Robert Kiyosaki Bitcoin Buying Spree amid Economic Chaos

Robert Kiyosaki, the esteemed author of *Rich Dad Poor Dad*, is once again making headlines with his latest venture into bitcoin investment as he releases a new book on entrepreneurship. By purchasing additional bitcoin today, Kiyosaki demonstrates his commitment to financial independence, especially amidst the mounting fears of an economic collapse. He has been vocal about the dire need to prioritize hard assets, like bitcoin, gold, and silver, throughout his recent communications. As the global financial system faces increasing instability, Kiyosaki’s insights into the importance of bitcoin serve as a rallying cry for investors eager to protect their wealth. This strategic move not only underlines his bullish stance on bitcoin but also highlights the urgency he feels as central banks lose control over economic policies.

In the current economic landscape, Robert Kiyosaki’s approach extends beyond personal finance and taps into the broader themes of investment education and empowerment. Kiyosaki’s latest activities emphasize the significance of cryptocurrencies like bitcoin as a shield against declining traditional currencies. As financial systems waver under pressure, the focus on acquiring hard assets resonates deeply with those seeking refuge from fiscal chaos. His new publication aims to enlighten readers on navigating these turbulent times while champions the notion that preparedness is key to achieving economic stability. Kiyosaki’s perspective recognizes that transcending conventional investment strategies is essential for maintaining wealth in an increasingly uncertain world.

The Urgency of Bitcoin Investment Amid Economic Instability

Robert Kiyosaki’s recent decision to increase his bitcoin holdings serves as a critical wake-up call for investors around the world. With the global economy facing unprecedented challenges, the urgency of investing in hard assets like bitcoin has never been more apparent. As Kiyosaki points out, today’s economic chaos—marked by inflation and dwindling purchasing power—highlights the need for financial independence and proactive asset management. For many, taking Kiyosaki’s advice to heart could mean the difference between long-term stability and financial ruin.

Investing in bitcoin is not solely about chasing profits; it’s about securing a means of protecting one’s wealth. The current economic collapse is exacerbating concerns over traditional investments like stocks and bonds, which are highly susceptible to market fluctuations. Kiyosaki’s bullish outlook on bitcoin stems from its potential as a hedge against the looming risks posed by fiat currency depreciation. He argues that now is the time to act, empowering individuals to take charge of their financial destinies by making informed decisions about their investments.

Robert Kiyosaki’s New Book and Its Impact on Bitcoin Awareness

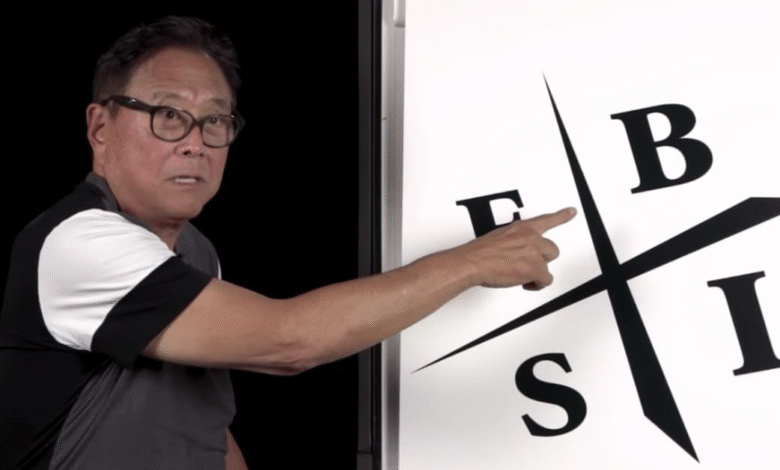

As Robert Kiyosaki works on his new book focused on entrepreneurship, he continues to shed light on the relevance of bitcoin in today’s financial landscape. His writings advocate for financial literacy and investment strategies that emphasize the importance of hard assets. By incorporating bitcoin into his narrative, Kiyosaki is not only enhancing the visibility of this digital currency but also encouraging readers to rethink what constitutes ‘real money’ in an era of economic uncertainty. This initiative aligns seamlessly with his overarching message of financial independence.

Kiyosaki’s commitment to educating the public about bitcoin through his new book is significant, especially as more individuals seek alternatives to traditional banking systems. The financial crisis currently unfolding may serve as a catalyst for many to explore cryptocurrency investment. By presenting bitcoin as a viable option for wealth preservation, Kiyosaki empowers his readers to consider how digital assets can fit into their broader investment portfolios, reinforcing the notion that financial independence is attainable through informed decisions.

Preparing for Economic Collapse: Kiyosaki’s Forecasts and Recommendations

In light of Kiyosaki’s projections about an impending economic collapse, it’s crucial to consider his recommendations for navigating these turbulent times. He emphasizes the importance of diversifying one’s investment portfolio to include hard assets such as bitcoin, gold, and silver. This diversification approach not only mitigates risks but also positions investors to thrive despite the challenges posed by a volatile economy. Kiyosaki’s insights serve as a guide for individuals looking to fortify their financial positions during uncertain times.

Kiyosaki’s warnings about the U.S. economy and central banks losing control resonate with many who are feeling the financial strain. By advocating for tangible assets, he underscores the shift away from reliance on traditional monetary systems, which he believes are destined for failure. His proactive stance encourages individuals to rethink their investment strategies and consider the long-term benefits of cryptocurrencies like bitcoin in preserving wealth, thereby fostering a mindset geared towards resilience and preparation for future economic shifts.

The Shift to Hard Assets: Kiyosaki’s Wealth Preservation Strategy

Robert Kiyosaki’s strategy for wealth preservation revolves around the acquisition of hard assets, especially in light of today’s economic uncertainties. He posits that physical commodities like gold and silver, alongside bitcoin, hold intrinsic value that fiat currencies lack. As more individuals recognize the importance of investing in hard assets, the conversation surrounding cryptocurrencies becomes increasingly relevant. Kiyosaki’s advocacy for bitcoin as a safeguard against inflation serves as a rallying cry for those seeking stability in their financial future.

By promoting hard assets, Kiyosaki is encouraging people to shift their perspectives on wealth accumulation. The current economic environment has prompted many to reconsider traditional investment avenues, which Kiyosaki argues are fraught with potential risks. As more people become disenchanted with the volatility of traditional markets, many are turning to hard assets like bitcoin as reliable options for security and growth. Kiyosaki’s ongoing emphasis on this shift reflects a broader understanding of the evolving nature of wealth in the 21st century.

Bitcoin: The Future of Financial Independence According to Kiyosaki

Kiyosaki’s perspective on bitcoin portrays it as a cornerstone for achieving financial independence. As traditional economic systems face instability, bitcoin emerges as a beacon of hope for individuals looking to secure their financial futures. Kiyosaki argues that through bitcoin investment, people can take control of their financial destinies, freeing themselves from dependence on failing institutions. His insights encourage potential investors to view bitcoin not just as a speculative asset but as a necessity in a world increasingly leaning towards economic disruption.

Moreover, Kiyosaki emphasizes the significance of financial literacy in understanding the dynamics of bitcoin and its role in personal finance. He believes that educating oneself about cryptocurrencies can empower individuals to make better financial decisions, ultimately leading to greater independence. By advocating for engagement and learning in the crypto space, Kiyosaki’s message resonates with those who aspire to break free from the constraints of traditional financial models and embrace the transformative potential of digital currencies.

Leveraging Kiyosaki’s Insights for Smart Bitcoin Investment

Leveraging Robert Kiyosaki’s insights can significantly enhance the approach one takes towards bitcoin investment. Kiyosaki’s background in financial education prepares him to provide valuable strategies tailored to navigating volatile markets. By sharing his experiences and principles, such as the importance of acting swiftly and intelligently, he empowers new and seasoned investors alike to make informed decisions. Investors who adopt Kiyosaki’s proactive mindset are more likely to recognize opportunities as they arise in the crypto market.

Understanding Kiyosaki’s core principles of financial independence and hard asset investment can reshape one’s strategy for bitcoin. It’s crucial for investors to recognize the potential risks involved, as well as the rewards that come with volatility. Kiyosaki’s teachings encourage thorough research and a disciplined approach to investment—traits essential for success in the unpredictable landscape of cryptocurrency. By integrating these principles into their strategies, investors can position themselves favorably in the ever-evolving landscape of bitcoin.

Defending Wealth Against Inflation: Kiyosaki’s Bitcoin Strategy

As inflation continues to erode purchasing power, Robert Kiyosaki underscores the crucial role that bitcoin plays in defending wealth. He argues that traditional assets are becoming increasingly vulnerable to economic shocks, making it essential to diversify into hard assets that provide stability. Kiyosaki cites bitcoin’s limited supply as a key factor in its value proposition, believing that its decentralized nature will protect investors from the inflationary pressures that threaten fiat currencies.

Kiyosaki’s approach to bitcoin investment is a comprehensive strategy aimed at preserving wealth in a tumultuous economic climate. He encourages individuals to consider bitcoin as a long-term store of value rather than a mere speculative gamble. This perspective aligns with his broader message that financial literacy and astute investing are indispensable tools for safeguarding one’s financial future. In doing so, Kiyosaki empowers individuals to take charge of their wealth and safeguard it against burgeoning inflation.

Education and Awareness: The Role of Kiyosaki’s Teachings in Bitcoin Adoption

Robert Kiyosaki’s teachings play a pivotal role in increasing awareness and understanding of bitcoin within the investment community. By educating people about financial independence and the importance of hard assets, Kiyosaki fosters a culture of informed investing. His efforts to demystify bitcoin and highlight its benefits can accelerate its adoption among individuals previously hesitant to venture into the cryptocurrency space. This education is critical in empowering others to make educated decisions regarding their financial futures.

Moreover, Kiyosaki’s narratives often emphasize the need for a proactive approach to personal finance. By leveraging his platform to advocate for bitcoin, he not only shares critical insights but also encourages a collective movement towards financial literacy in the cryptocurrency realm. This advocacy helps to cultivate an informed community that is better equipped to navigate the complexities of investing in digital currencies, thereby contributing to the wider acceptance and legitimacy of bitcoin in mainstream finance.

Frequently Asked Questions

What does Robert Kiyosaki think about Bitcoin investment today?

Robert Kiyosaki has been vocal about his positive outlook on Bitcoin investment, particularly as he intensifies his buying amidst looming economic challenges. He believes that Bitcoin represents a vital hard asset and has predicted its price could reach $250,000 due to current financial instability and central bank failures.

How is Robert Kiyosaki’s new book related to Bitcoin?

In his latest endeavors, Robert Kiyosaki is working on a new book focused on entrepreneurship which intertwines his investment strategies, including Bitcoin. As he buys more Bitcoin, Kiyosaki emphasizes the relevance of financial independence and asset protection, encouraging readers to consider Bitcoin as a key asset during economic turmoil.

Why does Robert Kiyosaki emphasize hard assets like Bitcoin?

Robert Kiyosaki emphasizes hard assets like Bitcoin because, in his view, they serve as safe havens during times of economic collapse. He firmly believes that as fiat currencies decline, investing in tangible assets such as Bitcoin becomes crucial for preserving wealth and ensuring financial independence.

What warnings has Robert Kiyosaki issued regarding the economic collapse and Bitcoin?

Robert Kiyosaki has warned that an economic collapse is imminent due to systemic failures within the financial system. He promotes Bitcoin as a hedge against hyperinflation and economic instability, arguing that individuals must act now to secure their financial futures by investing in Bitcoin and other hard assets.

How does Robert Kiyosaki believe Bitcoin will perform amid current economic conditions?

Kiyosaki forecasts that Bitcoin will perform exceptionally well amid current economic conditions, predicting a significant price surge due to increasing central bank failures and bankruptcies. He views Bitcoin’s fixed supply and decentralized nature as attributes that will attract more investors seeking stability in fluctuating markets.

| Key Point | Details |

|---|---|

| Kiyosaki’s Bitcoin Purchase | Robert Kiyosaki has bought more bitcoin as a strategy to protect his wealth amid economic uncertainty. |

| Economic Context | He signals that economic chaos is deepening, suggesting a potential economic collapse. |

| Bitcoin Prediction | Kiyosaki predicts bitcoin could reach $250,000 this year due to current financial system failures. |

| Warnings on Financial Crisis | He warns that hyperinflation is affecting economies and urges action to protect assets. |

| Kiyosaki’s View on BTC | He positions bitcoin as ‘real money’ and a crucial asset for wealth preservation during crises. |

Summary

Robert Kiyosaki Bitcoin is gaining significant attention as Kiyosaki’s recent actions and predictions illustrate his steadfast belief in the cryptocurrency’s future potential. With the U.S. economy showing signs of instability and central banks struggling to maintain control, Kiyosaki’s purchase of more bitcoin serves as both a personal investment strategy and a public call to action. He emphasizes the need to embrace hard assets like bitcoin, asserting that they are essential for safeguarding financial well-being amid looming economic challenges. As he prepares to release a new book, Kiyosaki continues to advocate for financial independence and protection against inflation, reinforcing the message that now is the time to act.