Private Credit ETFs: Wall Street’s New Investment Strategy

In today’s financial landscape, private credit ETFs are revolutionizing the investment world, granting Main Street investors access to opportunities that were once the exclusive domain of high-net-worth individuals. Major financial players like JPMorgan and BlackRock are leading this charge, creating innovative ETF products that incorporate alternative investments and strategies commonly associated with private banking. This rise in popularity is not accidental; it reflects a growing demand for buffered income ETFs and specialized investment strategies that offer a hedge during market volatility. With the SEC’s recent approval of the first private credit ETF, the industry is witnessing an evolution that promises to reshape how individuals approach their investment portfolios. As traditional pathways to wealth management evolve, exploring these ETFs can enhance the financial resilience of everyday investors.

Private credit exchange-traded funds (ETFs) represent a groundbreaking shift in how average investors engage with the financial markets, particularly in the realm of alternative assets. These investment vehicles have emerged from the shadows of elite finance, with major institutions such as JPMorgan and BlackRock paving the way for broader accessibility. Unlike conventional investment strategies, these buffered income portfolios are designed to withstand market fluctuations while providing potential income generation. The emphasis on innovation in ETF strategies signifies a response to the changing demands of investors, as they seek to diversify their holdings and explore new avenues for growth. As the landscape of alternative investments continues to develop, private credit ETFs are becoming a vital component in the diversified portfolios of everyday investors, helping them to navigate the complexities of modern markets.

The Rise of Private Credit ETFs in Today’s Economy

In recent years, private credit ETFs have emerged as a significant investment vehicle, capturing the attention of a broader range of investors, including those on Main Street. These ETFs provide exposure to private credit markets, which were once reserved for high-net-worth individuals and institutional investors. With their ability to offer access to business loans and private debt markets, private credit ETFs present an attractive alternative for investors seeking yield in low-interest environments. Leading asset managers such as JPMorgan and BlackRock are developing innovative ETF products that incorporate these private credit strategies, making them more accessible to everyday investors.

The increasing interest in private credit ETFs reflects the changing dynamics of the investment landscape, where traditional investment strategies are no longer sufficient amidst market volatility. Investors are looking for diversification and income stability, which private credit can provide. ETFs incorporating private credit allow investors to participate in the income generated from loans to businesses, while also benefiting from the structural advantages of ETFs, such as lower costs and ease of trading. As more investors become aware of these products, it’s likely that private credit ETFs will play a crucial role in the portfolios of mainstream investors seeking alternative investment options.

Buffered Income ETFs: A Shield in Volatile Markets

Buffered income ETFs are gaining traction as a strategic way for investors to navigate market volatility while seeking consistent income. These ETFs are designed to cap both gains and losses, providing a safety net during turbulent times. Investment firms like Goldman Sachs have pioneered these strategies, helping to attract investors who might otherwise shy away from equity markets due to fears of significant downturns. The appeal lies in the balanced approach that these funds offer; by limiting potential losses, investors can engage more comfortably with the market, making it easier to transition out of conservative positions like cash.

JPMorgan’s Equity Premium Income ETFs exemplify this strategy, utilizing options to generate income while managing risk. The innovative design of buffered income ETFs allows investors to maintain exposure to the market without the fear of catastrophic losses, which is particularly appealing in a landscape where economic uncertainty looms large. As investment trends evolve, understanding the role buffered income ETFs play in portfolios will be crucial for both advisors and clients looking to achieve well-rounded investment outcomes. The ongoing dialogue around these products highlights an important shift towards risk-managed investment approaches that cater to a wider audience.

JPMorgan and BlackRock: Leading the ETF Revolution

JPMorgan and BlackRock are at the forefront of the evolving ETF market, strategically positioning themselves to deliver innovative solutions to both institutional and retail investors. Their focus on integrating alternative investments, particularly private credit, into ETF offerings demonstrates a commitment to meeting investor demand for more complex investment strategies. Both firms have recognized the shift in investing paradigms, moving towards products that not only offer beta but incorporate aspects of alpha from traditionally less accessible markets.

The efforts of these financial giants to democratize investment access through ETFs reflect a broader trend where high-quality, alternative investment strategies are made available to the masses. This approach not only caters to wealth management for high-net-worth clients but also embraces Main Street investors’ growing desire for diversified income and growth opportunities. The integration of products like private credit ETFs highlights how leading firms are innovating within the ETF space, thus reshaping how investors can interact with the market and benefit from alternative investment strategies.

Understanding Investment Strategies for Main Street Investors

As investment strategies evolve, Main Street investors are increasingly seeking ways to grow and protect their portfolios amid economic uncertainties. With the emergence of buffered income ETFs and private credit options, investors are finding new avenues to optimize returns while minimizing risks. The accessibility of these products poses a significant shift; previous generations of investors relied heavily on traditional equities and fixed income instruments to secure their financial futures, but today’s investors are embracing innovative strategies that allow for greater flexibility and protection.

Investment firms are adapting these strategies to align with the preferences of the everyday investor, providing educational resources and tailored investment solutions that suit a variety of risk appetites. By understanding the dynamics of modern investment approaches, such as those offered by ETFs and alternative options, Main Street investors can construct portfolios that not only withstand market fluctuations but thrive in them. As developments in the ETF space continue to unfold, staying informed will be key to making confident investment decisions.

The Evolution of ETFs: From High Finance to the Average Investor

The evolution of ETFs has brought sophisticated investment vehicles within reach of average investors, breaking down barriers that once confined alternative investments to the ultrahigh net worth elite. Firms like BlackRock are actively bridging this gap by integrating comprehensive research coupled with strategic product development, thereby catering to the nuanced needs of retail investors. This democratization of investment has redefined what it means to participate in financial markets, allowing a wider audience to engage with investment strategies that were previously considered too complex or expensive.

Though ETFs have traditionally been associated with standard equity and debt investing, recent innovations have introduced products that target more specialized market segments. With private credit ETFs and buffered income strategies gaining momentum, the landscape of investment opportunities continues to expand. Investors are now empowered to make more informed decisions, leveraging ETFs that provide diversified access to a broad range of assets without the high costs of traditional investment methods. Navigating this changed landscape requires investors to cultivate a deeper understanding of the benefits and risks associated with these innovative ETF offerings.

BlackRock’s ETF Strategies: Capitalizing on Alternative Investments

BlackRock has been a trailblazer in integrating alternative investments into its ETF strategies, particularly with the growing trend of private credit. The firm’s proactive approach in acquiring providers of alternative investment research and products illustrates its commitment to leading the market in innovation. By targeting investment strategies that appeal to both institutional and retail clients, BlackRock enhances the accessibility of complex asset classes like private credit and buffered income directly through ETF structures.

The growing popularity of BlackRock’s ETFs, which include private credit allocations, derives from their ability to offer lower fees and easier trading compared to traditional funds. This shift towards efficiency and transparency resonates well with investors who desire both solid returns and manageable risks in their portfolios. By focusing on alternative investments, BlackRock not only meets the needs of modern investors but also helps reshape the conventional understanding of how ETFs can function in today’s dynamic market.

The Future of Investment: Combining Stability and Growth

Investors are increasingly looking for strategies that not only promise growth but also provide stability during volatile market conditions. The rise of buffered income ETFs exemplifies this desire for protective strategies that yield income while capping potential losses. This combination is particularly appealing to those wary of drastic market shifts, as it allows for participation in upward trends while maintaining a safeguard against downturns. The adaptability of these ETFs meets the evolving needs of a new generation of investors who are cautious yet eager to capitalize on market opportunities.

As investment landscapes become more intricate, the integration of traditional strategies with modern approaches will be crucial. The comfort investors find in buffered income and private credit ETFs indicates a shift toward seeking holistic portfolio solutions that balance risk and reward. Firms that prioritize these dual objectives will likely prosper in the coming years, as more retail investors embrace frameworks that empower them to navigate their financial futures with confidence. The future of investment lies in harnessing both the potential for growth and the need for stability through innovative products.

Liquid Alternatives: The Case for ETFs

The liquidity of ETFs has positioned them as an attractive alternative to traditional funds, especially in the realm of alternative investments. Liquid alternatives, including those investing in private credit, offer the rare benefit of accessibility while maintaining the potential for enhanced returns. Investors have become more aware of the restrictions often associated with alternative investments while also understanding the advantages that liquidity presents. ETFs allow investors to gain exposure to these asset classes without the lengthy lock-up periods typical of private equity funds.

By creating products that blend the benefits of liquidity with the complexity of private credit and other alternative strategies, firms are effectively broadening the appeal of ETFs to a wider audience. This shift is accentuated by the entry of major players like JPMorgan and BlackRock into the market, reinforcing the validity and robustness of ETFs as a primary method of accessing alternative investments. As liquid alternatives become more mainstream, they will play a pivotal role in diversifying investors’ portfolios while mitigating risks associated with traditional asset classes.

Frequently Asked Questions

What are private credit ETFs and how do they work?

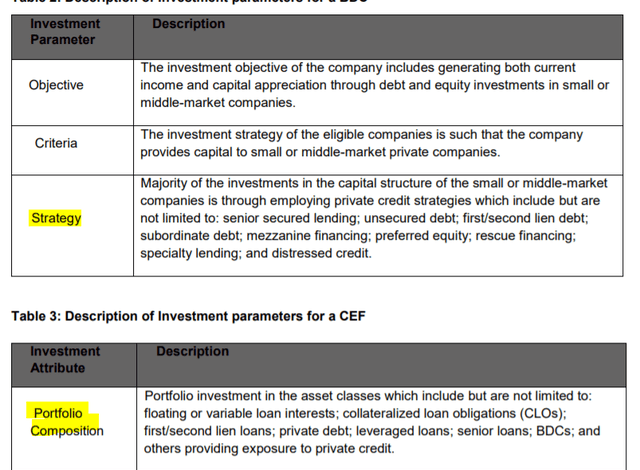

Private credit ETFs are exchange-traded funds that invest primarily in private debt markets, providing investors access to loans issued by private companies. These ETFs enable individual investors to diversify their portfolios with alternative assets typically reserved for institutional investors, such as business development companies (BDCs) and other non-traditional lenders.

How do private credit ETFs differ from traditional bond ETFs?

Unlike traditional bond ETFs that invest in public debt securities, private credit ETFs focus on loans to private companies, which can yield higher returns but also come with elevated risks. This differentiation allows investors to capture unique opportunities in the private credit market that are not generally accessible through conventional bond investments.

What are the benefits of investing in private credit ETFs?

Investing in private credit ETFs offers several benefits, including potential for higher yields compared to standard bond ETFs, diversification into alternative investments, and the ability to capture income streams typically available to affluent investors. Additionally, they provide greater liquidity compared to direct investments in private debt.

Who are the major players in the private credit ETF market?

Major players in the private credit ETF market include JPMorgan Chase and BlackRock, both of which are actively developing ETF products targeting private credit and alternative investments. They offer innovative ETF strategies that aim to cater to the growing demand from Main Street investors seeking yield and diversification.

What role do buffered income ETFs play in a market downturn?

Buffered income ETFs aim to provide downside protection in volatile markets by capping potential losses while allowing for some degree of upside gain. These ETFs are designed for conservative investors who wish to remain exposed to the market, offering a cushion against rapid declines—critical in today’s unpredictable economic environment.

Are private credit ETFs suitable for all investors?

While private credit ETFs can enhance portfolio diversification and income potential, they may not be suitable for every investor. Those considering these investments should evaluate their risk tolerance, as private credit can involve higher levels of risk due to factors like lower liquidity and higher default risk compared to traditional bond investments.

What should investors consider when evaluating private credit ETF options?

Investors should consider factors such as the expense ratios, yield potential, the underlying quality of the credit assets, liquidity, and the fund manager’s expertise and track record. Additionally, it’s essential to understand how these ETFs fit within the broader investment strategy, especially in relation to risk and return objectives.

How are private credit ETFs regulated by the SEC?

The SEC regulates private credit ETFs similarly to traditional ETFs, ensuring that they meet specific standards for disclosure and transparency. However, obtaining SEC approval for these funds often involves balancing investor desires for high returns against potential risks associated with illiquid assets, which can influence the structure and management of the ETFs.

Can you explain the difference between private credit ETFs and interval funds?

Private credit ETFs generally offer greater liquidity and trade on exchanges, allowing for real-time buying and selling, whereas interval funds provide limited liquidity as they only allow redemptions at specified intervals. This makes private credit ETFs more accessible to everyday investors looking for exposure to the private credit market.

Why is there growing interest in private credit ETFs among Main Street investors?

Growing interest in private credit ETFs among Main Street investors stems from the desire for enhanced income, diversification of portfolios, and access to investment strategies previously reserved for high-net-worth individuals. Additionally, amid market volatility, these ETFs offer potential opportunities for risk management and income generation.

| Key Points |

|---|

| Major banks like JPMorgan Chase and BlackRock are developing ETFs targeting private credit previously reserved for high-net-worth individuals. |

| Main Street investors are seeking strategies to protect and grow investments, leading to asset flows into income and buffered equity ETFs. |

| Wall Street is making investment strategies available that were once exclusive to private banking clients. |

| Private credit is becoming a standard part of bond portfolios and offers more sophisticated trading strategies beyond traditional equity funds. |

| The SEC recently approved the first private credit ETF, indicating a growing acceptance of these investment vehicles. |

| ETFs provide a more affordable and accessible way for investors to partake in previously illiquid private investments. |

| Buffered ETFs are gaining popularity for providing downside protection while allowing investors to earn income from options strategies. |

| There is a growing demand for buffered products as investors seek to transition out of cash into the market amidst volatility. |

| Overall, private credit ETFs are expected to become the norm as they provide structural benefits to accessing illiquid investments. |

Summary

Private credit ETFs are becoming an increasingly popular and essential investment tool for both individual and institutional investors. With major financial institutions like JPMorgan Chase and BlackRock leading the charge, these ETFs are opening access to strategies once reserved for wealthy individuals. As investors navigate a volatile market, private credit ETFs offer not only potential income through alternative strategies but also a buffer against market downturns, making them a smart choice during uncertain economic times. As the acceptance and sophistication of these products grow, they will likely transform the investment landscape, providing valuable opportunities for all types of investors.