Supreme Court Staff Reductions: What You Need to Know

Recent Supreme Court staff reductions have sparked significant debate as the Court allows the Trump administration to implement extensive cuts across various federal agencies. This decision, while reflecting the administration’s push for federal agency reductions, is only one chapter in a broader saga that may eventually be revisited by the Justices. Opponents of these cuts argue they jeopardize vital services and infringe upon congressional authority, with Justice Jackson’s dissent highlighting these concerns. The ruling underscores the contentious nature of the Supreme Court’s role in shaping labor policies and government structure in the face of executive action. As the legal battles unfold, the implications of this decision will likely extend far beyond the immediate impacts on job cuts and federal agency operations.

The recent decision by the Supreme Court concerning workforce changes highlights the contentious issue of drastic employment reductions within federal agencies. Known for addressing high-profile cases, the Court’s ruling enables the Trump administration’s initiative to carry out substantial layoffs while challenges to this directive continue in lower courts. Many are watching closely, including unions and local government bodies, as legal questions about the authority of executive orders and their impact on agency operations remain contentious. Justice Jackson’s dissent adds another dimension to this debate, signaling potential long-term repercussions for workforce management within the government. As efforts to contest these decisions unfold, the dialogue surrounding federal workforce policy is poised to evolve significantly.

The Impact of Supreme Court Staff Reductions on Federal Agencies

The recent Supreme Court ruling permitting the Trump administration to implement extensive staff reductions at various federal agencies is a significant development that could reshape the operational landscape of federal governance. These staff cuts, challenged by a coalition of unions and some state entities, reflect ongoing tensions between the executive branch’s directives and legislative oversight. As these reductions proceed, there could be substantial implications for service delivery and agency efficiency, warranting close scrutiny from both legal observers and the public.

Supporters of the ruling argue that the executive order providing for these cuts follows a long-standing tradition of presidential authority to oversee federal workforce management. However, opponents contend that such unilateral action bypasses necessary congressional involvement, potentially undermining the foundational structures of the administrative state. This intricate interplay of power raises questions about the future stability of federal agencies amid significant workforce changes.

Justice Jackson’s Dissent: A Call for Legislative Oversight

Justice Ketanji Brown Jackson’s dissent against the Supreme Court’s ruling highlights a critical perspective on the implications of executive authority in federal workforce matters. She expressed concerns that allowing substantial staff cuts without adequate legislative input could lead to a problematic restructuring of federal agencies, which are fundamentally established by Congress. This viewpoint aligns with broader discussions about the need for checks on executive overreach, especially regarding policies that impact millions of American workers and essential public services.

Jackson’s articulation of the potential consequences of these reductions emphasizes the necessity for a balanced approach to federal governance. By underscoring the idea that reorganizations ought to be conducted within legislative frameworks, she encapsulates the argument that democratic accountability is essential in shaping policies that affect national welfare. Her dissent serves as a critical reminder that legal discussions surrounding executive orders must also consider the broader implications of such decisions on public service provision.

Legal Precedents and the Future of Federal Workforce Stability

The recent Supreme Court ruling on staff reductions is not just a momentary legal victory for the Trump administration but may set a precedent regarding executive power over federal workforce management. Historically, the balancing act between presidential authority and congressional decree has been a pivotal aspect of U.S. governance. As the court prepares to revisit this matter, the implications of current trends in federal agency management could resonate for years to come, influencing subsequent administrations and their legal baselines for workforce changes.

The ability of future presidents to undertake similar actions may hinge on how courts interpret the ruling regarding the executive’s authority in conjunction with legislative mandates. If future rulings favor the administration’s stance, it could open pathways for more aggressive cuts without the necessary legislative consultation. Conversely, if the courts recognize the need for legislative compliance, it may solidify Congress’s role in overseeing substantial reductions in federal personnel and services, adhering to constitutional principles.

Public Reaction to Supreme Court Decisions on Staff Reductions

Public reaction to the Supreme Court’s decision allowing the Trump administration’s staff cuts offers insight into the divide over governmental authority and its implications for citizens. Advocacy groups, unions, and concerned citizens have strongly voiced their apprehensions about the potential negative impacts on the quality of federal services, suggesting that these cuts could lead to prolonged detriment in areas like public health, safety, and essential services. Their concerns underline an awareness among the public regarding how federal decisions affect everyday life.

On the other hand, supporters of the ruling believe that reducing the federal workforce will enhance efficiency and accountability within government agencies. This ongoing debate intertwines broader themes of government reform, economy, and the efficacy of federal functions in a rapidly changing political landscape. As the public and various stakeholders continue their discourse, the Supreme Court’s future decisions could fundamentally influence not only the structure of federal agencies but also the societal trust in governmental effectiveness.

The Role of Executive Orders in Federal Workforce Reductions

Executive orders have long been a powerful tool for presidents to enact policy changes without immediate legislative approval, and President Trump’s recent order directing federal agencies to prepare for large-scale reductions exemplifies this dynamic. By issuing directives that pivotally shape the federal workforce, the executive branch can rapidly respond to perceived inefficiencies, yet such actions raise questions about democratic accountability and the scope of presidential power. As observed in the dissenting opinions of justices, the balance of authority is crucial in ensuring that workforce management remains aligned with congressional intent.

The reliance on executive orders for workforce restructuring has prompted debates around their legitimacy and long-term impacts. Legal scholars and political analysts alike are closely watching the implications of these orders not just for the current administration but as a barometer for future presidential actions. Should executive orders facilitate significant unilateral shifts in workforce management, it may alter the historical expectations of cooperation between the executive and legislative branches of government.

The Challenges of Judicial Review in Workforce Reductions

Judicial review of executive actions, especially concerning workforce reductions, poses distinct challenges, particularly when balancing statutory interpretations and constitutional mandates. The Supreme Court’s decision to allow staff reductions reflects the complexities inherent in adjudicating cases where the executive branch’s authority is contested. As various stakeholders challenge these workforce reductions in lower courts, the process unfolds, revealing deeper tensions within the judiciary regarding how to interpret the boundaries of lawful executive action.

Courts must navigate a nuanced landscape of precedent, statutory law, and the interpretations that arise from specific cases. As seen in the dissent of Justice Jackson and support from Justice Sotomayor, there exists a faction of the Court that prioritizes the implications of executive orders on legislative authority. Thus, ongoing litigation surrounding workforce reductions is likely to provoke further scrutiny of executive power and its ramifications in an evolving governmental framework.

Long-term Implications for Federal Agency Functionality

The ruling by the Supreme Court to uphold reductions in federal workforce raises substantial questions about the long-term functionality of federal agencies. Service delivery models within these agencies may face challenges, including diminished employee morale, potential loss of institutional knowledge, and operational efficiency. Critics argue that significant staff cuts risk undermining the core missions of agencies tasked with delicate public responsibilities, from environmental protections to public health oversight.

In the wake of such reductions, federal agencies may need to reassess their roles and functions, which could potentially lead to adjustments in how they engage with citizens and implement programs. The fear amongst critics is that without adequate staffing, services that communities depend on could deteriorate, leading to fragile support structures. As the implications of Supreme Court rulings continue to unfold, stakeholders must consider how best to advocate for the resources necessary to ensure effective governmental response and accountability.

The Intersection of Politics and Workforce Decisions

The decision surrounding Supreme Court staff reductions is intricately tied to the prevailing political environment characterized by stark partisan divides. The Trump administration’s approach to federal workforce reductions reflects its broader agenda aimed at downsizing government and reorienting agency priorities. Supporters celebrate these moves as essential for efficiency, while critics see them as political maneuvers disregarding vital public services. This intersection of politics and workforce decisions signals a transformative period in American governance.

As the ramifications of this decision ripple through political discourse, the consequences for future administrations will be profound. The way in which executive power is leveraged to initiate drastic changes could establish new norms in governmental operations. Hence, as the political landscape continues to evolve, it remains imperative for lawmakers, advocates, and citizens alike to actively engage in discussions around the implications of workforce policies on democracy and governance.

Future Legal Challenges Ahead for Staff Reductions

The question of workforce reductions arising from executive orders is anticipated to remain a contentious issue, with various stakeholders poised to explore further legal challenges against the Trump administration’s staff cuts. Legal analysts suggest that subsequent lawsuits could amplify concerns about the constitutionality of unilateral reductions and the lack of legislative oversight. As these controversies unfold, the Supreme Court’s position and rulings will be pivotal in framing whether such actions remain permissible under existing federal law.

Looking ahead, advocates pushing back against these cuts will likely emphasize the necessity for congressional involvement in workforce decisions, reinforcing the principle of checks and balances integral to American governance. As the landscape continues to evolve, closely monitored litigation may serve to clarify the extent of executive authority, thereby shaping the future of federal workforce management and its adherence to legislative mandates.

Frequently Asked Questions

What are the implications of the Supreme Court staff reductions allowed during the Trump administration?

The Supreme Court’s decision to permit staff reductions during the Trump administration allows several federal agencies to proceed with significant workforce cuts despite ongoing legal challenges. This ruling raises concerns about the legality of such actions without Congressional approval, potentially undermining public services.

How does the Supreme Court ruling affect Justice Jackson’s dissent on staff reductions?

Justice Ketanji Brown Jackson’s dissent highlights her concerns about the impact of the Supreme Court’s ruling on staff reductions. She argues that allowing the Trump administration to implement workforce cuts could undermine Congressional authority and jeopardize essential government functions.

What is the status of the federal agency reductions ordered by the Trump administration following the Supreme Court ruling?

The Supreme Court’s ruling is a temporary measure that allows federal agency reductions to move forward, but it does not finalize the legality of these cuts. The case may revisit key legal questions regarding Executive Order workforce changes in the future.

In what way did the Trump administration justify the need for large-scale staff reductions?

The Trump administration justified large-scale staff reductions by asserting that an executive order permitted such actions as part of necessary workforce management, which they argue aligns with an established historical tradition of Executive Branch authority.

What legal challenges are currently being faced regarding the Supreme Court staff reductions?

The Supreme Court staff reductions authorized under the Trump administration are facing legal challenges from a coalition of unions and local governments arguing that these cuts violate Congressional mandates and undermine the operational integrity of federal agencies.

What concerns did Justice Sotomayor express regarding the Supreme Court ruling on staff reductions?

Justice Sonia Sotomayor, while siding with the majority, acknowledged the importance of ensuring that any staff reductions comply with Congressional mandates, thus expressing concern over potential overreach by the Executive Branch in restructuring federal agencies.

What does the term ‘Executive Order workforce’ mean in relation to the Trump administration staff reductions?

The term ‘Executive Order workforce’ refers to the authority granted to the Trump administration through an executive order directing federal agencies to prepare for significant staff reductions, an action now under scrutiny from legal challengers.

Why might the Supreme Court revisit the issue of staff reductions in federal agencies?

The Supreme Court may revisit the issue of staff reductions because the recent ruling left unresolved questions about the legality and implications of mass workforce cuts initiated by the Trump administration, particularly regarding Congressional oversight.

| Key Aspect | Details |

|---|---|

| Supreme Court Ruling | The Supreme Court allowed the Trump administration to proceed with staff reductions at federal agencies. |

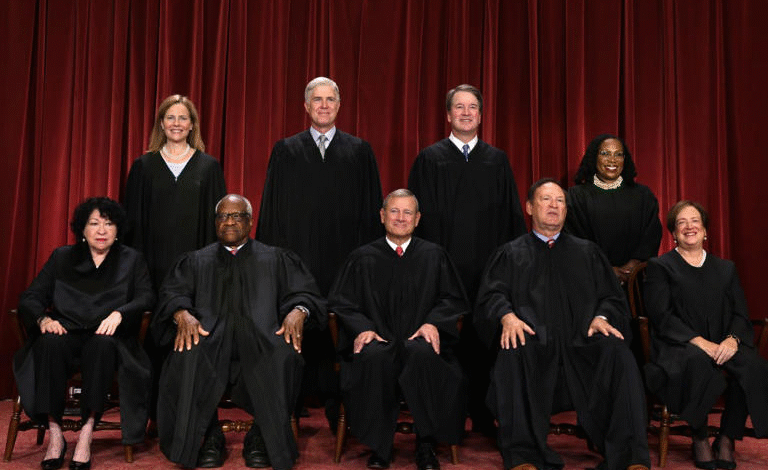

| Dissenting Opinion | Justice Ketanji Brown Jackson was the sole dissenting vote, warning of the implications for democracy. |

| Legality of Cuts | The Supreme Court’s order does not determine the legality of the staff reductions, which are still subject to ongoing lawsuits. |

| Executive Authority | The ruling indicates the Trump administration is likely to succeed in its assertion that the executive order for reductions is lawful. |

| Congressional Role | Critics argue that large-scale reductions violate constitutional principles requiring congressional approval. |

| Ongoing Litigation | Challengers are working to block the staff reductions through lawsuits, which may still reach the Supreme Court. |

Summary

Supreme Court Staff Reductions have been permitted by the Supreme Court, marking a significant political and legal development. As the Trump administration moves forward with extensive staff cuts across federal agencies, the implications for government operations and services remain contentious and unresolved. While the ruling allows for the continuation of these reductions, it also sets the stage for ongoing legal battles and discussions about the role of Congress and the Executive branch in workforce management. The dissent from Justice Ketanji Brown Jackson highlights concerns about the impact of these changes on democracy and governance.