Ripple XRP Case Resolution Sparks New Crypto Regulations

The Ripple XRP case has recently concluded, marking a pivotal moment for the cryptocurrency landscape as the SEC shifts gears to establish clearer regulations. This landmark legal battle has not only brought closure to Ripple Labs and its executives but also signaled hope for the overall cryptocurrency market impact that is largely dependent on regulatory clarity. With the SEC’s previous enforcement actions now behind them, many stakeholders within the digital asset ecosystem are eager to see how the agency will craft SEC crypto regulations designed to facilitate growth. Moreover, the SEC’s decision to grant Ripple a Regulation D waiver enhances their ability to raise capital, potentially paving the way for further innovations in blockchain technology. As the dust settles on this high-profile case, the focus turns to formulating SEC clear rules for crypto that foster both development and protection for investors.

The conclusion of the legal proceedings surrounding Ripple’s digital token, XRP, represents a significant turning point in the ongoing discourse about digital asset regulation. This development comes after a lengthy legal dispute involving the U.S. Securities and Exchange Commission, which has now redirected its efforts toward establishing definitive guidelines for the burgeoning cryptocurrency sector. The resolution of this high-stakes conflict not only rejuvenates hopes for Ripple but also promises a broader impact on the cryptocurrency market’s future growth. By easing regulations and offering strategic waivers, the SEC is poised to create a landscape where innovation can flourish while ensuring investor protections remain intact. As regulators seek to craft a framework that empowers the crypto space, the outcome of this landmark case will likely shape the future of digital currencies.

The Impact of the Ripple XRP Case on the Cryptocurrency Market

The conclusion of the Ripple XRP case has sent waves throughout the cryptocurrency market, reigniting interest and confidence among investors. Ripple’s legal battles with the SEC had created uncertainty and fear, causing many to reevaluate their investments in cryptocurrencies. Now that the case has officially been resolved, market analysts anticipate an influx of capital into XRP and other digital assets as wary investors return. This renewed hope can potentially stabilize the market, as clarity regarding the legal status of cryptocurrencies becomes more well-defined.

As a result of the Ripple case closure, there is optimism that clearer regulations will inspire innovation and further development in the crypto sector. Investors are now looking towards the SEC’s next steps in regards to establishing comprehensive regulatory frameworks that could positively impact the cryptocurrency market. These developments signal a pivotal moment, where the lessons learned from the Ripple legal battle could guide future regulations, ultimately fostering a healthier environment for cryptocurrency as a legitimate asset class.

SEC’s Shift Towards Clear Rules for Crypto Following Ripple Case

In light of the conclusion of the Ripple case, the SEC is now poised to focus on the creation of clear rules for the cryptocurrency market. SEC Commissioner Hester Peirce emphasized the importance of moving from litigation to regulation, stating that this transition will better enable the agency to develop guidelines that support innovation in the crypto space. The SEC’s effort, dubbed “Project Crypto,” aims to unify the regulatory landscape for cryptocurrencies, which has previously been marred by inconsistent enforcement and ambiguous policies.

This shift in approach marks a significant breakthrough in the regulatory environment, potentially leading to the establishment of clear definitions and classifications for digital assets. By carefully crafting guidelines that promote growth while ensuring investor protection, the SEC can create a balanced framework that fosters both regulatory compliance and technological advancements in blockchain and cryptocurrency. As the Ripple case has shown, a clear regulatory environment is critical for both user confidence and market stability.

Regulation D Waiver Grants New Opportunities for Ripple

The SEC’s decision to provide Ripple with a Regulation D waiver has significant implications for the company’s ability to raise capital. This waiver removes the ‘bad actor’ status that had hindered Ripple’s fundraising efforts amid its ongoing legal issues. As Ripple looks to the future post-litigation, it can engage more freely with accredited investors, tapping into a crucial funding source that may facilitate further development and expansion of its business operations.

This regulatory flexibility not only benefits Ripple directly but also sets a precedent for how similar cases involving crypto companies might be handled in the future. The removal of punitive designations opens doors for innovation and allows Ripple to leverage its blockchain technology more effectively. As the cryptocurrency landscape evolves, this could signal a turning point where regulators increasingly recognize the importance of fostering entrepreneurial growth within the digital asset space.

Future Regulatory Landscape for Cryptocurrency After Ripple Verdict

With the Ripple XRP case concluded, stakeholders within the cryptocurrency community are eagerly awaiting the SEC’s next moves regarding regulatory structures. The agency’s newfound focus on establishing clear rules presents a unique opportunity for crypto firms to align their business models with emerging standards, which could lead to enhanced legitimacy and investor trust. This evolution reflects a growing understanding that regulation is necessary to protect consumers and foster healthy market competition.

As the SEC seeks to craft regulations that effectively balance innovation with protection, how they interact with major players like Ripple will be telling. If the regulatory framework encourages collaboration between regulators and industry participants, we could see the cryptocurrency market stabilize and mature significantly. Companies in the sector will have the ability to navigate this new landscape, fostering growth and compliance while avoiding the lengthy battles that characterized the recent past.

Ripple’s Legal Battle and Its Influence on SEC Policies

Ripple’s legal battle with the SEC has been a pivotal moment in defining the intersection between digital innovation and regulatory oversight. The outcome not only affects Ripple but also shapes the broader policies the SEC may implement moving forward. The lessons learned from this case could inform future approaches to regulation within the cryptocurrency space, emphasizing the need for collaborative dialogues between Innovators and regulators to cultivate an environment conducive to growth.

Furthermore, the resolution of this case serves as a catalyst for the SEC to reconsider its stance on cryptocurrency regulations, initiating dialogue that may ultimately result in clearer policies. As regulators transition from litigation to a more facilitative role, they can encourage the evolution of digital assets, creating pathways for legal compliance while safeguarding investor interests. Ripple’s experience illustrates the importance of understanding the dynamics of technology and regulation, a crucial aspect as the market continues to evolve.

Optimism in the Crypto Sector Post-Ripple Litigation

The successful closure of Ripple’s case has sparked renewed optimism within the cryptocurrency sector. Investors and industry leaders are beginning to envision a future free from the uncertainty that legal disputes bring. The optimism is palpable not just for Ripple but for the entire cryptocurrency ecosystem, as many see this resolution as a precursor to a potentially vibrant market environment. This development indicates a shift where innovation can thrive under a clear regulatory framework.

Additionally, the lifting of legal burdens allows Ripple to refocus its efforts on product development and partnerships, which could propel XRP and its underlying technology to new heights. The heightened interest in digital assets following Ripple’s positive outcome may lead to more institutional investments and greater market activity. As broader acceptance of cryptocurrencies grows, the industry may witness an influx of supportive regulations that align with the desires of both regulators and market participants.

The Ripple Case as a Blueprint for Future Crypto Regulations

Ripple’s interactions with the SEC have created a significant template for future cryptocurrency regulations, showcasing both the challenges and opportunities companies may face. As regulators look to develop clearer frameworks, the Ripple situation offers valuable insights into the nuances of cryptocurrency as a financial vehicle. This might mean fewer regulatory firestorms for emerging crypto projects and a focus on creating sustainable, compliant pathways for them to operate within the financial system.

By learning from the Ripple case, both the SEC and cryptocurrency developers can engage in proactive dialogue as they shape regulations that reflect the realities of digital assets. This could ultimately lead to more nuanced approaches that respect the unique aspects of blockchain technology while maintaining essential consumer protections. The establishment of such frameworks will likely be essential in aiding the growth of the cryptocurrency market while simultaneously ensuring investor confidence and market stability.

Ripple’s Contribution to the Discussion on SEC Crypto Regulations

Ripple’s case with the SEC has been a focal point in discussions about cryptocurrency regulations, marking an important chapter in the dialogue between innovation and regulation. As the SEC moves towards defining explicit rules for crypto, Ripple’s experience provides a practical understanding of how existing laws can be interpreted and adapted to new financial instruments. Moving forward, Ripple could play a role in shaping conversations around these policies, advocating for an environment that encourages innovation while protecting investors.

Furthermore, Ripple’s responses to SEC actions highlight the need for regulations to evolve alongside technological advancements. By advocating for clarity and fairness in regulatory practices, Ripple’s position in the industry can serve as an example for other crypto companies navigating similar challenges. The ongoing discourse around SEC rules for crypto is enriched by insights from Ripple’s legal journey, offering potential solutions for fostering a compliant yet flourishing cryptocurrency ecosystem.

Emerging Trends in Crypto Regulation Following the SEC-Ripple Case

The conclusion of the SEC-Ripple legal dispute paves the way for emerging trends in crypto regulation that are adaptable and forward-looking. As the industry reassesses the implications of the case, crypto companies are increasingly seeking to align their practices with potential regulatory standards. This climate of collaboration between innovators and regulators can lead to a more favorable environment for developing and introducing new digital assets to the market.

Moreover, this environment fosters opportunities for creating industry-specific guidelines that can cater to the unique characteristics of cryptocurrencies. By focusing on collaboration and proactive policy development, regulators can not only support the growth of the sector but also mitigate risks associated with market volatility and fraudulent activities. As the cryptocurrency landscape continues to evolve post-Ripple, the sector can look forward to more robust and relevant regulatory frameworks.

Frequently Asked Questions

What is the current status of the Ripple XRP case after the SEC’s recent decision?

The Ripple XRP case has officially concluded, with the SEC and Ripple filing a joint stipulation of dismissal, effectively ending their legal battle. This dismissal allows Ripple to move forward without the burden of ongoing litigation and paves the way for establishing clearer regulations in the cryptocurrency market.

How will the SEC’s clean slate for Ripple affect future cryptocurrency regulations?

With the SEC declaring the Ripple XRP case closed, regulators are shifting their focus toward creating clearer rules for cryptocurrencies. This transition is expected to foster an environment that encourages innovation in the crypto space while providing a framework that protects investors.

What implications does the SEC’s Ripple case dismissal have on other cryptocurrencies?

The dismissal of the SEC Ripple case is seen as a positive development for the entire cryptocurrency market. It may signal a potential shift towards more favorable conditions for crypto projects, as it encourages the SEC to clarify its stance on digital assets and provides a pathway for other projects to operate with more certainty.

What does the Regulation D waiver mean for Ripple following the SEC case?

The SEC granted Ripple a Regulation D waiver, which removes the ‘bad actor’ designation related to the previous lawsuit. This enables Ripple to raise capital more efficiently from accredited investors, likely boosting its business prospects as it navigates the post-legal landscape.

What are the SEC’s next steps after closing the Ripple XRP case?

Following the closure of the Ripple XRP case, the SEC is focusing on developing a clear regulatory framework for digital assets. This approach is part of their ‘Project Crypto’ initiative, which aims to modernize regulations governing cryptocurrencies and enhance the regulatory environment for blockchain technologies.

What was the key outcome of the SEC Ripple legal battle?

The primary outcome of the SEC Ripple legal battle was the conclusion of the lawsuit, with Ripple required to pay a civil penalty but free from ongoing litigation. This resolution has instigated positive sentiment in the cryptocurrency market, as it creates opportunities for clearer regulatory guidelines moving forward.

How will the conclusion of the Ripple legal battle influence investor confidence in cryptocurrencies?

The resolution of the Ripple XRP case is likely to boost investor confidence in the cryptocurrency market, as it signifies a turning point towards clearer regulations. Investors may feel more secure with established guidelines in place, potentially leading to increased investment in the crypto sector.

What role does SEC Commissioner Hester Peirce play in shaping future cryptocurrency regulations post-Ripple case?

SEC Commissioner Hester Peirce has been vocal about the need for a clear regulatory framework following the Ripple XRP case. Her advocacy for regulatory clarity is expected to influence the SEC’s policies, steering them towards a more transparent and supportive approach for the cryptocurrency market.

What has been Ripple’s response to the SEC’s decision to end their case?

Ripple expressed gratitude for the SEC’s decision to conclude the legal battle. Ripple’s Chief Legal Officer acknowledged the significance of the closure, emphasizing the potential for Ripple to focus on growth and for regulators to develop clearer rules that benefit the overall cryptocurrency landscape.

How might the Ripple legal battle affect future SEC actions against other crypto projects?

The conclusion of the Ripple legal battle may set a precedent for how the SEC approaches future inquiries into other crypto projects. It indicates a potential shift towards more collaborative engagement with cryptocurrency companies, particularly in developing clearer regulations that align with industry growth.

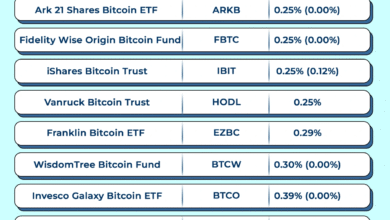

| Key Points | Details |

|---|---|

| SEC Ends Case Against Ripple | The SEC concluded its legal dispute with Ripple, allowing both parties to move forward. |

| New Regulatory Focus | With the case closed, regulators are now focused on establishing clear regulations for cryptocurrency. |

| Civil Penalty Remains Effective | Ripple must still comply with a $125 million civil penalty as part of the agreement. |

| Ripple’s Regulatory Waiver | Ripple received a waiver allowing it to raise capital more easily due to the removed bad actor designation. |

| Project Crypto Initiated | The SEC launched Project Crypto to modernize regulations and support innovation in financial markets. |

Summary

The Ripple XRP case has marked a significant turning point in the cryptocurrency landscape, concluding a lengthy legal battle with the SEC. With the conclusion of the Ripple v SEC case, the focus is now shifting towards the establishment of clear regulations that will support the future growth of digital assets. This pivotal moment has not only reinstated optimism within the XRP community but also sets the stage for a more structured approach to cryptocurrency regulation in the United States.