Recession Specials: A New Trend Amid Economic Woes

In the face of a shifting economic landscape, businesses are increasingly rolling out recession specials, a strategy that reflects the deteriorating consumer sentiment prevalent in today’s market. As fears of an economic downturn grow, many establishments, from local cafes to popular restaurants, are recognizing recession indicators and responding with deals that resonate with cost-conscious consumers. The latest data reveals a troubling decline in consumer confidence, prompting businesses to offer enticing recession specials aimed at encouraging patronage. Events featuring recession-themed promotions, such as the Brooklyn coffee shop’s $6 gelato and espresso deal, are becoming more common as establishments strive to attract customers wary of rising prices. These recession trends not only serve a practical purpose but also underscore the collective anxiety about the financial outlook among young Americans and older generations alike.

In recent times, the introduction of budget-friendly offers, commonly referred to as economic crisis deals, has become a prevalent response to shifting economic conditions. Establishments are tapping into what some may call budgeting strategies, reassessing how they cater to consumers amid narratives surrounding financial struggles. Various dining venues and coffee shops are not just marketing affordability but are also responding to the palpable sense of panic regarding the future. The adoption of these economic savings promotions aligns closely with broader economic concerns and discussions around consumer behavior and spending habits. As more businesses lean into these creative pricing strategies, they provide a glimpse into how the market adapts during periods of uncertainty.

Understanding Recession Indicators: Key Signs of Economic Downturn

Recession indicators serve as crucial signs pointing toward the potential decline of an economy. Commonly referenced metrics include the unemployment rate, GDP growth, and consumer sentiment, all of which provide insights into the health of the economy. For instance, a noticeable uptick in unemployment often triggers concerns about an impending economic downturn, as fewer jobs can lead to decreased consumer spending and declining business profits. Other indicators, such as manufacturing output and retail sales, also reflect overall economic activity, creating a comprehensive picture of the market’s state.

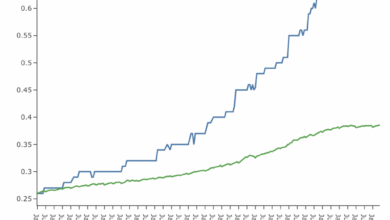

In recent times, the declining consumer confidence index has raised alarms among economists and analysts. The University of Michigan has reported significant drops in consumer sentiment, suggesting that people are growing more cautious about their financial futures. A decline in confidence often leads consumers to curtail their spending—which in turn affects businesses that rely on customer sales. As fears of an economic downturn intensify, many sectors are starting to recognize these recession indicators, adapting their strategies to survive potential pitfalls.

The Rise of Recession Specials: A Creative Marketing Response

In response to the growing concerns surrounding the economy, many businesses are adopting creative strategies such as offering ‘recession specials.’ These promotions are tailored to attract budget-conscious customers, especially during periods of economic uncertainty. Restaurants and bars are prominent players in this trend, utilizing humor and clever marketing to draw attention to their special deals. For example, promotions like the $6 gelato and espresso ‘recession special’ at Clever Blend highlight how businesses are attempting to stay relevant within a changing consumer landscape.

The phenomenon of recession specials isn’t limited to a single location; rather, it reflects a nationwide trend where establishments recognize the value of appealing to frugal consumers. The ‘Recession Burger’ at Super Duper serves as a case in point, demonstrating how brands can leverage current economic sentiments to craft innovative offerings that resonate with customers. By tapping into the zeitgeist with relatable promotions, businesses not only address their economic challenges but also foster a sense of community among patrons who might be sharing similar concerns about financial stability.

Declining Consumer Confidence: Its Impact on Purchasing Behavior

Declining consumer confidence can significantly affect purchasing behavior across various sectors. When consumers feel uncertain about their financial stability or anticipate an economic downturn, they tend to hold off on making discretionary purchases. This hesitation is particularly pronounced among younger consumers, many of whom lack the financial cushion available to older generations. As evidenced by the recent sentiment index data from the University of Michigan, a drop in consumer confidence can lead to a marked reduction in spending, sparking significant concerns for businesses reliant on consistent consumer activity.

Moreover, the ripple effect of declining consumer confidence often leads to broader economic implications, including slowed economic growth and elevated recession fears. As consumers tighten their wallets, businesses report declining sales, which can prompt them to adjust their operations and costs to weather the storm. This reactionary behavior underscores the importance of monitoring consumer sentiment closely, as shifts in confidence levels can reveal critical insights into the overall health of the economy and help predict future recessions.

Adapting to Economic Trends: Business Strategies in Challenging Times

In light of challenging economic trends, businesses are increasingly adopting adaptive strategies to navigate potential downturns. The reintroduction of recession specials serves as one effective strategy to not only retain existing customers but also attract new ones. By offering discounted items or unique bundles during periods of high inflation and economic strain, these establishments can appeal to budget-conscious consumers who remain wary of spending money.

Flexibility is key; businesses that can pivot quickly in response to economic indicators such as consumer sentiment are better positioned to maintain their market share. As companies gauge the mood of their clientele—from launching innovative menu items to implementing targeted sales—success during challenging times often hinges on understanding and responding to evolving consumer needs.

Humor as a Marketing Tool During Economic Strain

Adding a layer of humor to marketing efforts can be an effective way for businesses to connect with consumers during times of economic distress. Brands across various sectors, from dining to entertainment, have begun using light-hearted promotions, like ‘Recession Pop Parties’ at local bars, to resonate with customers facing uncertainty. By framing their offers in a humorous light, businesses not only provide an opportunity for customers to save money but also create a sense of community and shared experiences amid economic anxiety.

Additionally, social media has become a vital platform for humorous branding, allowing businesses to engage in playful banter regarding recession indicators. This not only helps in alleviating some of the tension associated with economic downturns but also fosters brand loyalty. Consumers are more likely to support businesses that they find relatable and approachable, thus solidifying the effectiveness of humor as a marketing tool during such challenging periods.

The Cultural Shift Influencing Recession Specials

A cultural shift toward acknowledging economic challenges has given rise to recession specials across many businesses. This trend reflects a collective awareness among consumers regarding the potential impacts of current economic indicators, with many establishments interpreting these signals as a cue to respond with budget-friendly offers. These efforts resonate deeply with consumers, as the shared understanding of economic uncertainty becomes a part of their daily lives.

Businesses using culturally aware branding strategies can create programming and promotions that reflect current sentiments. By embedding recession specials into their narratives, these establishments not only enhance their visibility but also establish a connection with consumers. The cultural acknowledgment of recession trends ultimately strengthens community bonds, as people come together to navigate economic challenges together.

Impact of Economic Policies on Consumer Behavior

Economic policies, including tariffs and regulations, play a significant role in shaping consumer behavior. As recent trade policies implemented by President Donald Trump have raised concerns about an economic downturn, consumers are reflecting this apprehension in their purchasing habits. The uncertainty surrounding economic policies leads to reduced willingness to spend, as individuals weigh the implications these changes have on their own financial futures.

Consequently, businesses are responding by adjusting their pricing strategies and marketing approaches. By recognizing how external economic factors impact consumer sentiment, they can tailor their offerings—like implementing recession specials—to meet the needs of a cautious customer base. In the long run, staying attuned to the ripple effects of economic policies on consumer behavior will be crucial for businesses aiming to thrive in turbulent times.

Long-term Consequences of Declining Consumer Sentiment

The long-term consequences of declining consumer sentiment can be severe, potentially leading to persistent economic sluggishness. As consumers continually adjust their spending behaviors in reaction to negative sentiment indicators, businesses may experience prolonged reduced revenues that can affect their sustainability and growth. A wholesale retreat from discretionary spending sends ripples through markets, impacting everything from employment numbers to business investment in future projects.

Moreover, the collective mindset of consumers directly influences economic recovery prospects. A pessimistic outlook can create a self-fulfilling prophecy, where reduced spending perpetuates economic stagnation. To mitigate these effects, businesses and policymakers must focus on rebuilding consumer confidence and addressing the underlying issues contributing to negative sentiment, ensuring the economy can return to a path of growth.

Creating Community Connections Through Economically Friendly Offers

Creating robust community connections has become increasingly important for businesses during economic uncertainty. By developing promotions like recession specials, local establishments can demonstrate understanding and empathy toward their clientele. Such initiatives work to strengthen bonds within the community, inviting consumers to come together over shared experiences of financial stress while providing tangible support through affordable offerings.

Additionally, these strategies can advance economic resilience by encouraging community members to support local businesses amidst broader economic challenges. Engaging customers through promotions that resonate with their experiences fosters loyalty and potentially drives word-of-mouth marketing, establishing a supportive community environment that cultivates long-term customer relationships.

Frequently Asked Questions

What are recession specials and why are businesses starting to offer them?

Recession specials are discounts or special menu items offered by businesses, particularly in dining and retail, in response to declining consumer confidence and the fear of an economic downturn. As consumer sentiment dips and indicators of a recession emerge, businesses create these promotions to attract cost-conscious customers.

How do recession indicators influence the availability of recession specials?

Recession indicators, such as declining consumer confidence and economic downturn fears, directly influence the availability of recession specials. When consumer sentiment drops, businesses see a need to entice customers through discounted offerings, like recession specials, to maintain sales during challenging economic times.

Can you give examples of businesses that are currently offering recession specials?

Yes, businesses like Clever Blend in Brooklyn are advertising unique offerings like their $6 gelato and espresso ‘recession special.’ Similarly, Super Duper in the San Francisco Bay Area has introduced a ‘Recession Combo,’ showcasing how dining establishments respond creatively to recession trends.

What does the declining consumer confidence tell us about recession specials?

Declining consumer confidence indicates that consumers are apprehensive about their financial future, leading them to seek out recession specials. Businesses that recognize this shift often implement these promotions as a way to cater to customers’ needs during times of economic uncertainty.

How do recession trends affect consumer behavior and spending?

Recession trends lead to cautious consumer behavior, where individuals prioritize necessities over luxuries. This behavior drives businesses to offer recession specials to align with changing spending habits, ensuring they remain competitive and relevant during an economic downturn.

What impact do tariffs have on consumer sentiment and recession specials?

Tariffs can contribute to fears of an economic slowdown, further affecting consumer sentiment. As uncertainties about future costs and economic stability grow, businesses respond by offering recession specials to make their products more appealing to budget-conscious consumers.

Where can I find more information about recession specials in my area?

To find more information about recession specials near you, consider searching local dining guides or social media, where many establishments promote their deals. Additionally, websites dedicated to food and dining trends often publish articles about current recession specials as a response to evolving consumer sentiment.

| Key Point | Details |

|---|---|

| Reintroduction of Recession Specials | Businesses are offering deals like ‘recession specials’ to attract customers amid economic fears. |

| Concerns Over Economy | Young consumers are increasingly aware of recession indicators, influenced by fears of a slowing economy and tariffs. |

| Declining Consumer Sentiment | The University of Michigan reported a drop in consumer sentiment indicating fears of an economic downturn. |

| Examples of Recession Specials | Clever Blend offers $6 gelato and espresso; Super Duper features a ‘Recession Burger’ and ‘Recession Combo’ for $10. |

| Wider Implications | The trend of ‘recession specials’ reflects broader concerns about economic stability and consumer spending. |

Summary

Recession specials are becoming increasingly popular among businesses, indicating a growing concern for the economy and consumer sentiment. As fears of a recession loom larger, establishments are adapting by offering enticing deals, reflecting the current economic climate and consumer expectations. This trend highlights the urgency with which businesses are responding to potential economic challenges, ensuring they remain competitive while catering to the needs of cautious consumers.