Retail Investor Buying Trends After Moody’s Downgrade

Retail investor buying trends have become a captivating focal point in today’s financial landscape, particularly following Moody’s recent credit rating downgrade of the U.S. government. This significant event spurred individual investors to engage in a vigorous buying spree, with net stock purchases reaching an impressive $5.4 billion after the initial market opening on Monday. Such activities reflect a robust trend in retail trading volume, showcasing a continued commitment to the “buy the dip strategy” even amid market fluctuations. As the S&P 500 navigated through volatility, the retail segment distinguished itself by accounting for 36% of total trading activity, a notable milestone that speaks to shifting investment behavior. Analysts suggest that these buying patterns may be indicative of a broader movement within stock market trends, where individual investors increasingly assert their influence.

The phenomenon of individual investors actively participating in the stock market, especially in response to economic shifts like the recent downgrade by Moody’s, highlights a new era of investment dynamics. Observing retail trading trends reveals a collective approach among these investors, as they capitalize on opportunities during market dips. Frequently employing strategies such as the ‘buy the dip’ approach, these participants inject substantial volumes into the market, significantly impacting overall trading activity. As traditional investment norms shift and more individuals take charge of their portfolios, analyzing the behavior of retail traders sheds light on emerging stock market patterns. This collective behavior underscores the vital role that retail investors play in shaping the financial landscape today.

Understanding Retail Investor Buying Trends Post-Downgrade

The recent downgrading of the U.S. credit rating by Moody’s has significantly impacted market dynamics, particularly in terms of retail investor behavior. Following this downgrade, individual investors demonstrated a remarkable buying spree, showcasing their unwavering confidence in purchasing stocks during market dips. With retail buyers purchasing a staggering net of $4.1 billion by midday on Monday, it’s evident that the ‘buy the dip’ strategy has taken firm hold among these investors. Such behavior signals an underlying belief in the resilience of the stock market, irrespective of external pressures like declining credit ratings.

The phenomenon of retail investors stepping up during market downturns can be attributed to several factors, including the growing accessibility of trading platforms and the emergence of social media as a tool for investment education. These traders, often influenced by market sentiment shared online, are increasingly willing to navigate volatility by seizing opportunities during dips. As noted, the retail segment accounted for an impressive 36% of total trading volume on the day of the downgrade, highlighting a trend that continues to evolve as retail trading becomes an influential force in stock market trends.

The Impact of Moody’s Credit Rating Downgrade on Market Sentiment

Moody’s recent downgrade of the U.S. credit rating has raised eyebrows among market analysts and investors alike. By adjusting the rating from Aa1 to Aaa, Moody’s has expressed significant concern about the sustainability of the government’s financial strategy amid escalating debt and a concerning deficit. This move typically ignites a ripple effect through the financial markets, influencing not only institutional investors but also energizing retail investors. The immediate aftermath, however, demonstrated that retail traders are unfazed, as they engaged in robust buying activity, following their established strategy of purchasing stocks during dips.

Despite the downgrade triggering increased volatility and concerns about rising bond yields, which reached above 5% for the 30-year U.S. bond, retail investors have maintained a proactive stance. Their ability to capitalize on market uncertainties reflects an emerging investment behavior that’s resilient to negative news, driven by the perception of long-term value in the stock market. This mentality becomes increasingly relevant as investors acknowledge that periods of decline may represent lucrative buying opportunities.

Trends in Retail Buying: A Reaction to Economic Indicators

Retail buying trends often serve as a barometer for broader economic sentiment, especially during uncertain financial climates. As seen this past Monday, the influx of retail trading volume reached record levels in the wake of negative economic indicators such as Moody’s credit rating downgrade. Investors, motivated by the ‘buy the dip’ mentality, are often inclined to invest heavily when faced with market corrections, showcasing their belief in the eventual market recovery. This strong retail presence signals not just individual confidence but also a potential shift in market dynamics, as these investors gradually stake their claim in the equities market.

Retail investors, traditionally viewed as the underdogs in the trading arena, are increasingly making waves on Wall Street with significant buying activity. For example, their net purchases of $5.4 billion on the same day the downgrade was announced demonstrate their readiness to seize opportunities. These trends underscore the importance of monitoring retail buying as they not only impact stock prices but also reflect investor sentiment and the overall economic landscape.

How ‘Buy the Dip’ Strategy Shapes Investment Behavior

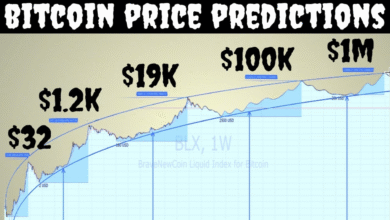

The ‘buy the dip’ strategy has become a cornerstone for many retail investors, particularly in the current volatile economic environment. This approach hinges on the belief that purchasing stocks at a lower price will yield profitable returns when the market inevitably rebounds. Particularly during events like the recent Moody’s downgrade, where uncertainty reigns, this strategy allows retail investors to navigate the fluctuations gracefully, capitalizing on perceived bargains. Such behavior was evidently on display when individual investors collectively purchased more stocks than ever before during significant market dips.

Moreover, this investment behavior is not occurring in isolation; it’s part of a broader trend reflecting changing attitudes among retail investors. Fueled by improved access to trading technology and a wealth of online investment resources, these traders are less risk-averse than previous generations. With record inflows of $40 billion in April amid tariff turmoil, the resilience of these investors demonstrates their confidence in the stock market’s long-term potential, regardless of immediate economic challenges.

The Relationship Between Retail Trading Volume and Stock Performance

The correlation between retail trading volume and subsequent stock performance has increasingly become a focal point for analysts. As retail investors accounted for over 36% of total trading volume following Moody’s credit downgrade, it is crucial to acknowledge how their buying patterns shape stock trajectories. Typically, high retail trading volume can indicate heightened market interest, often driving prices upward as increased demand meets reduced supply. February’s records are a testament to this dynamic, with retail investors significantly influencing stock valuations.

This relationship highlights the need for institutional investors to consider retail trends when formulating their trading strategies. As the stock market continues to evolve, understanding if and how retail activity impacts broader market performance can provide valuable insights. Moreover, the trend towards increased retail participation suggests that traditional investment models may need adjustment to account for this growing influence.

Retail Investors’ Resilience Amidst Economic Turmoil

In an unpredictable economic climate marked by inflation fears and rising interest rates, retail investors have demonstrated resilience that sets them apart from institutional counterparts. During an era of turbulence, such as the one triggered by Moody’s rating downgrade, these investors have continued to assert their presence in the market decisively. By engaging firmly in purchasing activities, retail traders have shown a robust commitment to their investment strategies despite external pressures.

Their actions reflect a resilient mentality, often born from a belief in long-term financial growth and stability. This steadfastness is evidenced by April’s unprecedented $40 billion in net purchases, suggesting that retail investors, rather than being deterred by negative sentiment, may actually view downturns as an opportunity to reinforce their positions. Their contributions are significant in maintaining liquidity and overall market confidence.

Analyzing the Role of Corporate Buybacks in Retail Investment Dynamics

As retail investors surged into the market in response to recent economic indicators, another factor influencing stock prices has been the role of corporate buybacks. Companies often repurchase their own shares as a strategy to enhance shareholder value, which can bolster stock prices and create an environment conducive to retail buying. This dynamic can further amplify the effects of retail trading volume on stocks, especially during periods of volatility like the aftermath of Moody’s recent downgrade.

The interaction between retail investors and corporate buybacks can generate a cyclical effect, where rising stock prices encourage more retail purchases, consequently attracting even more attention from companies looking to buy back shares. Such interactions highlight the complex web of influences in the market, emphasizing the critical need for investors to monitor both retail activity and corporate strategies when navigating stock market trends.

The Long-Term Outlook for Retail Investors Post-Credit Downgrade

Given the recent shifts in the market driven by Moody’s credit downgrade, the long-term outlook for retail investors remains a topic of intrigue. Historical trends suggest that following significant economic events, retail investor sentiment can play a crucial role in determining the recovery trajectory of the market. The recent buying surge indicates a strong belief in the fundamentals of the market, despite short-term turbulence, suggesting that retail investors are prepared to weather economic storms.

Moreover, as market conditions evolve, retail investors may increasingly position themselves for growth by adapting their strategies to incorporate elements such as diversification and long-term holds. This adaptability, combined with their demonstrated belief in buying during dips, could ultimately fortify their standing as crucial market participants.

Future of Retail Trading in an Evolving Financial Environment

As we look towards the future of retail trading, the environment is likely to become more complex, influenced by both external economic factors and technological advancements. The ‘buy the dip’ mentality may persist among retail investors, particularly in light of economic uncertainty such as that brought about by Moody’s recent downgrade. The key for these investors will be to remain informed and strategic, leveraging technology to adapt their buying decisions to evolving market conditions.

In conclusion, the future landscape of retail investing promises to bring even greater opportunities for engagement, particularly as financial platforms continue to innovate and evolve. With a focus on effectively understanding market indicators and a sustained commitment to long-term investment success, retail traders are poised to remain an integral force within the stock market for years to come.

Frequently Asked Questions

What are the recent retail investor buying trends following Moody’s credit rating downgrade?

After Moody’s downgraded the U.S. credit rating, retail investors displayed notable buying trends, contributing $5.4 billion in net purchases on a single trading day. This marked a significant response, as individual investors capitalized on the ‘buy the dip’ strategy amid market volatility, accounting for 36% of the total trading volume.

How did retail trading volume respond to the stock market amid recent volatility?

Retail trading volume surged dramatically following the Moody’s credit rating downgrade. On the day of the announcement, retail investors contributed a record 36% of total market trading volume, showing their willingness to engage aggressively in buying, specifically utilizing the ‘buy the dip’ strategy during downturns.

What is the ‘buy the dip’ strategy and how has it influenced retail investor behavior this year?

The ‘buy the dip’ strategy has been a driving force behind retail investor behavior in 2023. Following events like Moody’s credit downgrade, individual investors have shown a strong inclination toward purchasing stocks during market dips, leading to a record $40 billion in net purchases in April alone, despite broader market concerns.

What impact did Moody’s credit rating downgrade have on retail investor sentiment?

Moody’s downgrade of the U.S. credit rating appeared to bolster retail investor sentiment rather than deter it. Retail investors reacted by significantly increasing their stock purchases, embodying their confidence in the ‘buy the dip’ strategy even amidst market instability, as they accounted for a substantial part of the trading activities.

How do stock market trends reflect retail investor activity in light of economic announcements like credit downgrades?

Stock market trends often reflect the resilience of retail investors in response to economic announcements such as credit downgrades. The recent downgrade by Moody’s led to an uptick in retail buying activity, showcasing how individual investors influence market resilience by adhering to strategies like buying during downturns.

What role do retail investors play in influencing stock market trends during economic uncertainty?

Retail investors have increasingly become pivotal in influencing stock market trends, especially during economic uncertainties. For instance, following Moody’s debt downgrade, retail participants were responsible for a significant portion of trading volume, demonstrating their ability to sway market dynamics through strategic buying decisions.

| Key Points |

|---|

| Retail buyers increased their activity following Moody’s downgrade of the U.S. credit rating. |

| Individual investors net purchased $4.1 billion worth of stocks by 12:30 p.m. ET on a single day, setting a new record. |

| Retail trading volume accounted for 36% of total market activity on that day, another record high. |

| Despite concerns about a potential recession, retail investors maintained a ‘buy the dip’ strategy, net purchasing $40 billion in April. |

| Moody’s downgrade to Aa1 was based on rising federal costs and increasing debt burdens, causing a ripple effect on bond yields. |

Summary

Retail investor buying trends have been notably strong in recent sessions, especially following financial perturbations such as credit downgrades. The current market behavior indicates that individual investors are eagerly embracing opportunities to purchase stocks amidst fluctuations, often characterized as a ‘buy the dip’ mentality. The evident resilience of retail traders in navigating concerns about the economy signals a robust engagement with the market, showcasing their pivotal role in current trading dynamics.