Ripple Stablecoin Payments: $200M Deal With Rail

Ripple stablecoin payments are set to revolutionize the way global financial institutions execute transactions, thanks to Ripple’s recent acquisition of Rail for $200 million. This strategic move aims to enhance Ripple’s already robust offerings in the realm of stablecoin transactions, providing comprehensive solutions for businesses looking to leverage digital assets. The collaboration between Ripple and Rail will not only streamline B2B stablecoin payments but also ensure a seamless infrastructure tailored to meet the evolving needs of modern finance. With an emphasis on compliance and asset flexibility, this partnership is poised to establish Ripple as the premier provider of digital asset payments across international markets. As stablecoins gain traction, Ripple’s innovative approach positions it to lead the charge in transforming traditional finance into a more efficient, digital-first ecosystem.

In the fast-evolving landscape of financial technology, Ripple stablecoin solutions are capturing significant attention. The integration of Rail’s advanced payment infrastructure heralds a new era for businesses engaging in cryptocurrency financing, especially in B2B contexts. This merger not only amplifies Ripple’s capabilities in executing stablecoin transactions but also enhances its standing among global financial players. As institutions increasingly seek reliable digital asset payment options, Ripple’s commitment to building a comprehensive framework promises to address the critical needs of modern enterprises. The acquisition represents a forward-thinking strategy to capitalize on the growing importance of cryptocurrencies in the global economy.

The Impact of Ripple’s Acquisition of Rail on Global Stablecoin Payments

Ripple’s recent acquisition of Rail represents a significant milestone in the evolution of global stablecoin payments. This $200 million deal aims to solidify Ripple’s dominance in the digital asset payments arena, particularly as financial institutions increasingly seek more efficient transaction mechanisms. By integrating Rail’s capabilities, Ripple is positioned to streamline stablecoin transactions, making it easier for enterprises to leverage digital currencies in their operations.

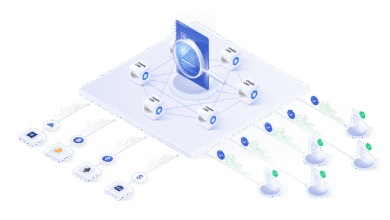

Furthermore, this strategic acquisition is set to enhance Ripple’s existing payment frameworks. Rail brings valuable infrastructure, including an API-based platform and established banking relationships, which will facilitate the transition for businesses looking to adopt stablecoin solutions. As Ripple emphasizes its commitment to supporting global financial institutions, this partnership could pave the way for enhanced liquidity management and cross-border payment simplifications.

Revolutionizing Digital Asset Payments with Stablecoin

Digital asset payments are rapidly transforming the financial landscape, with stablecoins at the forefront of this revolution. Unlike traditional cryptocurrencies, which are often subject to high volatility, stablecoins offer price stability by being pegged to fiat currencies. This stability makes them particularly appealing for businesses engaged in B2B transactions, providing a reliable method of payment that mitigates risks associated with value fluctuations.

Ripple’s focus on enhancing stablecoin payments infrastructure is indicative of a broader trend among global financial institutions. As more companies recognize the benefits of using stablecoin for transactions—such as reduced transaction fees and faster settlement times—Ripple’s infrastructure solutions can play a vital role in the adoption of these digital asset payments. This shift not only fosters innovation within payments but also aligns with the growing acceptance of blockchain technology in corporate finance.

B2B Stablecoin Payments: Unlocking New Avenues for Growth

The forecasted growth of B2B stablecoin payments is noteworthy, with predictions indicating that it could encompass over 10% of projected payment volumes in the coming years. As many enterprises grapple with traditional payment systems’ inefficiencies, adopting stablecoins can lead to a more agile and cost-effective approach to managing transactions. This paradigm shift could unlock new avenues for business growth and foster deeper global trade relationships.

Ripple’s acquisition of Rail stands to enhance its offerings in the B2B space significantly. By leveraging Rail’s advanced payment platforms and partnerships with banking institutions, Ripple can provide unparalleled services tailored to businesses engaged in international commerce. Support for B2B stablecoin payments could empower companies to transfer funds across borders with greater speed and reliability, further solidifying stablecoins’ role as an essential component of the global financial ecosystem.

The Future of Stablecoin Transactions in Finance

As stablecoins continue to gain traction within the finance sector, their role in everyday transactions is set to expand. The convenience and flexibility offered by digital currencies make them attractive alternatives for both consumers and businesses. With innovative solutions like those anticipated from Ripple’s acquisition of Rail, the financial landscape could see a marked shift toward more streamlined, digital-first transaction methods.

Moreover, the alignment of Ripple with Rail could accelerate the adoption of stablecoin transactions among global financial institutions. By providing integrated compliance tools and infrastructure, Ripple is taking significant steps towards fostering a regulatory-friendly environment that enhances trust and reliability in digital transactions. This evolution is critical as the world increasingly looks to digital finance solutions as the future of monetary exchange.

Compliance and Security in Stablecoin Payments

As the stablecoin market grows, ensuring compliance with global regulations becomes increasingly paramount. Ripple’s acquisition of Rail aims to address these concerns by providing integrated compliance tools to facilitate adherence to regulations across jurisdictions. This focus on compliance is crucial for gaining the trust of global financial institutions, which are often hesitant to engage with novel financial technology without robust safety nets.

The incorporation of Rail’s banking partners into Ripple’s network could also enhance compliance and security measures for stablecoin payments. By collaborating with established financial entities, Ripple can ensure that it meets stringent regulatory requirements while also safeguarding user funds. This layered approach will bolster confidence among users and institutions alike, encouraging wider adoption of digital asset payments.

Blockchain Implementation in Financial Transactions

The implementation of blockchain technology in financial transactions has revolutionized how businesses conduct operations. By leveraging decentralized networks, firms can achieve greater transparency, security, and speed in their dealings. Ripple’s acquisition of Rail underscores the importance of integrating modern blockchain solutions into traditional financial systems, particularly in stablecoin transactions.

In the evolving landscape of finance, blockchain serves as an enabler for more efficient transaction mechanisms. Stablecoins, when paired with blockchain technology, can facilitate instantaneous settlements and lower the cost of cross-border payment systems. This not only enhances operational efficiencies for financial institutions but also democratizes access to financial services, making it easier for businesses of all sizes to participate in the global economy.

Strategic Partnerships Driving Innovation in Stablecoin Payments

Ripple’s growth trajectory is fueled by strategic partnerships that enhance its capabilities in stablecoin payments. Collaborations with firms like Ctrl Alt and Openpayd highlight Ripple’s commitment to evolving the landscape of digital asset payments. Through these initiatives, Ripple aims to develop comprehensive solutions that address diverse financial needs.

By leveraging external expertise and technology, Ripple can accelerate the introduction of innovative stablecoin payment solutions to market. Such partnerships not only enrich Ripple’s service offerings but also foster a collaborative ecosystem where multiple players can contribute to the development of a robust payments infrastructure. This cooperative approach is essential for driving the widespread adoption of stablecoins among global financial institutions.

Global Financial Institutions Embracing Stablecoin Innovations

As stablecoins continue to gain acceptance, global financial institutions are increasingly exploring innovative digital asset solutions. Institutions that embrace these technologies can streamline operations, reduce costs, and deliver better services to their clients. Ripple’s acquisition of Rail is a clear indication of how major players in the financial sector are positioning themselves to capitalize on the agility and efficiency that stablecoin payments provide.

The collaboration between Ripple and Rail aims to eliminate legacy inefficiencies, making way for a new era of financial transactions that leverage the advantages of stablecoins. By providing institutions with the tools necessary for successful integration, Ripple is fostering a banking environment that is more responsive to market demands and customer needs. This transformation is vital as financial entities seek methods to remain competitive in a rapidly changing economic landscape.

Ensuring Future-readiness in Payments Infrastructure

The need for future-ready payments infrastructure has never been more critical as the world transitions toward digital currencies. Ripple’s acquisition of Rail reflects an understanding of this need, where traditional and modern payment systems must converge to meet emerging market demands. By investing in Rail’s innovative approach, Ripple is ensuring that its payments infrastructure remains relevant and agile.

A keen focus on future-readiness will enable Ripple to support a diverse range of use cases, from retail to institutional trading. As more businesses look to integrate stablecoins into their operations, having a robust, scalable infrastructure is essential for facilitating seamless transactions across borders. Ripple’s strategy to enhance its capabilities through technology partnerships is a proactive step towards creating a resilient financial ecosystem that can adapt to future challenges.

Frequently Asked Questions

What are Ripple stablecoin payments and how do they work?

Ripple stablecoin payments refer to transactions conducted using stablecoins on the Ripple network, which is designed to provide fast, secure, and low-cost transfers. By utilizing stablecoins, Ripple enables global financial institutions to settle transactions in real-time, reducing volatility and increasing efficiency in digital asset payments.

How will the Ripple acquisition of Rail impact stablecoin transactions?

The acquisition of Rail by Ripple is set to enhance stablecoin transactions by integrating Rail’s advanced payment infrastructure with Ripple’s capabilities. This will create a more robust solution for global financial institutions, enabling seamless and efficient execution of stablecoin payments, thus driving adoption in the marketplace.

What benefits do global financial institutions gain from Ripple stablecoin payments?

Global financial institutions benefit from Ripple stablecoin payments by accessing an efficient, low-cost payment infrastructure that supports instant transactions and asset flexibility. The integration of compliance tools and a reliable infrastructure allows these institutions to enhance their service offerings and improve customer experiences with digital asset payments.

What role do stablecoins play in B2B stablecoin payments on the Ripple platform?

Stablecoins play a critical role in B2B stablecoin payments on the Ripple platform, as they provide a stable asset for transactions, minimizing currency volatility. Ripple’s infrastructure, combined with Rail’s technology, positions it to process a significant volume of B2B stablecoin payments efficiently, ensuring secure and swift transactions for businesses.

How does the Ripple and Rail partnership impact the future of digital asset payments?

The partnership between Ripple and Rail is expected to reshape the future of digital asset payments by offering the most comprehensive stablecoin payment solutions available. This collaboration aims to drive innovation and broaden the usage of stablecoins in the global financial landscape, enabling faster and more secure transactions.

What is the significance of the regulatory approval in the Ripple acquisition of Rail?

Regulatory approval is significant in the Ripple acquisition of Rail as it ensures compliance with financial regulations and standards. This step is crucial for the seamless integration of Rail’s stablecoin payments infrastructure into Ripple’s operations, ultimately enhancing the security and trustworthiness of the digital asset ecosystem.

How does Ripple ensure the security of stablecoin transactions for financial institutions?

Ripple ensures the security of stablecoin transactions for financial institutions through integrated compliance tools, automated workflows, and partnerships with prestigious banks. These measures create a secure framework for executing digital asset payments while minimizing risks associated with fraud and regulatory compliance.

| Key Point | Details |

|---|---|

| Acquisition Announcement | Ripple announced a $200 million deal to acquire Rail on August 7, 2025. |

| Enhancing Services | The acquisition aims to enhance Ripple’s enterprise offerings in stablecoin payments. |

| Comprehensive Solution | Ripple and Rail will deliver the most comprehensive stablecoin payments solution. |

| Strategic Fit | The acquisition is positioned to boost Ripple’s leadership in digital asset payments infrastructure. |

| Future Financial Infrastructure | Stablecoins are becoming essential in modern finance, with Rail enhancing Ripple’s offerings. |

| Rail’s Contributions | Rail processes over 10% of the projected $36 billion in B2B stablecoin payments for 2025. |

| Global Expansion | Ripple is expanding into various sectors including blockchain finance, custody services, and trading. |

Summary

Ripple stablecoin payments are set to undergo a significant transformation with the recent $200 million acquisition of Rail. This strategic move not only enhances Ripple’s offerings but positions them as a leader in the stablecoin payments market, facilitating essential services for global financial institutions. With Rail’s proven capabilities in handling B2B payments, Ripple is poised to innovate the future of financial transactions with stablecoins, ultimately pushing the boundaries of what is possible in digital payment infrastructure.