing demand for identity and access management solutions across industries. Monitoring Okta’s quarterly results will be essential to assess whether this upward trend continues.

Nio’s SUV Launch: Driving Up Stock Prices

Nio’s recent launch of its ES8 SUV has evidently energized share prices, with U.S.-listed shares soaring more than 9% in premarket trading. As one of Nio’s most affordable offerings at around $43,000 through a battery subscription plan, this model is strategically positioned to attract a broader customer base. The reception of the ES8 is crucial as it emphasizes Nio’s commitment to innovation and accessible electric vehicles in an increasingly competitive automotive market.

This surge in stock price underlines not just immediate consumer interest but also reflects investor confidence in Nio’s growth strategy. As automakers pivot towards electric vehicles, Nio’s market positioning with new, consumer-friendly pricing structures is likely to bolster its sales growth. Investors should keep an eye on Nio’s future product launches and sales figures, as these will be key indicators of the company’s ability to maintain its upward momentum.

Impact of Furniture Stocks on the Market

The furniture stocks have been a focal point in premarket trading, primarily due to President Trump’s announcement regarding an investigation into imported furniture. This news has led to declines in several key players, with companies like Williams-Sonoma and RH experiencing losses over 3% and 7% respectively. The market’s reaction indicates concern over potential tariffs, which could increase costs and impact profit margins for these companies.

However, amidst these declines, Ethan Allen saw a gain of more than 3%, suggesting a degree of differentiation among furniture retailers. Analysts may be assessing how various companies will navigate the possible regulatory changes and their implications on pricing and inventory management. The overall sentiment in the furniture stocks sector illustrates the broader influence of government policy on market dynamics.

Intel’s Market Momentum: Key Developments

In premarket trading, Intel experienced a 2% rise following the confirmation that the U.S. has acquired a 10% stake in the company. This strategic investment signals confidence in Intel’s market position and future growth potential as a leader in semiconductor manufacturing. Such backing could bolster investor sentiment and stabilize share prices amid overall market fluctuations.

Intel’s recent momentum not only reflects its robust business model but also highlights a broader trend of governmental involvement in technology sectors critical to national security. As the landscape for semiconductor demand continues to evolve, Intel’s performance and strategic developments warrant close attention. Investors should analyze how this stake might influence Intel’s operations, innovation capabilities, and competitive edge in the tech industry.

Frequently Asked Questions

What are the main stocks making moves in premarket trading today?

In today’s premarket trading, notable stocks include Keurig Dr Pepper, Verint Systems, Okta, and Nio. Keurig Dr Pepper announced an $18 billion acquisition of JDE Peet’s, which caused its shares to drop over 3%. Verint Systems surged 12% on news of an impending acquisition by Thoma Bravo, valuing the company at around $2 billion. Okta’s stock rose 2% following an upgrade to buy by Truist, while Nio’s shares soared over 9% after launching its new ES8 SUV.

How did Keurig Dr Pepper’s acquisition impact its premarket trading performance?

Keurig Dr Pepper’s announcement of its $18 billion acquisition of JDE Peet’s led to a premarket trading decline of more than 3% in its shares. The market reaction reflects investor concerns about the logistics and financial implications of splitting its beverage and coffee businesses into separate publicly traded entities post-acquisition.

What was the effect of the Verint Systems acquisition news on its premarket stock price?

Verint Systems experienced a significant spike of 12% in its premarket trading following a report that Thoma Bravo is close to acquiring the company. The potential acquisition is valued at approximately $2 billion, capturing investors’ optimism about the deal.

Why did Okta’s stock receive an upgrade, and how did it affect premarket trading?

Okta’s stock was upgraded from hold to buy by Truist, indicating that the company is nearing an ‘inflection point’ which could lead to improved performance. This upgrade resulted in a 2% increase in premarket trading, with a new price target suggesting a potential upside of 35% from the previous closing price.

What impact did Nio’s new SUV launch have on premarket trading?

The launch of Nio’s new ES8 SUV positively impacted its U.S.-listed shares, which saw an increase of over 9% in premarket trading. The ES8 is marketed as an affordable vehicle through a battery subscription plan, enhancing its appeal to customers and contributing to the stock’s surge.

How are furniture stocks performing in premarket trading?

Furniture stocks generally declined in premarket trading due to President Trump’s announcement of an investigation into imported furniture. Stocks like Williams-Sonoma dropped over 3%, while RH fell more than 7%. In contrast, Ethan Allen saw a slight increase of over 3%, indicating some mixed performance in the sector.

What is the significance of Intel acquiring a stake in the company for its premarket trading?

Intel’s shares gained about 2% in premarket trading after news surfaced that the U.S. government has acquired a 10% stake in the company. This acquisition is seen as a vote of confidence in Intel’s future, likely contributing to the upward momentum in its stock price.

How does premarket trading impact investors’ perceptions of stock performance?

Premarket trading provides investors with insights into potential stock performance based on news and events that may not have occurred during regular trading hours. For example, stocks like Verint Systems and Okta reacted positively to acquisition news and upgrades, while Keurig Dr Pepper’s acquisition announcement led to a decline, illustrating how crucial news can influence investor sentiment and trading decisions.

| Company | Stock Movement | Key Reasons |

|---|---|---|

| Keurig Dr Pepper | -3% | Acquiring JDE Peet’s for $18 billion; planned separation of beverage and coffee businesses. |

| Verint Systems | +12% | Private equity firm Thoma Bravo nearing a $2 billion acquisition. |

| Furniture Stocks (Williams-Sonoma, RH, Ethan Allen) | -3%, -7%, +3% | Investigation into imported units announced by President Trump impacts stock performance. |

| Okta | +2% | Truist upgraded stock to buy; positive outlook towards fiscal 2026. |

| Nio | +9% | Recent launch of the ES8 SUV and affordable pricing boost shares. |

| American Eagle Outfitters | -3% | Bank of America downgraded; concerns over tariffs overshadow ad campaign. |

| Intel | +2% | Acquisition of a 10% stake in company further boosts market confidence. |

Summary

Premarket trading showcased significant movements in various stocks today, highlighting key developments in the market. Keurig Dr Pepper faced a decline after announcing a major acquisition, while Verint Systems climbed sharply due to a potential buyout deal. The furniture sector suffered as new import investigations loom, and clothing retailer American Eagle Outfitters faced headwinds from a downgrade. In contrast, Okta and Intel saw modest gains owing to favorable analyst outlooks and strategic corporate actions. Meanwhile, Nio gained momentum from its new SUV launch, illustrating how product developments can drive investor sentiment. Overall, today’s premarket trading reflects a dynamic interplay of market news and economic indicators.