Retail Investor Enthusiasm: A Disaster Waiting to Unfold

Retail investor enthusiasm in the ETF market has reached unprecedented levels, raising eyebrows among seasoned analysts and experts alike. With billions of dollars pouring into high-risk assets, the potential for a market correction looms large, igniting concerns over possible overheating. Industry figures like ETF Action’s Mike Akins caution that this exuberance mirrors patterns seen during previous market peaks, particularly in volatile sectors like thematic ETFs. As retail investors eagerly chase yield-focused products, they may be ignoring the inherent ETF market risks associated with these high-flow strategies. Investors should be vigilant, as this wave of enthusiasm could very well signal a brewing storm ahead.

The current fervor exhibited by individual investors towards exchange-traded funds (ETFs) highlights a crucial shift in the financial landscape. This surge is characterized by a remarkable influx of capital into high-yield and thematic products, with many newcomers lured by the prospect of quick gains. Analysts warn that such behavior often precedes market downturns, particularly when investment flows begin to indicate overheating conditions. The increasing popularity of riskier offerings, including leveraged and inverse ETFs, raises questions about sustainability and the long-term health of the market. As retail players dominate these spaces, the importance of understanding underlying market dynamics and potential pitfalls cannot be overstated.

Retail Investor Enthusiasm: An Overheated Market Indicator

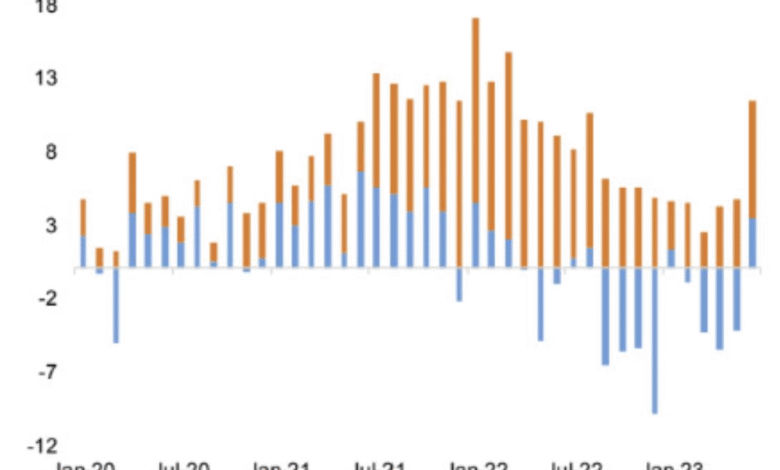

The recent surge in retail investor enthusiasm has drawn caution from market experts, particularly as it relates to the exchange-traded fund (ETF) market. Many retail investors are diving into high-risk ETFs, which raises red flags about potential market overheating. Mike Akins from ETF Action highlights that the volume of funds flowing into niche strategies, especially thematic and innovative sectors, mirrors the frenzy of 2020 and 2021 just before a market correction. Such enthusiasm often serves as a contrarian signal, indicating that the market may be on unstable ground.

Additionally, the imbalance between retail investors and institutional players suggests that this frenzy is unsustainable. With retail investors pouring billions into speculative strategies like single-stock ETFs and leveraged funds—where institutions hold a fraction of that investment—the risk of a significant pullback rises. This disproportionate investment behavior creates a precarious situation that could destabilize the overall ETF market and lead to broader economic ramifications.

The Risks Posed by Thematic ETFs and Yield-Focused Products

Thematic ETFs have gained traction among retail investors for their potential high returns, but they come with considerable risks. During periods of market exuberance, such as those witnessed during the pandemic, these funds can attract significant inflows that contribute to an overheated atmosphere. Akins notes that while these products may generate impressive short-term gains, they do not offer the same level of institutional support as more traditional investments. The lack of institutional backing means that the burden of loss falls heavily on retail investors when market conditions change.

Moreover, yield-focused products, particularly covered call ETFs linked to individual stocks, pose their own unique challenges. These investment vehicles can deliver steady income during rising markets but become dangerously unmanageable if the underlying assets begin to falter. Akins warns that a yield-covered strategy promising exceptionally high returns could lead to disastrous outcomes, especially in a volatile market. As history has shown, the drive for income in a declining market can lead to panic and significant losses, underscoring the importance of cautious investment strategies across the retail investor demographic.

Market Overheating: A Historical Perspective on ETF Trends

Market overheating is a critical concern in the current landscape of ETF investments, as evidenced by historical patterns of retail investor behavior. The surge of interest in thematic ETFs and niche strategies often correlates with high levels of speculative investments, reminiscent of the past. Experts argue that heightened inflows into risky assets frequently precede a market correction, marking a potential shift in investor sentiment. Akins emphasizes that when retail investors dominate the influx of cash into these products, it typically signals an imbalance that could lead to a downturn.

Additionally, past market trends illustrate how rapid inflows can deteriorate investor confidence during downturns. For example, during the last bull market, significant capital was directed toward thematic ETFs based on future potential rather than fundamental stability. When retail enthusiasm peaked, many of these investments failed to provide sustainable returns as market conditions shifted. Consequently, understanding these historical parallels can help current investors evaluate their strategies and potentially identify warning signs that indicate an overheated market.

The Role of Institutional Investors in Stabilizing ETF Markets

Institutional investors play a critical role in stabilizing the ETF market, serving as a counterbalance to the exuberance of retail investors. Currently, institutions account for approximately 64% of the overall ETF investments, focusing primarily on traditional and less volatile strategies. This presence not only brings stability but also adds a layer of credibility to the ETF market. When retail investors flock to riskier assets without institutional support, as seen with single-stock and leveraged ETFs, it can lead to heightened volatility and risk.

However, the minimal engagement of institutional investors in speculative strategies raises concerns about market vulnerability. As Akins notes, the limited allocation by institutions in nontraditional ETFs suggests a lack of confidence in these products, which are mostly held by retail investors. This lack of institutional participation may contribute to the rapid fluctuations often observed in the ETF market, making it crucial for retail investors to heed these indicators of potential risk.

Navigating ETF Market Risks as a Retail Investor

Navigating the ETF market can be particularly challenging for retail investors, especially in light of rising risks associated with thematic and yield-focused products. With many investors chasing high returns without a thorough understanding of associated risks, it is essential to educate oneself on the nuances of different ETF strategies. Tools like risk assessment reports and insights from ETF experts can provide valuable information to help investors make informed decisions.

Additionally, retail investors should consider diversifying their portfolios beyond high-risk ETFs to mitigate potential losses. This broader approach not only spreads the risk but also includes safer investment options that can offer stability during turbulent market conditions. As highlighted by Akins, awareness of market overheating and the importance of balancing risky investments with safer alternatives is essential for long-term investment success.

The Future of ETFs: Trends and Predictions

As financial markets evolve, the future of ETFs is likely to be influenced by changing investor behavior and the regulatory environment. With increasing participation from retail investors, there will be a need for transparency and frameworks that can safeguard against the pitfalls of market overheating. Experts predict that as technology advances, new ETF products will emerge, focusing on sustainable and low-risk investment strategies that can appeal to a more cautious investor base.

Moreover, the rise of environmentally, socially, and governance (ESG) factors in investment choices may reshape the ETF landscape in coming years. Retail investors are becoming more discerning, often seeking products that align with their values while still providing substantial returns. If the industry can successfully navigate the complexities of market risks while meeting the evolving demands of investors, the future of ETFs could maintain its relevance and stability in an ever-changing financial environment.

Recognizing Signs of Market Correction

Recognizing the signs of a market correction is crucial for retail investors, especially in the context of the current ETF landscape. The increasing influx into high-risk ETFs can serve as an early warning signal of potential instability. Experts advise investors to monitor trading volumes and price fluctuations closely, as well as sentiment trends within the retail investor community. Understanding behavioral finance can also aid investors in identifying irrational exuberance that often precedes market downturns.

Additionally, keeping abreast of economic indicators such as interest rates, unemployment rates, and overall market performance can provide context for assessing when a correction may be imminent. By staying informed and proactive, retail investors can better position themselves to respond to market changes and minimize potential losses. Ultimately, a well-informed strategy, grounded in research and awareness of market dynamics, will empower retail investors to navigate the complexities of the ETF market successfully.

The Impact of Speculative Investing on Market Stability

Speculative investing has a profound impact on market stability, particularly in the ETF sector, where retail enthusiasm can drive prices higher than fundamentals justify. This tendency for retail investors to flock to hot products often leads to inflated valuations, prompting concerns about sustainable growth. As seen in previous market cycles, such behavior can create bubbles that, when burst, result in widespread losses for those who entered the market at peak levels.

Furthermore, the lack of institutional guidance in speculative areas often exacerbates market volatility. Retail investors, driven primarily by a fear of missing out, might ignore fundamental analysis that could provide a clearer picture of the underlying risks. Consequently, it becomes imperative for investors to adopt a more analytical approach to their investments, focusing on long-term viability rather than short-lived trends that may not stand the test of time.

Strategies for Mitigating Risk in ETF Investments

Implementing strategies to mitigate risks in ETF investments is crucial for retail investors who seek to protect their portfolios from adverse market movements. Strategies such as dollar-cost averaging can help investors avoid the pitfalls of market timing, allowing them to spread their investments over time. This method not only reduces the risk of entering at a market peak but also encourages a disciplined investment approach, which is vital in a volatile environment.

Additionally, considering a diversified portfolio that includes a mix of asset classes—such as bonds, stocks, and cash—can provide stability during market fluctuations. By balancing high-risk ETFs with more conservative investments, retail investors can cushion their portfolios against potential losses. Ultimately, adopting a well-rounded investment strategy that aligns with individual risk tolerance and financial goals will enable investors to navigate the complexities of the ETF market with greater confidence.

Frequently Asked Questions

What are the risks of retail investor enthusiasm in the ETF market?

Retail investor enthusiasm in the ETF market can lead to significant risks, especially when exuberant buying behavior appears to signal potential market overheating. Experts warn that when retail investors pour billions into high-risk ETFs, such as those focused on thematic sectors or single stocks, it may indicate a bubble that could eventually burst.

How do thematic ETFs contribute to retail investor enthusiasm?

Thematic ETFs have gained immense popularity among retail investors due to their focus on innovative and niche strategies. This enthusiasm can drive inflows that often mirror previous market highs, raising concerns that such exuberance may enhance the risk of market overheating, much like the trends seen during the 2020 and 2021 peaks.

Why are yield-focused products considered risky for retail investors?

Yield-focused products, like covered call ETFs, draw significant attention from retail investors due to their ability to offer consistent income. However, experts caution that if the underlying stocks do not perform well, these strategies can quickly become unmanageable, posing a substantial risk for investors caught up in retail enthusiasm.

What signals should retail investors watch for regarding ETF market overheating?

Retail investors should be cautious of surging inflows into ETFs, particularly in speculative areas. Historically, such trends act as contrarian indicators, suggesting that markets may be overheating, as was observed during the pandemic-driven rush into thematic ETFs.

How do institutional investors differ from retail investors in the ETF market?

Institutional investors typically account for a majority of the ETF market but are notably absent in rapidly growing and speculative categories such as leveraged and inverse ETFs. Their cautious approach contrasts with retail investors, who have been driving substantial inflows into these high-risk segments.

What role do retail investors play in the volatility of the ETF market?

Retail investors play a significant role in the volatility of the ETF market, particularly in high-risk segments. As they dominate ownership in speculative strategies, their enthusiastic buying can amplify price swings and contribute to overall market instability.

| Key Points | Details |

|---|---|

| Retail Investor Enthusiasm | Experts warn that current enthusiasm among retail investors in the ETF market could signal trouble ahead. |

| Market Concerns | The influx of billions into high-risk ETF products raises concerns of markets overheating. |

| Trends in ETF Market | The number of ETF products is at an all-time high, particularly in thematic and innovative sectors. |

| Institutional Participation | Institutions make up 64% of the ETF market but are mostly absent from speculative single-stock and leveraged ETFs. |

| Volatility of Speculative Strategies | Most speculative strategies are held by retail investors and are extremely volatile. |

| Risk of Yield-Focused Products | Yield strategies can lead to unsustainable payouts if underlying stocks decline. |

| Historical Parallels | Recent retail trends remind experts of past market peaks that preceded downturns. |

Summary

Retail investor enthusiasm is indeed raising critical alarms in the financial market landscape today. As investors pour money into high-risk ETFs without institutional backing, there is a palpable concern that this exuberance may lead to significant market distress. Experts like Mike Akins emphasize that caution is warranted, echoing historical precedents where similar patterns pointed to impending market corrections. Therefore, retail investors are urged to reassess their strategies in light of potential volatility and risks associated with current trends.